The growing importance of seamless payments in the SaaS industry

We’re in the midst of rapid growth in the Software-as-a-Service (SaaS) industry. In fact, according to Market Watch, by the end of 2025, the SaaS market is projected to grow to just shy of $100 billion. Contributing to that astronomical growth are a large number of SaaS healthcare providers such as Zocdoc, Talkspace, and AiCure. Despite these huge strides, there is still room for improvement and growth within the SaaS industry. One area under the spotlight is the payments industry.

Some of the issues facing SaaS providers include payment processors that aren’t compatible with the SaaS business model. When this occurs, it often leads to SaaS platforms relying on different inefficient and time-consuming payment systems, which only serve to complicate business operations. So, what do SaaS providers need? The answer is specialist payment service providers that can offer essentials such as:

- Recurring payments that can integrate with different subscription models

- Cross-border payments to process multiple currencies and payment methods

- Systems for retrying failed payments and alerting customers about expiring credit cards

- Reporting tools to provide insights directly from your payment data

All of these features go a long way toward improving user experience, customer satisfaction and retention, and ultimately positive revenue streams.

Payment challenges in the SaaS payment landscape

As discussed previously, many business models, including SaaS models, still face some roadblocks regarding payments. Chief among these challenges include:

- Adjusting to real-time billing changes such as upgrades, downgrades, new users, cancellations, or renewed subscriptions

- Automating invoices for various tiers, packages, and billing cycles is more cost-effective and faster than manual entry while also simplifying the process

- Establishing reliable recurring billing like one-off, flat-rate charges, or flexible payment schedules to manage more complex billing structures

- Managing failed payments to stabilise your revenue and lower customer churn as customer retention has a better ROI than acquiring new customers

Accepting versatile payment methods, detecting fraudulent transactions, and complying with PCI security standards are all basic requirements for SaaS business models.

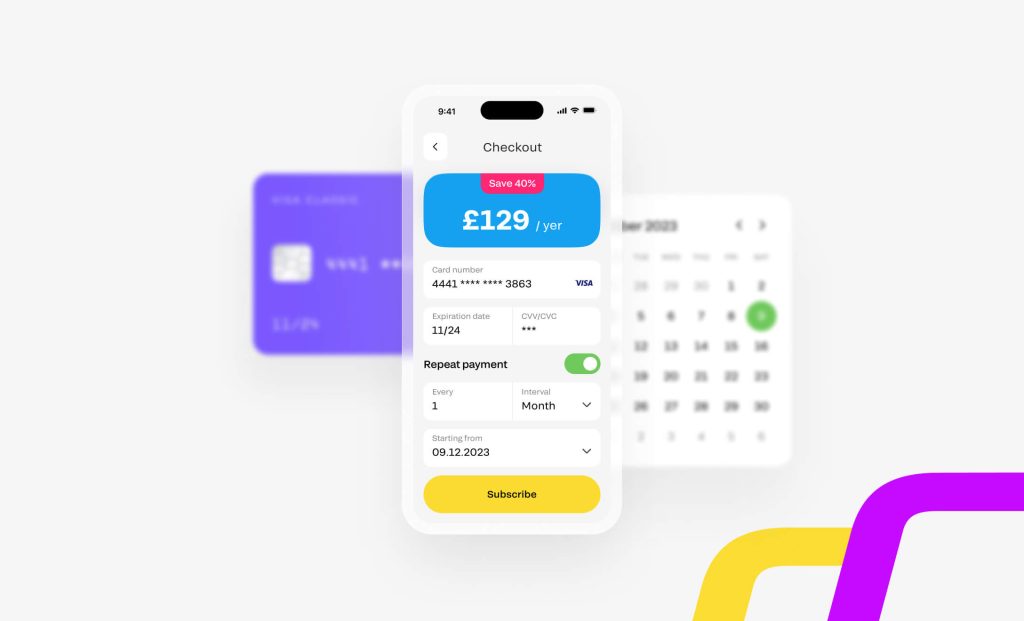

Payments for SaaS models need to account for more than just regular monetary transactions. That’s because users require adequate billing communication, including custom invoicing and various payment methods. These payment options need to include features such as split payments (for SaaS models with multiple partners like Deliveroo) and instant settlements where required, like Uber drivers who choose the ‘instant cashout’ option to collect their wages. To better understand the variety and functionality of SaaS platforms, check out our detailed guide what are examples of SaaS platforms. Learn how successful SaaS platforms operate and explore payment solutions that enhance their performance.

SaaS model payments also need to cater to customer upgrades, downgrades, account freezing or pausing, renewals, or cancellations. As it’s not realistic for SaaS companies to manually process invoicing, billing, and managing subscriptions, they need dedicated payment processing from PSPs like Flow Payments. Creating an in-house payments and billing system isn’t the answer, as it’s an expensive, time-consuming, and complex endeavour.

Hence, a versatile payment processor takes care of all the above while giving SaaS platforms valuable customer insights based on transaction data.

Payment solutions like Fondy are essential to the MedTech and Medical Services sector as they enable enhanced payment processes, improve user experiences, and contribute to the sector’s growth. Even better, payment service providers help address the associated challenges of payment compliance and security.

You could say that Fondy is a SaaS platform’s best tool. The advantages of using a payment provider like Fondy for SaaS businesses means benefitting from:

- Instant settlements mean improved cash flow and financial stability for SaaS companies

- Split payments to send funds to different partners in the SaaS ecosystem

- Instant payouts to credit local partners on cards or accounts in local currencies

- Account segregation to separate funds by department, location, or however you wish

- Access to acquiring banks and the entire banking network

- Advanced security (encryption and tokenization) and compliance adherence for storing customer data securely

- Reduced costs compared to building a custom payment system

- End-to-end account management

How to streamline revenue sharing with split payments

The best way to maximise revenue sharing is to embrace split payments. With split payments, different payment amounts from a transaction, such as those between a restaurant, food delivery platform, and a courier, are automatically divided and credited to the accounts of each recipient all at once.

So, if you need to make instant settlements with several different partners after each payment from a client, you can use Fondy’s split payment feature. This means that you can save time by eliminating manual reconciliations, reducing acquisition costs, and optimising your revenue management.

Revenue management means predicting customer behaviour to maximise revenue by selling the right products to the right markets at the right price. However, as SaaS products are so complex compared to traditional models, the best solution is to find a payment solution that fully integrates all the different components of revenue management, from payment operations to data analysis.

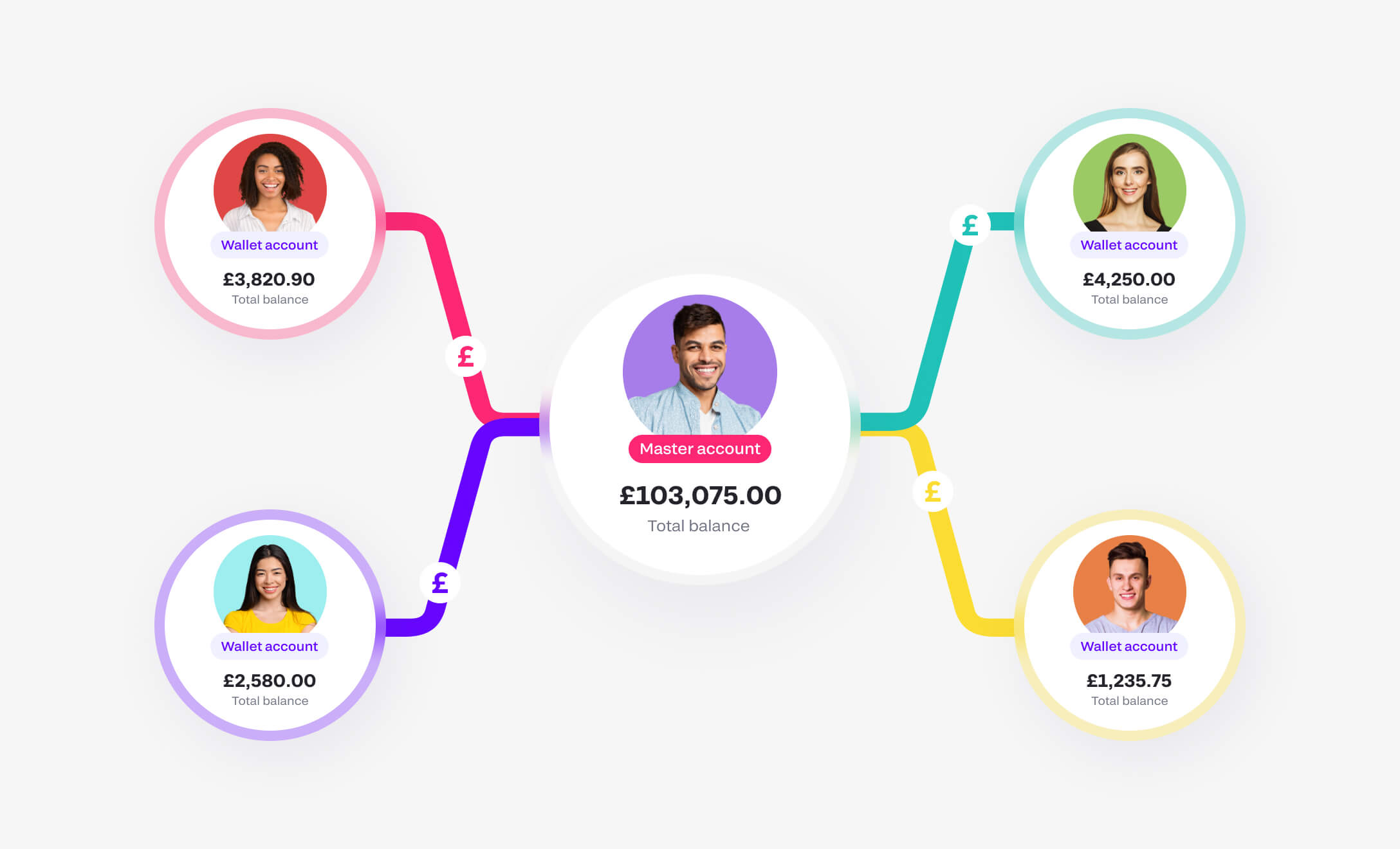

The role of account segregation in managing payments for platforms

Gone are the days when a business account meant just that: one unified account to put all business funds. That’s because, with modern business operations more complex than ever, having just one account often presents companies with confusion when it comes to attributing funds to certain markets, regions, or departments.

Instead, modern businesses, especially SaaS platforms, need “accounts within accounts” to match the makeup of the versatile business models.

With Flow Payments, you can segregate funds using a Standard or Master Account, each with their IBAN. Each type of account has the functionality to enable the creation of business Wallets (i.e., sub-accounts) so you can separate funds by business location, department, model, etc.

Even better, with unique payment references, you can direct funds into specific Wallets, making payment reconciliation between different partners, suppliers, or clients easier. If you need a complete overview of your SaaS platform, just check your Standard or Master Account balance, i.e., the sum of all Wallets under the same IBAN.

Segregated accounts like these not only simplify business processes but also enhance financial management, providing an end-to-end view into revenue and expense visibility and financial performance.