A guide to automated payments

If you need information about automated payments, you’re in the right place. Continue reading to discover more about automated payments, including:

- The definition of automated payments

- Using automated payments for split payments

- Using automated payments for invoices

- Types of automated payments

- The benefits of automated payments

- How to set up automated payments

What are automated payments?

When you run a business, there are many daily tasks you’ll need to perform. These include payroll and recruitment, inventory, bookkeeping, and email marketing. Luckily, many of these activities can be automated, including making business payments.

An automated payment system allows businesses to make payments directly via an electronic method. When talking about automating payments, it refers to technology that increases efficiency by eliminating the monotonous, manual processes involved when making payments.

Using automated payments for split payments

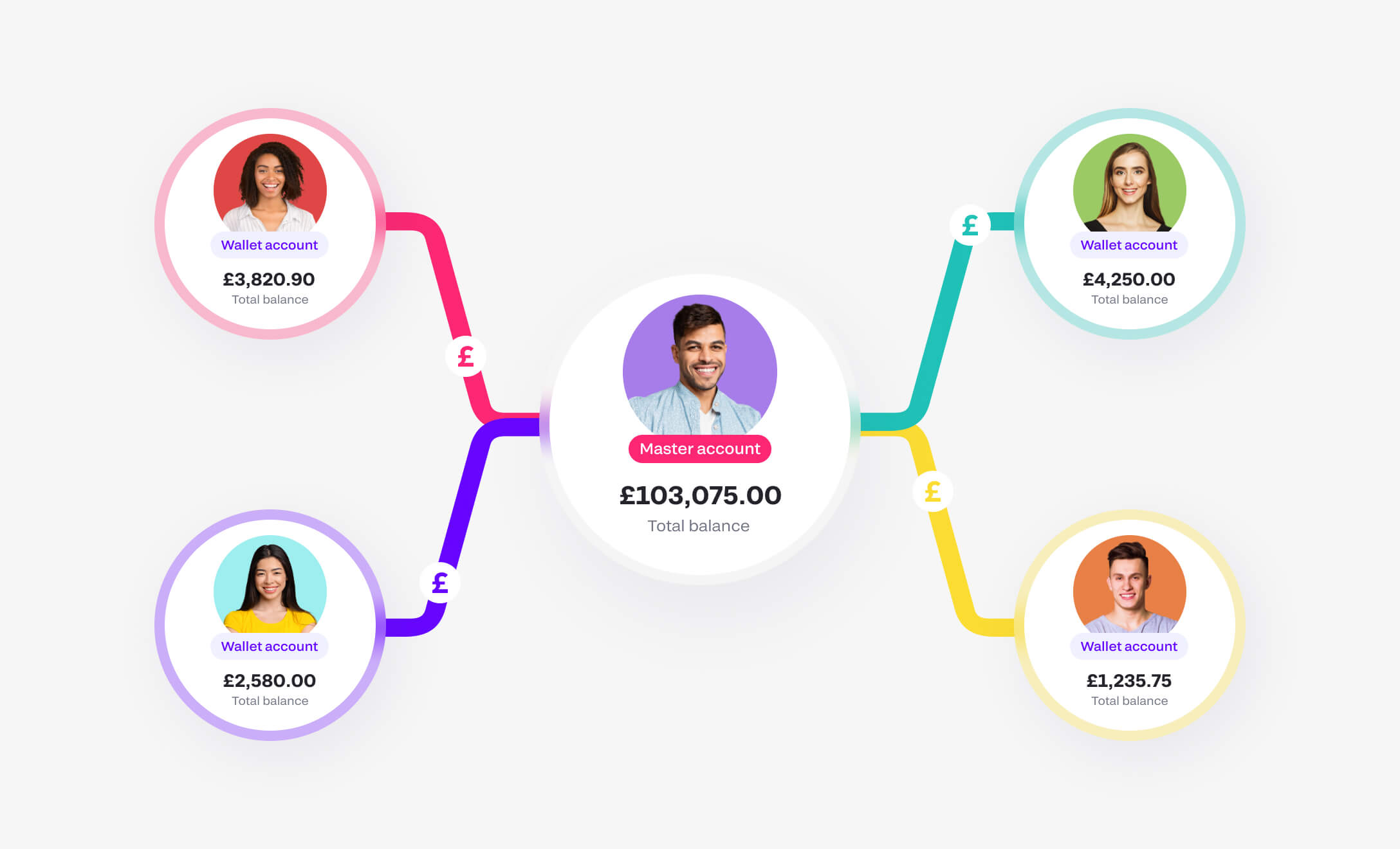

Automated payments can be advantageous if you need to handle things like split payments. If you need to send money to multiple accounts or individuals manually, you’re looking at spending a lot of time and running the risk of human error. With split payments, these payment amounts are automatically divided and credited to the accounts of several recipients all at once.

For instance, in businesses where there are several partners involved, such as marketplaces, car-sharing platforms, ticketing services, and travel brokers. If you need to make same day settlements with several different partners after each payment from a client, you can use Fondy’s split payment feature. This means that you can save time by eliminating manual reconciliations and reducing acquisition costs.

That way, you can credit sellers and service providers for their part of the payment process automatically without third-party services and aggregators. This will simplify mutual settlements and reduce the operational burden of your marketplace. All you have to do is choose the split payment model you need.

Using automated payments for invoices

Manually processing invoices has been an ad-hoc task of many accounting departments for years. And for new businesses and entrepreneurs, the manual invoice method may work for a while. But what happens when your company really starts to take off?

That’s where automating your invoices can be key to your business. As you begin to scale your business and pick up more clients, managing multiple invoices the traditional way will take up more precious time. Automated payments, such as automatic invoices, can help you gain back that time by streamlining these processes.

As a one-stop payment platform, Fondy understands businesses and eCommerce stores need flexible payment options like automated payments. Automate your payment processes and perform functions like automatic payouts to multiple parties in multiple currencies. Discover more on Fondy’s marketplace and platforms homepage.

Types of automated payments

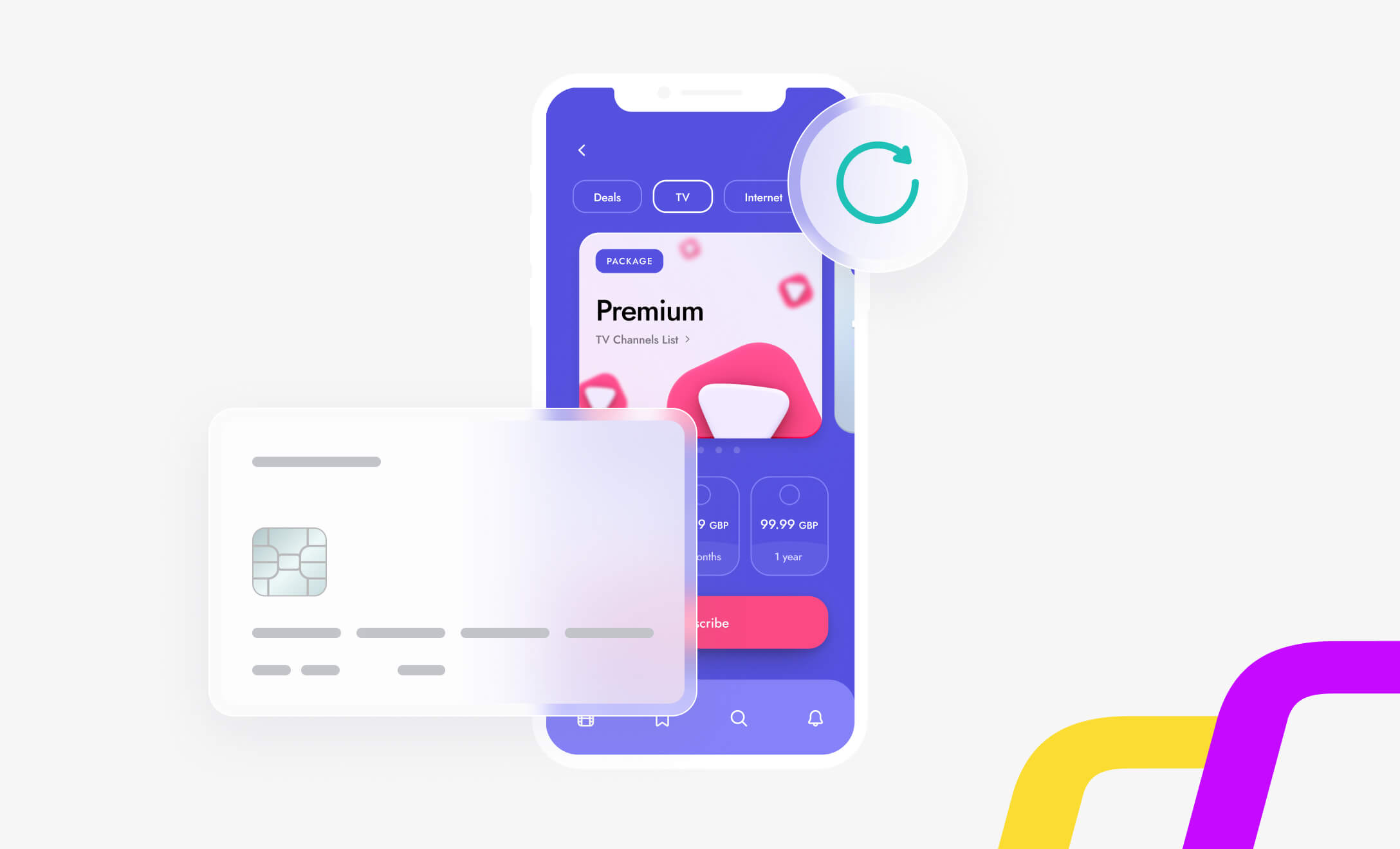

Automated payments aren’t a new concept. If you’ve ever set up a standing order, then you’ve used an automated payment system. The only difference between now is that nowadays, there are more advanced.

Automated payments can also include:

- Direct Debits for household bills.

- Loan repayments, like a credit card.

- Recurring payments, such as gym subscriptions.

The benefits of automated payments

Automated payments benefit businesses and customers alike. By providing frictionless payment processes, you’re developing a positive customer experience, and satisfied customers usually translate to loyal customers.

Here are some other advantages of automated payments:

Save time and money

The main benefits of payment automation are cost and time reduction. A paper invoice can take up to a week to process and, at some cost, to a business owner. Not only does payment automation speed up the process and increase efficiency, but it does so more cost-effectively.

Cash flow management

With payment automation, businesses can predict when best and how they pay their partners to ensure better cash flow management. This allows businesses to benefit from early or bulk pay discounts while avoiding late fees and duplicate payments.

Supports business growth

Payment automation helps to support your organisation’s business growth plan by enabling your team to complete their payments process on time, even remotely. The ability to facilitate this process remotely has proven to be especially helpful in recent times, such as the covid lockdowns.

Automatic reconciliation

With a complete view of the status of all payments at any given time, automated payments allow for a fully automated daily bank reconciliation of your cash accounts, eliminating the need for manual input.

Reduce fraud risk

With complete visibility into every payment, you can reduce fraud risks if they arise. In addition, payment gateways can strengthen your payments by tapping into their security features like encryption, two-factor authentication, and tokenization.

Save on interest charges

Automated payments can be a great way to save money on interest charges. When you set up an automated payment, your payment gateway or banking institution will make regular payments on your behalf. This can help you avoid missed payments and, therefore, late fees and penalties. Also, it can help you avoid paying interest charges on your outstanding balance.

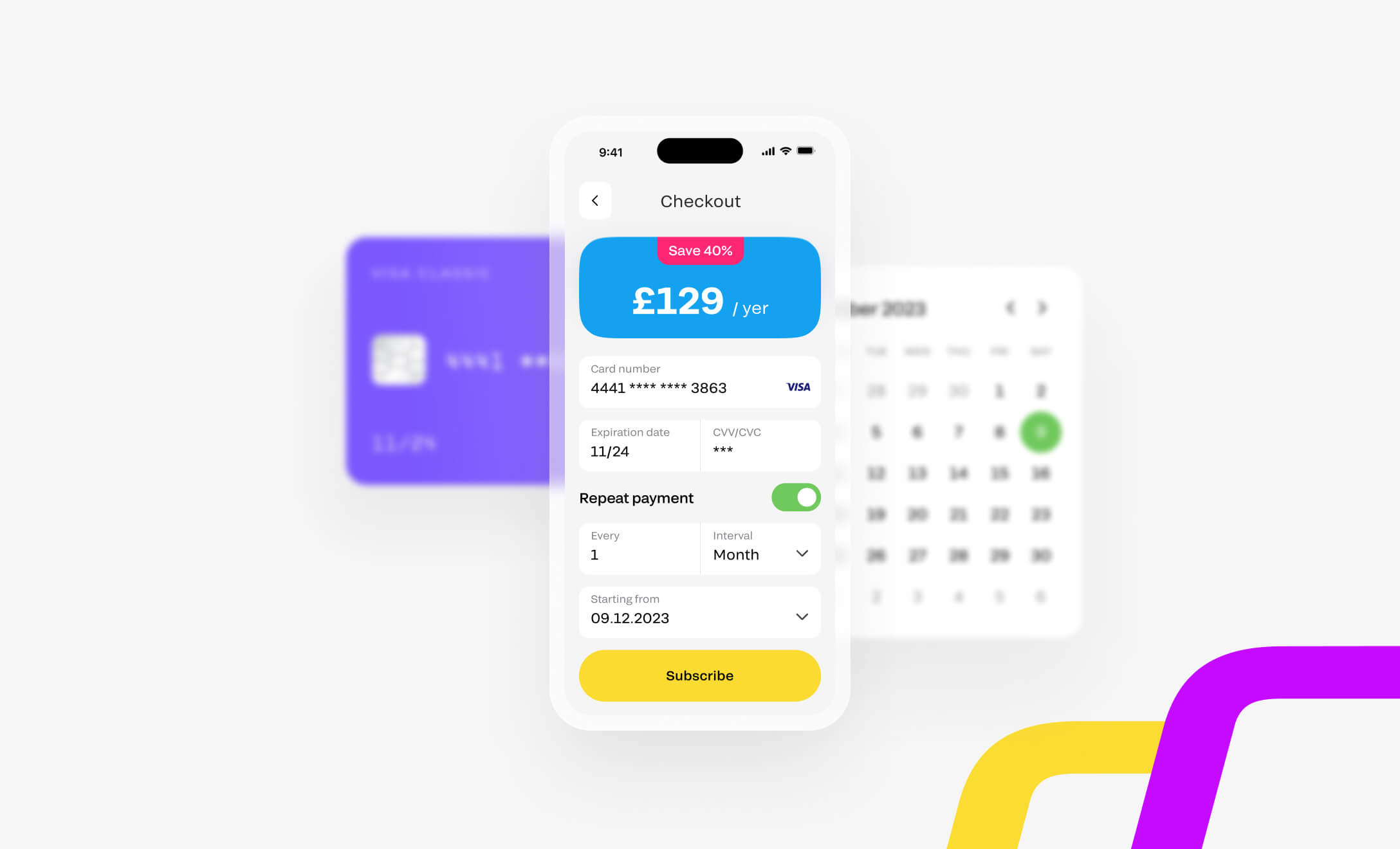

How to set up automated payments

Automated payments mean you can simplify your financial processes. This means arranging transactions such as split payments as you wish, setting up recurring payments, and making single or bulk payments with minimal fuss.

The best way to set up automatic payments is using a payment gateway like Fondy. Then you’ll also need to let your partners know that this feature is available to them and possibly offer some additional incentives for them to switch to automated payments.

There are clear advantages to using Fondy to automate payments. With an automated payment feature from Fondy, it’s simple and cost-effective to set up automated payments that are safe and secure, enabling your company to collect payments quickly and efficiently.

Fondy can help you automate your payment process, cutting down on your team’s time to deal with activities like chasing invoices and making ad hoc or recurring payments.