If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- What is pay-in and pay-out: a comprehensive guide to payment processes for online business

- Mastering delayed payouts: ensuring timely transactions with Fondy

- Streamline your payout process with our comprehensive payout system: low fees for outgoing financial transactions

- How to use payout gateway for outgoing payments on your platform

- How does split payment work for business with Fondy Flow

- A guide to eCommerce split payments

- What is split payment & how Flow Payments can help your business

- What are payouts: a guide to instant & global payouts for business

- How to split credit card payments online: solutions for platforms & marketplaces

- What are split payments, and how do they work on Flow Payments?

- The gig economy’s impact on traditional industries

- Integrating electronic health records with payment systems: advancing efficiency in MedTech billing

- The crucial role of payments in empowering gig platforms

- An introduction to recurring payments

- What is the Faster Payments Service (FPS)?

- A guide to eCommerce split payments

- A guide to instant and global payouts

- What is the SEPA payment method?

- What are quick payments in one click?

- What are cross-border payments?

- What is a payment link?

- What are open banking payments?

How to split credit card payments online: solutions for platforms & marketplaces

Introduction

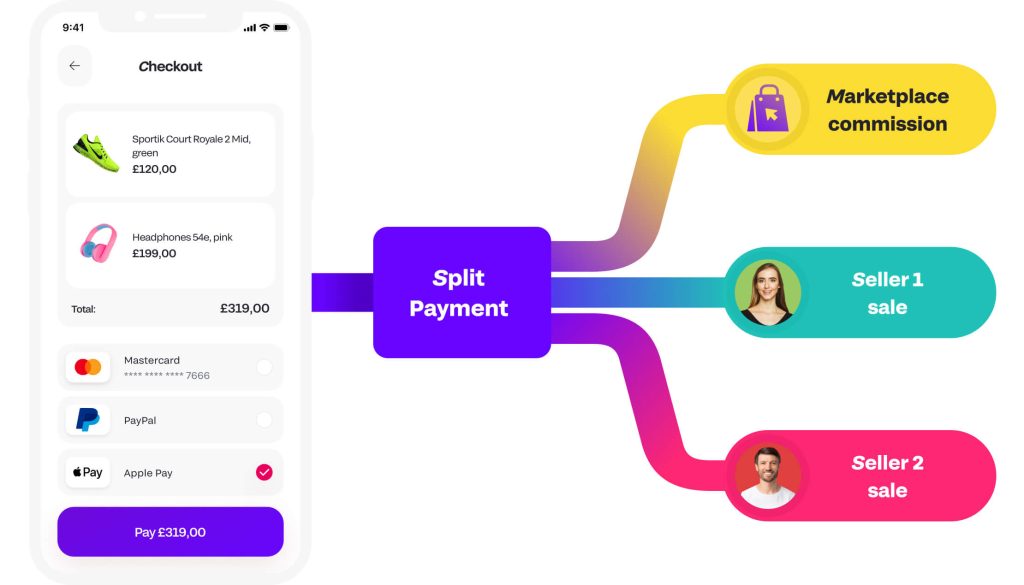

In today’s digital economy, platforms and marketplaces are evolving rapidly, and so are the payment solutions that support them. Understanding how to split credit card payments online is crucial for businesses looking to streamline financial operations and enhance user experience. This article explores the challenges and solutions for splitting payments, focusing on efficient methods that platforms and marketplaces can implement.

The ability to split online payments efficiently is a game-changer for two-sided platforms and e-commerce marketplaces. Whether you’re running a booking service, a freelance platform, or a delivery app, knowing how to split payments can significantly improve operational efficiency and customer satisfaction. This guide will walk you through the challenges of implementing split payments and introduce you to Fondy Flow, an all-in-one fintech solution designed to meet your needs and show you how to split credit card payments online.

Understanding split credit card payments

What are split payments?

Split payments involve dividing a single transaction into multiple parts to distribute funds to different parties. For example, when a customer makes a purchase on a marketplace, the payment can be automatically split between the seller and the platform. Knowing how to split credit card payments online allows for seamless financial transactions that benefit all stakeholders.

Why they matter for platforms & marketplaces

- Efficiency: Automating the payment splitting process reduces manual effort and errors.

- Transparency: Provides clear tracking of where funds are allocated.

- Compliance: Helps meet regulatory requirements by properly distributing funds.

Common use cases

- Booking services: Splitting payments between service providers and the platform.

- Freelance platforms: Dividing payments among freelancers and the hosting site.

- Delivery apps: Allocating funds between restaurants, delivery personnel, and the app.

To learn more about how split payments work and why they are essential for your business, check out our detailed article on “What is split payment & what does split payment mean for business“.

Challenges in implementing split payments

Technical complexities

Implementing split payments requires integrating complex payment systems that can handle multiple credit card transactions simultaneously. Knowing how to do a split payment online involves addressing issues like transaction routing and real-time fund allocation.

Regulatory compliance

Platforms must navigate KYC (Know Your Customer), KYB (Know Your Business), and AML (Anti-Money Laundering) regulations. Ensuring compliance adds another layer of complexity to splitting payments online.

Security concerns

Platforms must navigate KYC (Know Your Customer), KYB (Know Your Business), and AML (Anti-Money Laundering) regulations. Ensuring compliance adds another layer of complexity to splitting payments online.

Managing multiple stakeholders

Coordinating payments between providers, sellers, and end-users requires a system that can handle diverse requirements and preferences.

The need for specialized solutions

While generic payment gateways offer basic transaction processing, they often lack the features necessary for efficient split payments. For businesses managing online shopping split payment, choosing specialized solutions can provide the customization and scalability required to meet operational needs.

Limitations of generic payment gateways

- Lack of customization: Inability to tailor the payment process to specific needs.

- Insufficient support: Limited assistance in integrating complex payment features.

- Hidden costs: Unclear pricing structures can lead to unexpected expenses.

Importance of customization

A tailored payment solution allows platforms to:

- Meet specific business models: Align payment processes with operational needs.

- Enhance user experience: Provide a seamless payment journey for users.

- Scale efficiently: Adjust to growing transaction volumes without overhauling systems.

Introducing Fondy Flow: the all-in-one fintech solution

Designed for two-sided platforms and marketplaces

Fondy Flow is the comprehensive answer to how to split credit card payments online efficiently. It’s crafted specifically for platforms serving both providers and end-users, automating payments and payouts seamlessly.

Key features

- Accept payments: Handle various payment methods, including credit cards and digital wallets.

- Split payments: Automatically divide payments among multiple parties.

- Instant payouts: Flexibility in disbursing funds to card or bank accounts according to your business model.

- Auto seller onboarding: Simplify the process of adding new sellers or providers.

- Virtual IBAN accounts: Provide unique account numbers for seamless transactions.

Unique selling points (USPs) for startups

Transparent pricing and simple no-code integration

- No hidden charges: Clear pricing models to help you plan expenses.

- User-friendly design: Intuitive interfaces that require minimal technical expertise.

- Easy integration: Utilize payment links, invoices, or CMS integrations with platforms like Shopify, WIX, and WooCommerce.

Analytics dashboard and real-time export

- Real-time monitoring: Keep track of transactions as they happen.

- Data export: Easily export data for analysis and reporting.

Easy registration

- Quick sign-up: Start accepting payments without lengthy procedures.

Integration options

- No-code solutions: Over 30 plugins available for immediate setup.

- API and SDK access: For those who need custom integrations.

- Technical support: Assistance available to ensure smooth integration.

Payment acceptance

- Multiple payment methods: Accept cards, Apple Pay, Google Pay and local methods.

- Multi-currency support: Transactions in native local currencies.

- Optimized checkout experiences: UX-friendly and mobile-optimized embedded or hosted checkouts.

Split payments features

- Versatility: Supports all payment methods, including recurring payments.

- Flexible settings: Customize how payments are split between parties.

- Transparency and tracking: Monitor where every cent goes.

Seller onboarding

- Automated process: Simplify KYC and AML checks.

- User experience: UX-friendly onboarding with local language support.

- Compliance: Covers KYC/B in the UK & EU.

Payouts

- Multiple options: Fondy Wallets, direct IBAN transfers, and card payouts.

- Automated and flexible: Instant or delayed payouts tailored to your needs.

Unique selling points (USPs) for companies

Personalized payment solutions

- Customizable features: Tailor solutions to fit specific business requirements.

- Exclusive payment solutions: Develop unique payment processes that set you apart.

Transparent pricing with VIP support

- Clear costs: No surprises in your billing.

- Dedicated manager: Get personalized assistance for a smooth experience.

Scalability

- Cloud infrastructure: Capable of scaling operations tenfold in a single day.

- Rapid deployment: Quickly adapt to increasing transaction volumes.

Automated compliance

- Effortless regulation adherence: Automated KYC/B and AML checks keep you compliant.

Integration and customization

- API integration: Seamlessly integrate with your existing systems.

- Custom reports: Generate reports tailored to your business analytics needs.

Advanced features

- Enhanced split payments: Greater flexibility and transparency.

- Seller onboarding and compliance: Automated processes with local language support.

- Payout options: Customized to suit your operational requirements.

Implementing split payments with Fondy Flow

Step-by-step guide for startups

Step 1: Easy registration

Sign up on the Fondy platform with a straightforward registration process.

Step 2: Choose integration method

Select from no-code options like payment links or plugins for platforms such as Shopify and WooCommerce.

Step 3: Set up payment acceptance

Configure payment methods, currencies, and customize your checkout experience.

Step 4: Configure split payments

Set up rules for how payments are split among parties, including percentages or fixed amounts.

Step 5: Go live and monitor

Launch your payment system and use the analytics dashboard to monitor transactions in real-time.

Step-by-step guide for companies

Step 1: Contact Fondy for personalized setup

Get a dedicated manager to assist with migration and customization.

Step 2: API integration

Integrate Fondy Flow using APIs with support from technical teams, ensuring you know how to do split payment online effectively.

Step 3: Customize payment solutions

Develop exclusive features and custom reports to meet your specific needs.

Step 4: Automate compliance and onboarding

Leverage automated KYC/B and AML checks for seamless seller onboarding.

Step 5: Scale as needed

Utilize Fondy’s cloud infrastructure to scale your operations rapidly.

Best practices for managing split payments

Maintain transparency

- Clear communication: Inform stakeholders about fees, schedules, and any changes.

- Accessible records: Provide easy access to transaction histories and reports.

Ensure regulatory compliance

- Regular updates: Stay informed about changes in financial regulations.

- Audit trails: Keep detailed records for compliance checks.

Prioritize security

- Data protection: Use encryption and secure protocols to protect sensitive information.

- Fraud prevention: Implement measures to detect and prevent fraudulent activities.

Optimize user experience

- Seamless onboarding: Make it easy for sellers and providers to join your platform.

- Smooth checkout process: Ensure the payment process is quick and hassle-free.

Conclusion

Understanding how to split credit card payments online is essential for platforms and marketplaces aiming to stay competitive. Fondy Flow offers a comprehensive solution that addresses the unique challenges of splitting payments, providing scalability, compliance, and a seamless user experience for both startups and established companies.

By integrating Fondy Flow, you’ll not only understand how to split payments online but also position your platform for sustained growth and success.