Understanding payment account management

Need information about payment account management? You’ve come to the right place. Continue reading our guide to discover more about account management in payments, including:

- The meaning of payment account management

- Payment account management software

- How Fondy can help with your payment account management

Account management for payments

Account management in payments is the best way to handle the payment processes for businesses, including marketplaces and platforms. In the payments industry, account management goes beyond managing the transfer and collection of funds. That is because good account management for payments should deal with other aspects of payments, such as transaction history, email marketing, account reconciliation, and more.

Good account management for payments should be a win-win situation for payment service providers and the marketplaces and platforms that use their features.

For instance, if you’re the owner of a marketplace or platform, a payment service provider like Fondy can handle your account management needs. That means you can seamlessly:

- Onboard service providers, drivers, and sellers for payments and payouts while verifying merchant details to meet compliance requirements.

- Enhance payment journeys with integration with multiple currencies, languages, and global payment methods.

- Enjoy built-in bank-standard data and fraud prevention technology and software.

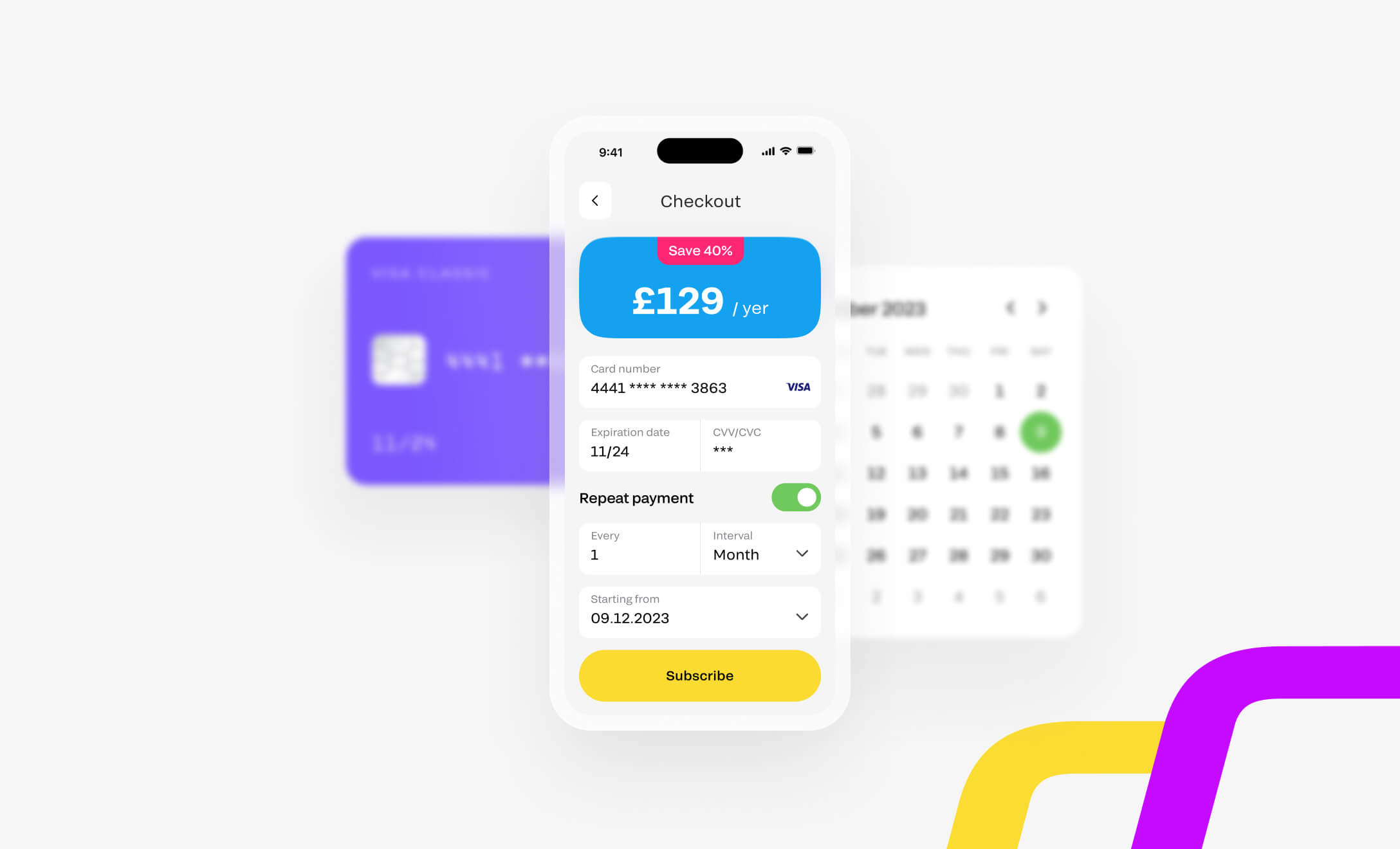

- Schedule tailored payments such as one-off payments, recurring transactions, or instant payouts and allow service providers to deposit earnings instantly.

Payment account management software

The goal of payment account management systems is to improve client relationships by increasing metrics such as retention and revenue. Usually, this involves the use of an account management software tool, process, or system that can help automate many tasks, such as payments, payouts, and more.

From a management perspective, payment account management software helps monitor progress. It can be used to set individual account milestones, such as a number of new payments, helping verify that tasks are completed and processed on time. It can also be used to set triggers and flag money movement on certain payment accounts when deadlines are missed or when special attention may be required, such as the movement of money cross-border, like in international banking.

That makes payment management software one of the essential tools for maintaining a positive relationship with business partners. For example, for accounting management, some of the most well-known global software APIs include Spendesk, Xero, and QuickBooks.

Alternatively, for payment account management, companies could use a payment service provider (PSP) like Fondy for their payment management needs. That means having a seamless, one-stop payment solution, all through a single API.

Even better, with a Fondy Flow business account, merchants can wow their partners with excellent electronic payment features such as instant payouts, payment settlements, recurring payments, and Open Banking, improving how they handle their money management, cash flow movement, and supplier relationships.

What’s more, with a Flow business account, companies can automatically transact with all UK payment rails, i.e., send and receive money to most banks in the UK. The account can also be used to settle funds from their payment acceptance business. That means that if they use the Flow business account to settle their funds from Gateway, they will have all the funds in one convenient location. That way, merchants can control the funds they receive from payment acceptance, and also, they can send the money out to pay suppliers, gig workers, etc.

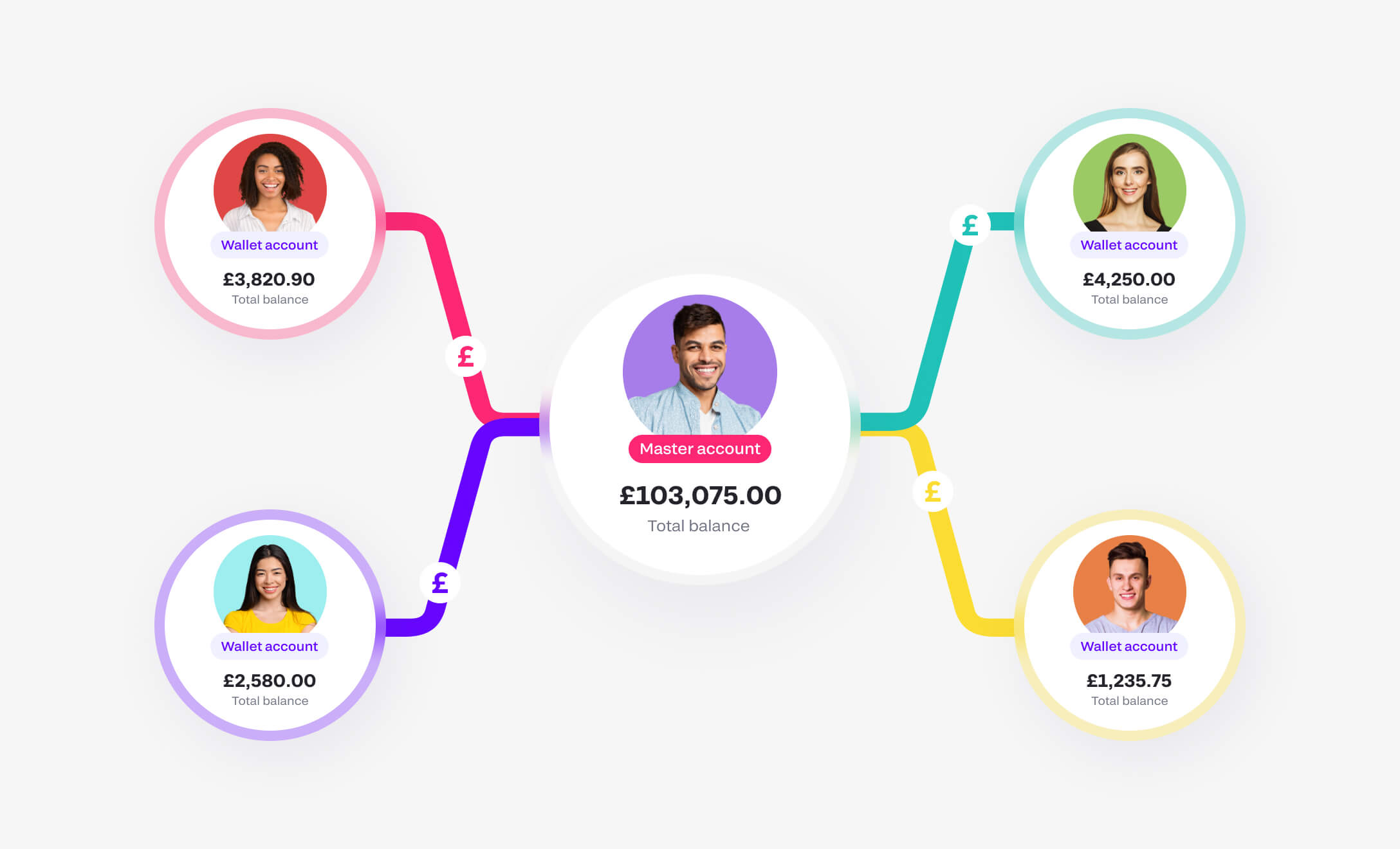

Merchants can also open Master accounts. Under each Master account, they can additionally create separate Wallets that can be used to segregate funds by department, source, purpose, etc. Fondy business account features an intuitive interface where merchants have complete visibility of account information, including IBAN details, transaction history, and their Master and Wallet account overview.