Explaining multicurrency bank accounts

In the modern world, it’s common for individuals and businesses to make transactions in different currencies internationally. But with most current and savings accounts, these purchases usually come with additional charges such as international conversion fees, foreign exchange rates, and more that don’t help you get the most out of your money. Over time, these charges start to add up. That’s where multicurrency business bank accounts come in handy. Continue reading to discover:

- What are multicurrency business accounts?

- The benefits of multicurrency business accounts

- The disadvantages of multicurrency business accounts

- International multicurrency business accounts

- How to open a multicurrency business account

- The top multicurrency business accounts and where Fondy fits in

- Domiciliary business bank accounts

What are multicurrency accounts?

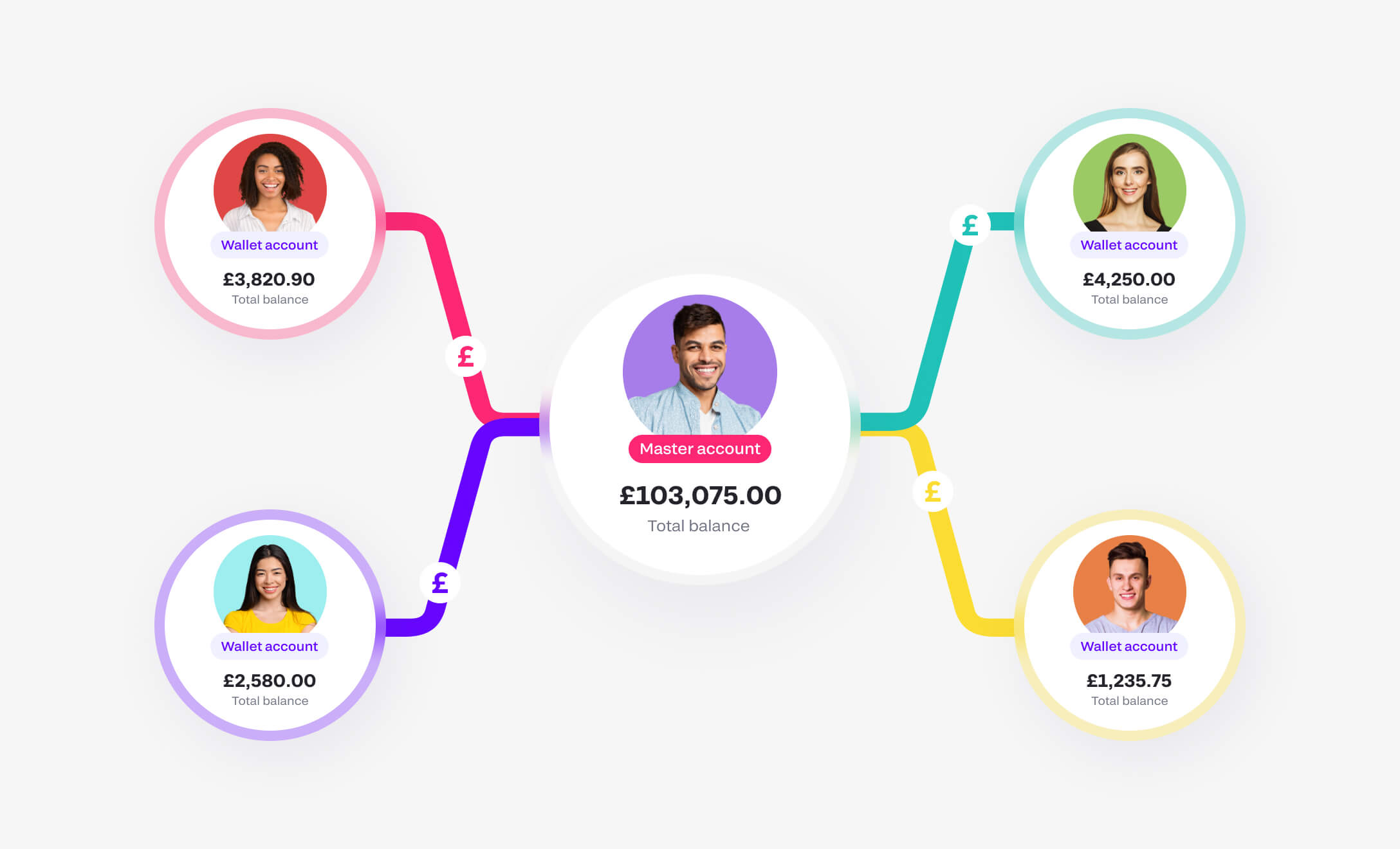

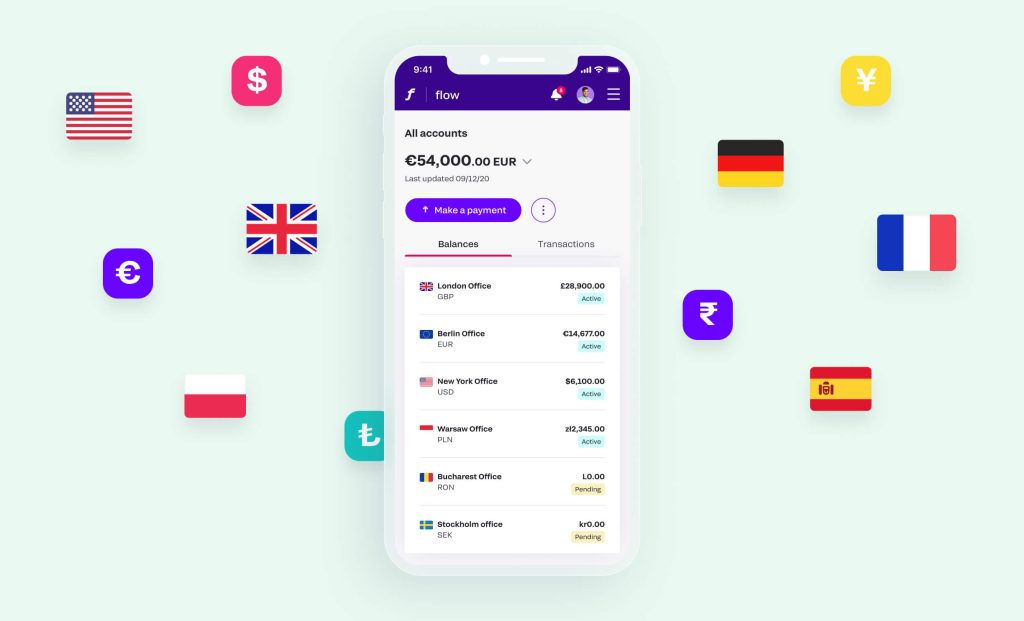

They’re exactly what they say on the label. Multicurrency business accounts are bank accounts held in more than one currency. Rather than having one balance like a current or savings account, a multicurrency business account has several balances, depending on which currencies it holds.

However, depending on which country and currency is the main one, the holder of the multicurrency bank account can consolidate and compare the overall balance in a main currency. For example, if you hold money in pounds sterling, euros, and US dollars, you can see the balance of all currencies when converted to one of your choices.

The benefits of multicurrency business accounts

You might wonder, “What is the reason for opening a multicurrency account”? Great question. If you transact internationally, then there are many reasons why you should have one.

Some of the main advantages of multicurrency accounts include:

Convenience

A multicurrency business account means you can hold money in different currencies in one place, removing the need to have or compare several bank accounts, online apps, paperwork, international money sources, etc.

Flexibility

This means you can get paid, receive or spend money in different currencies without having to exchange money or currencies and pay international bank conversion fees.

Consolidation

A multicurrency account is a simpler way to manage your money across multiple currencies internationally. In addition, they are great ways to consolidate multiple international currency balances, giving you an open and complete overview of your available business money.

Faster payments

Transacting in local currencies means paying or receiving money quicker without the usual international bank delays and extra costs incurred by converting currency.

Online banking

Most multicurrency business accounts offer the convenience of managing your money via around-the-clock international online banking.

Reduced transaction fees

Multicurrency bank accounts eliminate or reduce the several associated international transfer charges.

All of the above benefits mean that international businesses can enjoy the advantages of shopping, banking, and receiving money online, just like local individuals or merchants.

The disadvantages of multicurrency accounts

Depending on your circumstances, a multicurrency business account may not be the right option. Although there are many great benefits of multicurrency accounts, there can be some minor drawbacks, including:

- Some additional fees for opening the account.

- Annual maintenance and business charges.

- High minimum opening balance or monthly money pay-in requirements.

- Typically low-interest rates if you’re trying to save money.

Multicurrency business accounts

A multicurrency account could be the answer if you’re a business owner making regular overseas money payments. That’s because a multicurrency account makes it easier to collect money from online marketplaces or directly from your business customers in their own currency.

There are also significant savings in banking costs, money forex, and time management by using one account instead of several business accounts.

Additionally, if you have a global client base, you’ll need to pay for international marketing, delivery, freelancers, etc, in local currencies. For example, a Fondy multicurrency account means you have the best payment flows available, i.e., one that lets you receive funds from your clients in one currency and then pay your suppliers in the same currency avoiding any currency conversions and potential delays.

Use Fondy for your multicurrency business accounts

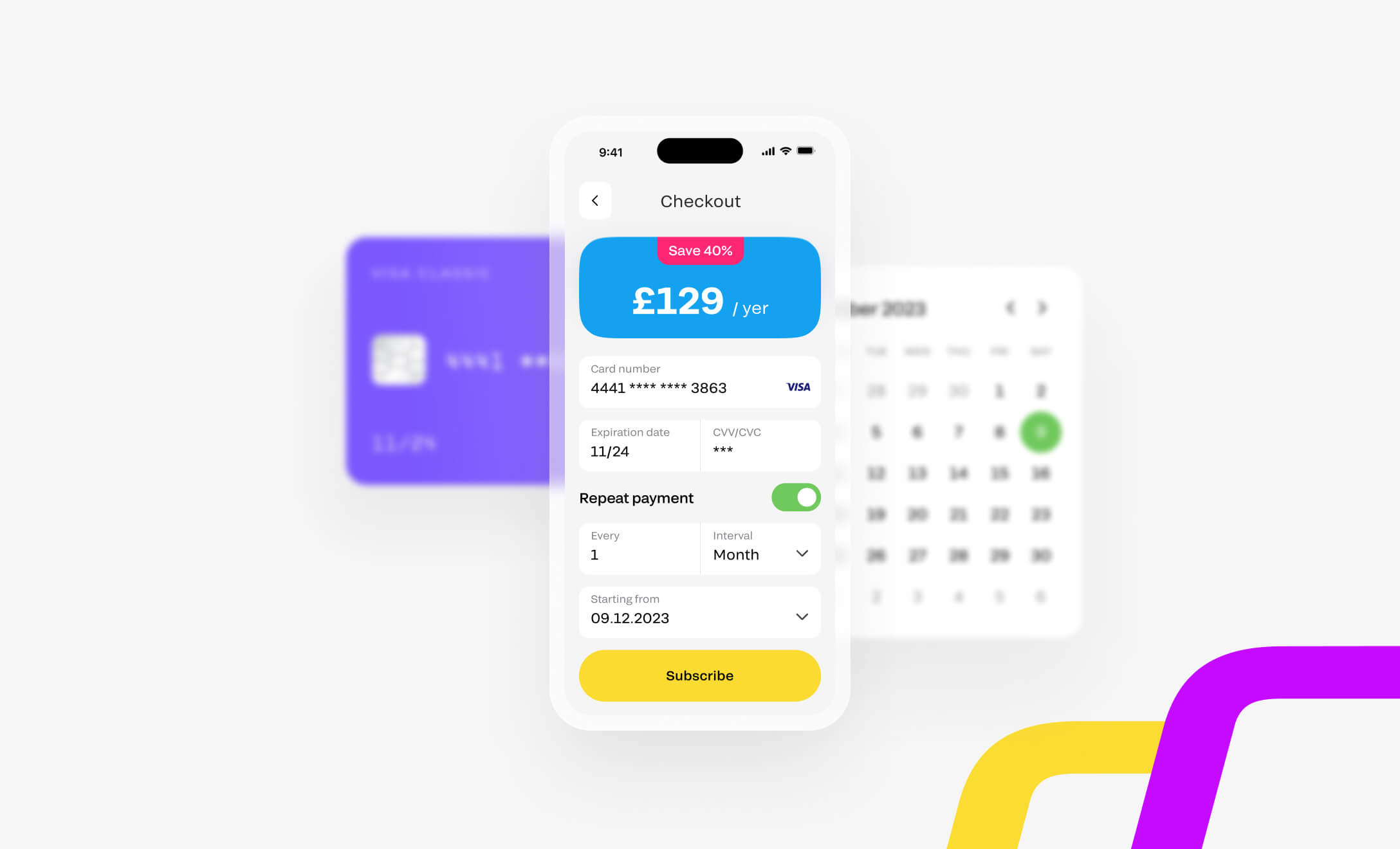

If you’re looking for the top multicurrency account for your business, why not try a Fondy multicurrency business account? Using Fondy as a business account means you get access to Fondy Flow payments, including the Fondy Gateway and Fondy IBAN accounts.

With Fondy Gateway, you have the functionality for payment acceptance from various payment methods. Additionally, a Fondy IBAN account gives merchants and businesses direct access to the UK banking ecosystem.

Fondy Flow payments, along with its multicurrency account functionality, makes cross-border money movement and money management as simple as 1, 2, 3. That way, you can focus on what matters the most, your customers.

How to open a multicurrency business account

The good news is that opening a global currency account is usually straightforward. A bank clerk can walk you through the steps in-branch, or you can apply online. If you’re creating your account online, the application process in the UK typically involves the following:

- Completing an application form.

- Uploading your identification documents such as a passport or driving licence.

- Taking and submitting a verification photograph or selfie.

- Recording and submitting a verification video.

- Submitting business registration information.

What are digital multicurrency bank accounts?

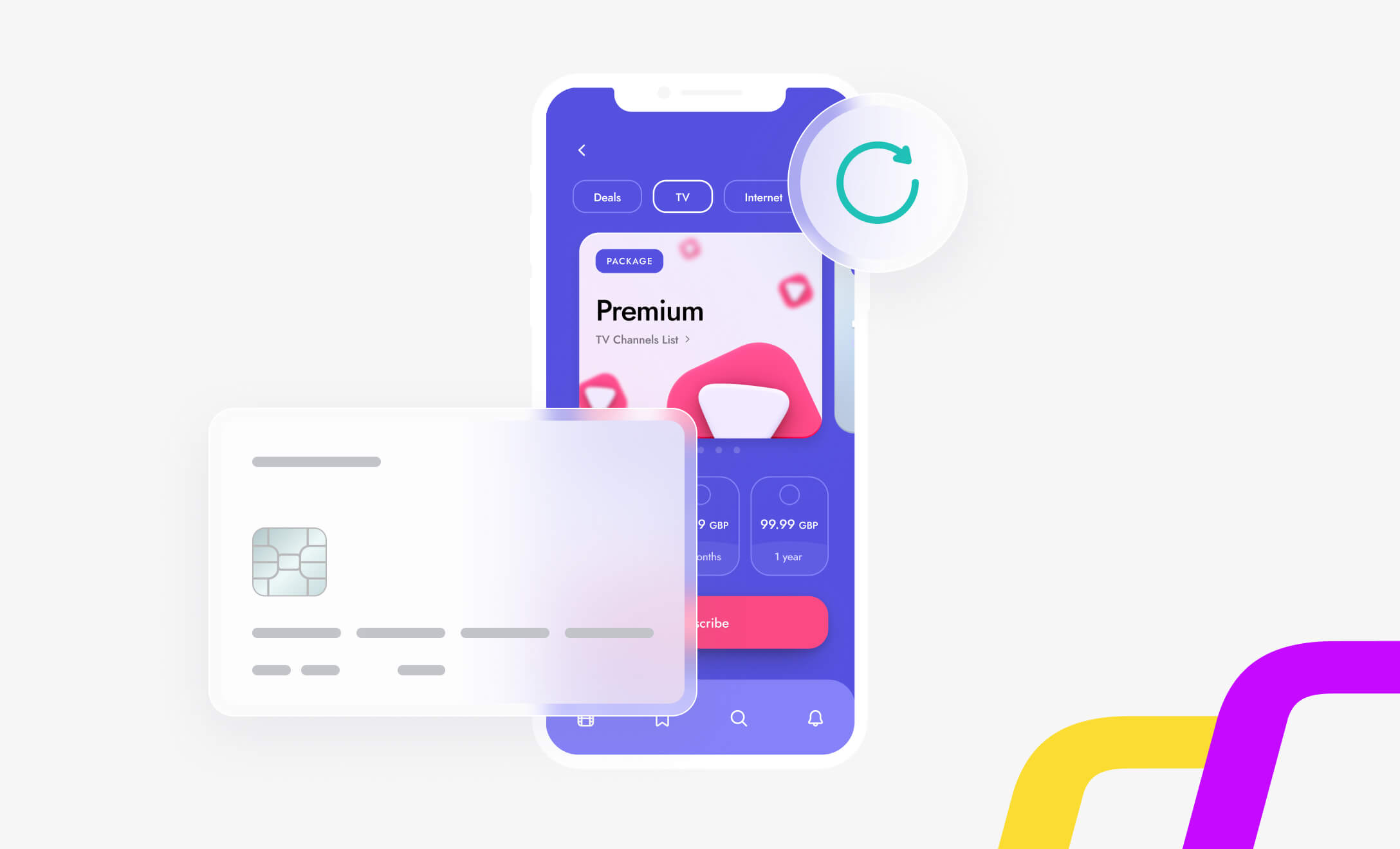

If you’re in the market for a multicurrency account for your business, you may consider a digital bank. These newer, independent providers offer businesses faster, cheaper, and more secure payment and currency management features.

Additionally, you still get many benefits from traditional bank accounts without the hefty fees. That’s because, for currency conversions, their rates are also some of the fairest on the market. And they’re usually transparent about the exact how many fees you pay. Furthermore, you’ll even be able to get local bank account details in various countries.

Some of the top multicurrency account providers for businesses include:

How do domiciliary bank accounts work?

Domiciliary accounts are the answer for individuals and businesses who want to make bank transactions in currencies other than the local currency. For example, how would a business or individual in Norway use a domiciliary account? They would use the account to make regular transactions in another currency, say GBP in the UK, besides the Norwegian Kroner.

Alternatively, a domiciliary account is defined as a type of bank account that operates in additional foreign currencies like dollars, pounds, euros, etc., as well as the local one. It allows you to fund it with foreign currencies and make foreign transactions on that account.

You can use a domiciliary account to receive, send, and deposit foreign currency from or to another country. A domiciliary account is not necessarily for saving money but for transacting business. A domiciliary account may also offer additional benefits such as debit cards, special foreign exchange rates, online banking, and mobile business banking. The main difference between domiciliary business accounts and multicurrency business accounts is the number of currencies involved.

While domiciliary accounts are reserved for two to three currencies, multicurrency accounts have no limit to the number of currencies a merchant can use. The main benefit of domiciliary accounts is that they are extremely useful for individuals, businesses, and countries where access to multicurrency accounts is limited.