If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- What is pay-in and pay-out: a comprehensive guide to payment processes for online business

- Mastering delayed payouts: ensuring timely transactions with Fondy

- Streamline your payout process with our comprehensive payout system: low fees for outgoing financial transactions

- How to use payout gateway for outgoing payments on your platform

- How does split payment work for business with Fondy Flow

- A guide to eCommerce split payments

- What is split payment & how Flow Payments can help your business

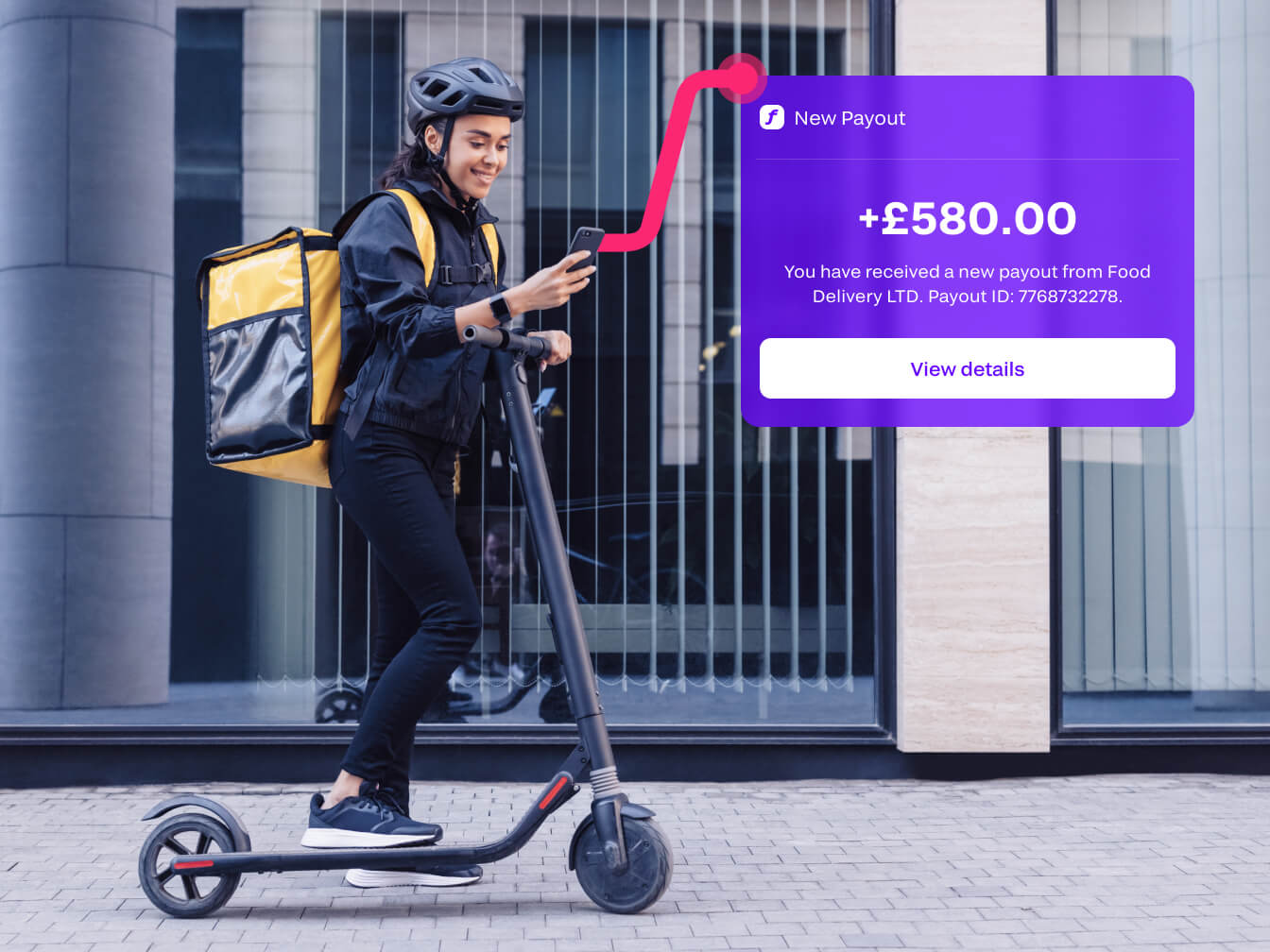

- What are payouts: a guide to instant & global payouts for business

- How to split credit card payments online: solutions for platforms & marketplaces

- The gig economy’s impact on traditional industries

- Integrating electronic health records with payment systems: advancing efficiency in MedTech billing

- The crucial role of payments in empowering gig platforms

- An introduction to recurring payments

- What is the Faster Payments Service (FPS)?

- What is the SEPA payment method?

- What are quick payments in one click?

- What are cross-border payments?

- What are open banking payments?

Streamline your payout process with our comprehensive payout system: low fees for outgoing financial transactions

Introduction

Fondy Flow offers an all-in-one fintech solution tailored for two-sided platforms and marketplaces seeking a reliable framework to manage incoming payments, split transactions, and handle payouts. Whether you operate a booking service, a freelance portal, or an e-commerce marketplace, our platform is designed to streamline the way you process money from diverse sources and pay out earnings to vendors, providers, or partners. With a focus on transparency and efficiency, Fondy Flow supports a range of local and international payment methods, ensuring seamless transactions for businesses of all sizes.

In the modern digital landscape, an efficient payout process is crucial for any platform that connects sellers, service providers, and buyers. A slow or convoluted approach to distributing funds can lead to frustration, diminished trust, and potential revenue losses. By adopting an international payout system that automates settlements, manages verification checks, and calculates accurate fees, platforms can improve user satisfaction and build a solid reputation in competitive markets. At Fondy, we understand this need deeply, and we have developed a robust structure that solves the challenges of payout finance. From transparent pricing that avoids hidden charges to flexible options for receiving payout money, our solution is designed to evolve with your business.

Fondy Flow as an all-in-one fintech solution

Fondy Flow is at the heart of an ecosystem that integrates multiple essential features to help you run a successful two-sided platform. We aim to remove the burden of maintaining separate systems for accepting transactions, splitting funds, onboarding sellers, and disbursing earnings. Instead, you gain access to a unified payment solution that seamlessly connects each stage of your financial cycle. By consolidating everything into one system, you simplify the entire process, reduce administrative overheads, and create an environment where service providers and end users can interact without interruption.

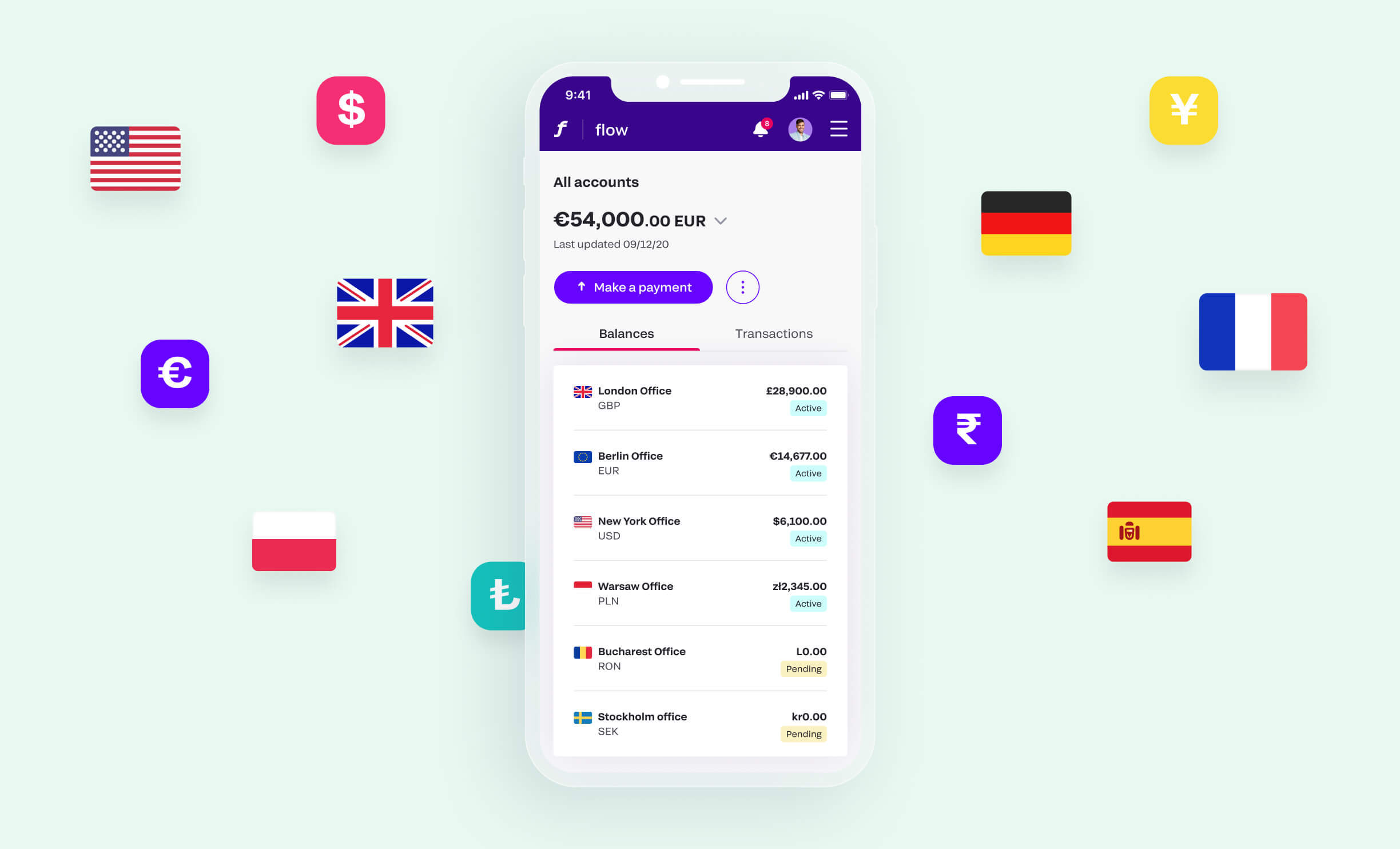

A significant part of our platform is dedicated to ensuring that every payment is processed in the currency and method that best suits your target market. We know that global expansion often hinges on convenience. That is why Fondy Flow supports not only popular payment cards but also Apple Pay, Google Pay, BNPL, and local payment options. An embedded or hosted checkout is included, giving you the freedom to choose how deeply you wish to integrate the payment journey into your user interface. This adaptability means you can deliver a refined experience to your customers, reduce cart abandonment rates, and improve overall satisfaction.

Accepting payments with multi-currency support

Within our all-in-one fintech ecosystem, accepting payments is more than a simple transaction; it is a deliberate process designed to boost conversions. By offering local payment methods, you make it easier for users in different regions to pay in their native currency, significantly enhancing their confidence. A system that supports multi-currency transactions helps minimise currency conversion complexities, so your platform can handle payments from numerous countries. This setup lays the groundwork for expanding into new territories without facing immediate limitations in your service model.

Our platform manages the full cycle of each transaction, including security checks and compliance requirements. Because we use advanced encryption and secure protocols, you can trust that sensitive information is protected. We also provide analytics features that allow you to track transactions in real time, giving you a clear overview of where your revenue is coming from and how often you should settle fees. As a result, you can stay agile and respond to shifts in consumer behaviour, adjusting your strategy whenever required.

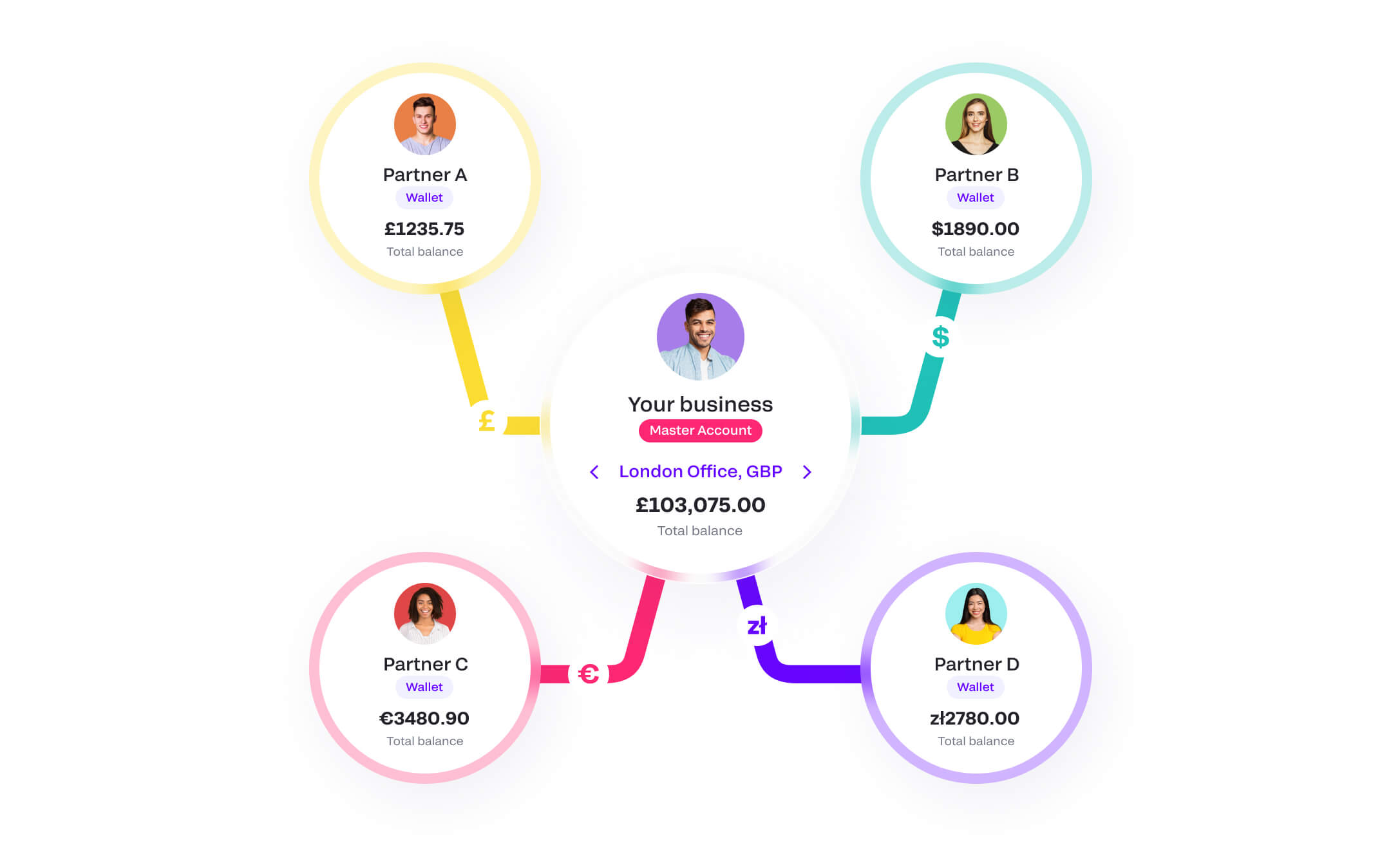

Split payments for easy collaboration

Two-sided platforms often involve multiple stakeholders who each need to receive a share of the funds. This requirement can become complicated if you do not have an intelligent split process in place. Fondy Flow’s split payment function enables you to define how payments are divided among different parties. Whether you distribute funds to freelancers, vendors, drivers, or property owners, the underlying system is built to handle a variety of scenarios. By automating this distribution, you reduce manual calculations, minimise accounting errors, and build trust through transparent payment flows.

Split payments extend beyond standard transactions. For recurring payments, such as subscription-based fees or membership renewals, our service ensures each stakeholder is compensated on time, every time. You have the flexibility to adjust percentages and track exactly how much each party is owed. By incorporating this level of detail into your payout process, you elevate the user experience and prove to partners that their earnings are managed responsibly and efficiently.

For platforms that handle B2C payouts, such as marketplaces and gig economy platforms, ensuring a smooth and automated payout experience is critical. Discover how Fondy simplifies B2C payouts in our dedicated guide.

Key benefits for startups

Startups often face unique challenges, particularly when it comes to finance, fee structures, and limited development resources. Fondy Flow caters to emerging businesses by delivering a straightforward approach to integration, transparent pricing, and user-friendly tools that do not require extensive coding. You can sign up swiftly, set up Payment Links or invoices, or install one of our 30+ plugins to power your e-commerce on Shopify, WIX, WooCommerce, and more.

Our no-code options suit startups that wish to start accepting money without investing heavily in development. At the same time, if you have tech-savvy teams or plan to scale rapidly, the API and SDK integrations are readily available. This combination of accessibility and depth lets you modify Fondy Flow to fit your specific needs. You can begin with a simple setup, then move on to a full-featured system as your business grows and requires advanced payout finance strategies.

Seamless payout process and services

For many startups, paying suppliers, freelancers, and other stakeholders can be just as important as receiving revenue. A polished payout process positions your brand as a reliable partner from day one. With Fondy Flow, you gain access to a flexible payout system that supports multiple avenues, including direct payouts to bank accounts, virtual IBANs via Fondy Wallets, and card-based transfers. This versatility eliminates the hassle of using separate banks or payment gateways, allowing you to maintain consistent service quality under one roof.

Because we support delayed or instant payouts, you can tailor the timing of each disbursement to your operational strategy. This is a crucial advantage if you need to withhold funds until a product is delivered or if you simply want to offer instant payouts for faster partner satisfaction. By integrating these features into a single solution, startups can streamline financial operations and avoid juggling numerous third-party systems that might not coordinate well.

Automated seller onboarding

Seller onboarding and verification are often time-consuming tasks for two-sided marketplaces, especially when they aim to follow strict KYC/B and AML standards. Fondy Flow helps automate these processes by offering a hosted interface that manages identification documents, background checks, and compliance verifications. By eliminating manual tasks, you reduce the chance of human error, accelerate your onboarding timeline, and enable new sellers to start transacting sooner.

Additional benefits extend to local language support, ensuring that KYC forms and instructions are intuitive for users based in different countries. This local focus helps startups quickly expand into new regions, where adopting the local language can significantly improve user trust. When combined with automated compliance checks, you can demonstrate that your marketplace or platform adheres to the highest standards of legal and regulatory obligations.

Key benefits for established companies

Larger companies or rapidly scaling businesses often demand more customised solutions, dedicated managers, and the ability to handle high volumes of traffic. Fondy Flow is built on cloud infrastructure that can handle a 10x scale-up in a single day, ensuring you will not encounter performance bottlenecks as your platform experiences sudden growth. This agility is backed by a dedicated management team prepared to expedite your migration to Fondy, offering VIP support and personalised guidance.

Established companies usually appreciate a transparent pricing model with no hidden charges, and that is precisely how Fondy Flow operates. By providing clarity on each fee, we empower you to plan budgets, manage forecasts, and maintain profitability. Having access to custom reports further refines your insight into financial performance. These reports can be tailored to meet specific data requirements, making them invaluable for internal audits or stakeholder presentations.

Advanced payout finance for large-scale operations

Effective payout finance goes far beyond merely transferring funds. For established platforms dealing with thousands of transactions daily, the strength of a centralised payout system can transform operational efficiency. Fondy Flow’s automated payouts allocates funds to the correct stakeholders based on your rules. You can design unique payment flows, ensure that each party is compensated accurately, and easily reconcile your finances at the end of the day.

Support for virtual IBAN accounts offers an additional layer of flexibility. Instead of relying solely on external bank accounts, you can handle certain disbursements within the Fondy environment. This approach lowers the risk of error and simplifies financial management because you can view and control all transactions in one place. By automating recurring payouts or scheduling delayed disbursements, you maintain a consistent cash flow pattern that aligns with your internal policies and agreements.

Seller onboarding, compliance, and regional expansion

For larger enterprises, compliance is more than a formality. It is the bedrock of trust that users expect. To meet these high standards, Fondy Flow automates KYC/B and AML checks, sparing you the complexity of maintaining separate verification services. The platform’s system not only accelerates onboarding for new sellers and service providers but also mitigates risk by adhering to region-specific regulations in the UK and EU.

Because the service supports multiple languages, expanding into new markets feels less daunting. Businesses can open their services to fresh demographics without worrying that the verification process will falter due to language barriers. This is especially vital for platforms that rely on a quick onboarding sequence, as it prevents potential sellers from abandoning the application simply because the steps are too complicated or unclear.

Final thoughts on choosing the right payout system

In a competitive digital environment, both startups and established businesses require a payment and payout process that is secure, intuitive, and flexible. Fondy Flow delivers a comprehensive payout system and payout services capable of handling everything from acceptance of different payment methods to automating KYC checks and facilitating instant settlements. By providing transparent pricing, user-friendly design, and versatile tools, we help you focus on growth rather than the details of complex financial operations.

Whether you need a quick, no-code solution to start receiving money right away or a customised integration that scales to support thousands of daily transactions, Fondy Flow offers the right balance of technology and service. Our platform redefines the way you engage with finance, from handling each payout fee to distributing payout money efficiently across various stakeholders. By consolidating key processes into a single system, you enhance your platform’s credibility and optimise your workflow.