The meaning of instant settlements

If you need information about instant settlements, you’re in the right place. Continue reading to discover more about instant settlements, including:

- What instant settlement payments mean

- How instant settlement payments work

- Payment gateways with instant settlements

- The benefits of instant settlement payments

- The difference between same-day and instant settlement payments

What is an instant settlement?

Whenever a customer makes a payment, there is usually a time gap between the money leaving the customer’s bank account or card and being available in a company’s merchant bank account. This time span is known as a settlement period or settlement payment period.

For businesses seeking to streamline their cash flow and access funds faster, an instant settlement payment gateway can make all the difference, enabling real-time payments and greater financial flexibility.

As a customer, you’re unlikely to even notice this period as the funds leave your bank account almost immediately after payments, after which you should receive the goods or services you’ve made a payment for. As a business owner, this payment period typically takes anywhere between a day, several days, and a number of weeks.

Well, there are a number of different reasons. First of all, the payment scheme could involve multiple participants, such as an acquirer, card issuer of cards, and account holder. Also, if there are multicurrency payments, the bank will need to make currency conversions and use an international payment scheme. That means that some transactions will need the participation of several banks before the payment reaches the merchant account.

Settlement periods are also used to check transactions for fraudulent activity and other payment obstacles that could cost them more in fees later down the road.

While most transactions involve multiple parties, you add more to the mix whenever you use a payment gateway. This can lead to a prolonged settlement period in terms of hours and days as gateways need to work in collaboration with third parties like payment processors, banks, and other intermediaries to process transactions.

With online banking (or account-to-account payments), the settlement process varies because it doesn’t involve so many participants. That said, online banking still experiences some delays as payment service providers will aggregate all the funds and, according to the payment schedule, then make settlements to merchant bank accounts.

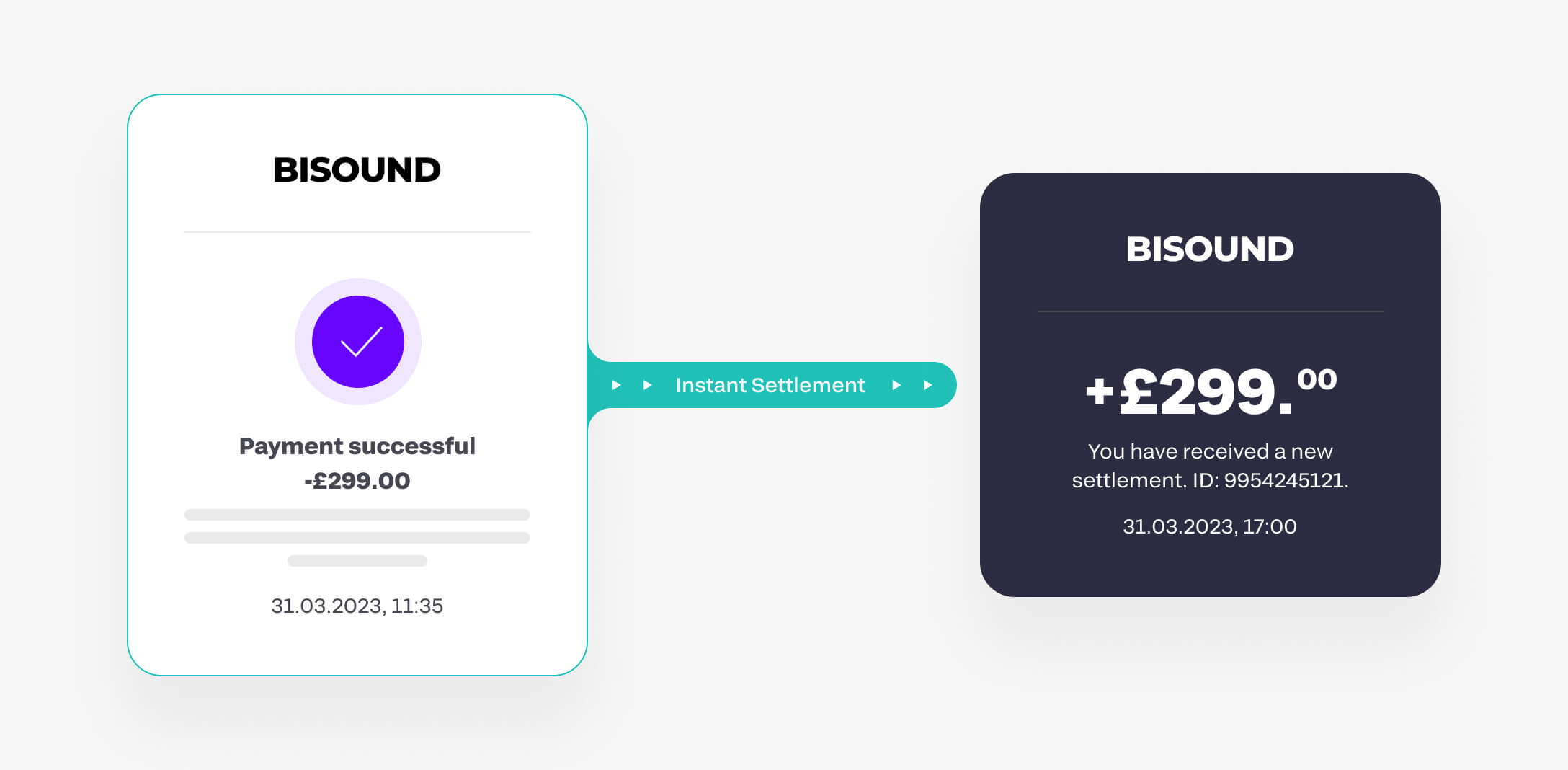

Many payment gateways work to eliminate or reduce this settlement period by transferring payment funds directly into merchant bank accounts. This enables fast, real-time payments, i.e. instant settlements that can be processed immediately on weekdays, even on bank holidays and weekends.

As a business owner, instant settlements mean having immediate access to funds on the same day once your customers have hit the payment button. In turn, you get complete control over your cash flow and the opportunity to accelerate your business growth.

As a one-stop payment platform, Fondy understands businesses and electronic commerce stores need flexible payment types such as instant settlements, payouts, etc. Get complete control over your cash flow and accelerate your business growth with instant access to funds via Fondy’s instant settlements feature.

How do instant settlements work?

For a better grasp of how instant settlements work, it helps to understand what happens during a typical transaction. Most online transactions usually include separate banks for the customer and merchant and a payment processor.

Imagine you’re a business owner in Germany, and your company sells computer monitors. A school in the UK buys 12 of your computer monitors, paying by bank card.

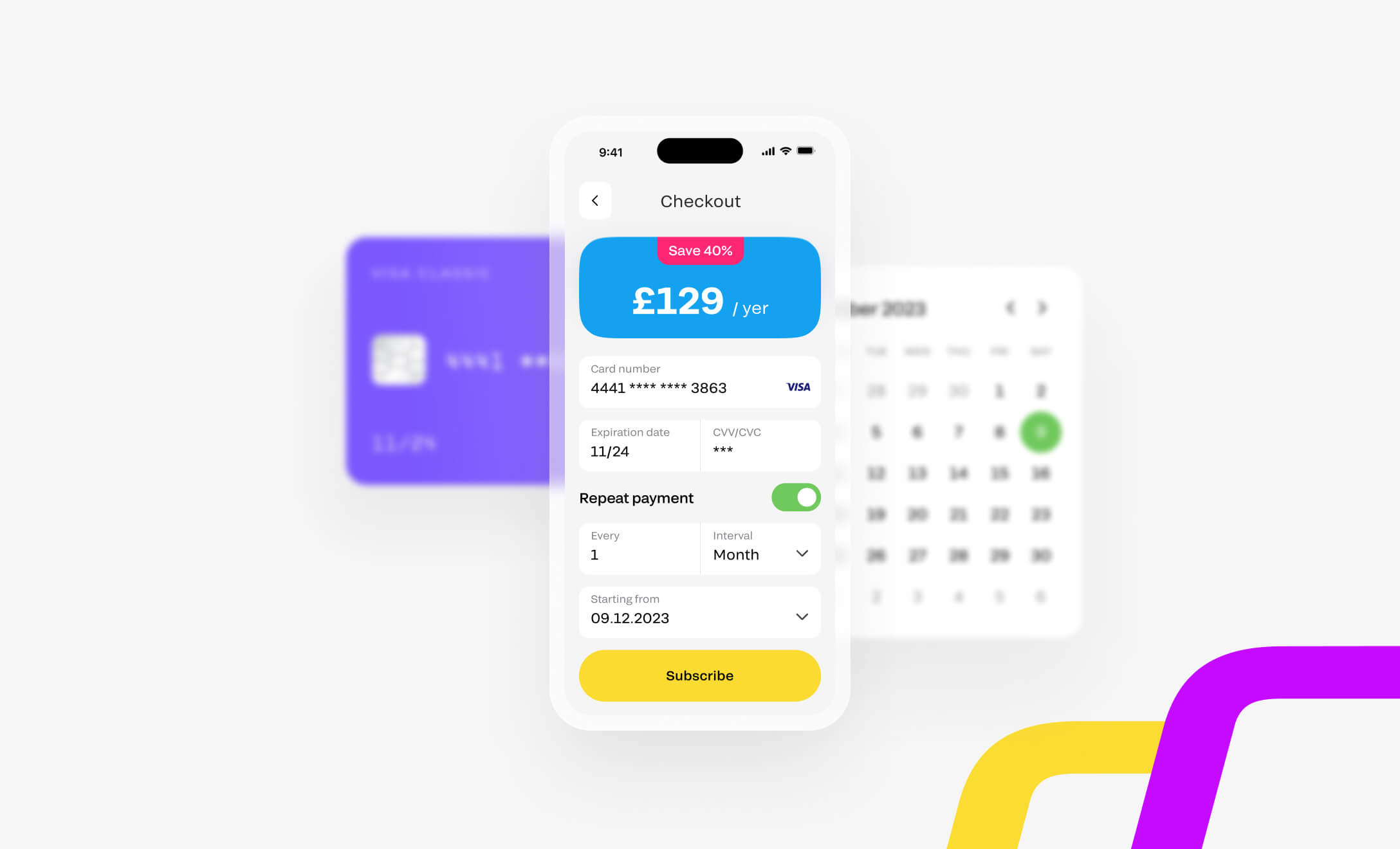

- The school makes a payment to your business using the checkout payment page of an online payment gateway.

- Payment gateways authorise each payment through a payment processor at the end of the day. Then, the acquirer processes all payments completed during the day and makes the settlements the next day. If the transactions occur in a foreign currency, then the settlement may take up to two days to complete.

- The payment processor passes the batch details on to the credit card company or bank.

- The cardholder’s (the school’s) bank debits the card and sends the funds to the acquirer, and after that, the funds reach the merchant account.

- The merchant’s bank deposits the total amount of authorised transactions into your business bank account, deducting applicable payment fees.

With instant settlement payments, the daily batches occur more frequently. Depending on the gateway, the batches could take place hourly, every few hours, or as specified. Consequently, the settlements can be almost instant in nature, allowing for greater payment efficiency and speed.

For Open Banking payments, instant settlements occur differently. In this case, the payment gateway initiates the payment from the bank account of the account holder, i.e. the school. The account holder confirms the payment via online banking, thus debiting the funds from the account. The amount reaches the payment gateway account, and according to the payment schedule, the payment gateway transfers the amount to the merchant account.

Payment gateways with instant settlements

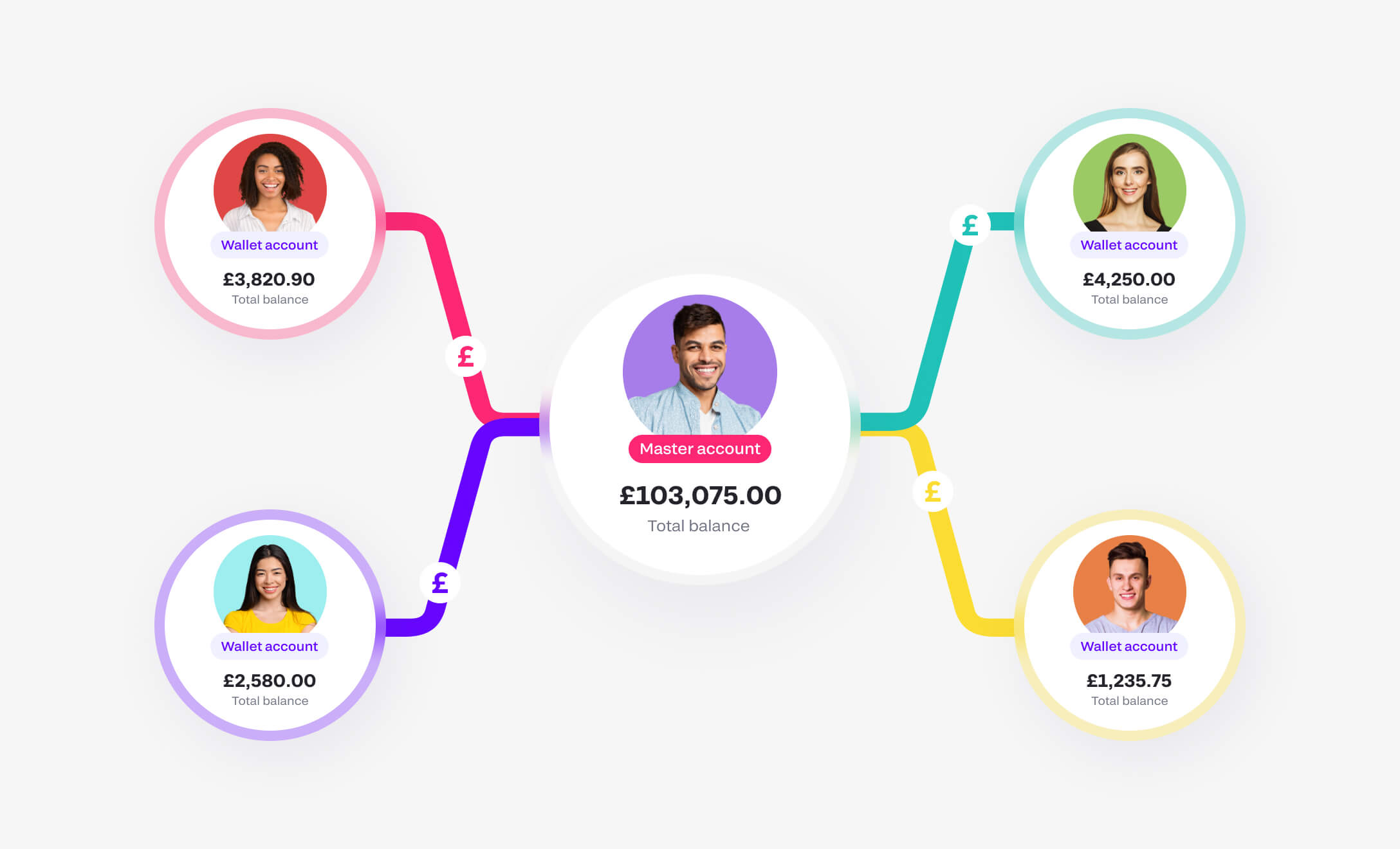

With your Fondy multicurrency business account, you can receive payments from customers and make payouts instantly to partners thanks to instant settlements.

Choose where, how and in which currency you would like to send money so that your suppliers, partners, etc, can receive the funds’ access within minutes. Faster settlements equal smoother business, which aids positive cash flow in every market in that you have a presence.

At Fondy, we initiate the payment from the payer’s preferred payment method, such as from a bank account or bank card. Card payments will arrive in your account on the next day. For Open Banking transactions, we initiate payments, and you receive the funds the same day in the same currency as your client’s payments. All the payments will be reconciled and matched with the initiated payments.

Discover more on our instant settlements homepage.

The benefits of instant settlement payments

Instant settlement payments have many advantages, especially for small to medium-sized enterprises (SMEs), platforms, marketplaces, and eCommerce companies. Using our computer monitor example above, you can see the benefits of instant settlements.

While Microsoft won’t need to rely on instant settlements for the sale of only 12 monitors, a small business owner like you would.

Firstly, global services corporations like Microsoft have a different business model compared to eCommerce providers, marketplaces, and platforms. Secondly, Microsoft operates with bigger budgets, meaning they aren’t as reliant on individual sales.

Smaller business owners don’t have the luxury of waiting a few days before having access to sales revenue.

That’s because they usually need instant liquidity to settle certain payment services in advance or cash flow to restock their inventory. In some sectors, next-day settlements merchant bank accounts aren’t quick enough.

For platforms, instant settlements are important as they help build loyalty with their partners by making it advantageous to work with them. Instant settlements also improve payment conditions with automatisation that helps develop the best payment conditions for their partners. As a result, instant settlements can really support business owners by helping pay suppliers and partners on time and maintain better cash flow management.

For example, hospitality businesses like restaurants often take payments after the banks have closed and therefore fall into the next working day. Industries like this, such as businesses like Deliveroo and Uber, benefit the most from instant settlements as they sometimes need to remunerate their employees immediately.

Some additional advantages of having account access to instant settlements include:

Faster access to payment funds

No more waiting days for payments to reach you. Get access to funds within minutes on the same day.

Reduced payment costs

Eliminate the costs of using card payment schemes and bank foreign exchange.

Better projections

Plan your short-term business goals better without assumptions. That means using calculated logic and not guesswork to plan for the future.

Better capital management

Pay employees, and purchase inventory, or business bills easily. With instant access to your account funds, you can easily plan your business expenditure better and drive your business towards growth. Instant settlements also help avoid the dependency on costly short-term account loans to cover business requirements.

Handle refunds and chargebacks better

With instant settlements, you get immediate access to funds and, in case of refunds or chargebacks, you can easily reverse the payments without incurring any loss for those account transactions.

Accelerate your business growth with settlement payout solutions

Looking to streamline your cash flow even further? Explore our settlement payout solutions designed to optimise payment distribution and ensure smooth, timely transactions. Whether you’re managing global operations or working locally, our tools help you take full control of your financial operations. Discover how Fondy can transform your payout process and drive your business forward with confidence.

The difference between same-day and instant settlements

The main difference is in the name. Same-day settlement payments occur within the same 24-hour period while most instant settlements happen within an hour.

With instant settlements, you can accept online payments from your customers and access those funds from your account within minutes from the time of payment capture, even during the evening and on public holidays. As mentioned previously, you can specify the time or day interval for settlement and all the settlements will be carried out accordingly.

On the other hand, with same-day settlements, all the payments made to their business account between a specified slot, say 9 am and 5 pm will be credited on the same day, usually at the close of business.

But why do some settlements take so long?