Understanding payment localisation

If you need information about localising payments, you’ve come to the right spot. Continue reading to discover everything you need to know about localising payments, including:

- The definition of localising payments

- Is payment localisation safe?

- The benefits of localising payments

- How to implement payment localisation

What does localising payments mean?

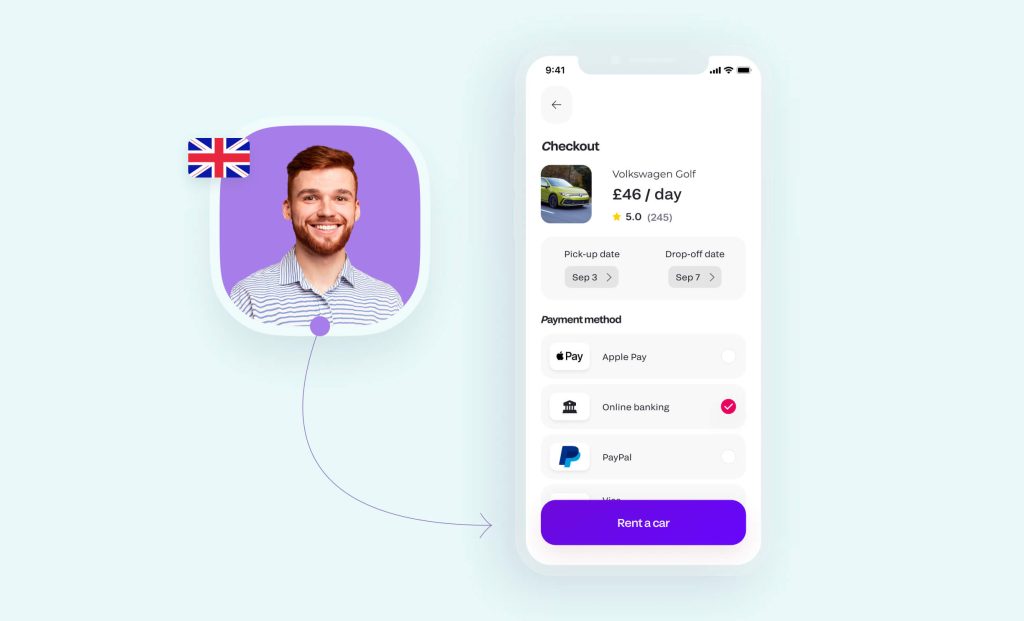

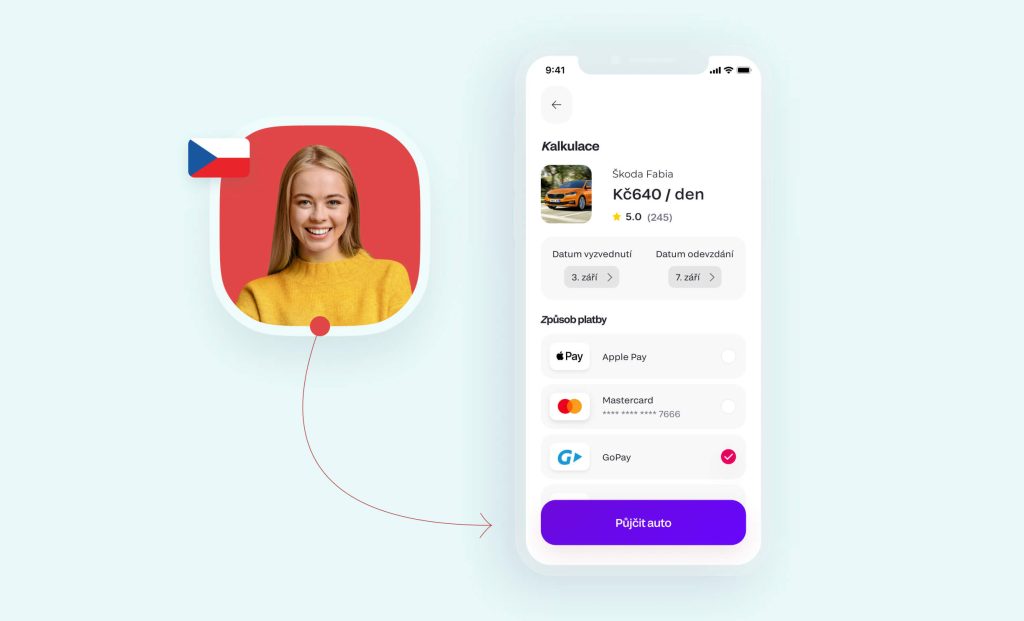

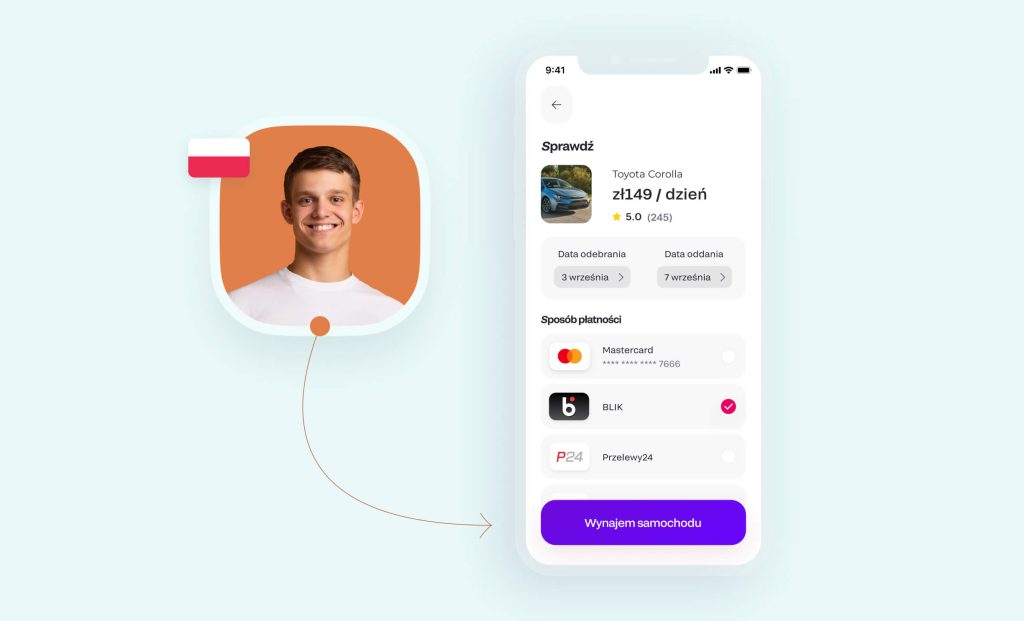

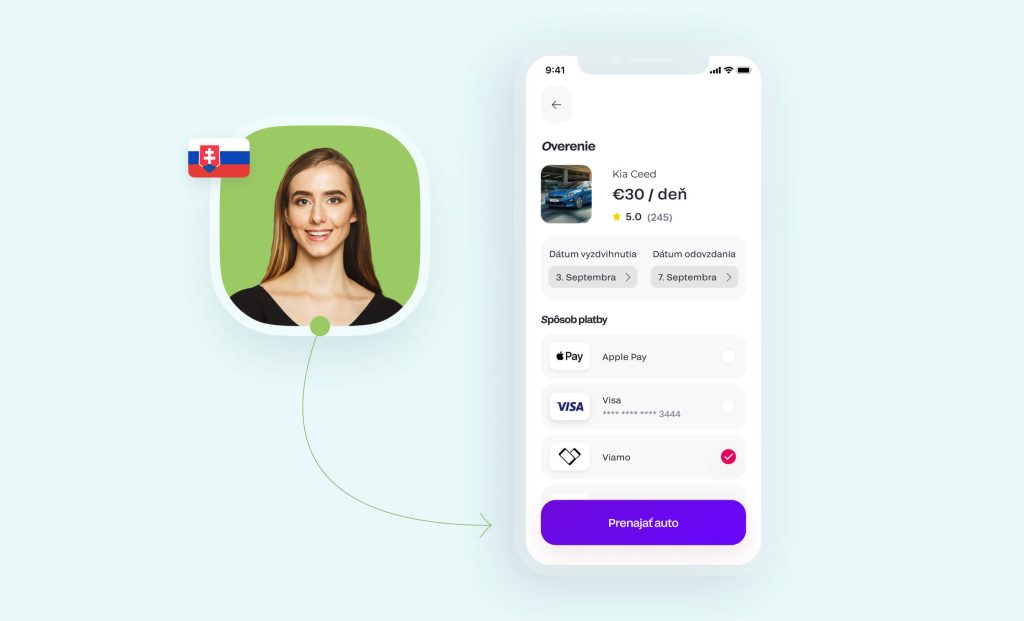

Localising payments (or payment localisation) is tailoring global payment options to the local payment environments of different countries and territories.

The bottom line is that accepting global payments increases revenue for entrepreneurs, so it’s important to stay ahead of the curve.

For example, if you own a UK-based company selling hospitality packages to tourists from China, offering Alipay would count as localising payments. That’s because Alipay is one of China’s most popular payment methods, thereby creating cross-border payment flows that feel like they do at home. The same can be said for France’s reliance on the Carte Bancaire card network and the popularity of iDEAL in the Netherlands.

Although payment localisation starts with the appropriate payment method, it also means complying with local laws, translating into local languages, currency exchange rates, and so many other factors. So while overseas customers can enjoy the convenience of a familiar payment method, they can do so in their own currency and language.

Given all the requirements, it’s no surprise then why most business owners choose to use payment service providers to manage localisation on their behalf. So merchants looking for a global consumer base might even find gateways and providers that support as many payment methods as possible to cover every consumer demand in markets near and further afield.

Is payment localisation secure?

Yes. Collaborating with different payment networks and gateways in multiple countries does present some risk to customer payment information. But thanks to tools like tokenisation, the payment localisation process remains safe and secure. Tokenisation ensures payment security by minimising the exposure of personal payment information. The encrypted token is generated and replaces the customer’s payment information by acting as a decoy during card transactions. Tokenisation also means that card numbers or details are never shared with merchants and, therefore, can’t be stolen by scammers.

As a one-stop payment platform gateway, Fondy understands the need for businesses to accept various online payment methods in various currencies. Want to know more about us? Great. Check out our About Fondy page and discover what inspires us and how that can benefit your business, regardless of size.

The advantages of localising payments

Offering familiar payment methods is a first great step to localising payments for your customers. But it goes much further than that. Localising payments can also include offering different multicurrency and multilanguage options. In some cases, a choice of payment flows, such as offering both a regular checkout and a payment in one click option.

So if we imagine the aforementioned Chinese shoppers again, then offering them a choice of paying in either Chinese Renminbi (RMB), Chinese yuan (CNY), or other currency, i.e, complete payment flexibility.

Additionally, the choice of different languages further aids in a harmonious payment journey for your customers.

Some other advantages of localising payments include:

Enhanced UX

With all of the above features in place, it’s fair to say that the chances of cart abandonment are low. Consequently, localising payments tend to increase conversions. Even better, payment localisation means that your customers can usually avoid the usual card transaction and currency conversion fees associated with unfamiliar payment options.

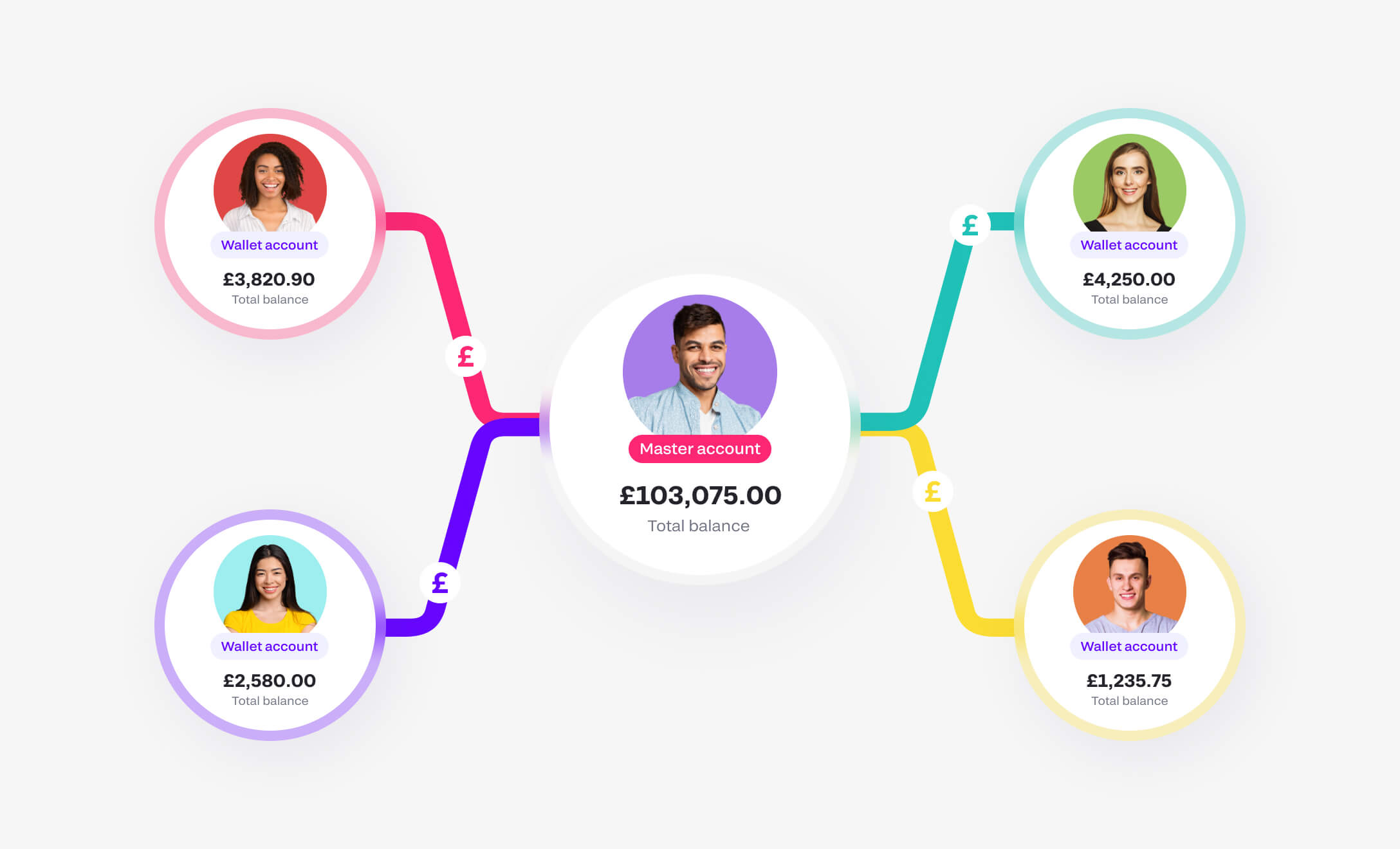

Loyalty

Localising payments give customers the confidence that they’re buying and paying like a local, even from far away. With a situation like that, why would your customers go anywhere else? That way, you increase loyalty and keep your competition at bay.

That’s why it’s essential to diversify the payment options by including local payment methods such as specialised payment cards and apps that are popular among consumers in their country of residence.

How to implement payment localisation

The first step to localising your payments is to research where your customers are based. That way, you can start thinking about ways to make your existing payment flows more convenient. After that, you can then get to grips with local laws, customs, and legislation in the countries that you’re targeting. Unfortunately, both tasks can come at a heavy price.

The cost of achieving payment localisation is usually steep for small business owners and entrepreneurs, but there’s a great solution to that. A payment gateway that supports localisation is a simple, convenient, and cost-effective solution for businesses that don’t have the budget or in-house expertise to implement it. That’s because a robust payment gateway like Fondy will allow you to diversify your payment options while keeping costs low.

Expertise and cost aren’t the only obstacles for small business owners integrating localisation. That’s because there are hundreds of global payment methods, each with its own time-consuming requirements. As each of those payment methods can have specific onboarding specifications, integration can set smaller businesses months, even years of development and engineering work.