If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- How to create, build, set up, and start a crowdfunding platform with expert insights & Fondy’s payment solutions

- App vs platform: discover the difference between an application and a platform for business with Fondy’s solutions

- Simplify B2C payouts for marketplaces and the gig economy with Fondy

- Flexible payout schedules and seamless settlement payouts for two-sided platforms

- Boost your growth with automated payouts by implementing payout automation on your platform

- International payouts with our innovative system for two-sided platforms

- Product vs Platform: exploring the benefits and choosing the right payment solution

- How to accept payment on marketplaces: a guide to streamline your platform

- How to create a platform: step-by-step guide for building an online success

- What is an online platform or marketplace platform: key insights & payment solutions

- How does marketplace work: a focus on online payments and payouts

- How to create a marketplace website with payment solutions designed to build growth

- Ecommerce Platform vs Marketplace: key differences and how to choose the right payment solution

- What is a SaaS platform: meaning, examples, and payment solutions to boost their performance

- The role of advanced APIs in enabling seamless payment flows for MedTech innovators

- Maximising positive impact: the synergy of AI, sustainability, and comprehensive payment solutions

- Deconstructing payment processing

- How to accept payments on social networks?

- What are the best payment gateways for WooCommerce?

- What is the best payment gateway for marketplaces and platforms?

How to create a marketplace website with payment solutions designed to build growth

Introduction

In today’s digital era, online marketplaces have revolutionised the way we buy and sell products and services. Platforms like Amazon, eBay, and Airbnb have set new standards for connecting buyers with sellers globally. The success of these giants has inspired many entrepreneurs to consider creating an online marketplace of their own. But how do you build a marketplace website that not only attracts users but also fosters sustainable growth?

Building a marketplace involves more than just setting up a website; it requires careful planning, understanding of market dynamics, and the integration of seamless payment solutions. Payment processing is a critical component that can significantly impact user experience, trust, and ultimately, the success of your platform.

This comprehensive guide will walk you through how to create your own marketplace website from scratch. We’ll delve into the types of marketplaces, essential features, challenges you might face, and the costs involved. Additionally, we’ll highlight the importance of choosing the right payment solutions designed to build growth, featuring how Fondy’s all-in-one fintech solution can empower your marketplace.

What is a marketplace website?

A marketplace website is an online platform where multiple vendors (sellers) offer products or services to a wide range of customers. Unlike traditional e-commerce websites operated by a single entity, a marketplace brings together various sellers under one virtual roof, facilitating transactions between buyers and sellers.

Key characteristics of a marketplace:

- Multi-vendor platform: Hosts multiple sellers who manage their own listings.

- Diverse product or service range: Offers a wide variety of products or services.

- Facilitated transactions: The marketplace handles payment processing and may offer dispute resolution.

- Revenue model: Generates income through commissions, subscription fees, listing fees, or advertising.

Examples of successful marketplaces:

- Amazon: A global e-commerce marketplace offering a vast array of products.

- eBay: An online auction and shopping website where people buy and sell goods worldwide.

- Airbnb: A platform connecting travellers with hosts offering accommodation.

- Etsy: A marketplace focusing on handmade or vintage items and craft supplies.

- Uber: A ride-sharing platform connecting drivers with passengers.

If you’re interested in diving deeper into the concept of marketplace platforms, check out our detailed guide: “What is a marketplace platform“.

Why create a marketplace website?

Creating an online marketplace offers numerous benefits, both for the platform owner and the users. Here are some compelling reasons to build your own marketplace:

1. Market demand:

- Growing e-commerce sector: The online marketplace industry is booming, with increasing consumer preference for online shopping.

- Gap in the market: Opportunity to cater to underserved niches or regions.

2. Diverse revenue streams:

- Multiple monetisation models: Generate income through commissions, subscriptions, listing fees, advertising, and premium features.

- Scalability of earnings: As the user base grows, so does the potential revenue.

3. Network effects:

- Increased value with more users: The platform becomes more valuable as more buyers and sellers join.

- Community building: Fosters a loyal user base centred around a common interest or need.

4. Flexibility and control:

- Customisable platform: Tailor the marketplace to specific requirements or preferences.

- Data ownership: Access to valuable data insights for strategic decision-making.

5. Competitive advantage:

- Innovation opportunities: Introduce unique features or services not offered by competitors.

- Brand establishment: Build a recognised brand in a particular niche or industry.

6. Lower inventory risks:

- No need for own inventory: Sellers manage their own stock, reducing the platform owner’s financial risk.

7. Global reach:

- Cross-border trade: Ability to connect buyers and sellers from different countries.

- 24/7 accessibility: Operate around the clock without geographical limitations.

Types of online marketplaces and business models

Understanding the different types of marketplaces and business models is crucial when you decide to build an online marketplace. This knowledge will help you tailor your platform to your target audience and monetisation strategy.

Types of marketplaces:

1. By participants:

- B2C (business-to-consumer): Businesses sell products or services directly to consumers. Example: Amazon.

- B2B (business-to-business): Businesses offer products or services to other businesses. Example: Alibaba. Read our detailed guide “How to start a B2B marketplace“.

- C2C (consumer-to-consumer): Consumers sell products or services to other consumers. Example: eBay.

- Peer-to-Peer services: Individuals provide services to others via the platform. Example: Airbnb, Uber.

2. By focus:

- Horizontal marketplaces: Offer a wide range of products across various categories. Example: eBay.

- Vertical marketplaces: Specialise in a specific niche or industry. Example: Etsy (handmade goods).

3. By interaction type:

- Product-based: Physical or digital goods are sold. Example: Amazon.

- Service-based: Services are offered and booked. Example: Upwork (freelance services).

- Rental marketplaces: Facilitate renting of goods or property. Example: Airbnb.

Business models:

1. Commission-based:

- Description: The marketplace charges a percentage fee on each transaction.

- Advantages: Direct correlation between platform success and revenue.

- Considerations: Requires robust payment processing to handle transactions efficiently.

2. Subscription-based:

- Description: Sellers pay a recurring fee to access the platform’s services.

- Advantages: Predictable revenue stream.

- Considerations: Must offer significant value to justify the subscription cost.

3. Listing fees:

- Description: Charging sellers a fee to list their products or services.

- Advantages: Immediate revenue from listings.

- Considerations: May deter sellers if fees are too high or if the platform lacks sufficient traffic.

4. Freemium model:

- Description: Basic services are free, but premium features are available at a cost.

- Advantages: Low barrier to entry encourages user sign-ups.

- Considerations: Requires compelling premium features to convert free users into paying customers.

5. Advertising model:

- Description: Revenue generated through third-party ads displayed on the platform.

- Advantages: Additional income without charging users directly.

- Considerations: Overuse of ads can negatively affect user experience.

6. Lead fees:

- Description: Sellers pay for leads or contacts generated through the platform.

- Advantages: Sellers pay for direct value received.

- Considerations: Needs a reliable system to track and deliver quality leads.

Key features of a successful marketplace

To create a marketplace website that thrives, it’s essential to incorporate features that cater to both buyers and sellers, enhancing user experience and fostering trust.

Essential features:

1. User-friendly interface:

- Intuitive navigation: Easy access to different sections of the website.

- Clean design: Visually appealing layout that highlights important information.

- Responsive design: Optimised for desktops, tablets, and mobile devices.

2. Advanced search and filtering:

- Search bar: Allows users to quickly find products or services.

- Filtering options: Filter by category, price range, location, ratings, etc.

- Sorting functions: Sort results by relevance, price, popularity, or date added.

3. Secure payment systems:

- Multiple payment methods: Support for credit/debit cards, digital wallets, bank transfers, etc.

- Encryption and security protocols: Protect sensitive user data.

- Payment gateways: Integration with reliable payment processors like Fondy.

4. User registration and profiles:

- Easy sign-up process: Simplify registration with email or social media accounts.

- User profiles: Detailed profiles for buyers and sellers, including personal information, transaction history, and preferences.

- Verification processes: Confirm identities to build trust within the platform.

5. Product listings and management:

- Detailed listings: Include descriptions, images, videos, pricing, and availability.

- Inventory management: Tools for sellers to track and update stock levels.

- Bulk uploads: Allow sellers to add multiple products simultaneously.

6. Review and rating system:

- Feedback mechanism: Enable users to rate and review transactions.

- Moderation tools: Monitor and manage reviews to prevent abuse.

- Transparency: Display ratings prominently to inform other users.

7. Messaging and communication:

- Internal messaging system: Facilitate communication between buyers and sellers.

- Notifications: Alert users about messages, orders, promotions, and updates.

- Support channels: Provide access to customer support via chat, email, or phone.

8. Order management:

- Order tracking: Real-time updates on order status.

- Invoice generation: Automatic creation of invoices and receipts.

- Returns and refunds: Policies and processes for handling returns.

9. Multilingual and multi-currency support:

- Language options: Cater to a global audience by offering multiple languages.

- Currency conversion: Display prices in users’ local currencies.

10. Security and compliance:

- Data protection: Comply with regulations like GDPR for user data privacy.

- KYC/AML checks: Verify users to prevent fraud and money laundering.

- SSL certificates: Secure the website with encryption protocols.

11. Analytics and reporting:

- Dashboard: Provide sellers with insights into sales, traffic, and performance.

- Custom reports: Enable data-driven decision-making.

12. Promotions and discounts:

- Coupon codes: Allow sellers to offer discounts.

- Featured listings: Paid options for sellers to promote their products.

13. Content management system (CMS):

- Easy updates: Modify content without needing technical expertise.

- Blog or news section: Share updates, tips, and industry news.

14. Mobile application (optional):

- Native apps: Offer dedicated apps for iOS and Android for enhanced user experience.

To ensure your marketplace succeeds, integrating secure payment gateway like Fondy can streamline transactions and setup settlements among users. Learn more about how marketplaces work in our detailed guide: “How does marketplace work: a focus on online payments and payouts“

How to create a marketplace website: step-by-step guide

Building an online marketplace involves several critical steps. Here’s a detailed guide to help you navigate the process.

Step 1: Define your marketplace idea and validate it

Identify Your niche:

- Market research: Analyse current market trends to find gaps or underserved areas.

- Target audience: Define the demographics, preferences, and pain points of your potential users.

Validate the idea:

- Surveys and interviews: Gather feedback from potential users.

- Competitor analysis: Study existing marketplaces to understand what works and what doesn’t.

- Minimum Viable Product (MVP): Consider developing a basic version to test the concept.

Step 2: Choose the right business model and monetisation strategy

Align with goals:

- Revenue objectives: Determine your financial targets.

- Value proposition: Ensure your model offers benefits to both buyers and sellers.

Select a monetisation strategy:

- Commission fees: Decide on percentage rates that are competitive yet profitable.

- Subscription plans: Offer tiered plans with varying levels of access or features.

- Combination models: Use a mix of strategies to diversify income streams.

Step 3: Select the best technology stack or platform

Development approaches:

- Custom development: Pros: full control over features and scalability. Cons: higher costs and longer development time.

- Marketplace platforms: Examples: Sharetribe, Magento Marketplace, CS-Cart. Pros: faster deployment, built-in features. Cons: limited customisation, potential scalability issues.

- No-code solutions: Examples: Bubble, WordPress with plugins. Pros: cost-effective, easy to use. Cons: less flexibility, may not handle high traffic well.

Technology considerations:

- Scalability: Can the platform handle growth?

- Security: Does it offer robust security features?

- Integrations: Ability to integrate with third-party services like payment gateways.

Step 4: Develop core marketplace functionality

User registration and authentication:

- Social media sign-in: Offer options to sign up via Facebook, Google, etc.

- Two-factor authentication (2FA): Enhance security during login.

Product listings:

- Media support: Allow images, videos, and PDFs.

- SEO optimisation: Enable meta tags and descriptions for better search visibility.

Shopping cart and checkout:

- Guest checkout: Allow purchases without mandatory registration.

- Save for later: Let users save items for future consideration.

Search and filtering:

- Auto-suggestions: Predictive text to assist in searches.

- Location-based search: Filter results based on geographical location.

Messaging system:

- Real-time chat: Immediate communication between users.

- Message notifications: Alerts for new messages.

Notifications:

- Email and SMS alerts: Keep users informed through multiple channels.

- Push notifications: For mobile app users.

Step 5: Integrate seamless payment solutions like Fondy

A secure and efficient payment system is crucial for the success of your marketplace.

Select a payment gateway:

- Multiple payment options: Support for various methods increases conversion rates.

- Security compliance: Ensure PCI DSS compliance.

Features of Fondy:

- Accept payments: Global payment methods: cards, Apple Pay, Google Pay, BNPL, and local methods. Multi-currency support: accept payments in over 150 currencies. Embedded checkout: customisable checkout that matches your brand.

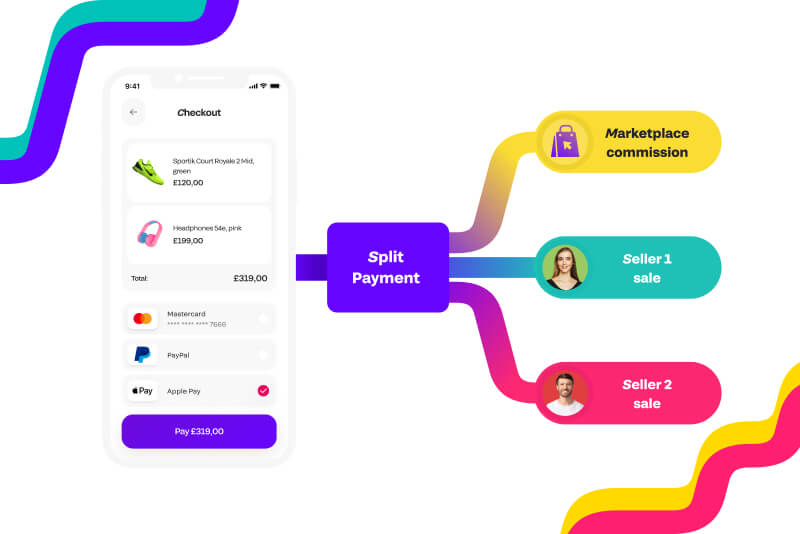

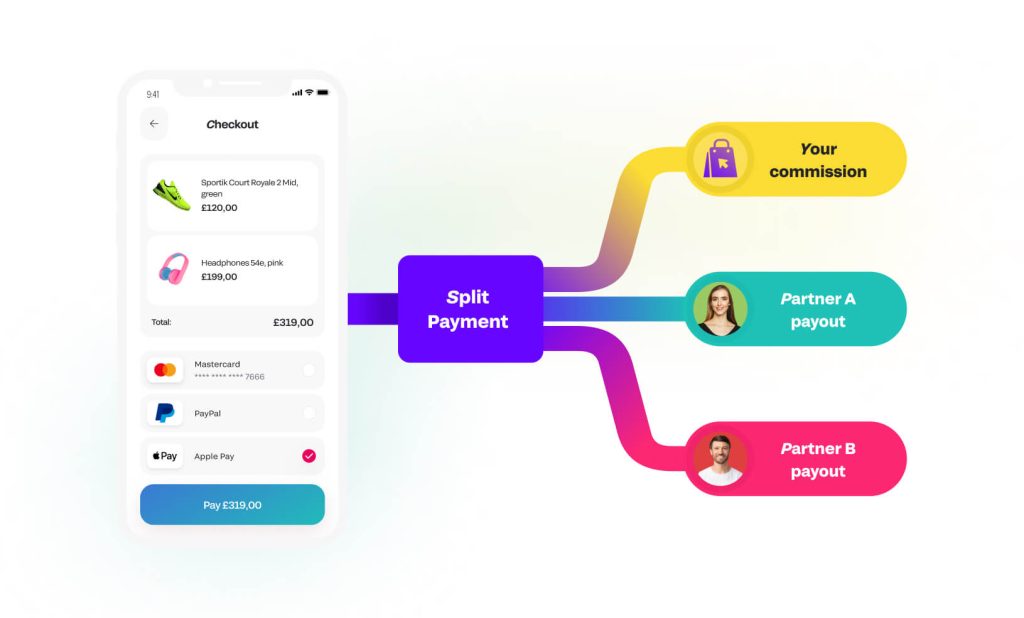

- Split payments: Automated distribution: allocate funds between platform and sellers instantly. Flexible configurations: set different commission rates for different sellers.

- Seller onboarding: Automated KYC/AML checks: streamline the verification process. Local language support: onboarding in the seller’s native language enhances user experience.

- Payouts: Fondy Wallets: virtual IBAN accounts for easy fund management. Bank transfers: payouts to any bank account globally. Card payouts: quick transfers directly to sellers’ cards.

- Integration: Easy API integration: developer-friendly APIs for smooth integration. Sandbox environment: test the payment processes before going live.

- Compliance and security: PCI DSS level 1 certified: highest level of payment data security. GDPR compliance: protects user data in accordance with EU regulations.

Step 6: Onboard initial users (sellers and buyers)

Attract sellers:

- Value proposition: Clearly communicate the benefits of joining your platform.

- Incentives: Offer reduced fees or promotional benefits for early adopters.

- Marketing outreach: Use targeted ads, social media, and networking events.

Attract buyers:

- Promotional campaigns: Discounts, coupons, or loyalty programmes.

- Content marketing: Publish blogs, videos, and infographics to draw interest.

- SEO optimisation: Improve search engine rankings to increase visibility.

Smooth onboarding process:

- Guided tutorials: Help users navigate the platform.

- Customer support: Provide assistance through chatbots or support teams.

- Feedback mechanisms: Encourage users to share their experiences for continuous improvement.

Step 7: Test and launch your marketplace

Testing phases:

- Alpha testing: Internal testing to catch major issues.

- Beta testing: Release to a select group of users for real-world feedback.

- Load testing: Ensure the platform can handle expected traffic volumes.

Quality assurance:

- Bug tracking: Use tools to document and fix issues.

- User experience testing: Evaluate the interface for usability.

Compliance verification:

- Legal requirements: Ensure adherence to laws related to e-commerce, data protection, and financial transactions.

- Terms and conditions: Clearly outline user agreements and policies.

Launch strategies:

- Soft launch: Release the platform quietly to monitor performance.

- Official launch: Announce the platform through marketing campaigns.

Post-launch monitoring:

- Analytics tracking: Monitor user behaviour and platform performance.

- Continuous improvement: Update features and fix issues based on feedback.

Challenges of creating a marketplace

Building a marketplace website comes with unique challenges that require careful planning and proactive management.

1. Balancing supply and demand:

- Chicken-and-egg problem: Difficulty in attracting sellers without buyers and vice versa.

- Solution: Focus on one side first, often the supply (sellers), and incentivise early adopters.

2. Building trust:

- User skepticism: New platforms may face credibility issues.

- Solution: Implement verification processes, secure payment systems, and transparent policies.

3. Regulatory compliance:

- Legal complexities: Varying laws across different regions.

- Solution: Consult legal experts and ensure compliance with local and international regulations.

4. Technical complexity:

- Scalability issues: Platform may struggle under increased load.

- Solution: Use scalable technologies and cloud services.

5. Competition:

- Established players: Competing with well-known marketplaces.

- Solution: Differentiate through niche focus, superior user experience, or innovative features.

6. Security risks:

- Cyber threats: Risk of data breaches and fraud.

- Solution: Invest in robust security measures and regular audits.

7. User retention:

- High churn rates: Users may not return after initial use.

- Solution: Enhance user engagement through personalised experiences and loyalty programmes.

8. Payment processing:

- Complex transactions: Managing multiple payment methods and currencies.

- Solution: Integrate comprehensive payment solutions like Fondy.

9. Marketing and growth:

- Limited budget: High costs associated with marketing efforts.

- Solution: Utilise cost-effective digital marketing strategies like SEO, content marketing, and social media.

How much does it cost to build a marketplace website?

The cost of building a marketplace website can vary widely depending on multiple factors. By understanding these elements, businesses can budget more effectively and align their resources with their goals.

Factors influencing cost

The development approach is one of the most significant factors affecting the cost. No-code platforms, such as Sharetribe or WordPress plugins, provide a cost-effective option ranging from £500 to £5,000 per year. These platforms include subscription fees and are suitable for businesses that prioritize speed and affordability. Conversely, custom development offers a tailored solution but comes with a price range of £20,000 to £200,000 or more, covering design, development, testing, and deployment.

Feature complexity also has a direct impact. Basic functionalities, like user registration and product listings, keep costs manageable. However, integrating advanced features such as AI-driven recommendations, custom analytics, or intricate integrations can significantly increase development time and expenses. Similarly, design requirements influence budgets—template designs are cheaper but less unique, while custom designs enhance branding at a higher cost.

The choice of technology stack matters too. Open-source solutions can lower licensing costs but require additional customization and maintenance. Proprietary software, while feature-rich, often involves recurring licensing fees. Additional third-party integrations, such as marketplace payment gateways, CRM systems, and analytics platforms, add another layer of costs depending on the provider.

Team expertise

The expertise and structure of the development team also influence the budget. In-house teams involve salaries for developers, designers, and project managers, while outsourcing to external firms may offer cost savings but depends on location and expertise. Whether opting for freelancers, agencies, or nearshore/offshore teams, it’s essential to balance quality and cost.

Maintenance and updates

Ongoing costs for hosting, security updates, and feature enhancements must also be considered. Typically, these expenses account for 15-20% of the initial development cost annually. Proper budgeting for maintenance ensures smooth operations and scalability.

Estimated cost breakdown (custom development)

Custom development is often divided into phases, with each phase contributing to the total budget. Planning and research range from £2,000 to £10,000. Design and UX/UI cost between £5,000 and £30,000, while front-end development requires £10,000 to £50,000. Back-end development typically adds £15,000 to £70,000, and testing and QA range from £5,000 to £20,000. Deployment costs fall between £1,000 and £5,000, bringing the total estimated cost to £38,000–£185,000.

Cost-saving strategies

There are several strategies to optimize spending during development. Starting with a minimum viable product (MVP) allows businesses to focus on core features and gather feedback for future improvements. Using scalable solutions, such as cloud services, reduces infrastructure costs while enabling growth. Modular architectures allow for incremental feature additions over time.

Leveraging existing tools is another way to cut costs. Payment systems like Fondy streamline integration, while open-source software offers a customizable foundation that saves on initial development. Outsourcing can also be cost-effective. Nearshore or offshore teams provide affordable options, and freelancers can handle specific tasks, though due diligence is essential to ensure quality.

Building a marketplace website involves various costs influenced by development choices, feature requirements, and ongoing maintenance. By understanding these factors and implementing cost-saving strategies, businesses can create a marketplace that fits their budget while supporting scalability and growth.

Why payment solutions are critical for marketplaces

Integrating the right payment solution is not just a technical necessity but a strategic decision that profoundly influences your marketplace’s success. From user trust to operational efficiency, payment solutions form the backbone of a seamless marketplace experience.

User trust and satisfaction

Secure and smooth payment processes are key to building trust among buyers and sellers. When transactions are protected, users feel confident in their purchases. Additionally, a hassle-free payment experience minimizes cart abandonment, ensuring that users complete their transactions without frustration.

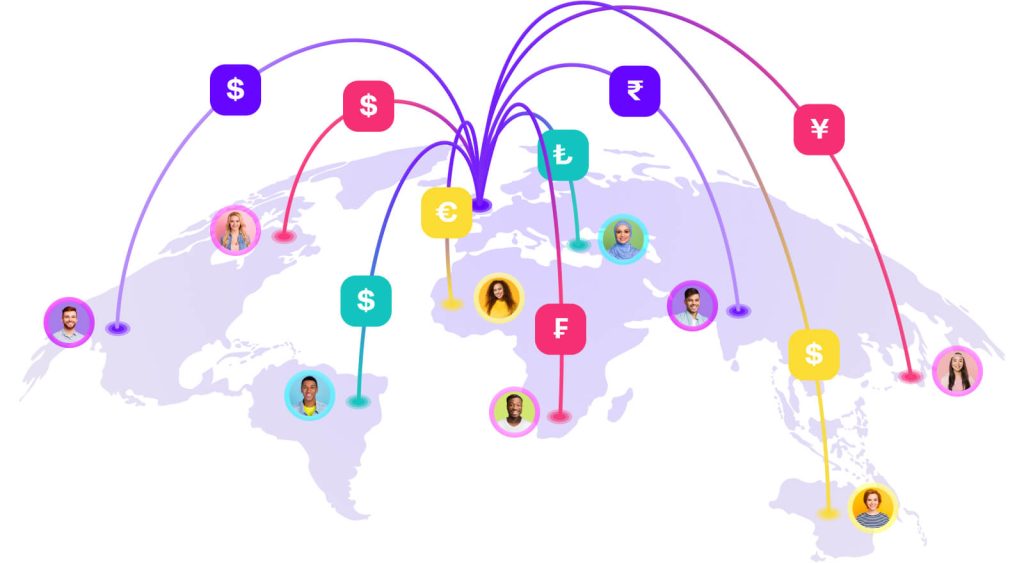

Global reach

Expanding your marketplace globally requires supporting multiple currencies and accommodating local payment preferences. By enabling users to pay in their preferred methods and currencies, your platform becomes more accessible to diverse audiences, increasing its appeal and usability.

Operational efficiency

Efficient payment systems streamline transactions by automating processes and enabling real-time settlements. These features not only reduce the need for manual intervention but also ensure that sellers have quicker access to their funds, improving their overall experience.

Compliance

Adhering to financial regulations is crucial for maintaining trust and avoiding legal pitfalls. Payment solutions help marketplaces comply with standards like KYC (Know Your Customer) and AML (Anti-Money Laundering), while robust data security safeguards sensitive financial information.

Monetisation facilitation

Payment solutions simplify monetisation strategies by automating commission collection and managing recurring payments for subscription-based services. These features ensure steady revenue streams and reduce administrative workload.

Analytics and insights

A well-integrated payment system provides valuable data on transactions, enabling marketplaces to analyze user behavior and sales trends. Detailed reporting tools further aid in financial planning and auditing, offering insights that drive strategic decisions.

Challenges without the right payment solution

Without an effective payment solution, marketplaces face significant hurdles. Fraud risks increase without robust security measures, while complicated payment processes can lead to user drop-offs. Moreover, manual handling of transactions is time-consuming and prone to errors, hindering scalability as transaction volumes grow.

By prioritizing the integration of a reliable and versatile payment solution, marketplaces can enhance user satisfaction, expand globally, and ensure smooth operations, paving the way for long-term success.

How Fondy can help your marketplace thrive

Fondy Flow is an all-in-one fintech solution tailored specifically for two-sided platforms and marketplaces. By addressing critical payment processing needs, it ensures seamless operations while fostering growth, efficiency, and user satisfaction.

Key features and benefits

Fondy offers a comprehensive set of features that empower platforms to accept marketplace payments effortlessly. With support for diverse payment methods, platforms can process major credit and debit cards, enable digital wallets like Apple Pay and Google Pay, and offer flexible options such as Buy Now, Pay Later (BNPL). Additionally, Fondy supports local payment methods like SEPA and iDEAL, ensuring businesses can cater to regional preferences. Multi-currency functionality allows platforms to accept payments in over 150 currencies with competitive exchange rates. A customisable embedded checkout further enhances the user experience by aligning with the platform’s brand identity and reducing friction during payment.

Streamlined split payments

Managing payouts to multiple sellers is simplified with Fondy’s split payment functionality. Payments can be automatically divided in real-time between the platform and its sellers, with the option to set custom commission rates or fees. Transparency is a priority, as detailed transaction reports and seller dashboards provide clear insights into earnings.

Efficient seller onboarding

Attracting more sellers becomes hassle-free with Fondy’s automated onboarding process. KYC/AML checks are completed in minutes rather than days, ensuring regulatory compliance without delays. The user-friendly process guides sellers through registration and verification, while multi-language support accommodates businesses with global ambitions.

Flexible and automated payouts

Fondy offers multiple payout options, including virtual IBAN accounts, bank transfers, and quick card payouts. Businesses can choose between instant payouts for immediate access to funds or delayed payouts tailored to their specific operational model.

Integration and scalability

Integrating Fondy into your platform is seamless thanks to developer-friendly APIs, comprehensive documentation, and a sandbox environment for testing. The scalable cloud infrastructure allows for rapid system expansion, ensuring high uptime and robust performance even during peak demand. Transparent pricing and VIP support, including a dedicated manager, provide clarity and assistance throughout the integration process.

Compliance and security

Fondy adheres to the highest security standards, including PCI DSS Level 1 certification and GDPR compliance. These measures protect user data and ensure trustworthiness, critical for building confidence among users.

Custom reporting and analytics

With advanced analytics and customisable dashboards, businesses gain deep insights into transactions, sales, and payouts. Data can be easily exported for accounting or further analysis, empowering decision-making based on real-time metrics.

Addressing marketplace challenges

Fondy is designed to tackle common marketplace hurdles. Quick onboarding processes attract more sellers, while secure payment systems enhance user trust. Multi-currency and local payment methods support international growth, and automation reduces administrative workload and errors. Regulatory compliance is ensured through automated KYC/AML processes, giving businesses peace of mind.

Case studies and success stories

Fondy’s impact is evident in real-world examples. A freelance services marketplace increased its seller base by 30% after implementing Fondy’s automated onboarding and multi-currency support. Similarly, an e-commerce platform saw a 25% reduction in cart abandonment rates thanks to Fondy’s seamless checkout experience.

Why choose Fondy

Fondy isn’t just a service provider – it’s a growth partner. With industry expertise, customisable solutions tailored to unique business models, and a commitment to scaling marketplaces, Fondy stands out as the ideal choice for platforms looking to thrive.

Conclusion

Building an online marketplace website is a complex but rewarding venture. By following this guide on how to create a marketplace website, you’re setting a foundation for success. From defining your idea and choosing the right business model to integrating essential features and selecting a robust payment solution, each step is crucial.

Integrating a payment solution like Fondy not only simplifies transactions but also adds value to your platform through features like split payments, automated seller onboarding, and multi-currency support. These capabilities are designed to build growth and give your marketplace a competitive edge.

As you embark on this journey, remember that the right tools and partnerships can significantly impact your marketplace’s success. By focusing on user experience, security, and scalability, you’re well on your way to building a thriving online marketplace.