If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- How to create, build, set up, and start a crowdfunding platform with expert insights & Fondy’s payment solutions

- App vs platform: discover the difference between an application and a platform for business with Fondy’s solutions

- Simplify B2C payouts for marketplaces and the gig economy with Fondy

- Flexible payout schedules and seamless settlement payouts for two-sided platforms

- Boost your growth with automated payouts by implementing payout automation on your platform

- International payouts with our innovative system for two-sided platforms

- Product vs Platform: exploring the benefits and choosing the right payment solution

- How to accept payment on marketplaces: a guide to streamline your platform

- How to create a platform: step-by-step guide for building an online success

- What is an online platform or marketplace platform: key insights & payment solutions

- How does marketplace work: a focus on online payments and payouts

- How to create a marketplace website with payment solutions designed to build growth

- Ecommerce Platform vs Marketplace: key differences and how to choose the right payment solution

- What is a SaaS platform: meaning, examples, and payment solutions to boost their performance

- The role of advanced APIs in enabling seamless payment flows for MedTech innovators

- Maximising positive impact: the synergy of AI, sustainability, and comprehensive payment solutions

- Deconstructing payment processing

- How to accept payments on social networks?

- What are the best payment gateways for WooCommerce?

- What is the best payment gateway for marketplaces and platforms?

International payouts with our innovative system for two-sided platforms

Introduction

When a two-sided platform or marketplace embarks on its journey, finding a reliable solution for handling transactions can be a game-changer. The success of a digital platform often hinges on the ability to deliver an uninterrupted and user-friendly experience for both providers and consumers. That is precisely why an international payout system becomes so vital. It fosters trust, eliminates roadblocks, and empowers your business to function effortlessly across borders.

Fondy Flow, an all-in-one fintech solution, is meticulously designed to address these requirements. It provides clarity on pricing, extensive integrations, and a robust platform that transforms how you approach international payouts. In an increasingly competitive digital environment, harnessing the power of advanced technology can set your platform apart. By embracing an international payout system that supports multiple payment methods, seamless split functionalities, and straightforward onboarding, you will be better equipped to cater to a global audience and create meaningful connections with customers everywhere.

Foundations of a two-sided platform: bringing providers and users together

A two-sided platform thrives on efficiency. It must manage a continuous flow of transactions in real time, ensuring that each participant feels confident in the process. When your goal is to bring providers and customers into an environment that facilitates smooth exchanges, operational challenges quickly come to the forefront. One such challenge often involves handling payouts. Particularly when expanding into new regions, it is essential to maintain a payment system that is both secure and transparent. By choosing a payout system, you mitigate the complexities associated with cross-border settlements.

The ability to offer various payment options from cards and mobile wallets to BNPL and local methods – helps you accommodate unique user preferences in multiple markets. Fondy Flow’s approach to facilitating international payouts relies on cloud infrastructure, multi-currency support, and an easy-to-integrate system that fits neatly into your existing workflow. This interconnectedness ensures that users from different countries can transact without facing unwanted delays or hidden fees. When providers and clients can trust that their funds will move accurately and swiftly, your platform payments build stronger loyalty and fosters long-term relationships.

Embracing a user-first mindset: focusing on clarity and transparency

Transparency lies at the heart of any successful international payout system. People who transact on your platform want to be informed about fees, timings, and procedures, so adopting clear pricing without concealed surcharges is indispensable. Fondy Flow addresses this by presenting all costs upfront. This straightforward approach goes a long way in nurturing user confidence: nobody likes surprises, especially when money is at stake. Beyond transparent pricing, the actual system behind the scenes must be intuitive.

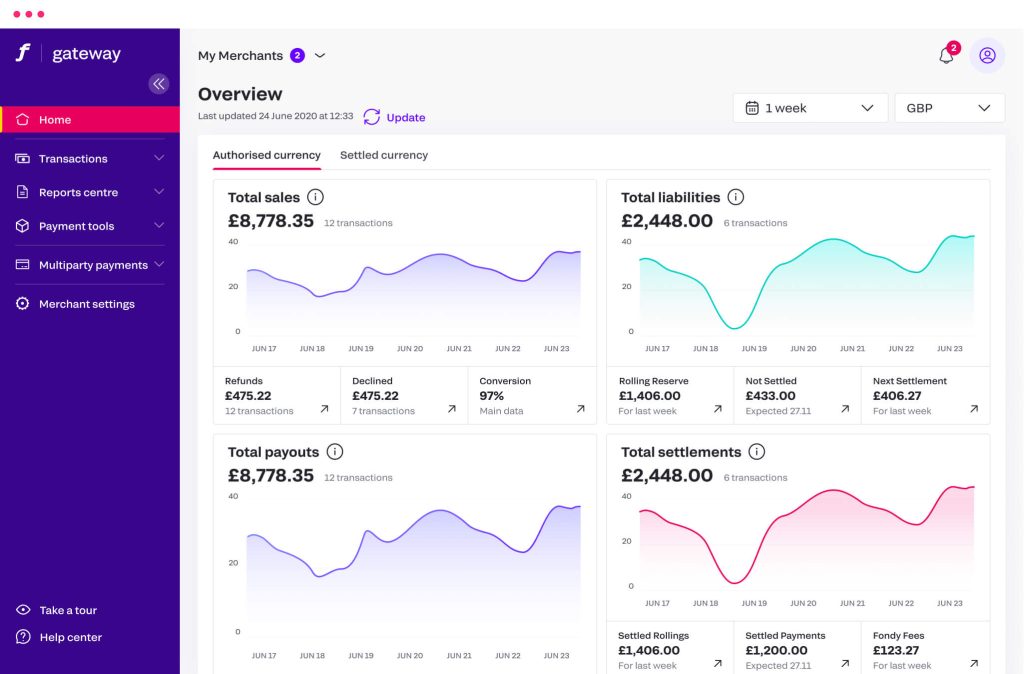

Through Fondy’s user-friendly dashboard, both platform owners and sellers can access detailed analytics in real time, monitor transactions, and export data for deeper insights. By placing important information at everyone’s fingertips, misunderstandings diminish, and the entire experience becomes significantly more satisfying. Providers can easily review how much they will receive after each transaction, while the platform can track payout patterns and predict future cash flows. Meanwhile, advanced reporting capabilities allow you to remain well-informed about the health of your enterprise, making it easier to optimize operations and plan future initiatives.

Balancing innovation with reliability: the power of cloud-based tech

Innovation is crucial, but for two-sided platforms aiming to sustain growth, reliability is equally important. A cutting-edge international payout system should be able to handle an increasing volume of transactions without hiccups, whether your platform is just starting or is already established. Fondy addresses this through a scalable cloud infrastructure. When your traffic and transaction load rise dramatically, perhaps when you enter a new region or run a marketing campaign, Fondy’s cloud-based system can expand its capacity in as little as one day, providing up to a tenfold increase in capability.

This elastic approach significantly reduces the risk of downtime and ensures that providers never have to wait unnecessarily long for their money. By combining cloud infrastructure with robust API documentation, you not only get a solution that can handle your needs now but also one that adapts to your future ambitions. Instead of worrying about the technicalities behind payouts, you can concentrate on shaping the strategic direction of your platform and offering more value to your users. Every time a provider requests their funds, the system’s reliability plays a part in reinforcing trust, which in turn fosters user satisfaction and repeat business.

Splitting payments for multiple stakeholders: unlocking platform potential

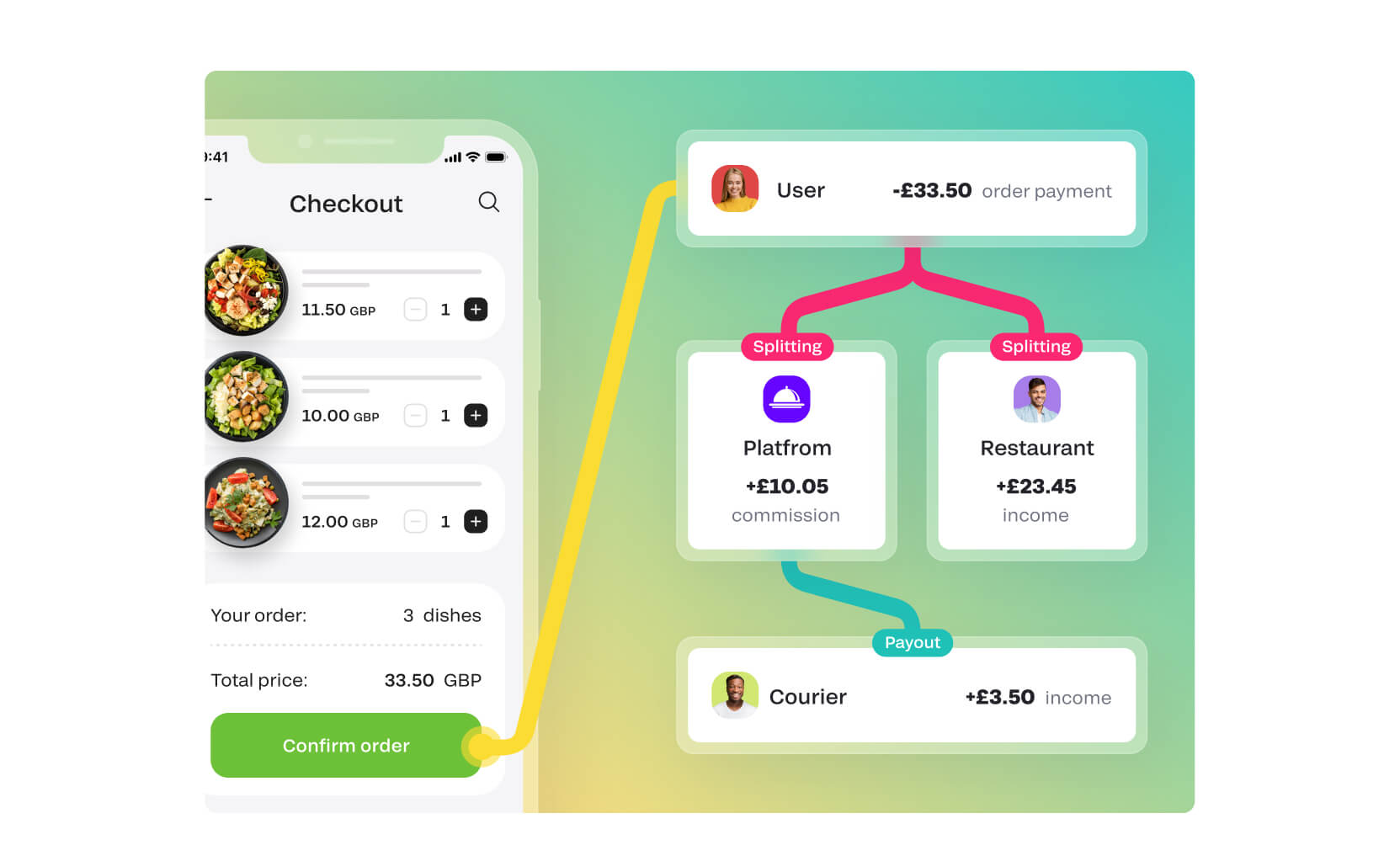

Many platforms struggle with the complexity of dividing funds among several participants. Whether you operate a freelance marketplace, a booking service, or a platform for renting goods, it is likely that you need to compensate multiple parties from a single transaction. An international payout system that supports split payments changes the game by automating much of this once-cumbersome process. Fondy Flow offers flexibility in handling different scenarios, from immediate disbursements to more complex arrangements involving partial payouts or recurring payments. Imagine a scenario where your platform takes a commission and pays out the remainder to the provider.

Alternatively, you might need to distribute shares between multiple sellers, sub-providers, or collaborators. Through clear parameter settings, you can define how these splits happen, which currencies are used, and when exactly they occur. Users see complete transparency in how their funds are allocated, while the platform retains full control. By limiting manual intervention, you reduce errors, save time, and foster a dependable environment. Once again, real-time tracking plays a pivotal role. You can monitor all split transactions, see how they contribute to overall revenue, and adapt swiftly if a strategic shift becomes necessary.

Uniting two-sided platforms and e-commerce marketplaces

Though two-sided platforms and e-commerce marketplaces operate on slightly different models, they both benefit from the same foundational pillars of streamlined operations, reliable payouts, transparent pricing, and robust scalability. Whether you are uniting sellers with buyers or connecting service providers to clients, an international payout system ensures that money moves correctly, quickly, and without confusion.

This reliability becomes a key selling point when onboarding new providers, as many look for a platform with a proven track record. By presenting them with an intuitive system for both payments and payouts, you encourage them to list more inventory or services. This creates a virtuous cycle in which more providers draw in more customers, who in turn appreciate the breadth of options. Meanwhile, your operational tasks lighten significantly thanks to automated processes.

The synergy between acceptance, splitting, and final payouts also helps avoid disputes, because every step of the transaction can be tracked and confirmed. For e-commerce marketplaces that list hundreds or thousands of products, controlling everything from inventory to shipping to finances can feel overwhelming. Yet with an advanced solution that addresses the financial side seamlessly, you reduce the burden on your internal teams and give yourself more bandwidth to focus on marketing, user engagement, or expansion strategies. The same principle applies to two-sided platforms focusing on freelance gigs, property rentals, or booking services, where timely payouts and transparent fee structures are integral to building credibility.

Transforming growth through the international payout system

To thrive in the digital era, adopting a global mindset is no longer optional. Whether you are a fledgling startup or an established conglomerate, tapping into international markets can unlock massive opportunities. However, localized payment preferences, regulatory nuances, and language barriers can hinder success if not addressed properly.

By incorporating an international payout system into your infrastructure, you create a user experience that feels comfortable for people regardless of where they live. This includes offering them a choice of currency, an array of local methods, and an effortlessly intuitive checkout that suits their region. In this way, you foster inclusivity and build momentum for expansion. Even if your immediate focus is on a single region, it pays to have the infrastructure ready for broader horizons.

Growth can accelerate unexpectedly, and when you have a system that scales quickly and supports multiple payout pathways, you can capitalize on newfound demand without missing a beat. Every additional market you enter can benefit from the same transparent pricing, robust compliance, and flexible onboarding that earlier markets enjoyed, streamlining the process and preserving a consistent brand image.

Expanding possibilities for passive growth

While the primary spotlight often shines on two-sided platforms and e-commerce marketplaces, there is also the benefit of passive growth from simply accepting payments. By establishing an environment that supports a broad array of payout methods, you inadvertently become attractive to other potential partners or niches. This passive expansion might come from affiliated business owners seeking a reliable system for their own platforms or from consumers who simply appreciate the convenience offered and start using your services more regularly. Over time, the trust, ease, and credibility you build can lead to organic promotion across various industries.

The robust infrastructure you deploy to support international payouts need not remain confined to one type of operation. If you decide to diversify your business model or introduce new revenue streams, the same stable system can underpin those endeavors, giving you a head start in new markets or verticals. In this sense, your decision to integrate a high-quality international payout system is not only about meeting current needs but also about laying a sustainable foundation for future growth.

Conclusion: elevate your platform with international payouts

In an era defined by digital transformation and borderless commerce, platforms that offer seamless transactions and swift payouts stand out from the crowd. By leveraging Fondy Flow as your all-in-one fintech solution, you adopt a system that handles multi-currency acceptance, automated onboarding, advanced split payments, and instant or delayed payouts – everything you need to run a thriving two-sided platform or e-commerce marketplace. This international payout system empowers you to be transparent, efficient, and scalable, all while providing a user experience that builds trust. The time to elevate your platform is now, and with transparent pricing, extensive support, and cloud-based adaptability, Fondy ensures you can do so with confidence. Whether you are focused on accelerating your startup’s growth or seeking a customized approach for an established enterprise, the tools you need are at your fingertips.