Open Banking with Fondy

Need information about using the Open Banking feature at Fondy? Look no further. Discover all you need to know, including:

- The meaning of Open Banking

- How Open Banking works at Fondy

- The benefits of Open Banking

- The challenges and opportunities of Open Banking

- Open Banking security features

What is Open Banking?

According to GOV.UK, by September 2023, 60% of the UK population will be using some type of Open Banking product. Having burst onto the financial scene less than ten years ago, that’s quite the rise in popularity. But what is Open Banking?

Open Banking is a banking feature that allows you to securely share certain financial information, such as your balance and transaction history, with other financial providers. As a result, you can pay for goods and services instantly and securely and gain access to the best and most cost-effective financial products and services on the market.

Everyone, from individuals to merchants, can take advantage of Open Banking as its reach extends everywhere from investments to donations, or lending to payments, and beyond, literally opening a wide range of financial services from the comfort of a smartphone, tablet, or PC.

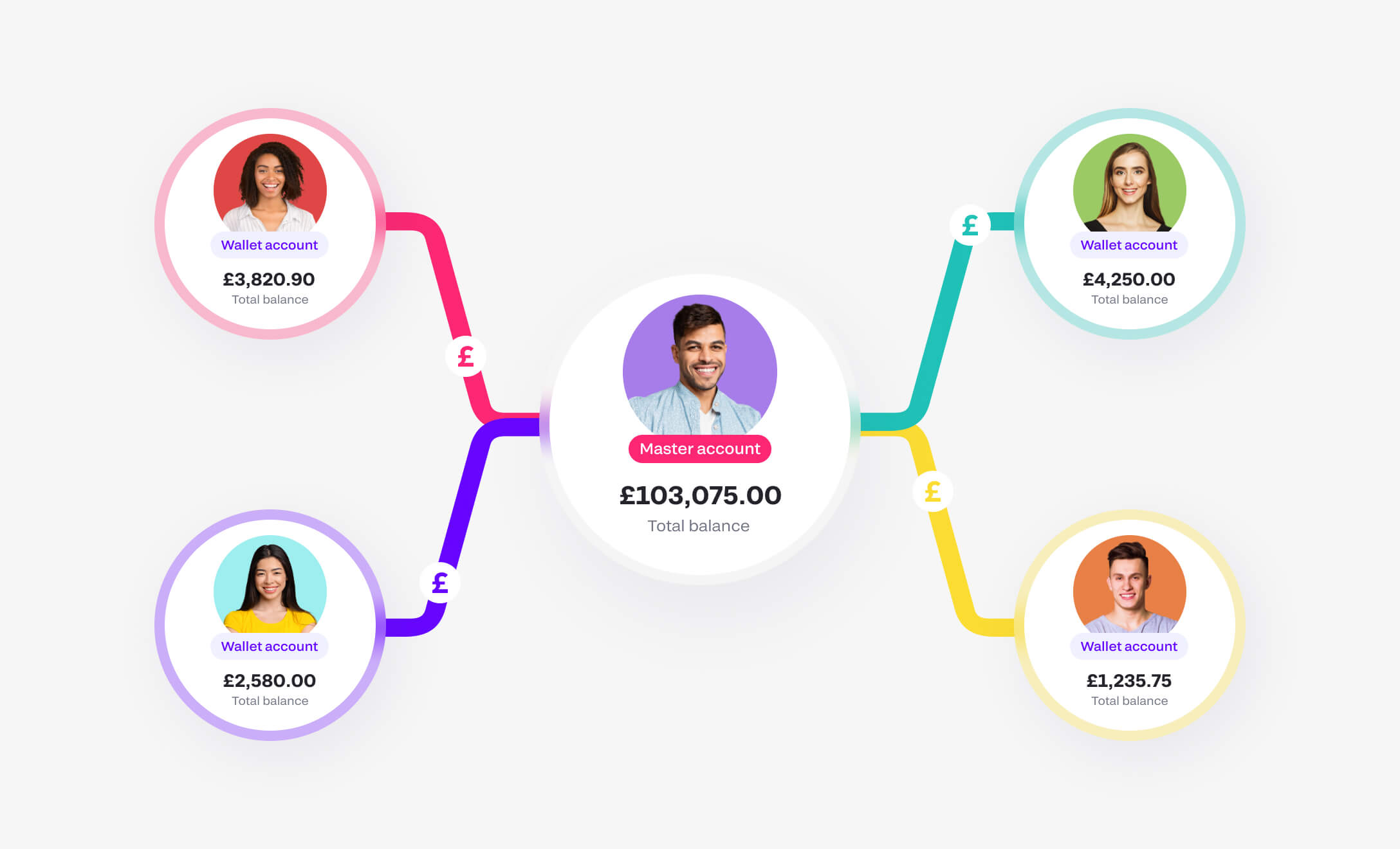

When it comes to eCommerce, Open Banking is game-changing. Instead of receiving traditional payments by credit card or debit card, merchants and customers can enable Open Banking payments. That means receiving account-to-account (a2a) payments directly from a customer’s bank or payment account, eliminating the time and cost of a middleman or third party.

As a result, merchants gain a more secure, smoother, and efficient method of accepting and making payments. Open Banking also gives marketplaces and platform owners access to real-time financial data that helps them manage their cash flow more effectively so that they can perform tasks like forecast budgets, applying for credit, or even speeding up outgoing or incoming payments.

As bank accounts hold plenty of information about your business, from invoicing to payroll, Open Banking means that you can find more cost-effective products and services to help you understand and run your business better.

How Open Banking works at Fondy

If you’re looking for a payment gateway for marketplace or platform with Open Banking functionality, the Fondy gateway is the answer.

Thanks to Fondy’s partnership with Yapily, the Fondy gateway provides Open Banking solutions to businesses, including marketplaces and platforms worldwide. Yapily is an Open Banking platform that helps companies grow through access to sophisticated banking and financial products. These features include:

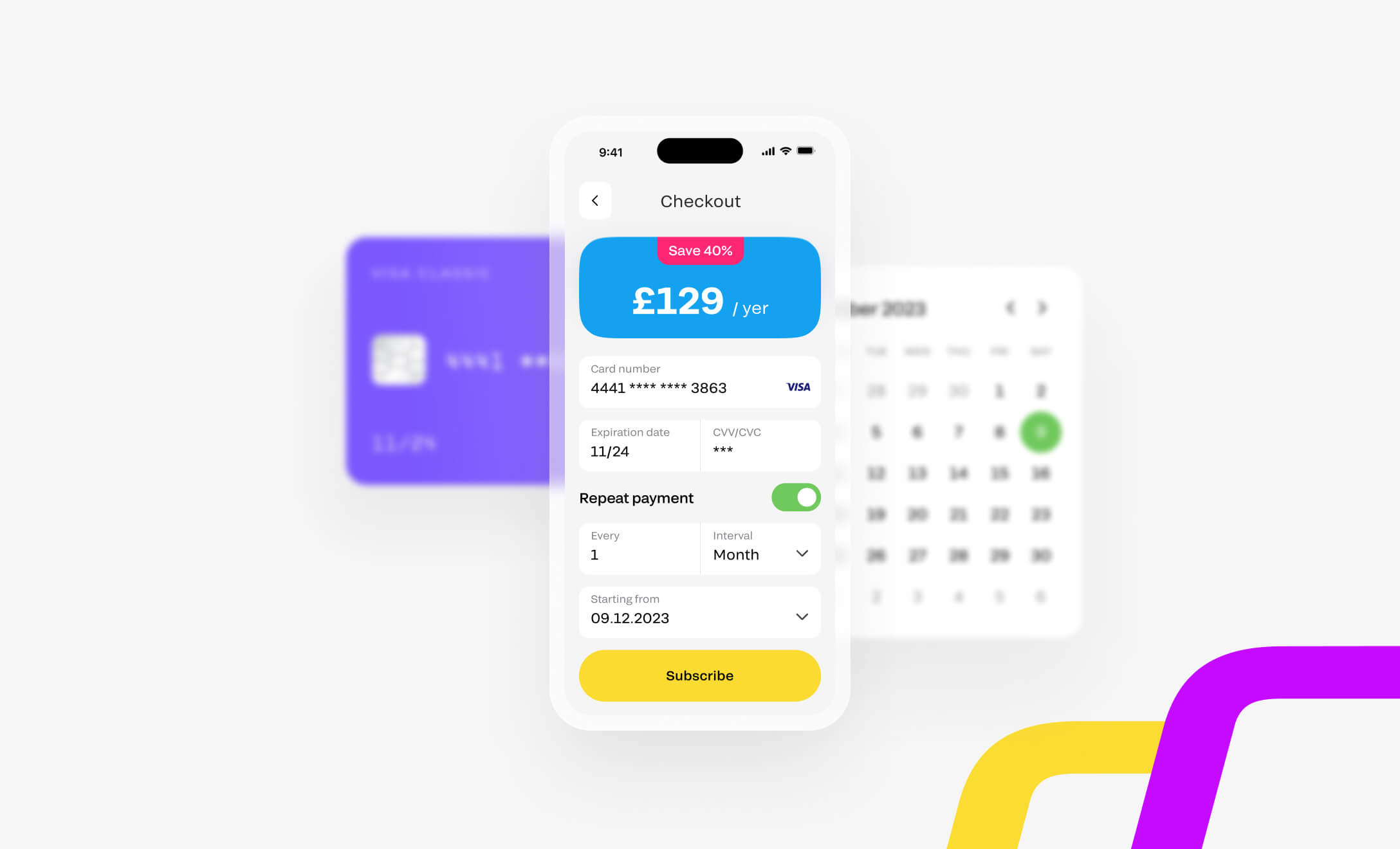

Instant payments

With Open Banking comes advanced payment initiation services (PIS), such as QR codes or barcodes that enable customers to make secure and instant payments in just a few clicks. In turn, these instantaneous payment flows help to boost sales.

Instant settlements

With card payments, especially those that are cross-border in nature, it can be difficult to know when the payment settles. This makes the visibility of funds for merchants difficult. Open Banking payments, when paired with instant payments, can improve settlement times for payment service providers like Fondy and their merchants.

Instant refunds

The time it takes to receive a refund is an important factor in whether or not a customer returns to an eCommerce store. With traditional card transactions taking around ten days to refund, Open Banking can enable merchants to complete this process instantly. That way, customers are refunded to the same bank account they used to make a transaction, allowing them to make new purchases straight away.

Additional benefits of Open Banking with Fondy include:

- Eliminating unnecessary fees with direct bank payments from one account to another (a2a payments).

- Sending funds to multiple recipients, such as partners, suppliers, gig workers, etc., from a single account in a single transaction.

- Granting instant access to financial data for a complete view of customer trends.

- Minimise chargeback fraud and errors by removing manual data inputting.

The benefits of Open Banking

Now that we’ve seen the benefits of Open Banking with Fondy let’s look at some of the advantages of Open Banking.

Some benefits of Open Banking to merchants, platforms, and their customers include:

- Reduce transaction costs – by cutting out the middlemen, i.e. credit card network, acquire, and issuer fees.

- Instant payments – by eliminating the middlemen, businesses improve payment journey speed meaning that payments become instantaneous.

- Secure payments – customers never have to share any data with Open Banking as they only grant access to their accounts by authenticating directly with their bank through secure APIs.

- Streamline the checkout process – as customers pay directly from their bank accounts which, by extension, increases conversion rates.

- Chargeback prevention – as Open Banking payments are instant, they settle just as quickly, meaning that they can help prevent chargebacks which have negative impacts on company cash flow.

- Eliminates late payments – by initiating payments via secure payment links with pre-populated invoice details.

- A 360-degree view – of your finances enables better cash flow management and forecasting.

The challenges and opportunities of Open Banking

The number one concern for customers will be their reluctance to share financial data unless they’re sure that it is handled securely. Despite these concerns, Open Banking adoption has continued to grow, with around 68 million individual open banking transactions processed last year. That’s the same as every person in the UK using at least one Open Banking product.

Recent digital trends plus social distancing measures mean that online payment fraud losses are expected to exceed $200 billion by 2025. But with Open Banking, secure payments directly from banking apps can help lower this estimation as card details are never shared with providers.

Additionally, according to recent studies with a Financial Crime Survey, 35% of companies spent upwards of £10 million each on anti-financial crime initiatives in 2022 alone.

Another challenge is upgrading many leading banks and financial providers’ older IT systems. To reap the full rewards of Open Banking, new end-to-end digital architecture is required. These new systems often require a significant investment of time, effort, and financial resources.

The alternative could be using a Software-as-a-service (SaaS) provider. For example, for Open Banking “services”, Fondy is powered by Yapily’s Open Banking “software” via its API. Yapily is a leading Open Banking provider. As a result, Fondy and our merchants have to access the most extensive Open Banking coverage across the UK and Europe for both consumer and business accounts.

Open Banking security features

As recently as two years ago, in 2021, Open Banking payments topped the £25 million mark. Last year that figure almost trebled to just under £70 million. With impressive growth like that, the end of 2023 could see Open Banking payments comfortably surpass £100 million.

But as the popularity of Open Banking continues to rise, so must the advancement of its security features.

While card security initiatives like Strong Customer Authentication (SCA) do their best at prevention, it often comes at the expense of seamless payment journeys. With secure authentication and seamless payments, Open Banking removes the threat of scammers getting hold of your information for fraudulent activities.

Open Banking gives merchants, platform owners, and customers peace of mind by adhering to:

- Bank-level security – Open Banking uses the same security systems as the world’s leading banks and financial institutions.

- Regulation – only apps and websites regulated by the FCA or European equivalent can use Open Banking functionality.

- Complete control – with Open Banking, only you get to choose when, with whom, and for how long you give access to your data.

Even better, you’ll never be automatically enrolled or opted-in to Open Banking. That means you’ll only enable Open Banking if you’ve given your explicit consent to the provider in question.