A beginner’s guide to card payment solutions

It is no secret that shoppers have ditched cash and coins in favour of easier payments with their virtual wallets, Google Pay and Apple Pay. But embracing a cashless society means efficient card payment solutions are essential.

Without a quick and easy-to-use card payment solution, businesses risk becoming less accessible to the customers they’re trying to reach. This accessibility is key to growing a larger customer base and retaining them.

If you want to grow and become the best at what you do, having the best card payment solutions is key.

But whilst having a web payment option that is easy to navigate and yields the most profit for your business, finding your groove can be difficult, especially if you are not as technically competent as you would like to be.

To make things easier for you, we have taken out the stress by giving you the 101 on card payment solutions. In this article, we will break down the key facts you need to know to set up your card payment solution, including:

How does taking a card payment work

In order to set up a card payment solution for your business, it is important to have a good understanding of how taking a card payment actually works. Any card payment involves five parties:

- Customer

- Cardholder

- Business

- Merchant

- Business’ payments company

It can seem complicated at first, but we’ve broken it down into three easy steps:

- Checks. Step one is the checking stage. This begins as soon as a customer uses their credit or debit card to make a payment. Once they’ve used their card, the acquirer of the payment sends the request to the card scheme, which is then checked with the customer’s bank to see if they have enough money to complete the purchase.

- Sale. If the card is secure and the funds are available, the payment is accepted and the money is taken from the customer’s bank account.

- Settled. At the end of each day, the acquirer sends the money from all of the merchant’s sales to their bank account. This is usually completed within a few working days. Any service fees and statements are billed and sent at the end of each month.

How to choose a card payment solution

- Check your website’s specifications

If you want to begin accepting card payments on your website, you’ll need a payment gateway.

The first thing you’ll need to do is to check which type of payment gateway your website works best with, especially if you have used a website builder such as Wix or Squarespace. If you have determined the type that is most suitable, you can then begin choosing the right payment gateway service for you.

But what do you need to take into consideration when choosing a card payment solution for your online business needs?

- Keep your customer’s information secure

Security and keeping on the right side of the law are absolutely essential when choosing a card payment solution. Any online card transaction is vulnerable to cybercrime and security issues, and you should ensure your customer’s information is safe when using your services.

It’s important to note that different services offer different levels of security, including fraud detection, so knowing the full extent of protection offered is key to ensuring the sensitive financial information being handled is safeguarded appropriately.

- Don’t blow your budget on a card payment solution

Costs can quickly add up and become difficult to manage later down the line. When deciding on a card payment solution for your business, one of the most important things you’ll need to take into consideration is the cost.

There are important costs that you’ll incur from using a card payment solution, including set-up fees, transaction fees and a monthly fee for using the service. Having a cost-effective solution also means taking into account the percentage the service would take off of each transaction.

Most are competitive, however, we recommend checking if a service’s fees are suitable for less frequent higher-value transactions or regular lower-value transactions. If you don’t find this balance, you might see a bigger impact on your business’ profits.

How Fondy can help

Fondy is able to support and help you with payment services curated by a team of professionals with more than ten years of experience in banking, FinTech and eCommerce.

By focusing on innovation and industry trends, our card payment solutions are always designed to support your business and provide an easy and enjoyable service for your customers. These priorities are what lead us to constantly improve these services, so your unique business needs are always cared for.

Customer-friendly shopping is part of Fondy’s promise. By designing user-friendly and simple systems, intuitive approaches help to reduce cart abandonment and encourage shoppers to return to spend more with you. Our customer and merchant support will also ensure that any necessary changes or emerging issues are dealt with.

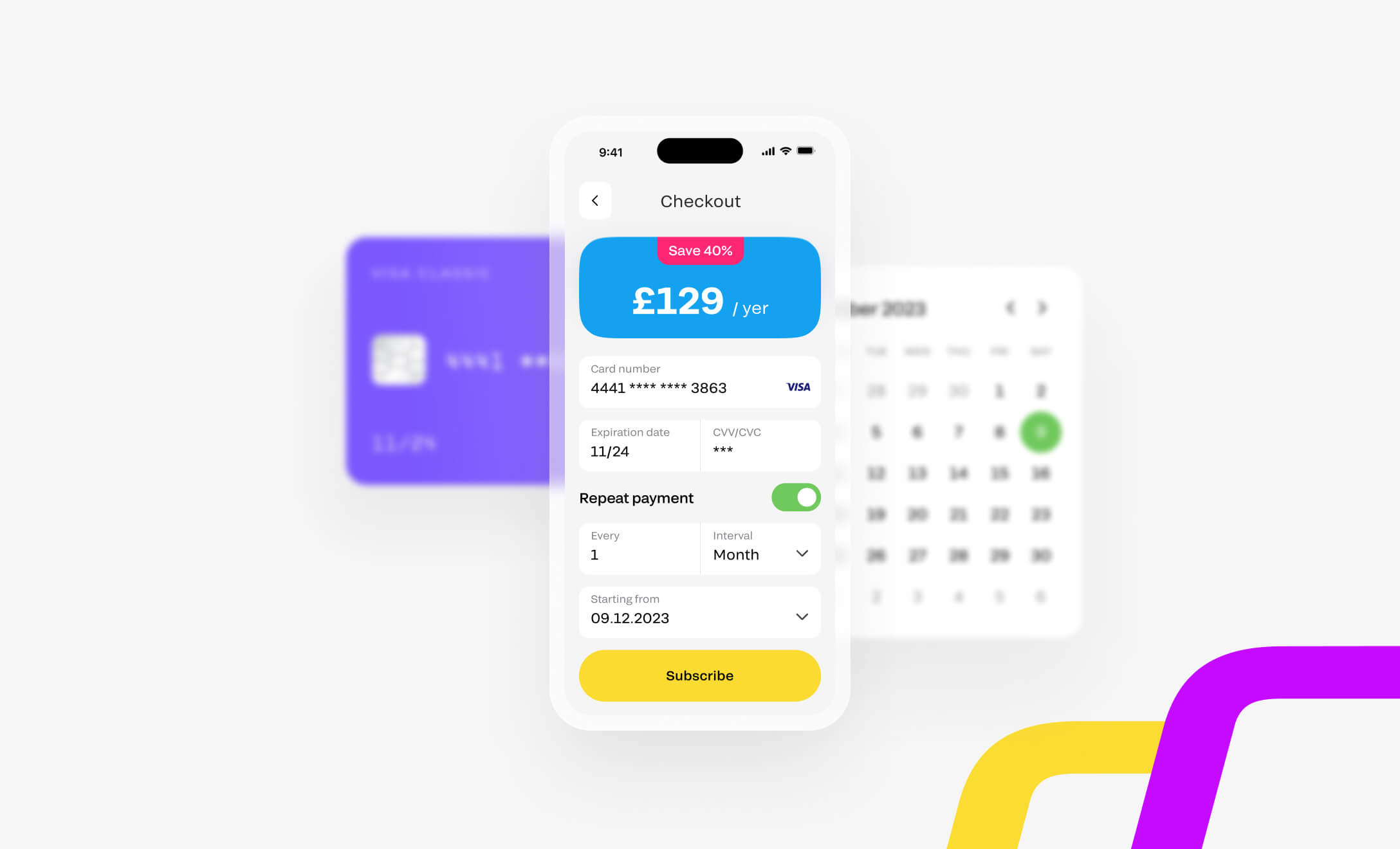

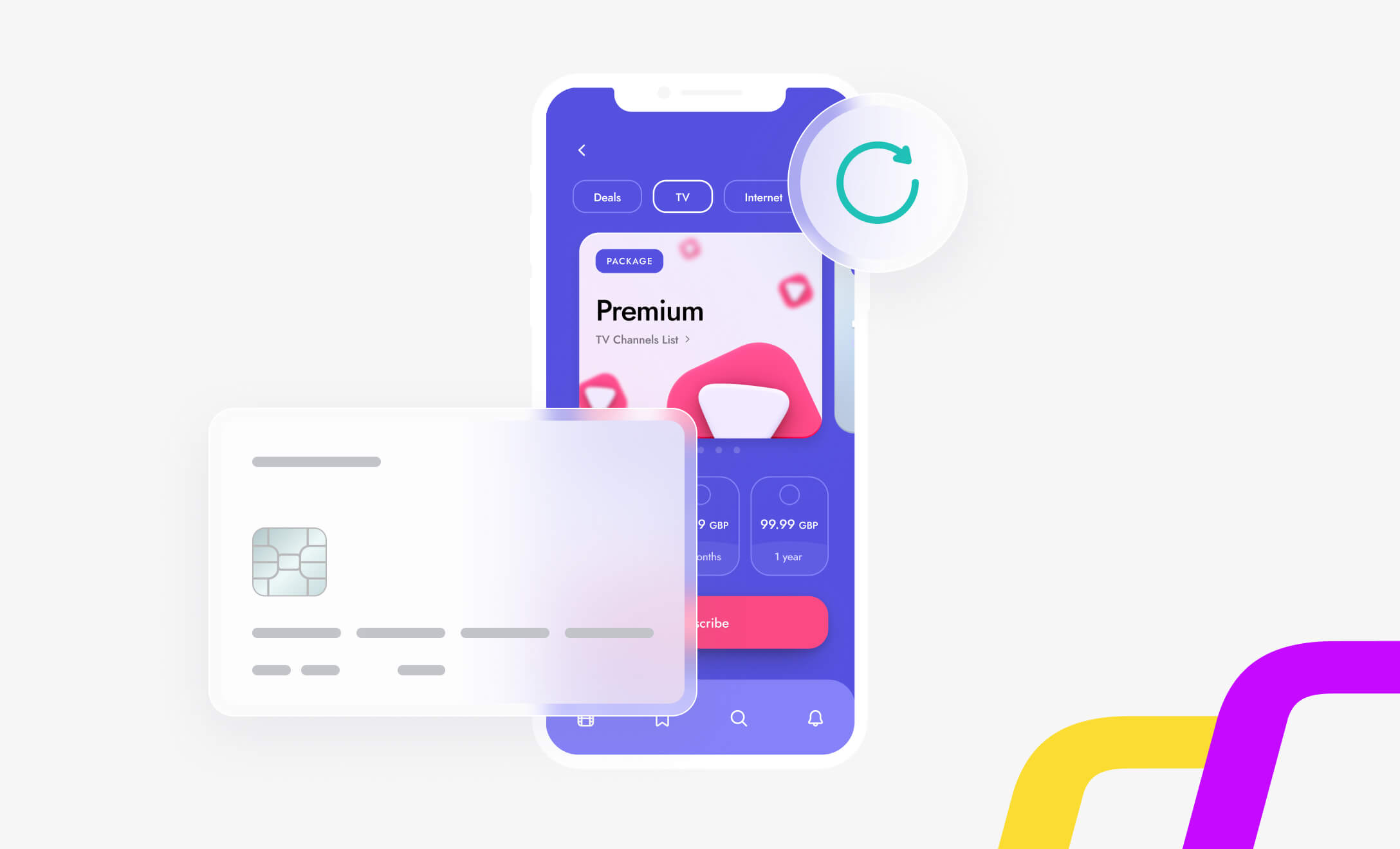

We also have quicker purchase options for your customers, with one-click checkout options to encourage shoppers to complete their shopping with you instead of leaving your site empty-handed. We have also developed subscription payment options, enabling customers to set up a repeat payment to your business, increasing profit and customer loyalty.

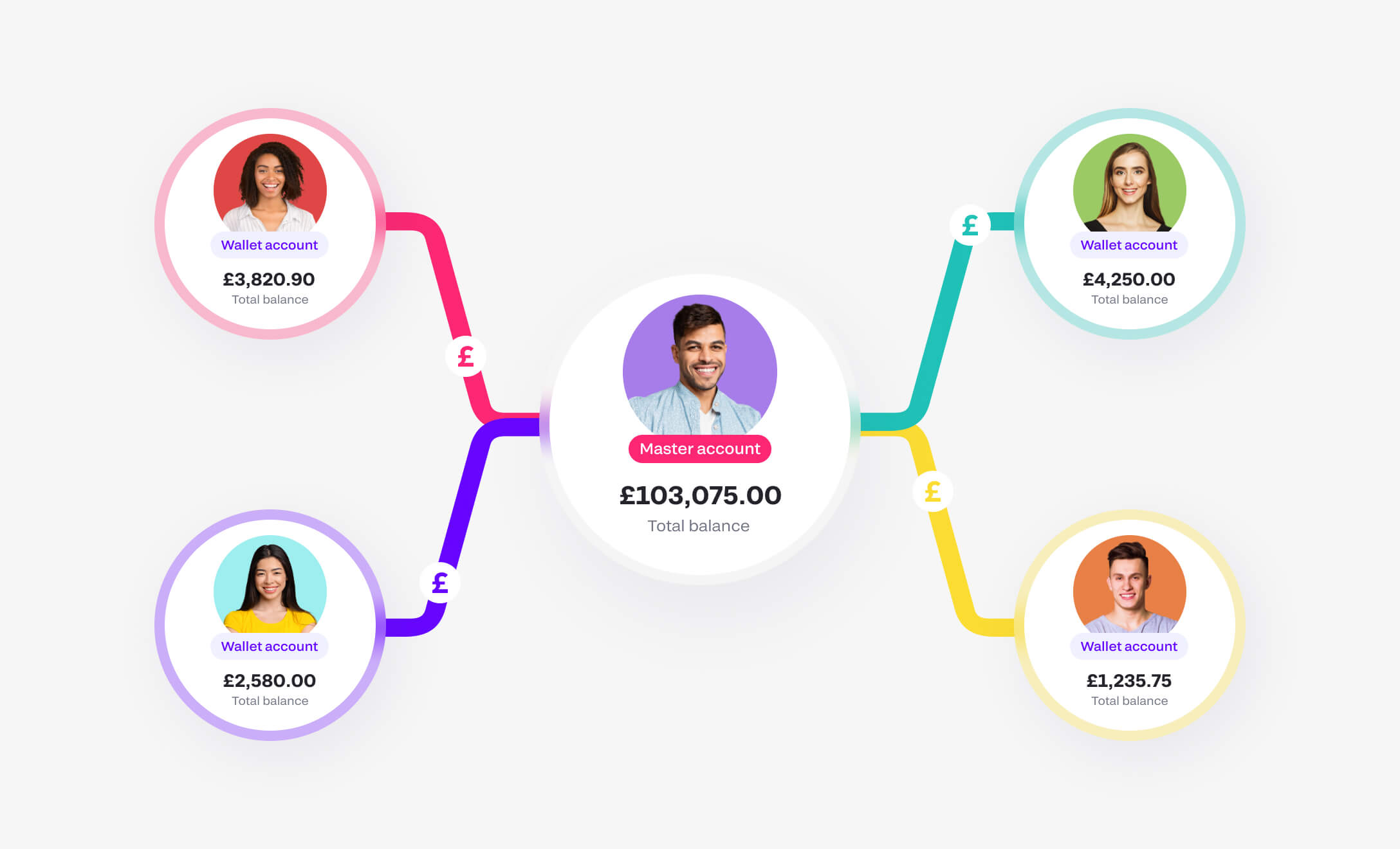

Whether it is a simple checkout experience that fits your website and makes it easy for shoppers to buy your products or services or a more in-depth system that supports instant payments, payouts, recurring and split payments, your customers will trust your business time after time. If you have used a website builder, you can enjoy Fondy too, as our services are designed to work with common web platforms like WordPress, Magento and Wix.