Understanding payment settlements

If you need information about payment settlements, look no further. Keep on reading to discover more about automated payments, including:

- What are payment settlements?

- The types of payment settlements

- Why are instant and same-day settlements useful?

- Payment gateways with instant settlements

- The benefits of payment settlements

- What is the best settlement period?

What are payment settlements?

A payment settlement occurs when money or funds from a customer is transferred to a merchant, online shop, or online service. For example, think about the last time you bought a cup of coffee from a high street retailer. By the time you’ve consumed the drink, that payment has probably only been authorised.

Payment authorisation is when the merchant submits a transaction request to the cardholder’s bank. The bank will then verify that you have enough money in your account, and the merchant will receive a response code from the card association or network either approving or declining the pending transaction. For a transaction to be approved, your account must have enough funds or available credit, and the card also must not be reported as lost or stolen.

After a transaction has been approved, the payment settlement is the next and final step. Settlement is when the issuing bank transfers the funds from the customer’s account to the payment processor, who then transfers the funds to the acquiring bank’s account. The merchant, in this case, the coffee shop, will then receive the funds in its merchant account.

Moving away from the high street, online payments are a great example of payment authorisation and payment settlement at work. While an eCommerce or online store will authorise a transaction during the checkout process, the transaction is usually settled on the next business day when the goods are shipped to the customer.

The types of payment settlements

Settlement times or periods vary based on the issuing bank and the type of transaction involved. Some authorised transactions may get settled immediately (instant settlements), while others could take hours (same-day settlements), days, or even weeks to settle.

With instant settlements, you can accept online payments from your customers and access those funds within minutes, even during the evening and on public holidays. As mentioned previously, you can specify the time or day interval for settlement, and all the settlements will be carried out accordingly.

On the other hand, with same-day settlements, all the payments made to their business account between a specified slot, say 9 am and 5 pm, will be credited on the same day, usually at the close of business.

As a one-stop payment platform, Fondy understands businesses and electronic commerce stores need flexible payment types such as instant settlements, payouts, etc. Get complete control over your cash flow and accelerate your business growth with instant access to funds via Fondy’s instant settlements feature.

Why are instant and same-day settlements useful?

While some business models may not rely on fast payment settlements, for smaller businesses and certain professions, there are several distinct advantages to instant access to funds.

Some examples of industries that would benefit the most from instant and same-day payment settlements include:

- Ride-sharing apps that work with various partners like car drivers.

- Building contractors who need payments settled in advance for materials.

- Online casinos and sports betting that pay out cash rewards.

Payment settlements with Fondy

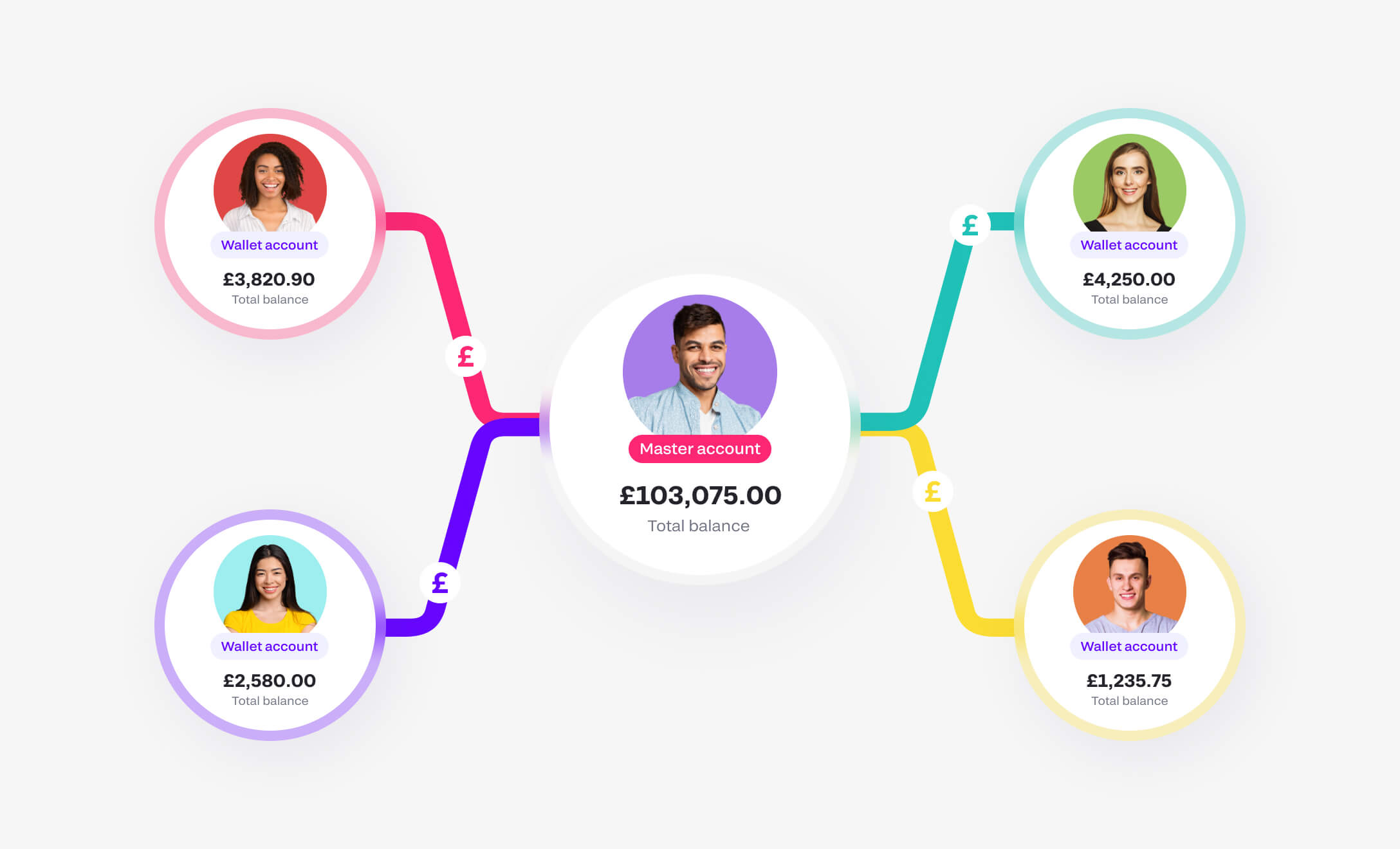

With a Fondy multicurrency business account, merchants can receive payments from customers and make payouts instantly to partners thanks to instant payment settlements.

Our geolocation technology means that we automatically recognise where your suppliers, partners, etc., are based and make settlements in the appropriate currency and via the most suitable local payment method. That way, all partners receive access to funds within minutes.

Faster settlements equal smoother business, which aids speedier cash flow in every market you have a presence in. That means everyone from merchants to their network of partners has instant access to cash in their Fondy Flow accounts, ready to use as they wish.

At Fondy, we initiate the payment from the payer’s preferred payment method, such as from a bank account or bank card. Card payments will arrive in your account on the next day. For Open Banking transactions, we initiate payments, and you receive the funds the same day in the same currency as your client’s payments. All the payments will be reconciled and matched with the initiated payments.

The benefits of instant payment settlements

In today’s digital age, faster is better. From online food ordering to those shoes you’ve wanted for a while, the quicker they arrive, the better.

For customers and merchants alike, the speed of instant settlements brings extra benefits, including:

Better capital management

Pay employees, inventory, and more easily. With instant access to your account funds, you can easily plan your business expenditure better and drive your business towards growth.

No reliance on loans

Instant settlements help avoid the dependency on costly short-term account loans such as bad payday borrowing to cover business requirements.

Reduced payment costs

Eliminate the costs of using card payment schemes. That means no fees and relying on poor bank foreign exchange rates.

Better projections

Plan your short-term business goals better without assumptions. That means using calculated logic and not guesswork to plan for the future.

Handle refunds and chargebacks better

Get immediate access to funds, and in case of refunds or chargebacks, you can easily reverse the payments without incurring any loss for those account transactions.

What is the best settlement period?

Normally, payment gateways are responsible for transmitting funds to merchants whenever a customer makes a payment.

The typical settlement period for most payment service providers is three to five working days. Whereas some PSPs can take weeks to complete a payment settlement, others like Fondy can make it happen instantly, depending on the merchant and the industry.

When choosing the ideal payment gateway for your small business, make sure you opt for a service that allows same-day settlements, as most businesses depend on timely settlements to manage their business effectively.