If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- How to create, build, set up, and start a crowdfunding platform with expert insights & Fondy’s payment solutions

- App vs platform: discover the difference between an application and a platform for business with Fondy’s solutions

- Simplify B2C payouts for marketplaces and the gig economy with Fondy

- Flexible payout schedules and seamless settlement payouts for two-sided platforms

- Boost your growth with automated payouts by implementing payout automation on your platform

- International payouts with our innovative system for two-sided platforms

- Product vs Platform: exploring the benefits and choosing the right payment solution

- How to accept payment on marketplaces: a guide to streamline your platform

- How to create a platform: step-by-step guide for building an online success

- What is an online platform or marketplace platform: key insights & payment solutions

- How does marketplace work: a focus on online payments and payouts

- How to create a marketplace website with payment solutions designed to build growth

- Ecommerce Platform vs Marketplace: key differences and how to choose the right payment solution

- What is a SaaS platform: meaning, examples, and payment solutions to boost their performance

- The role of advanced APIs in enabling seamless payment flows for MedTech innovators

- Maximising positive impact: the synergy of AI, sustainability, and comprehensive payment solutions

- Deconstructing payment processing

- How to accept payments on social networks?

- What are the best payment gateways for WooCommerce?

- What is the best payment gateway for marketplaces and platforms?

What is the best payment gateway for marketplaces and platforms?

To sell products online, you need a marketplace or marketplace merchant solution. Most of them come with a reliable marketplace payment gateway to collect funds from your customers.

Some of the most popular marketplace merchants and platforms include:

| ||

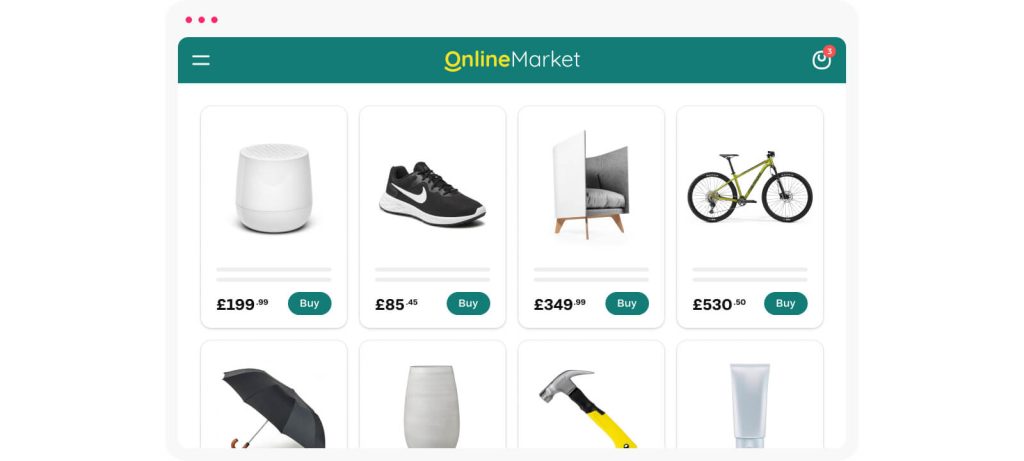

Marketplaces like Amazon or eBay include their own gateway solution so their merchants never have to worry about accepting payments. You simply upload images and descriptions of the goods, set a price, and the marketplace will take care of the rest.

Types of marketplaces and platforms

Online marketplaces are generally divided into two types: single-vendor systems and multi-vendor marketplaces.

A single vendor marketplace or marketplace merchant is where a single seller sells their goods or services to multiple customers. For example, a merchant like BeCause Tees with an online store on Shopify is a single vendor marketplace system.

A multi-vendor marketplace or marketplace merchant is where many sellers come together to sell their goods or services. Customers can buy products from different sellers or brands in multiple vendor marketplaces. The most commonly known multi-vendor marketplaces or platforms include Amazon, eBay, and Etsy.

If you want to delve deeper into the differences between e-commerce platforms and marketplaces, we recommend checking out our article “Ecommerce Platform vs Marketplace“.

Payment gateways for marketplaces and platforms

Simply put, a payment gateway is a software solution used by businesses, marketplaces, and platforms to accept card payments. The software includes everything from in-store card reader solutions to online platform portals.

Payment gateway services are important for all types of versatile platforms and marketplaces, such as food delivery services and ride-sharing apps where proceeds from one sale will need to be divided amongst different partners in a transaction system.

For example, with a company like Uber Eats, the £15 a customer pays for a meal will need to be divided among separate parties, including the courier, the restaurant, and Uber Eats. In this case, a payment gateway feature like split payments can automate this process.

In addition to split payments, a payment gateway solution should be able to handle other tasks, such as:

- Processing other payments, such as marketplace payouts, recurring or subscription-based payments, settlements, etc., without delays.

- Onboarding merchants or suppliers.

- Providing simple documentation for developers.

- Working with all types of currencies, bank systems, bank cards, and wallets.

- Providing a seamless checkout experience for customers.

- Highlighting merchant or supplier analytics via custom dashboards.

How does a payment gateway work?

Payment gateways are an important part of accepting online payments, but they work in conjunction with other elements and bits of technology. They use API technology to communicate between merchant websites and payment processor solutions.

Brick-and-mortar stores and businesses use gateways like POS terminals to connect to the payment processing network via a phone line, but more commonly, a WiFi connection.

In early adaptations of in-store gateways, POS terminals were used to accept bank cards (via swipes or the manual input of data). That later turned to “chip and pin” payments, where customers were required to insert their bank card into a POS terminal and punch in a personal identification number (PIN).

More recently, near-field communication (NFC), or contactless payments, means that payment gateways can process transactions quicker than ever. Today, payment gateway solutions can exist entirely online, meaning you can process payments from anywhere without using a POS terminal.

As a payment gateway for multi-vendor marketplaces, Fondy understands the need for marketplace and marketplace merchants to be flexible and to accept various payment methods in a variety of currencies. Want to know more about us? Great! Check out our About Fondy page and discover what inspires us and how that can benefit your business, no matter the size.

How to choose a payment gateway

A payment gateway’s primary function is to take payments. But on a deeper level, the best and most reliable payment gateways also need to execute several other transaction types for businesses and marketplaces like:

- Authorisation – the part of a transaction used to check a customer’s funds before the marketplace or business can initiate a sale.

- Capture – the actual processing of a previously authorised payment resulting in funds sent to the merchant’s account.

- Sale – this occurs when the authorisation and capture stages are both completed by the business or marketplace.

- Refund – when a purchase gets voided or a customer returns goods or services. Refunds result in merchants applying a refund payment to return the money to the buyer.

- Void – similar to refund but can be done if funds were not yet captured by the business, marketplace, or marketplace merchant.

With that in mind, it’s time to choose a payment gateway. There are plenty of options when it comes to gateways, so you’ll need to consider a number of factors, such as:

- Fees for users. In addition to payment for your goods, your customers will probably have to pay processing fees for each transaction. That’s why you’ll need to consider your business model and platform. Are your customers one-off or repeat buyers? Therefore, you’ll need to choose a gateway that charges affordable fees for your customers.

- Integration. If you have to integrate a payment gateway, you’ll need to know if it will be a simple or complex task for your business. Some integrations, like a Smart Payment button on your checkout page, can be as easy as adding a piece of HTML code to your website. Whereas integrating a custom gateway requires PCI DSS certification. On top of that, custom integration will require more time and expenses to custom-build your payment platform.

- Technical support. Unless you’re a technical wizard, you’ll need some assistance with maintaining your payment gateway platform. While some companies offer feedback forms, others give around-the-clock phone support in multiple languages. Consider how important technical support is to your business and if you can wait for assistance.

- Geolocation. Some gateways are restricted in certain countries. For example, PayPal no longer works in Turkey, Adyen doesn’t work in Ukraine, and Stripe Connect is unavailable in the United Arab Emirates. Make sure that your gateway supports countries that are important to your business.

Choose Fondy as your payment gateway

Fondy is the best payment gateway provider for marketplaces, platforms, and marketplace merchants. With Fondy, we provide features like instant payouts and settlements, automated payments, reconciliation of split payments, and accounting ledgers for marketplaces.

Even better, when you create a free Fondy account, you’ll get access to Fondy’s full suite of payment products in one straightforward integration. Fondy’s payment gateway processes transactions in multiple payment methods, including Open Banking across 300+ banks in the UK and EU, and gives your customers complete flexibility.

Our payment gateway seamlessly integrates into over 21 marketplaces, marketplace merchants, platforms, CMS systems, and website builders, including:

Discover the full list of plugins, platforms, and marketplaces that Fondy supports for your business. If you don’t see your preferred marketplace or marketplace merchant, plugin, or platform on the list, no problem. Our team can help with custom integration solutions or systems. Contact us at support@fondy.io to get started.

Fondy’s pricing starts at 0.5% plus a set fee of £0.20. That means on a transaction of £10,000 you’ll only pay a £50.20 processing fee.

Security for payment gateways

Along with fees, integration, technical support, geolocation, etc., the best payment gateways should offer various security and anti-fraud tools. That’s because payment gateway solutions are vital in preventing online scams and fraud. They are essential in differentiating genuine transactions from fraudulent ones.

Luckily, financial fraud detection technology is constantly evolving to identify and combat fraudulent transactions safely and efficiently.

Some of the preventative measures payment gateways need for businesses are:

- Payment Card Industry Data Security Standard (PCI DSS) – a set of security industry regulations that are implemented by card payment schemes. PCI DSS compliance is a requirement for all businesses that handle card transactions.

- Secure Socket Layer (SSL) – software that creates a safe, encrypted connection between a payment provider and a visiting web browser.

- 3D Secure – an authentication protocol that helps with customer authentication. Also known as 3DS, it adds an extra layer of protection against chargebacks and fraud.

- Data encryption – when you enter your card details at the checkout, the payment gateway should encrypt the data. In practice, that means turning the information into code that’s essentially useless to fraudsters. In some cases, a payment gateway can turn card data into tokens. This process is known as tokenization.

- Tokenisation – unlike data encryption, tokenisation increases security because the information is only transferred once by the platform.

- Secure Electronic Transaction (SET) – is a joint security venture created by Visa and Mastercard. SET encrypts the payment data of credit cards in a way that scammers and even merchants, marketplaces, or marketplace merchants don’t have access to it.