Do you need a multicurrency bank account? The pros & cons

If you often find yourself making international payments in different currencies, you probably feel as though the benefits of a multicurrency account are definitely worth the added cost.

Not every standard bank account will make it easy for you to transfer, pay or accept money from countries outside of your own. If you do try and make international transactions with a standard account you can find yourself facing additional fees, delays and even bank freezes.

However, multicurrency bank accounts don’t come cheap and can set you back a pretty penny to gain access to the services they offer. So, is it worth it?

We’ve broken down the pros and cons so you can decide for yourself if you think you need a multicurrency bank account, including:

- What is a multicurrency account

- When would you need a multicurrency account

- Pros of a multicurrency account

- Cons of a multicurrency account

- How Fondy can help

What is a multicurrency account

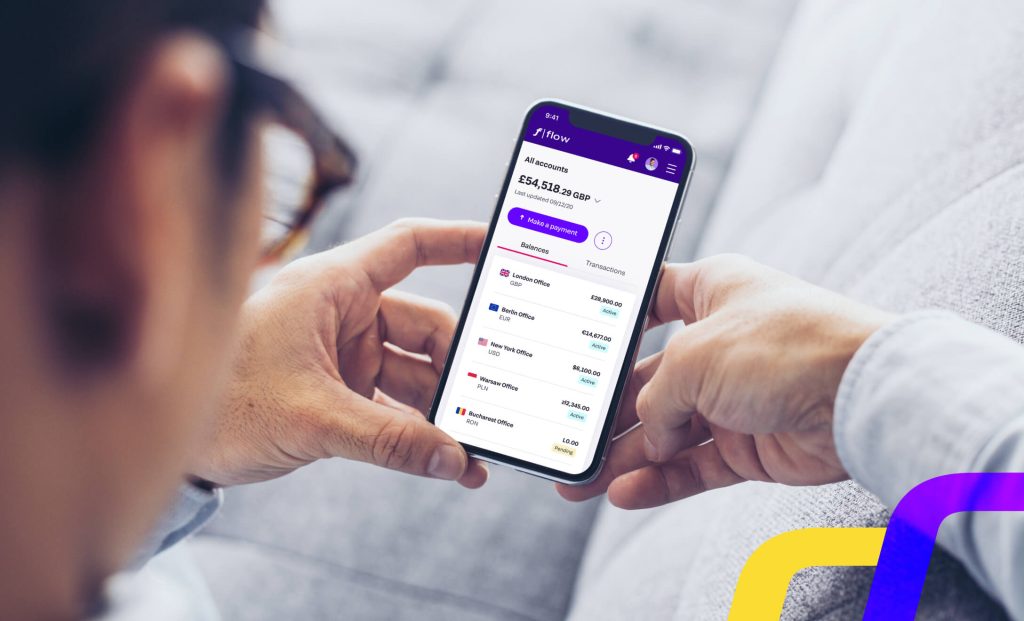

A business or a personal account, a multicurrency account is a type of bank account that you can use to send, receive and transfer money in a variety of different currencies from around the world.

This is done by making these transactions with pounds sterling and the other currency is held until you’re ready to exchange it. You’re often able to use the account to withdraw in a variety of currencies too, but most accounts are limited to major currencies such as dollars or euros.

These multicurrency accounts vary in service offerings, functions and features, prices and accessibility.

When would you need a multicurrency account

Whilst having access to a lot of different currencies in your bank account sounds like a nice convenience, it’s not always necessary.

However, if your lifestyle or career requires you to trade internationally, you’ve got a home or business in another country or you want to make the most out of your cash when handling the global markets. Similarly, if you’re a freelancer or business owner who needs to manage business payments into personal account, a multicurrency solution can streamline this process significantly.

Pros of a multicurrency account

Besides the obvious benefit of being able to have access to a wide variety of currencies, multicurrency accounts have other advantages that you should consider when deciding on if they’re the right option for you.

- Reduced transaction costs

Transaction costs can set you back by a serious amount if you’re making a lot of transactions in a variety of currencies. Account maintenance fees are often attached to this type of activity within your account, and many foreign banks have higher minimum amounts required on these transactions so that they can still make a profit on this activity.

With a multicurrency account, you bypass these charges and restrictions, and instead, you’ll have to pay a small one-off fee. You won’t even need to have a minimum balance requirement, so you’re all clear to simply enjoy your bank account’s features.

- Straightforward

Removing the complex elements of multicurrency bank transactions, the accounts dedicated to these types of services are easier to open and use instead. All of the intricate details are handled in the background, so you can focus on the information that’s important to you instead.

You’ll also bypass the waiting times, as foreign transactions can take a lot longer to confirm and go through. This much quicker process will save you time and potentially money when making transactions.

- Save money across the board

Of course, there are premiums and charges attached to a multicurrency bank account. These types of services are very valuable and they are priced at that rate.

However, a multicurrency bank account also offers the chance for users to earn interest on certain currencies, switch currencies to save money and even waive maintenance fees.

- Handle FOREX with ease

The foreign exchange service can take a huge chunk out of your bank balance if you’re not prepared, but a multicurrency bank account will mean you can manage FOREX at a much lower expense.

You can lose money when a financial transaction is made from one currency to another due to the exchange rates. Multicurrency accounts will allow you to wait until there is a good exchange rate before you convert your cash over to another currency, allowing you to save a lot of money on lost value.

Cons of a multicurrency account

Whilst you’ll notice there aren’t as many negatives attached to having a multicurrency account, the two points that are the most important are the ones that have the biggest impact on your cash.

Regardless of why you’re using your bank account, the value of your cash is often at the forefront of your mind, so these are very important disadvantages to take into consideration.

- High costs are attached

The costs you can face without a multicurrency bank account can be sky-high, however, that doesn’t mean the costs attached to a multicurrency account can be just as expensive.

The initial minimum balance is usually much higher than a regular bank account, and the actual cost to open up the account itself will also be added to this. From here, there are usually additional cash handling charges, overdraft fees and currency conversion feed added onto your account.

Over time, these fees can add up and if you’re not keeping track of them, they can be a nasty shock. So, before you open up your new multicurrency bank account, double-check that it is going to save you money in the long run.

- You can lose value on your cash

Much like your other bank accounts, you want to be able to hold onto the value of your assets.

However, with a multicurrency account, you can see your cash suffer. Interest rates are often lower than rates that come with other accounts, and foreign currency accounts are known for these poor rates.

Also, you can expect to see currency values fluctuate, changing the value of your cash in the account for the better, but sometimes for the worse.

How Fondy can help

Overall, you can find a multicurrency account that has features and services that save you time, money and stress over a longer period. The convenience of simplified transfers, better online banking services focused on a variety of currencies and even the ability to exchange your cash into a higher-value currency are all appealing factors.

However, the costly charges, fluctuating values and high minimum balances to open up a multicurrency account can hurt the benefits.

Fondy has plenty more information if you’re interested in learning more about multicurrency accounts, if they’re the right choice for you and how they can work for your money. Developed by a passionate team of people who want to provide a seamless service that is designed with you and your assets in mind, our multicurrency accounts are here to help, not hinder.