If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- What is pay-in and pay-out: a comprehensive guide to payment processes for online business

- Mastering delayed payouts: ensuring timely transactions with Fondy

- Streamline your payout process with our comprehensive payout system: low fees for outgoing financial transactions

- How to use payout gateway for outgoing payments on your platform

- How does split payment work for business with Fondy Flow

- A guide to eCommerce split payments

- What is split payment & how Flow Payments can help your business

- What are payouts: a guide to instant & global payouts for business

- How to split credit card payments online: solutions for platforms & marketplaces

- The gig economy’s impact on traditional industries

- Integrating electronic health records with payment systems: advancing efficiency in MedTech billing

- The crucial role of payments in empowering gig platforms

- An introduction to recurring payments

- What is the Faster Payments Service (FPS)?

- What is the SEPA payment method?

- What are quick payments in one click?

- What are cross-border payments?

- What are open banking payments?

What is pay-in and pay-out: a comprehensive guide to payment processes for online business

Overview

Understanding the intricacies of payment processing is essential for any online business today. In a world where digital transactions occur every day, many business owners often ask, what is pay-in and pay-out and how do these processes affect their daily operations? At its core, payment processing is the backbone of modern commerce. It involves a seamless flow of funds – from the moment a customer makes a card payment, through to the transfer of money into the business account, and finally the disbursement of funds out to sellers or partners. This article explores what pay-in and pay-out are, explains how they work, and discusses best practices for maintaining a secure and efficient payment gateway. By the end, you will see how solutions like Fondy can revolutionise the way your business handles payments.

Understanding payment processing for online business

In today’s digital age, payment processing is more than just a series of transactions – it is a critical component of a successful business model. Payment processing involves the complete cycle of a transaction: from the moment a customer decides to purchase a product or service to when the funds finally reach the business account. Central to this process is the payment gateway, which acts as a secure bridge between the customer’s card details and the bank accounts of both the business and the payment service provider.

A robust payment processing system ensures that customer payments are authorised, verified, and securely transmitted, minimising the risk of fraud or data breaches. For any online business, maintaining the integrity of this process is essential not only for safeguarding customer information but also for ensuring that funds flow efficiently and reliably throughout the system. Whether a customer pays using a card, digital wallet, or other methods, the flow of money in and out of the business account must be smooth and transparent.

Want to better understand the technology behind secure transactions? Our guide What is a payment gateway explains how payment gateways function in e-commerce, how they differ from processors, and why they’re essential for handling both pay-ins and pay-outs efficiently.

What is pay-in and pay-out?

To address the fundamental question, what is pay-in and pay-out, it is important to understand these terms in the context of modern payment systems. Essentially, pay-in refers to the process where funds are received by a business – typically when a customer makes a purchase. In contrast, pay-out is the mechanism through which funds are disbursed from the business account, often to sellers, service providers, or partners involved in the transaction.

These processes are not just abstract concepts; they are integral to the day-to-day operations of any online business. For example, when a customer pays for a product using a card, that payment is processed through a secure gateway and the funds are deposited into the business account. Later, the business may need to pay out a portion of that money to a seller or partner, which again requires a secure and reliable system. In essence, what is pay-in and pay-out are two sides of the same coin – one focuses on the inflow of funds and the other on the outflow, ensuring that every transaction is completed efficiently.

A closer look at pay-in

Focusing first on the pay-in process, consider how businesses accept payments from customers on a daily basis. When a customer decides to purchase an item online, they typically use a card or another payment method to initiate the transaction. At this point, the payment gateway plays a crucial role by securely transmitting the payment data to the financial institutions involved. The card details are encrypted, and the transaction is authorised before the funds are deposited into the business’s account.

This flow is critical because it determines how quickly and securely the funds are received. In many cases, the pay-in process happens almost instantly, enabling businesses to see real-time updates on their accounts. Furthermore, efficient pay-in processes help maintain a high level of trust between the business and its customers. When customers know that their payment information is secure and that their card details are handled professionally, they are more likely to make repeat purchases.

The process is not just about moving money; it is about ensuring a seamless flow that guarantees funds are available for the business to operate effectively every day.

A closer look at pay-out

Turning to the pay-out process, this mechanism is equally important as it governs how funds exit the business account. Once the business has received payments, there often arises the need to distribute a portion of these funds to other parties – this could be to sellers, service providers, or even as refunds to customers. The pay-out process can be managed in various ways, including instant or delayed payouts, depending on the needs of the business and the agreements in place with its partners.

For instance, on a freelance platform or an e-commerce marketplace, sellers rely on timely and accurate payouts to manage their operations. If a business experiences delays in processing pay-outs, it can disrupt the trust and reliability that customers and partners have in the service. Therefore, establishing a secure and transparent system for pay-outs is crucial. The technology behind these systems often involves advanced encryption, automated triggers, and thorough reconciliation processes to ensure that funds are transferred correctly and efficiently.

The pay-out process is about ensuring that money flows out of the business in a controlled manner, allowing for clear tracking of funds and maintaining financial stability across all transactions.

Integrating pay-in and pay-out on two-sided platforms and marketplaces

Two-sided platforms and marketplaces operate under unique dynamics where both providers and customers interact on a single platform. For such businesses, managing both pay-in and pay-out processes becomes even more critical. These platforms must handle a high volume of transactions every day, ensuring that payments from customers are received and that corresponding payouts to sellers or service providers are executed without any hitches.

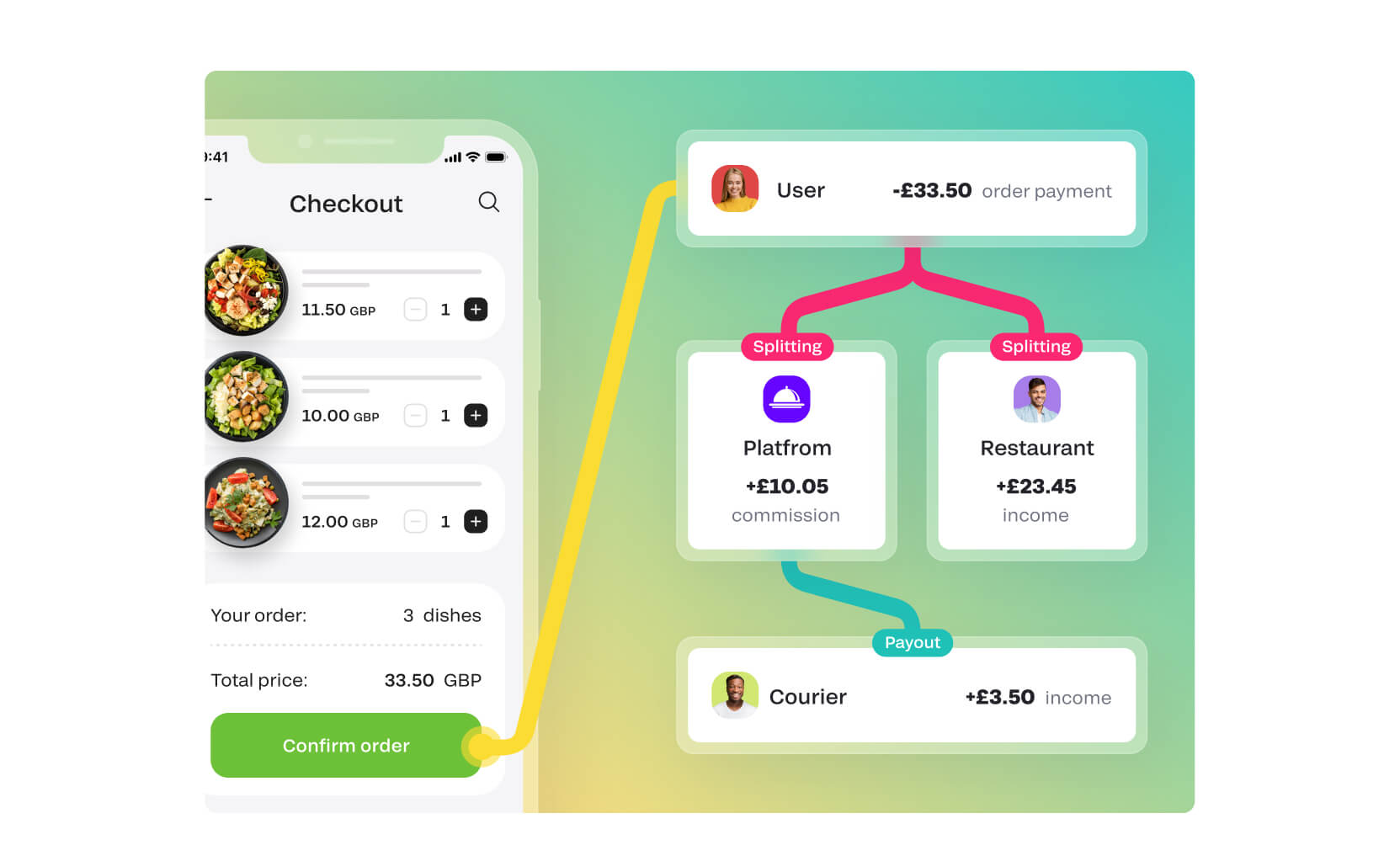

On these platforms, the payment flow must be seamless. For instance, a customer may pay for a service using their card, and the funds are then split between the platform and the seller. This requires an efficient payment gateway that can handle multiple transactions simultaneously, ensuring that the funds are accurately divided and sent to the correct accounts. The challenge lies in balancing speed with security – a fast payment processing system must still adhere to stringent security standards, including encryption and compliance with financial regulations.

The integration of pay-in and pay-out processes on two-sided platforms involves not only technical solutions but also operational strategies. Businesses need to establish clear protocols and use systems that provide transparency and accountability. This means that every transaction is tracked, and both inflows and outflows are documented in a way that any discrepancies can be easily identified and rectified.

Best practices for efficient payment processing

Achieving efficient payment processing involves a combination of technological innovation, best practices, and continuous monitoring. For online businesses, it is imperative to use systems that offer clear pricing without hidden charges, robust security measures, and a user-friendly design. This not only ensures that every transaction is processed correctly but also builds trust with customers and partners.

Some best practices include:

- Using a reliable payment gateway: A secure and efficient gateway ensures that all card details and customer data are encrypted and processed safely.

- Automating payment processes: Automation helps reduce human error, ensuring that both pay-in and pay-out transactions are handled accurately and swiftly throughout the day.

- Maintaining transparency: Detailed records of every transaction should be maintained, allowing businesses to track the flow of funds in and out of their accounts.

- Optimising integration: Whether through API integration or plug-ins, the easier it is to integrate payment solutions into existing systems, the smoother the overall payment process will be.

- Regular audits and updates: Continually reviewing and updating payment processing systems helps ensure compliance with current standards and addresses potential security vulnerabilities.

By following these best practices, businesses can streamline their operations and focus on growth without being bogged down by payment inefficiencies.

How Fondy simplifies payment processing for online businesses

This is where Fondy stands out. Fondy offers an all-in-one fintech solution (Fondy Flow) that is specifically designed for two-sided platforms and marketplaces. With Fondy Flow, businesses gain access to a comprehensive suite of tools that manage every aspect of payment processing. From accepting payments through various methods such as card, Apple Pay, and Google Pay, to facilitating split payments and managing both instant and delayed payouts, Fondy provides a seamless experience for both business owners and their customers.

Comprehensive payment processing tools

Fondy’s solution is built around clarity and simplicity. One of its key strengths is transparent pricing: there are no hidden charges, which means that businesses always know exactly what they are paying for. The platform’s user-friendly design ensures that even those with limited technical expertise can integrate and manage their payment systems effectively.

Versatile integration options

With more than 30 plugins available for platforms like Shopify, WIX, WooCommerce, and others, Fondy’s integration options are versatile and straightforward.

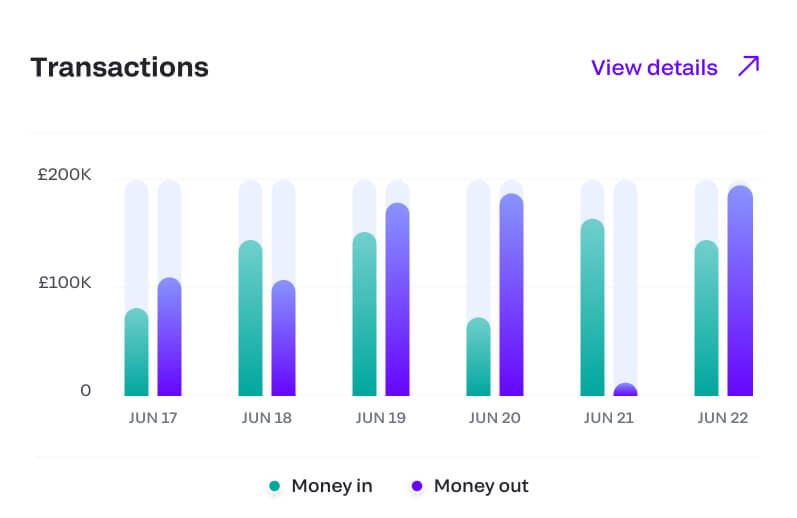

Real-time analytics for fund tracking

In addition, Fondy’s comprehensive dashboard offers real-time analytics, making it easy to track the flow of funds throughout the day. This level of transparency is critical for businesses that need to manage high volumes of transactions and require instant insights into their financial operations. Whether you are dealing with a surge of card payments or a steady stream of transactions via other payment methods, Fondy ensures that every detail is monitored and optimised.

Flexible split payments and automated seller onboarding

When it comes to split payments, Fondy excels in offering flexibility. Businesses can easily set up rules for how payments are divided among multiple parties, ensuring that every stakeholder receives their fair share in a timely manner. This is particularly useful for marketplaces and platforms where funds must be allocated between providers and customers seamlessly. Moreover, Fondy’s seller onboarding process is automated and user-friendly, with built-in KYC/B and AML checks that ensure compliance without sacrificing efficiency.

Flexible payout options to meet diverse needs

For payouts, Fondy provides several options to suit various needs. Whether it is through Fondy Wallets with virtual IBAN accounts, direct transfers to bank accounts, or even card payouts, the platform supports both instant and delayed payouts. This flexibility is vital for businesses operating in diverse markets, where different payout options may be preferred by sellers and partners.

Integrated solution for seamless payment flow

By integrating all these features, Fondy not only addresses the fundamental question of what is pay-in and pay-out but also delivers a robust solution that improves the overall payment flow for online businesses.

Final thoughts

In summary, understanding the dynamics of pay-in and pay-out is critical for any online business that aims to thrive in today’s competitive digital marketplace. The processes of receiving funds from customer card payments and disbursing money to sellers or partners are essential components of efficient payment processing. With a secure payment gateway and a well-managed flow of funds, businesses can ensure that every transaction is processed smoothly and transparently.

By embracing best practices and integrating advanced solutions, companies can optimise their payment systems to meet the needs of both customers and partners. Fondy exemplifies this approach by offering an all-in-one fintech solution that simplifies every aspect of payment processing. With transparent pricing, easy integration, and robust support for both pay-in and pay-out operations, Fondy is ideally positioned to help two-sided platforms and marketplaces streamline their financial operations.

For any online business, the key to success lies in understanding not only what is pay-in and pay-out but also in implementing efficient, secure, and user-friendly payment processes that support growth and foster trust. With innovative tools from Fondy, businesses can turn complex payment challenges into seamless operations, ensuring that funds flow smoothly every day, from the moment a customer taps their card to the final payout in the business account.