If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- How to create, build, set up, and start a crowdfunding platform with expert insights & Fondy’s payment solutions

- App vs platform: discover the difference between an application and a platform for business with Fondy’s solutions

- Simplify B2C payouts for marketplaces and the gig economy with Fondy

- Flexible payout schedules and seamless settlement payouts for two-sided platforms

- Boost your growth with automated payouts by implementing payout automation on your platform

- International payouts with our innovative system for two-sided platforms

- Product vs Platform: exploring the benefits and choosing the right payment solution

- How to accept payment on marketplaces: a guide to streamline your platform

- How to create a platform: step-by-step guide for building an online success

- What is an online platform or marketplace platform: key insights & payment solutions

- How does marketplace work: a focus on online payments and payouts

- How to create a marketplace website with payment solutions designed to build growth

- Ecommerce Platform vs Marketplace: key differences and how to choose the right payment solution

- What is a SaaS platform: meaning, examples, and payment solutions to boost their performance

- The role of advanced APIs in enabling seamless payment flows for MedTech innovators

- Maximising positive impact: the synergy of AI, sustainability, and comprehensive payment solutions

- Deconstructing payment processing

- How to accept payments on social networks?

- What are the best payment gateways for WooCommerce?

- What is the best payment gateway for marketplaces and platforms?

How to accept payment on marketplaces: a guide to streamline your platform

Understanding how to accept payment on marketplace

How to accept payment on marketplace platforms can seem complicated at first, especially if you’re trying to balance the needs of sellers, buyers, and your own operational requirements. Yet understanding how to streamline each step is crucial for creating a seamless experience. The goal is to build trust among users, maintain transparent transactions, and minimise any friction that might occur. When you accept business payments in a structured, user-friendly way, your marketplace is more likely to boost conversions and nurture long-term growth.

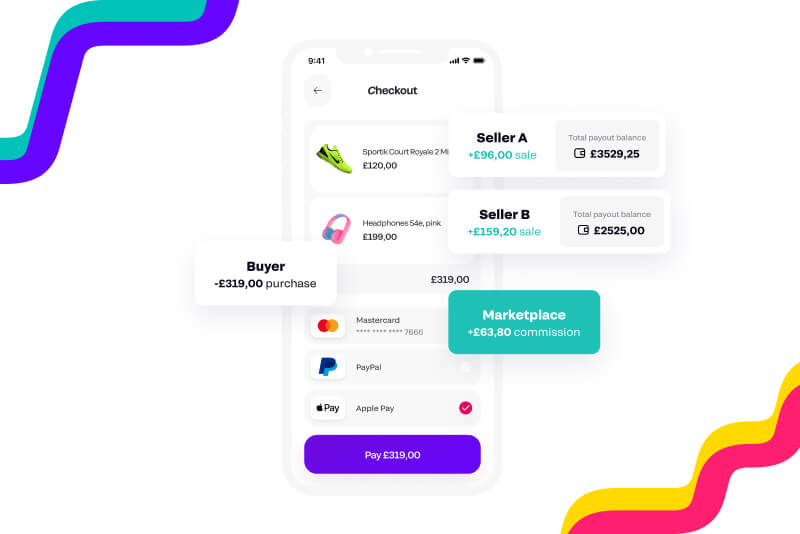

Balancing complex finances and user demands

Many marketplace owners struggle with managing split payments, onboarding multiple sellers, and dealing with multiple currencies. It’s not just about knowing how to accept money; it’s also about deciding when and how you want to distribute funds to different parties. For example, you might need to pay some sellers immediately after a transaction, while others could benefit from a delayed payout. Balancing these tasks without a centralised system often leads to complexity and confusion.

Choosing an all-in-one fintech solution

Adopting a well-designed fintech solution can eliminate much of the stress. Fondy Flow is an all-in-one approach for anyone wondering how to accept payment on marketplace platforms without getting bogged down by manual processes. It offers transparent pricing, so you won’t worry about hidden fees. Meanwhile, the cloud infrastructure ensures quick scaling when your volume of users suddenly increases, and a dedicated manager helps you migrate from existing systems swiftly. There’s also the advantage of integrating through a user-friendly API if you decide to customise your payment experiences further.

Automating seller onboarding and compliance

Sellers often require fast onboarding and clear compliance checks, which is another vital aspect of a healthy marketplace. When you accept payment from buyers in different locations, you might also need to verify your sellers efficiently. Fondy Flow provides automated KYC and AML checks, local language support, and a simple process for opening virtual IBAN accounts (Fondy Wallets) — ideal if you want to maintain an escrow-like environment. This means your marketplace has a robust foundation for protecting user data and securing each transaction, strengthening confidence in your platform.

Managing payouts with flexibility

Beyond simple acceptance of funds, handling payouts is equally important. A marketplace that offers multiple payout methods and flexible settings can draw more sellers and keep them happy. Fondy Flow accommodates everything from instant or delayed payouts to multi-currency settlements, meaning you can adjust how funds are released based on your business model. Whether you need direct transfers to IBANs, card payouts, or even specialised virtual accounts, the system adapts to your workflow and helps you avoid manual errors or delays.

Enhancing marketplace growth

If you’re looking to grow your marketplace faster, remember that an efficient payment flow encourages repeat business and positive feedback from both sellers and buyers. Seamless checkouts, split payments, and transparent dashboards all contribute to a positive user experience. By choosing a modern marketplace payment gateway, you remove hurdles that often inhibit expansion. Eventually, it’s not just about how you accept funds; it’s about improving the entire customer journey from the moment they visit your platform to the confirmation of a successful transaction.