If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- How to create, build, set up, and start a crowdfunding platform with expert insights & Fondy’s payment solutions

- App vs platform: discover the difference between an application and a platform for business with Fondy’s solutions

- Simplify B2C payouts for marketplaces and the gig economy with Fondy

- Flexible payout schedules and seamless settlement payouts for two-sided platforms

- Boost your growth with automated payouts by implementing payout automation on your platform

- International payouts with our innovative system for two-sided platforms

- Product vs Platform: exploring the benefits and choosing the right payment solution

- How to accept payment on marketplaces: a guide to streamline your platform

- How to create a platform: step-by-step guide for building an online success

- What is an online platform or marketplace platform: key insights & payment solutions

- How does marketplace work: a focus on online payments and payouts

- How to create a marketplace website with payment solutions designed to build growth

- Ecommerce Platform vs Marketplace: key differences and how to choose the right payment solution

- What is a SaaS platform: meaning, examples, and payment solutions to boost their performance

- The role of advanced APIs in enabling seamless payment flows for MedTech innovators

- Maximising positive impact: the synergy of AI, sustainability, and comprehensive payment solutions

- Deconstructing payment processing

- How to accept payments on social networks?

- What are the best payment gateways for WooCommerce?

- What is the best payment gateway for marketplaces and platforms?

How does marketplace work: a focus on online payments and payouts

Introduction

Online marketplaces have fundamentally transformed the way we engage in commerce, connecting buyers and sellers from all over the world on a single platform. But how does a marketplace work, especially when it comes to the complexities of online payments and payouts? Understanding the mechanisms behind these platforms is crucial for anyone looking to participate in or create a successful online marketplace.

What is a marketplace?

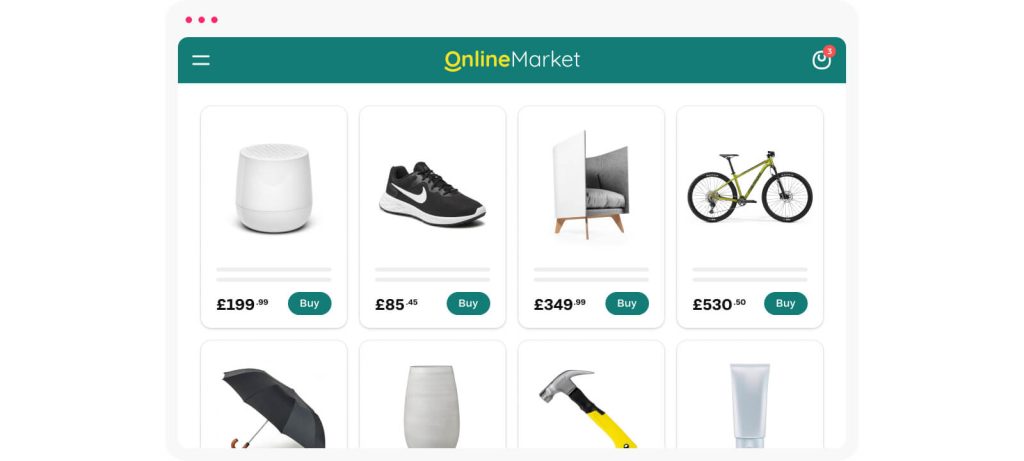

A marketplace is a digital platform that brings together multiple vendors and buyers in one place. Unlike traditional e-commerce websites that sell products from a single vendor, marketplaces allow various sellers to offer their goods or services to a broad audience. This model provides buyers with a diverse range of options and sellers with access to a larger customer base. To fully grasp how does an online marketplace work, we need to delve deeper into its operational framework.

How does a marketplace work?

At its core, a marketplace functions by facilitating transactions between buyers and sellers. Sellers register on the platform, list their products or services, and set prices. Buyers browse the listings, select items, and make purchases. The marketplace oversees the entire transaction process, ensuring that payments are securely processed and that both parties fulfil their obligations.

Understanding how does marketplace work involves recognising several key components:

- Registration and onboarding: Sellers and buyers create accounts on the platform. Sellers often undergo a verification process to ensure legitimacy.

- Product or service listing: Sellers upload detailed information about their offerings, including descriptions, images, and pricing.

- Search and discovery: Buyers use search tools and filters to find products or services that meet their needs.

- Transaction processing: The marketplace provides a secure payment system to handle transactions between buyers and sellers.

- Order fulfilment: Sellers are responsible for delivering the goods or services as agreed.

- Feedback and ratings: After transactions, buyers can leave reviews, helping to build trust within the community.

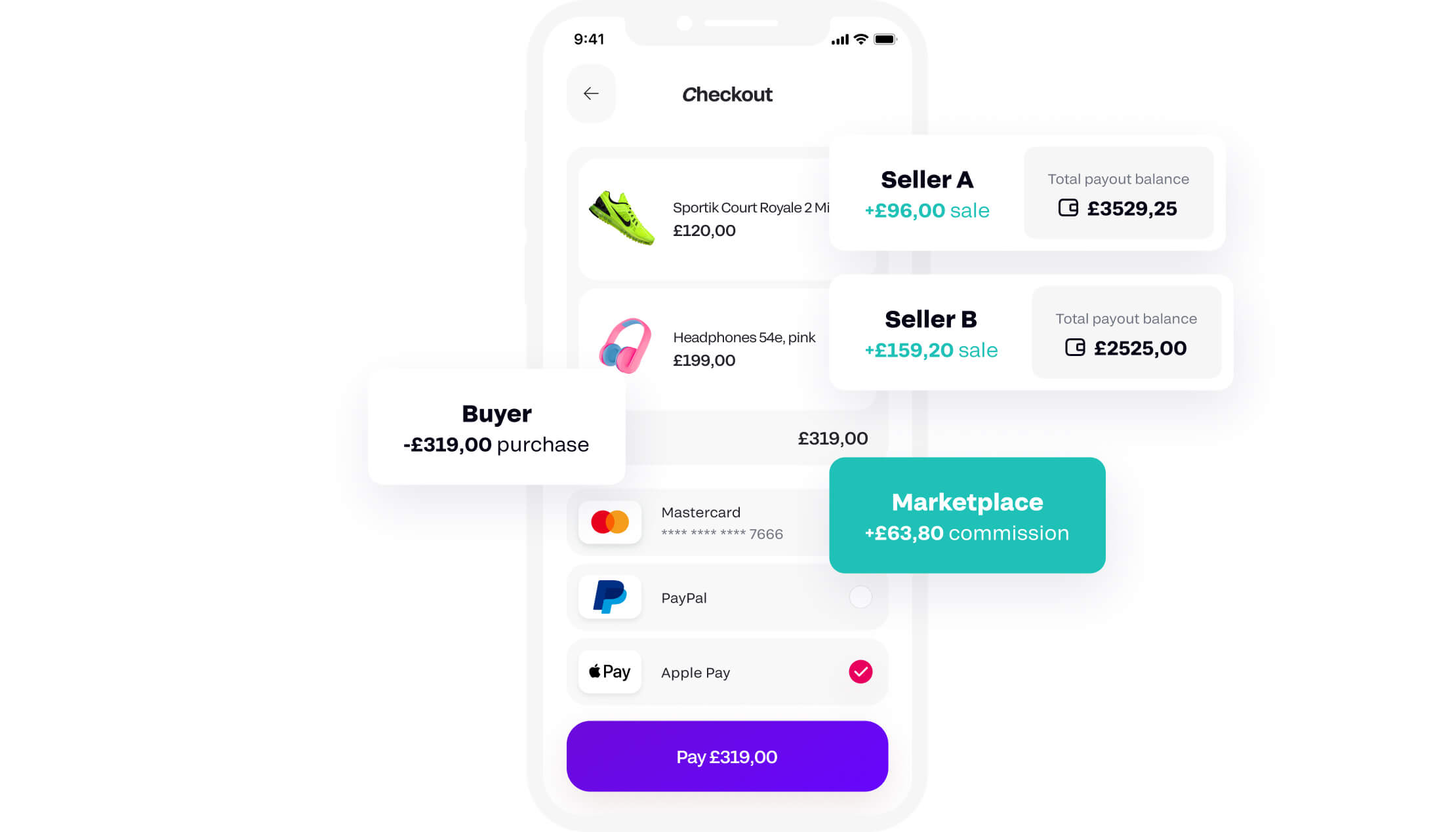

The question of how does marketplace payment work is central to the platform’s operation. Marketplaces typically handle the payment process to provide a seamless experience. When a buyer makes a purchase, the payment is collected by the marketplace, which may hold the funds in escrow until the transaction is confirmed. After deducting any fees or commissions, the marketplace pays out the remaining amount to the seller. This system builds trust among users, as both buyers and sellers rely on the marketplace to manage payments fairly and efficiently.

The role of online payments in marketplaces

Online payments are the backbone of any marketplace. They enable instant transactions, support multiple currencies, and provide secure methods for transferring funds. Without efficient payment solutions, marketplaces would struggle to maintain user trust and could face operational challenges.

Understanding how does marketplace work in relation to payments involves recognising the need for secure, reliable, and user-friendly payment systems. Buyers expect a variety of payment options, such as credit cards, digital wallets, and local payment methods. Sellers, on the other hand, need timely payouts to manage their businesses effectively. The complexity increases when dealing with international transactions, as currency conversion and regional payment methods come into play.

Challenges in marketplace payments

While online payments are essential, they come with their own set of challenges:

- Security concerns: Protecting sensitive financial information from fraud and cyber threats is paramount. Marketplaces must implement robust security measures, such as encryption and secure marketplace payment gateway, to safeguard user data.

- Compliance with regulations: Marketplaces must adhere to legal requirements related to anti-money laundering (AML) and know your customer (KYC) protocols. This adds layers of complexity to the payment process, requiring thorough verification processes.

- Managing payouts: Handling payouts to sellers can be complicated, especially when dealing with different banks, currencies, and payment preferences. Delays or errors in payouts can damage relationships with sellers.

- Integration of multiple payment methods: Catering to a global audience means supporting various payment options, which can be technically challenging to integrate and maintain.

- Currency conversion and exchange rates: Fluctuating exchange rates can affect the final amount sellers receive, leading to potential disputes or dissatisfaction.

How does marketplace payment work with Fondy Flow

To address these challenges, many marketplaces turn to specialised payment solutions. Fondy Flow is an all-in-one fintech solution designed specifically for two-sided platforms and marketplaces. So, how does a marketplace work more efficiently with Fondy Flow integrated into its system?

Fondy Flow streamlines the entire payment process, from accepting payments to managing payouts. It supports a wide range of payment methods, including cards, Apple Pay, Google Pay, Buy Now Pay Later (BNPL) options, and local payment methods. With multi-currency support, marketplaces can accept payments in the buyer’s local currency, enhancing the user experience and expanding the potential customer base.

To gain a deeper understanding of how to set up and optimise payment acceptance on your marketplace, explore our comprehensive guide:

“How to accept payment on marketplaces: a guide to streamline your platform“.

Enhancing seller onboarding and payouts

One of the critical aspects of how does an online marketplace work is the onboarding of sellers and managing their payouts. Fondy Flow offers automated onboarding and verification, simplifying the process for sellers to join the platform. It conducts KYC and AML checks for individuals and businesses, ensuring compliance without adding administrative burdens on the marketplace.

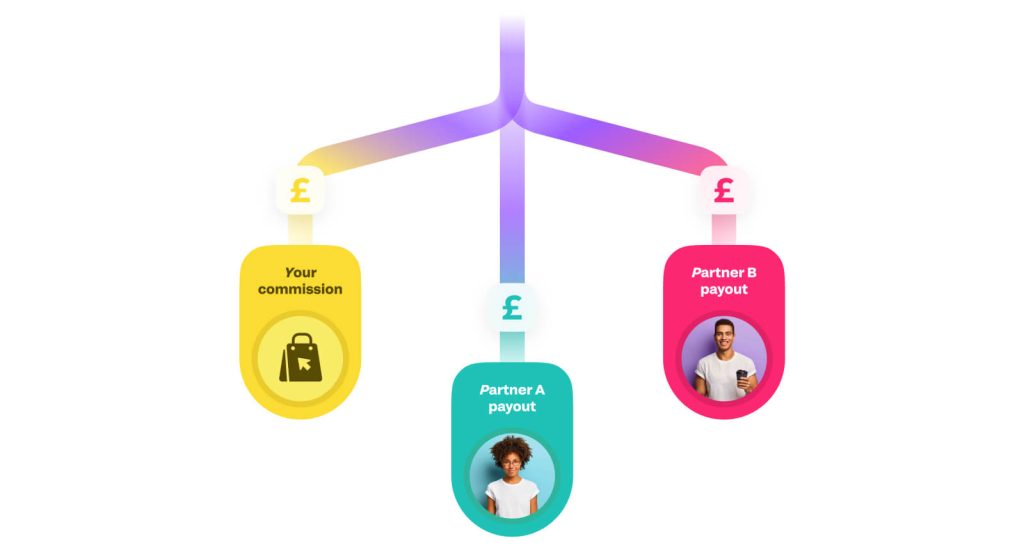

When it comes to marketplace payouts, Fondy Flow provides flexibility and efficiency. Sellers can receive funds directly to their virtual IBAN accounts, bank accounts, or even via card payouts. Automated payouts mean that sellers receive their earnings promptly, which is vital for maintaining a healthy relationship between the marketplace and its vendors. The ability to choose between instant and delayed payouts offers further flexibility, catering to the needs of different business models.

The importance of split payments

Split payments are a feature that significantly impacts how does marketplace payment work. They allow the marketplace to automatically divide a single payment among multiple parties. This is particularly useful when a transaction involves commissions, fees, or multiple sellers. For example, if a buyer purchases items from multiple sellers in one transaction, the payment can be seamlessly split and distributed accordingly.

Fondy Flow’s split payment functionality ensures transparency and accuracy, reducing the risk of errors and disputes. Sellers appreciate the clarity in how funds are allocated, and buyers benefit from a smoother checkout experience. This feature enhances trust and efficiency within the marketplace ecosystem.

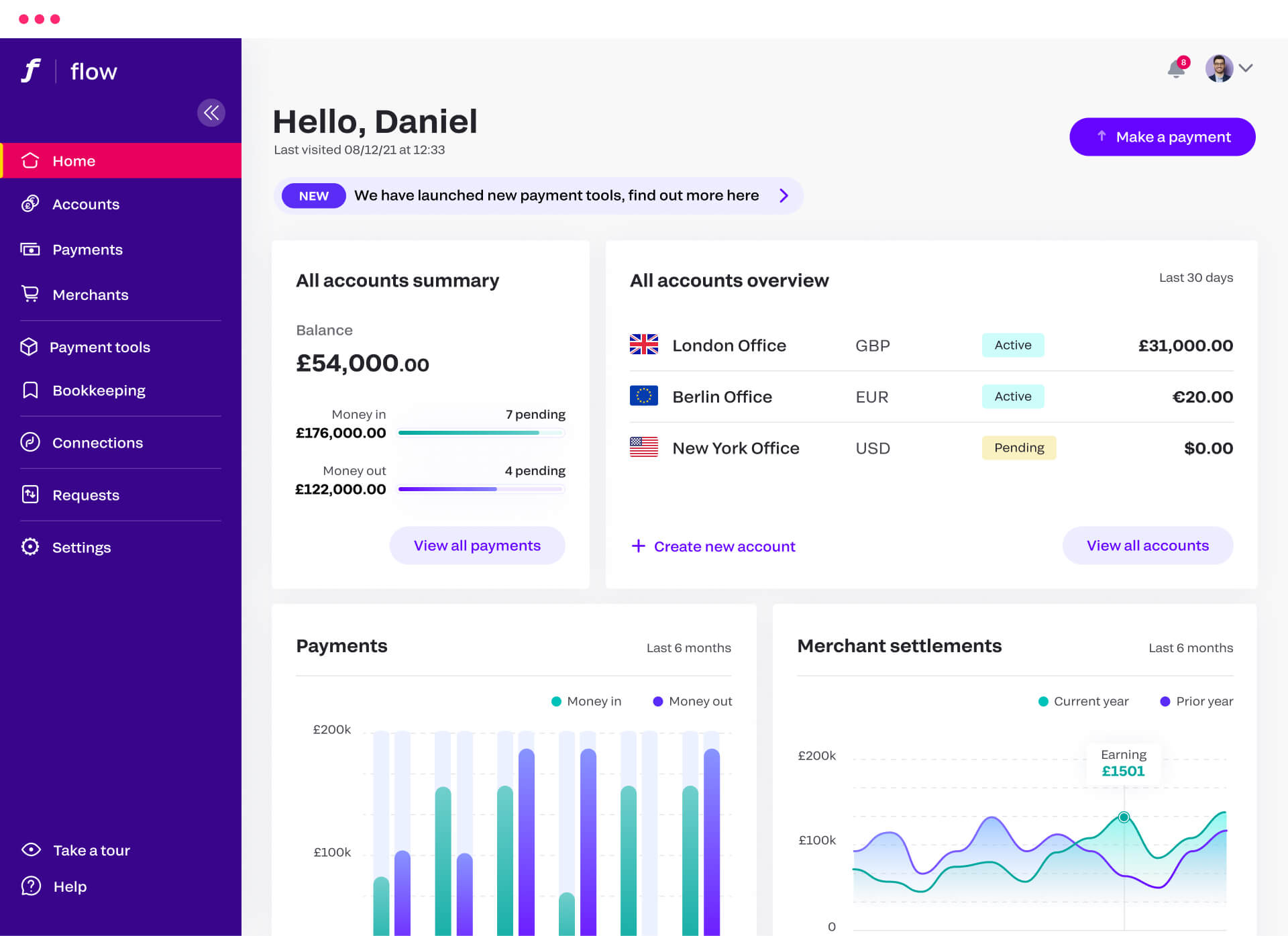

Scalability and support with Fondy Flow

Marketplaces need to scale efficiently as they grow. Fondy Flow’s cloud infrastructure allows for rapid scalability, capable of upgrading the system tenfold in just one day. This means that marketplaces can handle increased traffic and transaction volumes without compromising performance or security.

Moreover, Fondy Flow offers dedicated support, providing marketplaces with a dedicated manager to expedite migration processes and offer VIP assistance. Custom reports and individual payment solutions mean that marketplaces can tailor the system to their specific needs, enhancing how does a marketplace work for their unique business model. This personalised approach helps marketplaces stay competitive and responsive to market demands.

Advantages of using Fondy Flow

Choosing the right payment solution is crucial for the success of a marketplace. Fondy Flow stands out due to several key advantages:

- Transparent pricing: Clear pricing without hidden charges helps marketplaces manage costs effectively.

- Easy integration: Integration through API allows for quick and seamless implementation into existing systems.

- Multi-currency and local payment methods: Catering to international markets becomes more straightforward with support for multiple currencies and local payment options.

- Automated compliance: Built-in KYC and AML checks reduce the administrative burden and ensure regulatory compliance.

- Customisable solutions: Fondy Flow can be tailored to fit the specific needs of the marketplace, whether it’s custom reports or unique payment workflows.

Understanding the target audience

Fondy Flow is designed to support various types of marketplaces:

- Two-sided platforms: These include booking services, freelance platforms, rental platforms, and delivery and logistics services. They require automated systems for processing payments and payouts to both providers and end-users.

- E-commerce marketplaces: Platforms that connect sellers and buyers, such as online retail marketplaces, benefit from convenient solutions for managing payments and payouts.

By addressing the specific needs of these platforms, Fondy Flow enhances how does marketplace work in practice, contributing to growth and customer satisfaction.

The impact on user experience

A seamless payment process significantly improves the user experience for both buyers and sellers. Buyers appreciate quick and secure checkout options, while sellers value timely and accurate payouts. By leveraging Fondy Flow’s capabilities, marketplaces can offer:

- Embedded checkout: A streamlined checkout process embedded within the marketplace reduces friction and cart abandonment rates.

- Support for popular payment methods: Accepting widely used payment options increases the likelihood of conversion.

- Security and trust: Robust security measures and compliance protocols build confidence among users.

Understanding how does marketplace payment work with advanced solutions like Fondy Flow can be a differentiator in a crowded market.

Overcoming common marketplace challenges

Marketplaces often face hurdles that can impede growth:

- Technical limitations: Integrating multiple payment methods and managing complex transactions can strain resources.

- Regulatory compliance: Navigating the legal landscape across different regions requires expertise and vigilance.

- User trust: Building and maintaining trust is essential but can be undermined by payment issues or security breaches.

By partnering with a specialised payment provider like Fondy Flow, marketplaces can overcome these challenges. The ability to scale quickly, maintain compliance, and offer a superior user experience contributes to a stronger market position.

Future-proofing your marketplace

The digital commerce landscape is continually evolving. Marketplaces must stay agile and responsive to emerging trends, such as new payment technologies, changing consumer behaviours, and regulatory updates. Understanding how does an online marketplace work today is only part of the equation; anticipating future developments is equally important.

Fondy Flow’s commitment to innovation and scalability means that marketplaces can adapt to changes without overhauling their systems. Access to new features, updates, and support ensures that the marketplace remains competitive and relevant.

Case studies: success stories with Fondy Flow

To illustrate how does marketplace work effectively with Fondy Flow, consider these examples:

- A freelance platform: By integrating Fondy Flow, the platform streamlined its payment processes, allowing freelancers to receive instant payouts. This led to increased freelancer satisfaction and a 25% growth in platform registrations.

- An international e-commerce marketplace: With multi-currency support and local payment methods, the marketplace expanded into new regions, boosting international sales by 40%.

- A booking service: The ability to handle split payments enabled the service to manage commissions seamlessly, reducing administrative overhead by 30% and improving accuracy.

These case studies demonstrate the tangible benefits of adopting a comprehensive payment solution tailored to marketplace needs.

Conclusion

Online marketplaces have become an integral part of the digital economy, offering vast opportunities for businesses and consumers alike. Grasping how does marketplace work, particularly in terms of online payments and payouts, is essential for anyone involved in this space.

Efficient payment solutions not only facilitate transactions but also build trust, enhance user experience, and support scalability. Fondy Flow provides a comprehensive solution that addresses the complexities of online marketplace payments, making it easier for platforms to operate smoothly and focus on expansion.

If you’re looking to optimise your marketplace’s payment systems and provide a seamless experience for both buyers and sellers, consider the benefits that Fondy Flow can offer. Understanding how does marketplace payment work and leveraging the right tools can set your platform on the path to sustained success.