Creating a greener future: how AI-powered platforms can optimise payment flows and drive sustainability

Many companies, including financial institutions, are increasingly adopting artificial intelligence (AI) in their everyday business processes. These activities include improving cybersecurity, boosting efficiency through automation, improving the speed of service, leveraging customer data to inform decision-making, and uncovering opportunities for new products, promotions, and features. Many of these companies are also using artificial intelligence to improve their payment processes for both their partners and customers. And as a positive knock-on effect, AI-powered payment processes are driving growth towards a sustainable future.

For example, look at how Starbucks uses artificial intelligence in its payment processes. The coffee and refreshment retailer harnesses the Natural Language Processing (NLP) arm of artificial intelligence to speed up and make ordering and paying more efficient. The NLP gives the My Starbucks Barista app the ability to understand text and spoken words in much the same way that a human being, i.e., a barista, would in person.

And by offering a feature as simple as digital receipts, the app, via AI technology, can help reduce the need for paper receipts. On a global scale, that’s an enormous saving on paper and, subsequently, the need to cut down trees. But in what other ways can AI-powered platforms optimise payment flows and increase sustainability?

The environmental impact of traditional payment flows

Traditional payment methods include paper and plastic cash, paper cheques, gift vouchers, and cards, which all contribute to waste and pollution and strip the planet of its natural resources. The environmental effects of paper and plastic production and use include deforestation, the use of vast amounts of energy and water, and air pollution from production, transportation, and waste disposal.

From the type of food we consume to the modes of transport we take, individuals are more conscious about how the purchase they make can affect their carbon footprints. And this extends to commerce, where consumers expect businesses to do the same, from the products and services on offer to the payment options they provide.

According to Statista, there are over 2.9 billion Visa credit cards in use worldwide. By the time you add cards from other payment networks and credit card issuers, that’s an unimaginable amount of plastic being used in the payment industry. But it gets worse when you consider that traditional payment methods are also heavily reliant on paper and precious metals.

Of course, there is the issue of blockchain. It is widely acknowledged that blockchain technology can play a significant role in speeding up payment systems and reducing cross-border payment costs.

The environmental concern with blockchain comes from the estimated carbon footprint generated by the power plants providing that technology. For instance, a single Bitcoin transaction is estimated to use enough electricity to power a US household for over two months. As such, blockchain has a high carbon footprint due to the high energy use involved.

Similarly, cryptocurrency’s main environmental impact comes from the energy used for each transaction and for mining new coins. The challenge for payment service providers is to find a workable balance between offering innovative payment methods like Bitcoin and reducing the impact on the planet.

By encouraging and even incentivising payment methods such as virtual cards and digital wallets, payment flows can become more environmentally friendly.

How digital payments can reduce your carbon footprint

Digital payments have a lower environmental footprint when compared to traditional payment methods. That’s because digital payments require minimal resources to produce, including no manufacturing and transportation from one point to another, helping reduce carbon emissions. Digital payments also don’t require the production of cash, coins, or cheques, which saves precious natural resources like trees, water, and metals.

As mentioned in the Starbucks example previously, digital receipts are a quick and easy way to reduce the carbon footprint produced by your business. Instead of automatically printing receipts, customers receive their receipts on their smartphones or via email. Even better, digital receipts are easier to store and locate in the future.

To further promote sustainability, payment service providers such as Fondy can help you digitise many manual payment processes such as invoicing, one-time or recurring billing, split payment, and instant payouts.

Digital payments like those offered by payment service providers give customers the added benefits of speed, accuracy, cost-effectiveness, and convenience, which help in managing your workflow and cash flow.

Some other ways that businesses can make their payment processes more sustainable by integrating Fondy as their payment provider include:

Accepting digital wallets

Digital wallets like Google Pay and Apple Pay are cashless, cardless, and paperless, which is directly a more sustainable way to pay for goods. In addition, digital wallets can also be useful for storing tickets, vouchers, medical cards, and more, saving even more on paper.

Tapping into payment links

Payment links allow payment processes to become more seamless, convenient, and environmentally friendly. With payment links, you eliminate paper and plastic from your payment process while making payment flows more attractive to customers.

Scan more QR codes

QR codes are a great eco-friendly way of promoting digital vouchers, sending invoices, and providing a direct passage to your payment checkout page. In traditional brick-and-mortar businesses like restaurants, QR codes can replace physical menus, enabling customers to order and complete a purchase online. All this with a single use of paper or plastic.

Leveraging technology for optimised payment flows

In the current digital age, businesses are being forced to address outdated payment systems. Merchants now need faster and more convenient payment flow from their payment gateways and providers. Modern business-to-business payments need to function similarly to consumer transactions. That is, they need to be instantaneous, easy, and frictionless.

Despite their advanced software suite, even AI-powered platforms can leverage the technology of payment service providers to optimise their payment flows and thereby improve their overall service.

Take Shopify, for instance. Shopify is a leading artificial intelligence eCommerce platform that provides tools and services for online sellers. One of the advantages of Shopify’s AI-powered platform includes its seamless integration with other eCommerce marketplaces and payment service providers like Fondy, meaning that by association, those PSP and marketplace merchants can benefit from Shopify’s AI-automated processes. As well as optimising payment flows, Shopify’s versatile integration compatibility can also help their merchants expand their reach to new markets by offering additional payment features via Fondy’s payment service.

How SaaS platforms can optimise their payment flows

For SaaS platforms, integrations are the heartbeat of their operations.

For example, an accounting Software as a Service (SaaS) platform can integrate its digital accounting services and features directly into the products of other non-accounting businesses. This way, the non-accounting platform, such as a marketplace, can offer its customers digital accounting services such as accounts receivable, accounts payable, tax compliance, and financial reporting without needing to acquire a certification or licence of their own.

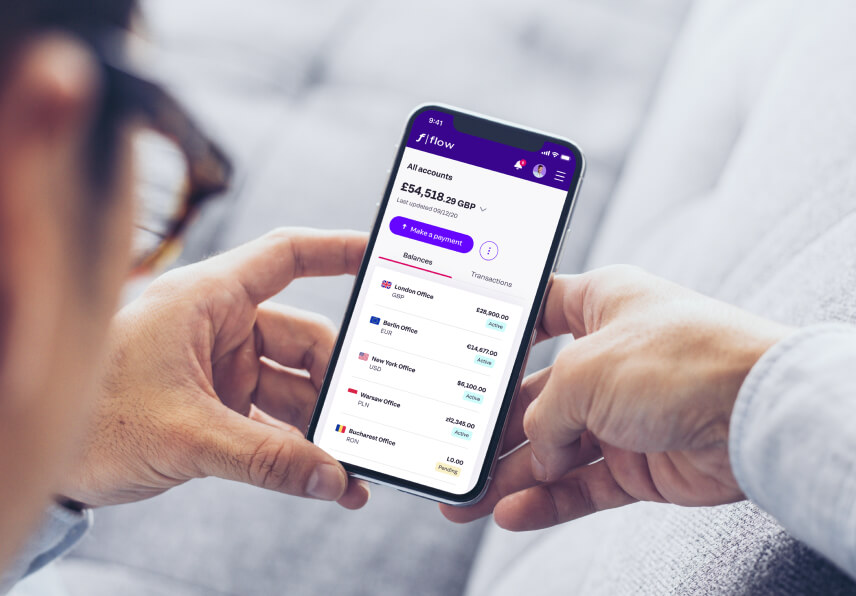

Integrations can also be advantageous to SaaS platforms in reverse. That’s because the SaaS provider can also integrate other software into its existing systems. So, for SaaS platforms looking for the best way to streamline their payment processes, they can integrate the software of a payment service provider (PSP) such as Fondy. That way, the SaaS platform can tap into the PSP’s features like automated invoicing, split payments, multicurrency accounts, and end-to-end money movement tracking.

By using all the available features, SaaS platforms optimise their entire operations, from payment to the delivery of the software.

And there are even more advantages of streamlined payment processes for SaaS platforms. These benefits include huge savings in cost and time while improving efficiency and the impact on the environment.

According to studies, almost half of all large businesses admitted to making payment mistakes to the tune of around £3 million per year. By investing in streamlined payment solutions capable of integrating with existing business infrastructure, a lot of human error and manual processes can be eliminated.

In terms of efficiency, streamlining your payment processes will likely decrease the amount of paper use and data entry for your business while also requiring less manpower, as many of the tasks can be performed automatically. As well as saving on costs, employees will likely become more productive when the more repetitive and tedious processes are streamlined.

Additionally, by streamlining payments, businesses can obtain enhanced cash visibility, empowering company owners with access to real-time monitoring data from multiple account sources. This allows business owners to benefit from features such as automated data segmentation and custom analytical reports, enabling better-informed decisions.

Where the environment is concerned, streamlining payments goes way beyond replacing paper, plastic, and precious metals used to produce coins with digital payments. The Åland Index on Amazon Web Services, for example, provides an innovative way to calculate the carbon dioxide impact of certain purchases and transactions. The index uses a simple API that businesses can integrate into digital payment and banking services, delivering that insight and information directly to customers.

Data analytics for sustainable decision-making

When it comes to SaaS platforms, most user analytics tools let you segment your customers by demographic features, user journey stage, and payment preferences such as language, payment method, currency, and more.

Due to the environmental concerns of everyone from customers to employees and investors, SaaS platform owners are relying on data-driven solutions to build sustainable services by identifying opportunities to improve customer service matters, reduce energy usage, cut carbon emissions, conserve resources, and minimise waste, while measuring performance toward sustainability goals.

For example, look at how a SaaS platform like Deliveroo uses data insights to calculate the optimal routes for its drivers. This not only reduces the number of miles they travel by the millions, but it also benefits the environment too. Further to that, this use of data-driven decision-making saves the platform millions on fuel costs and wages, which means it can offer customers more competitive prices.

Fraud detection and security for SaaS platforms

As SaaS platforms store vast amounts of personal data, they operate at a potential risk to online fraudsters. Therefore, SaaS providers face distinct challenges of their own to meet customers’ expectations and maintain efficiency in delivering products and services.

Ensuring you have a secure payment system for processing payments is key for SaaS models that tend to operate using recurring pricing models such as subscription-based, usage-based, or credit-based transactions. As such, SaaS businesses will need to employ features like encryption and tokenization tools to protect customers’ credit card data in the unlikely event of a breach.

But how do they best adhere to modern security requirements? The easiest way is to use a versatile payment service provider (PSP). In addition to encryption and tokenization, a reliable PSP will conform to all leading security protocols and industry standards.

Payment security goes beyond data protection measures. SaaS platforms will also need to secure their transactions by employing multi-layered fraud detection, often powered by artificial intelligence.

AI has emerged as a powerful tool in the fight against financial fraud. AI-powered fraud detection systems can help SaaS providers by processing large amounts of data in real-time and identifying patterns and irregularities that may indicate fraudulent activity.

These systems use AI-fueled machine learning algorithms to continuously improve their accuracy and effectiveness over time. AI can also help prevent fraud with predictive analytics algorithms that can identify high-risk customers or transactions and alert financial institutions to potentially suspicious activity before it occurs.

Collaboration and partnerships for sustainability

For the first time ever, businesses have access to the knowledge and the data to best handle issues such as climate change and global warming. In a recent survey from Deloitte, nearly 70% of customers would welcome their payment service providers offering them the choice of environmentally friendly products and services. Even further, almost half of those polled would like their payment gateway to highlight the carbon footprint of purchases from AI-powered platforms such as airline ticket providers, car rental bookers, and food delivery services.

For this to arise, both the business and payment service provider will need to establish their environmental credentials. Most customers want to believe they are acting responsibly on sustainability, and they want the goods and services they purchase and the companies they interact with to be responsible, too. That way, partnerships between AI-powered platforms and sustainable payment solution providers that congratulate (or even reward) customers for making climate-friendly purchases may be a highly attractive option for all involved.

Even Buy Now, Pay Later (BNPL) providers Klarna have made strategic moves with the environment in mind. The BNPL platform has recently teamed up with luxury brands like Harrods and Liberty to offer their payment plans to customers while encouraging them to consider the impact of their shopping habits on the environment. That’s because luxury products tend to be more durable, are made from higher-quality materials, and could even be passed down across generations or resold, making them more sustainable in the long run.

Future trends and possibilities

Looking towards the future, some of the emerging trends for AI platforms include features such as:

- The Internet of Behaviours (IoB) for collecting data from multiple sources including customer databases, social media, and location-tracking services

- No-code technology where customers report an issue in plain English, and conversational AI will generate the necessary code to solve it

- More cloud-based solutions to solve the problem of gathering, structuring, and analysing huge volumes of data being generated by artificial intelligence

And as AI evolves, so do the benefits it can bestow on payment platforms looking to offer more sustainable payment solutions.

As consumers dig deeper into the long-term effects of their spending habits, providing more sustainable payment options can help them make more informed buying decisions. One such way is through green or sustainable banking. Green banking promotes environmentally friendly practices that reduce the carbon footprint of certain banking activities. The strategy considers all environmental, social, and governance (ESG) factors as part of banking operations with the goal of both profit and environmental protection.

Concepts like green banking can also help SaaS solutions keep pace with climate change. That way, you can show your customers the impact their purchases have on the environment by including carbon footprint calculations along with transaction summaries.