If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- How to create, build, set up, and start a crowdfunding platform with expert insights & Fondy’s payment solutions

- App vs platform: discover the difference between an application and a platform for business with Fondy’s solutions

- Simplify B2C payouts for marketplaces and the gig economy with Fondy

- Flexible payout schedules and seamless settlement payouts for two-sided platforms

- Boost your growth with automated payouts by implementing payout automation on your platform

- International payouts with our innovative system for two-sided platforms

- Product vs Platform: exploring the benefits and choosing the right payment solution

- How to accept payment on marketplaces: a guide to streamline your platform

- How to create a platform: step-by-step guide for building an online success

- What is an online platform or marketplace platform: key insights & payment solutions

- How does marketplace work: a focus on online payments and payouts

- How to create a marketplace website with payment solutions designed to build growth

- Ecommerce Platform vs Marketplace: key differences and how to choose the right payment solution

- What is a SaaS platform: meaning, examples, and payment solutions to boost their performance

- The role of advanced APIs in enabling seamless payment flows for MedTech innovators

- Maximising positive impact: the synergy of AI, sustainability, and comprehensive payment solutions

- Deconstructing payment processing

- How to accept payments on social networks?

- What are the best payment gateways for WooCommerce?

- What is the best payment gateway for marketplaces and platforms?

What is an online platform or marketplace platform: key insights & payment solutions

Introduction

In today’s digital era, businesses are increasingly leveraging the internet to expand their reach and engage with a broader audience. This shift has given rise to concepts like online platforms and marketplace platforms, which have revolutionized the way we interact, shop, and conduct business. Understanding what an online platform is and how it differs from a marketplace platform is crucial for businesses aiming to strengthen their digital presence. Moreover, selecting the right payment solutions is a critical factor that can significantly influence the success and sustainability of these platforms.

What is an online platform?

An online platform is a digital environment that facilitates interactions among users, enabling them to share content, communicate, collaborate, or engage in various activities. These platforms act as intermediaries, providing the necessary infrastructure and tools for users to connect and participate in diverse activities. Examples include social media networks like Facebook and Twitter, content-sharing sites like YouTube and Vimeo, and collaboration tools like Slack and Microsoft Teams.

Online platforms are designed to be versatile and user-friendly, catering to a wide array of needs across different industries and sectors. They often offer application programming interfaces (APIs) and development tools that allow third-party developers to build applications or services on top of the existing platform. This flexibility enables businesses to innovate and reach their target audiences more effectively. For instance, a company can integrate its services with a platform’s functionalities to enhance user engagement and provide more value to its customers.

These platforms have transformed the way we interact by fostering communities, enabling the exchange of ideas, and providing access to a wealth of information. They support various forms of content, including text, images, videos, and live streams, allowing users to consume and contribute in multiple ways. The interactive nature of online platforms has also paved the way for new business models, such as influencer marketing, user-generated content campaigns, and subscription-based services.

If you’re inspired to create your own digital environment, check out our comprehensive how to build an online platform guide. It provides a step-by-step approach to crafting a platform designed for success, packed with insights and strategies to help you achieve your goals.

The role of online platforms in business

For businesses, online platforms offer numerous advantages. They provide opportunities to engage directly with customers, promote products and services, collaborate internally and externally, and gather valuable data and insights. By harnessing the capabilities of online platforms, businesses can enhance their operations, improve customer satisfaction, and stay competitive in a rapidly changing digital environment.

Engaging directly with customers allows businesses to communicate in real-time, receive feedback, and build stronger relationships. Through targeted advertising and content sharing, companies can increase brand awareness and drive sales. Collaboration tools enable teams to work together more efficiently, regardless of their physical location. Analytics provided by online platforms help businesses understand user behavior and preferences, informing strategies and decisions that can lead to better outcomes.

What is a marketplace platform?

A marketplace platform, on the other hand, is a specific type of online platform that focuses on facilitating transactions between buyers and sellers. It serves as a virtual marketplace where multiple vendors can offer their products or services to a broad customer base. Prominent examples include Amazon, eBay, Etsy, and Alibaba.

Marketplace platforms provide comprehensive infrastructure for commercial transactions, including product listings, search functionality, shopping carts, payment processing, and customer support. They enable businesses, particularly small and medium-sized enterprises, to access markets that would otherwise be difficult to reach. For consumers, marketplace platforms offer the convenience of exploring a vast array of products or services from different sellers in one location.

These platforms have transformed the retail landscape by democratizing access to markets and lowering the barriers to entry for sellers. They have also enhanced the shopping experience for consumers by offering competitive pricing, diverse product selections, and user reviews to inform purchasing decisions.

If understanding what a marketplace platform is sparks your interest, you might be wondering how to build one yourself. For a step-by-step guide on bringing your marketplace idea to life, don’t miss our article: “How to create a marketplace website“. This resource dives into everything you need to know about building a marketplace, from choosing the right platform infrastructure to integrating payment solutions that drive growth.

Key differences between online platforms and marketplace platforms

While online platforms and marketplace platforms share the commonality of operating in the digital space and facilitating interactions, they differ fundamentally in their core purposes and functionalities.

An online platform is primarily designed to enable communication, content sharing, and collaboration among users. Its main goal is to connect people for social interaction, professional networking, or information exchange. The emphasis is on facilitating user engagement and fostering communities. User roles on online platforms are generally uniform, with most users engaging in similar activities such as posting content, commenting, and sharing.

In contrast, a marketplace platform is specifically built for commerce. Its primary objective is to facilitate commercial transactions between buyers and sellers. The focus is on providing tools and features that support buying and selling activities, such as inventory management, order processing, and secure payment systems. User roles are distinct, with clear divisions between buyers, who seek products or services, and sellers, who offer them. To delve deeper into the key distinctions and implications of these models, explore our detailed article on product vs platform.

Revenue models also differ between the two. Online platforms often generate income through advertising, premium subscriptions, or offering additional features to users. Their monetization strategies rely on user engagement and the value provided to advertisers or paying subscribers. Marketplace platforms generate revenue through transaction fees, commissions on sales, listing fees, or offering premium services to sellers. Their income is directly linked to the volume and value of transactions facilitated on the platform.

Technological infrastructure requirements vary as well. Online platforms need systems that support content management, user authentication, and communication features. Marketplace platforms require more complex infrastructures to handle inventory management, order fulfillment, payment processing, and logistics coordination. They must ensure that transactions are processed smoothly and securely, and that sellers can manage their operations effectively within the platform.

You can learn more about the differences between online platforms and marketplaces in our detailed article “Ecommerce Platform vs Marketplace“.

Why payment solutions matter for online platforms and marketplaces?

Efficient and secure payment solutions are vital for both online platforms and marketplace platforms, but their needs can differ significantly. For online platforms that offer premium services, subscriptions, or digital goods, robust payment systems are essential to process transactions smoothly. Ensuring that payments are secure and convenient enhances user trust and encourages customers to make purchases or subscribe to services.

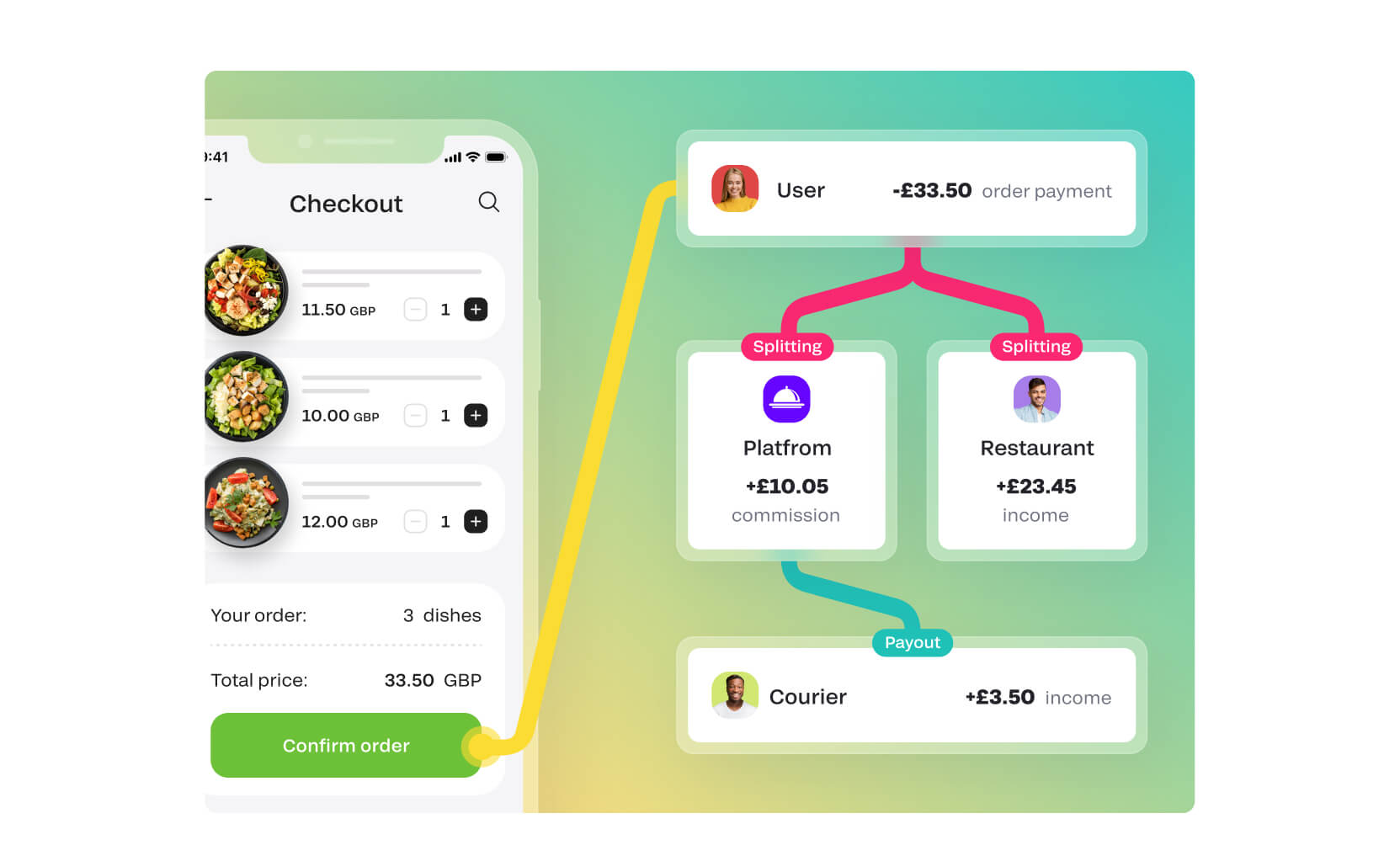

Marketplace platforms face more complex payment challenges. They need to handle transactions involving multiple parties, including processing payments from buyers, distributing funds to sellers, and managing refunds or disputes. The payment systems must support split payments, handle various payment methods, and comply with financial regulations across different jurisdictions. Supporting multiple currencies and local payment preferences is often necessary to reach a global audience.

Challenges in marketplace payment processing

Managing payments involves navigating a complex landscape of technical and regulatory hurdles. Security concerns are paramount, as protecting sensitive financial data from fraud and breaches is critical. Platforms must implement strong encryption, tokenization, and other security measures to safeguard transactions.

Regulatory compliance is another significant challenge. Adhering to financial regulations, such as anti-money laundering (AML) laws and Know Your Customer (KYC) requirements, is essential to operate legally and maintain trust. This is particularly complex for platforms operating internationally, as they must comply with the regulations of each country in which they operate.

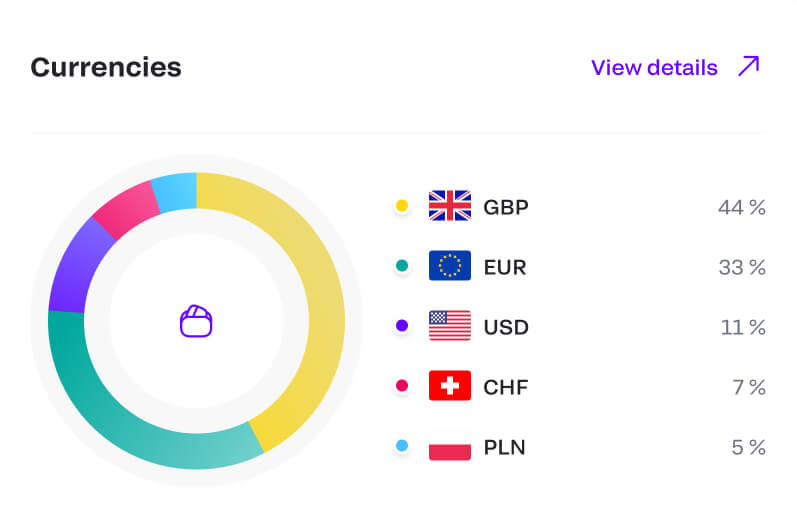

Handling international transactions adds layers of complexity due to different currencies, exchange rates, and regional payment methods. Platforms need to manage currency conversion, cross-border fees, and regional regulations effectively. Providing a seamless and intuitive user experience is crucial to prevent cart abandonment and enhance customer satisfaction. As platforms grow, their payment systems must be scalable to handle increased transaction volumes without compromising performance.

Platforms need for sophisticated payment solutions

Given these challenges, platforms require advanced payment solutions that can handle the intricacies of modern digital commerce. They need systems that can process transactions securely and efficiently, support a variety of payment methods, and comply with regulatory requirements. Automation of compliance checks, such as KYC and AML procedures, can streamline operations and reduce administrative burdens.

For marketplace platforms, the ability to manage split payments is essential. This involves distributing funds accurately and transparently among multiple parties involved in a transaction. Platforms also need to offer flexible payout options to sellers, such as instant or scheduled payouts, and support for various payout methods.

How Fondy enhances online platforms and marketplaces?

Fondy offers an all-in-one fintech solution designed specifically for online platforms and marketplace platforms. Understanding the unique needs of these platforms, Fondy provides a suite of services that address the challenges of payment processing in these environments.

Seamless integration for effortless functionality

With Fondy, online platforms can achieve seamless integration through developer-friendly APIs. This allows businesses to implement advanced payment functionalities without extensive development efforts, enabling them to focus on their core services. Fondy’s integration process is designed to be straightforward and efficient, minimizing disruption to existing operations.

Wide acceptance of payment methods

Fondy empowers online platforms to accept a wide range of payment options, including major credit and debit cards, digital wallets like Apple Pay and Google Pay, Buy Now Pay Later (BNPL) services, and local payment methods. The support for multi-currency transactions allows businesses to operate globally, accepting payments in customers’ native currencies and expanding their market reach.

Flexible split payments for transparency

Understanding the importance of transparent and efficient fund distribution, Fondy provides flexible split payment solutions. This feature is essential for marketplace platforms dealing with multiple sellers, allowing for accurate and automatic distribution of funds according to predefined rules. It enhances transparency and builds trust among all parties involved.

Automated seller onboarding and verification

Fondy streamlines the process of bringing new sellers onto a marketplace platform through automated onboarding and verification. Automated KYC/B and AML checks ensure compliance while reducing administrative burdens. The onboarding process is user-friendly and supports multiple languages, making it accessible to a global seller base.

Customizable payout solutions

Online platforms can choose from various payout types with Fondy, including virtual IBAN accounts (Fondy Wallets), marketplace payouts to bank accounts, and card payouts. The flexibility in setting instant or delayed payouts helps businesses manage their cash flow effectively and meet the needs of their sellers.

Scalable and secure infrastructure

Fondy’s cloud infrastructure allows online platforms to scale rapidly, accommodating growth without compromising performance. The ability to upgrade the system quickly ensures that businesses can handle increased demand smoothly. Robust security measures protect data and transactions, maintaining user trust.

Dedicated support and transparent pricing

With clear pricing and no hidden charges, Fondy provides businesses with predictability and transparency. A dedicated manager assists with migration and offers VIP support, ensuring that platforms have the assistance they need to succeed. Custom reports and solutions can be tailored to meet specific business requirements.

Conclusion

Understanding what an online platform and a marketplace platform are is essential for businesses navigating the digital landscape. While both platforms serve to connect users, their functions, user engagement, revenue models, and technological needs differ significantly. Efficient and secure payment processing is a critical component that can influence user trust, operational efficiency, and the overall success of the platform.

Fondy offers tailored payment solutions that address the specific challenges faced by online platforms and marketplace platforms. By providing seamless integration, diverse payment options, split payment capabilities, automated compliance processes, and scalable infrastructure, Fondy empowers businesses to focus on growth and enhancing customer satisfaction.