If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- How to create, build, set up, and start a crowdfunding platform with expert insights & Fondy’s payment solutions

- App vs platform: discover the difference between an application and a platform for business with Fondy’s solutions

- Simplify B2C payouts for marketplaces and the gig economy with Fondy

- Flexible payout schedules and seamless settlement payouts for two-sided platforms

- Boost your growth with automated payouts by implementing payout automation on your platform

- International payouts with our innovative system for two-sided platforms

- Product vs Platform: exploring the benefits and choosing the right payment solution

- How to accept payment on marketplaces: a guide to streamline your platform

- How to create a platform: step-by-step guide for building an online success

- What is an online platform or marketplace platform: key insights & payment solutions

- How does marketplace work: a focus on online payments and payouts

- How to create a marketplace website with payment solutions designed to build growth

- Ecommerce Platform vs Marketplace: key differences and how to choose the right payment solution

- What is a SaaS platform: meaning, examples, and payment solutions to boost their performance

- The role of advanced APIs in enabling seamless payment flows for MedTech innovators

- Maximising positive impact: the synergy of AI, sustainability, and comprehensive payment solutions

- Deconstructing payment processing

- How to accept payments on social networks?

- What are the best payment gateways for WooCommerce?

- What is the best payment gateway for marketplaces and platforms?

Boost your growth with automated payouts by implementing payout automation on your platform

Introduction

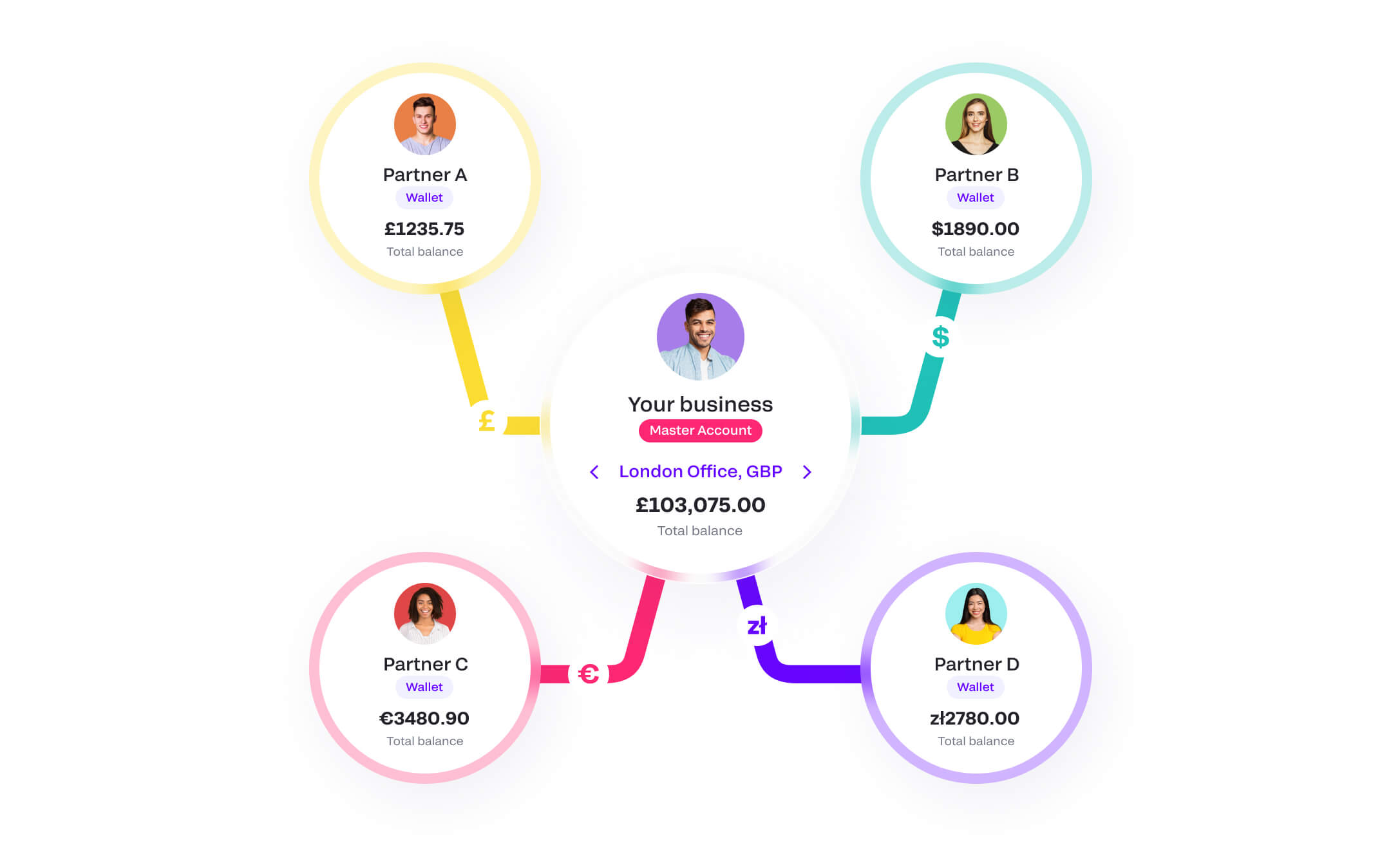

Fondy Flow is an all-in-one fintech solution that unifies payment acceptance, split transactions, automated seller onboarding, and auto compliance checks in a single, powerful service. It is designed with two-sided platforms and marketplaces in mind, making it easier for providers and end-users to transact, while helping you reduce operational complexity and scale quickly. Whether you run a startup in need of transparent pricing and a no-code setup or manage a large enterprise looking for tailor-made payment solutions, Fondy Flow offers a seamless experience built around payout automation and streamlined financial operations. Our advanced payouts framework ensures dependable transactions for all.

At its core, Fondy Flow does more than simply process payments. It enables you to handle a variety of functions in one place, from accepting transactions across multiple currencies to conducting automated payouts. This structure is ideal for two-sided platforms, where providers need swift and accurate receipt of funds, and end-users demand a smooth, secure checkout. By consolidating payment and settlement tasks, you eliminate the need for several disconnected systems, reducing technical hurdles and minimising the risk of errors. You also gain the advantage of real-time analytics and transparent reporting, which help you make smarter decisions about your platform’s financial management. This holistic approach to payout fosters deeper trust among users.

Catering to Two-sided platforms

Two-sided platforms, such as booking services, freelance marketplaces, and rental platforms, often face a range of challenges around payouts, user onboarding, and compliance. The ability to receive, hold, and distribute funds to multiple parties in different locations is crucial for maintaining trust and consistency. Fondy Flow simplifies these tasks by merging acceptance and settlement into a single ecosystem, backed by automated processes that reduce manual oversight. In practice, this means a faster flow of funds, fewer delays, and a more transparent environment for everyone involved. By focusing on automated payout and payout automation, Fondy Flow helps your platform maintain a healthy, scalable financial structure.

Built for Startups

Many startups want a solution that not only scales but is also straightforward in its pricing and integration. Fondy Flow offers transparent rates with no hidden charges, so you can easily budget your operational costs. A variety of no-code tools, including payment links and invoices, allow quick deployment without demanding extensive developer resources. If you do have technical specialists in your team, our comprehensive API and SDK provide deeper customisation options, letting you embed automated elements into checkouts or dashboards as needed. Throughout every stage, user experience remains paramount, ensuring that your core team can devote its energy to product development or service improvements instead of wrestling with complex payment setups.

Simplifying integration for rapid growth

Startups often operate under tight deadlines and evolving goals, which makes easy integration a high priority. By offering direct connections to popular CMS platforms, including Shopify, WIX, and WooCommerce, along with over 30 additional plugins, Fondy Flow eliminates the need for complex coding. You can set up acceptance for cards, Apple Pay, Google Pay, BNPL, and other local methods in just a few clicks. This no-code approach extends to how you manage automated payout and automated processes, so your team can focus on fine-tuning the platform’s user experience rather than spending excessive time on technical documentation. A refined payout strategy can also minimise administrative costs.

Expanding your global reach with multi-currency acceptance

Cross-border transactions can be daunting, but Fondy Flow simplifies them by providing multi-currency support. With the ability to accept local currencies, you improve conversion rates and build trust among international audiences. Embedded or hosted checkouts are mobile-optimised and user-friendly, removing barriers at the final stage of purchase. This approach is particularly beneficial for marketplaces aiming to grow beyond their domestic market. When combined with payout automation, the entire process from user payment to seller payout – remains efficient and transparent. Buyers can pay in a currency they recognise, while sellers receive funds with minimal delays, creating a strong foundation for future growth. Seamless cross-border payouts establish trust and reliability.

Efficient split payments

Many two-sided platforms deal with orders involving multiple providers, each entitled to a share of the total payment. Fondy Flow handles split transactions automatically, ensuring each participant receives the correct portion without delay. You can set up recurring or one-off payments, offer BNPL or card-based options, and still rely on the payout system to split funds accurately among various parties. This removes the need for manual calculations or repeated tracking of who is owed what, reducing errors and building confidence among both sellers and customers. A clear audit trail and real-time notifications reinforce your platform’s commitment to transparency, which can be a vital selling point in a competitive marketplace. Consistent payouts across multiple providers ensure satisfaction for everyone involved.

Streamlined seller onboarding

Seller onboarding is a critical aspect of any marketplace. Fondy Flow supports automated checks for KYC (Know Your Customer) and KYB (Know Your Business), as well as AML (Anti-Money Laundering) requirements. Instead of subjecting new sellers to a drawn-out process, your platform can present them with a user-friendly portal to upload their documents and verify their identities. Because everything is tied to an automated payout ecosystem, newly registered sellers can begin receiving funds almost immediately, accelerating their active engagement. This approach is especially appealing for platforms operating across multiple countries or regions, as we support local languages for KYC checks in the UK and EU. This swift approach to payout encourages a healthy marketplace dynamic.

Auto compliance and local languages

Through Fondy Flow, compliance obligations such as AML and fraud prevention are built into the platform. This auto system minimises the burden on your team, delivering a swift and user-friendly experience for prospective sellers. Local language support further reduces barriers to entry, encouraging a diverse range of participants to join your marketplace and start earning. Because sellers often evaluate multiple platforms before deciding where to list their services or products, a frictionless onboarding process can give you a decisive edge.

Flexible payout types

Depending on your platform’s needs, Fondy Flow supports various payout options. Fondy Wallets offer virtual IBAN accounts, allowing easy holding and management of funds, especially when dealing with multiple currencies. For those who prefer a more direct route, payouts to standard IBANs are equally straightforward, meaning funds can go to any bank account around the world. Card payouts are also available, appealing to sellers who want immediate access to their earnings. All these methods can operate with instant or delayed cycles, giving you the autonomy to decide what aligns best with your business model. The central theme remains payout automation, freeing you from the day-to-day management of settlements. Reliable payouts drive loyalty among platform participants.

Tailor-made solutions for established businesses

Growing companies often require bespoke configurations, particularly if they handle large volumes or specialised compliance measures. Fondy Flow is built on a scalable cloud infrastructure, allowing your platform to expand capacity tenfold in just one day when necessary. We assign a dedicated manager to guide you through any required migrations or adjustments, delivering VIP support at every step. If you need exclusive payment solutions or custom reports, our team can develop precisely the right approach. By pairing flexibility with a commitment to automated payout flows, we ensure your platform never gets bogged down in outdated or disjointed payment methods. Tailored payout solutions can help you navigate high transaction volumes with ease.

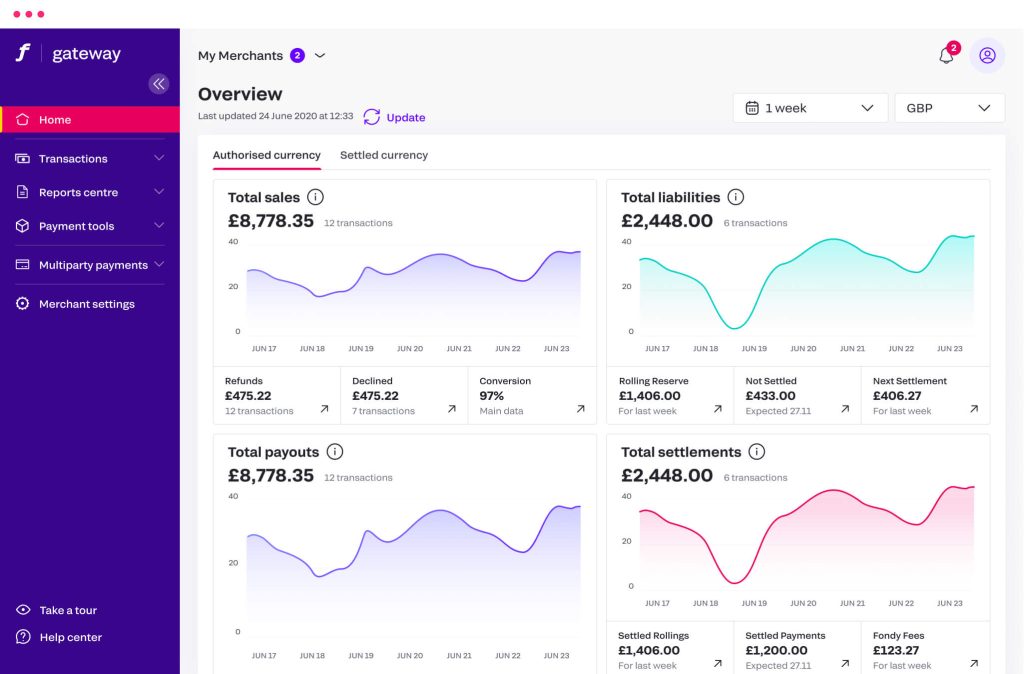

Real-time analytics and reporting

A key advantage of Fondy Flow is the ability to access real-time data about transactions, conversions, and user activity. By presenting this information in a clear dashboard, we enable you to make data-driven decisions quickly and confidently. You can generate tailored reports to see exactly how different payment methods, currencies, or seller groups perform. Because everything is unified within one system, analytics can go beyond mere snapshots, offering a full picture of your platform’s financial health. This visibility dovetails with our automated payout framework, which ensures that the insights you gain can be used to refine your strategies around settlement cycles and user engagement.

Enhancing agility with reliable insights

When your data is accurate and up to date, you can experiment with new ideas, adapt to shifting market conditions, and track the results in near real time. Platforms stuck with manual processes or multiple disconnected solutions often struggle to spot trends until it is too late. By contrast, Fondy Flow’s integrated environment helps you maintain agility, a crucial factor in industries that evolve rapidly. Whether you are testing new geographical markets or adding niche product lines, the combined capabilities of real-time analytics and automated payouts ensure you can respond swiftly and with confidence.

Customised user experience

We recognise that maintaining brand identity is crucial for any platform. Fondy Flow supports embedded and hosted checkouts that can be styled to match your design guidelines, ensuring a cohesive look and feel. Sellers gain confidence from a platform that appears well organised, while buyers appreciate a frictionless, mobile-optimised payment journey. The ability to tailor elements such as recurring payments, partial authorisations, or multi-party splits further sets you apart from competitors. Instead of forcing you into a one-size-fits-all model, Fondy Flow adapts to how you operate, supporting continuous growth without sacrificing the simplicity or reliability of automated payout functionality.

Conclusion

Fondy Flow stands as a robust, user-focused, and future-proof system for two-sided platforms and marketplaces across a variety of industries. Its all-in-one fintech approach caters to both emerging startups and established enterprises, merging transparent pricing with cloud scalability, a dedicated support team, and seamless user experience. Through automated payout mechanisms and payout automation, your business can handle transactions, onboard new sellers, and distribute funds with minimal manual intervention. Real-time insights, compliance safeguards, and customisable payment flows elevate your platform’s reputation and streamline operations, giving you a decisive edge in a competitive market. Whether you run a small niche service or a multinational marketplace, Fondy Flow can align with your unique operational needs.