If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- WooCommerce recurring payments: how to set up subscriptions & monthly orders with Fondy gateway

- WooCommerce credit card processing: add a plugin to accept Visa & Mastercard with Fondy’s low-fee payment gateway

- Apple Pay WooCommerce plugin: how to add fast payment gateway to your store

- Google Pay for Shopify: how to add GPay and why use Fondy

- Apple Pay Shopify integration: how to enable, setup & best practices from Fondy

- Shopify payment provider guide: third-party payment processors and split payments solutions

- Shopify payment processing fees: complete guide to transaction costs and international payments

- Wix payment processing fees: complete guide to Wix credit card processing costs in 2025

- Shopify payments: What it is, how it works and how UK ecommerce businesses accept credit card payments

- How to accept payments on Wix: why Fondy beats other Wix payment gateways

- How to create a payment link: step-by-step guide to make or generate it online

- How does a payment gateway work to process online payments: a complete guide with examples

- What is the cheapest payment gateway in the UK: compare online payments for Ecommerce

- Payment gateway fees comparison 2025: find the low cost payment gateway for your business

- Top 10 payment gateways in the UK, Europe, and the World: 2025 list of most popular providers

- Complete guide to payment gateway integration: connect, setup, and implementation process for your website

- 10 best payment gateways for e-commerce in the UK or Europe & Why Fondy leads the way

- What is a payment gateway: a guide for entrepreneurs interested in e-commerce

- How to accept mobile payments?

- How to integrate payment gateway APIs?

- How to accept international payments and transactions?

- How to choose the best payment gateway for small businesses?

How does a payment gateway work to process online payments: a complete guide with examples

Every time you buy something online, whether it’s your morning coffee through a mobile app or a new laptop from an e-commerce store, there’s an invisible process happening in the background. In those few seconds between clicking “pay now” and seeing “payment successful,” a complex series of transactions takes place. At the heart of this process sits the payment gateway – the technology that makes modern online commerce possible.

Understanding how payment gateways work isn’t just technical curiosity. For businesses, it’s essential knowledge that can impact everything from conversion rates to security compliance. This guide will walk you through exactly how payment gateways process online payments, complete with real-world examples and practical insights you can apply to your business.

A few words about what a payment gateway is

A payment gateway is the digital equivalent of a physical card terminal in a shop. It’s the technology that captures and transfers payment data from the customer to the acquirer. While we won’t dive deep into definitions here for a comprehensive understanding, check out our detailed guide: What is a payment gateway in e-commerce. It’s important to understand that a payment gateway serves as the crucial bridge between your customer’s payment method and your business bank account.

The reason we need to understand how payment gateways work goes beyond mere curiosity. Knowing the mechanics helps businesses make better decisions about payment processing, troubleshoot issues more effectively, and ultimately provide a smoother experience for customers.

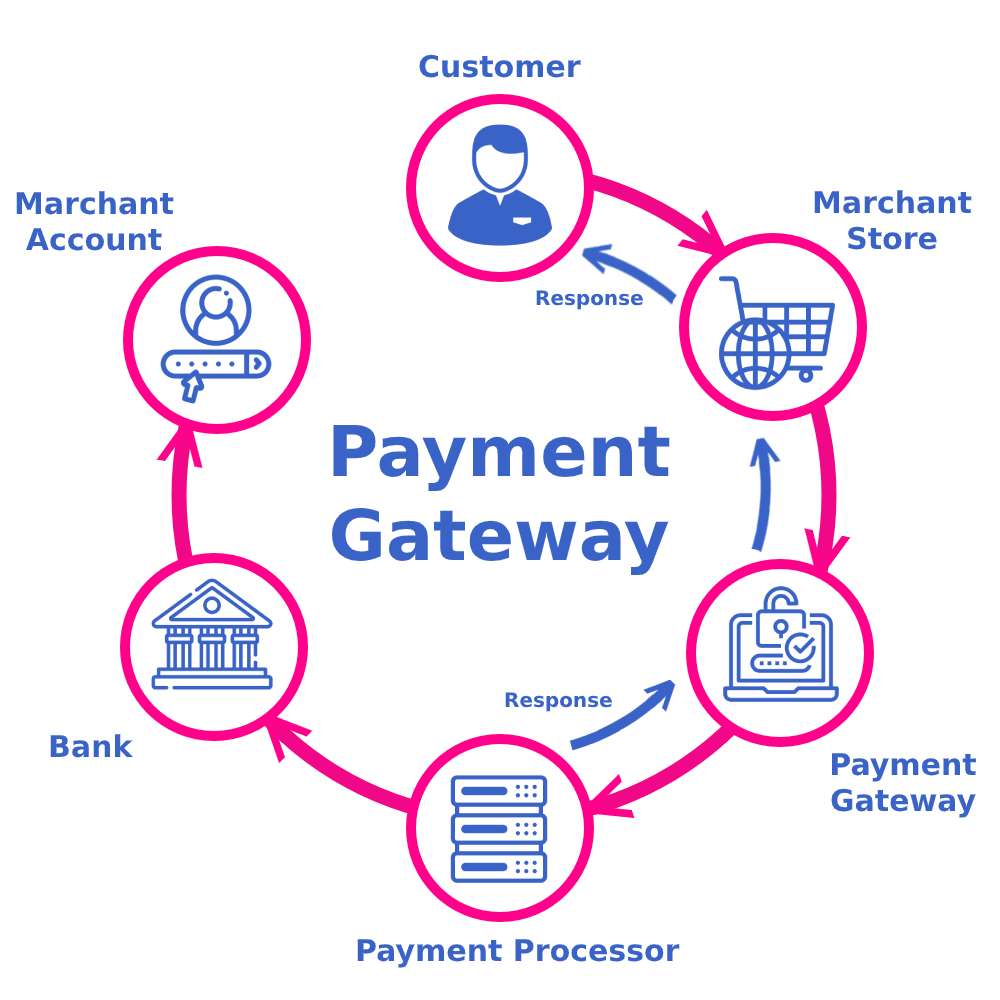

The anatomy of a payment gateway transaction

Throughout this entire process, multiple security protocols work simultaneously. The payment gateway maintains PCI compliance, implements fraud detection algorithms, and ensures all data remains encrypted. Modern gateways can complete this entire sequence in under five seconds – a remarkable feat considering the number of parties involved.

Step 1: Payment initiation (0-0.5 seconds)

Sarah enters her card details on the checkout page. The payment gateway immediately encrypts this sensitive information using SSL technology, converting it into an unreadable format. This happens the moment she clicks “submit” – before the data even leaves her device.

Step 2: Data transmission (0.5-1 second)

The encrypted payment information travels from the merchant’s website to the payment gateway. During this transmission, the gateway performs initial validation checks: Is the card number format correct? Is the expiry date valid? These basic checks happen instantly.

Step 3: Gateway to processor communication (1-2 seconds)

The payment gateway forwards the encrypted transaction details to the payment processor. This is where the gateway adds merchant-specific information like the merchant ID and transaction amount. The processor acts as the middleman between the gateway and the card networks.

Step 4: Bank authorisation request (2-3 seconds)

The payment processor sends the transaction to the appropriate card network (Visa, Mastercard, etc.), which then routes it to Sarah’s issuing bank. The bank checks several things: Does Sarah have sufficient funds? Is this transaction within her spending limits? Does it match her typical purchasing patterns?

Step 5: Authorisation response (3-4 seconds)

Sarah’s bank makes a decision and sends a response code back through the same chain: bank to card network, card network to processor, processor to gateway. This response is either an approval with an authorisation code or a decline with a reason code.

Step 6: Merchant notification (4-5 seconds)

The payment gateway receives the response and immediately notifies the merchant’s website. If approved, the gateway stores the transaction details and authorisation code. The website then displays a success message to Sarah and triggers any post-payment processes like sending a confirmation email.

Step 7: Settlement process (end of day)

While Sarah sees her transaction as complete, there’s one more step. At the end of the business day, the payment gateway initiates the settlement process. This is when the actual money moves from Sarah’s bank account to the merchant’s account, typically taking 1-3 business days.

Throughout this entire process, multiple security protocols work simultaneously. The payment gateway maintains PCI compliance, implements fraud detection algorithms, and ensures all data remains encrypted. Modern gateways can complete this entire sequence in under five seconds – a remarkable feat considering the number of parties involved.

Key players in the payment process

Understanding how payment gateways work requires knowing who’s involved in each transaction. Think of it as a relay race where each participant has a specific role:

- The merchant (seller) This is the business accepting the payment. They’re responsible for integrating the payment gateway into their website or app and ensuring a smooth checkout experience. The merchant also bears responsibility for maintaining security standards on their end of the transaction.

- The customer (buyer) The person making the purchase. While they only see the front-end of the process, their bank and card details are the catalyst for the entire transaction flow. Their experience – how quickly and smoothly they can complete a purchase – often determines whether they’ll return.

- The payment gateway Acts as the secure messenger, encrypting and transmitting payment data between all parties. It’s the technology layer that makes online transactions possible, handling everything from data encryption to response codes.

- The payment processor Often confused with the payment gateway, the processor is the company that actually handles the transaction on behalf of the merchant. They have relationships with card networks and manage the technical infrastructure for moving money.

- The acquiring bank This is the merchant’s bank – the financial institution that receives the funds from customer payments. They underwrite the merchant account and assume some of the risk associated with processing payments.

- The issuing bank The customer’s bank that issued their payment card. They’re responsible for approving or declining transactions based on the customer’s account status and available funds.

- Card networks Visa, Mastercard, American Express, and others maintain the infrastructure that connects issuing and acquiring banks globally. They set the rules, standards, and interchange fees that govern card transactions.

Each player communicates through specific protocols and standards. When someone asks “how does a payment gateway work?”, the answer involves understanding how all these parties interact seamlessly in seconds.

How payment gateways ensure security

Security isn’t an add-on feature for payment gateways – it’s fundamental to how they work. Every aspect of payment gateway functionality is designed with security as the primary concern.

PCI DSS compliance

The Payment Card Industry Data Security Standard (PCI DSS) sets the baseline for payment security. Payment gateways must achieve and maintain the highest level of compliance, which involves:

- Regular security audits by qualified assessors

- Maintaining a secure network infrastructure

- Implementing strong access control measures

- Regular monitoring and testing of networks

- Maintaining an information security policy

Tokenisation in action

Here’s a practical example of how tokenisation works: When a customer saves their card for future purchases, the payment gateway doesn’t actually store the card number. Instead, it creates a unique token – a random string of characters that represents that specific card. If a hacker somehow accessed the database, they’d find meaningless tokens rather than usable card numbers.

SSL certificates and encryption

Every piece of data transmitted through a payment gateway is encrypted using SSL (Secure Sockets Layer) technology. This creates an encrypted tunnel between the customer’s browser and the payment gateway. Modern gateways use at least 256-bit encryption – so secure that it would take the world’s fastest supercomputer billions of years to crack a single transaction.

3D Secure authentication

Also known as “Verified by Visa” or “Mastercard SecureCode,” 3D Secure adds an extra authentication step for online payments. When implemented, customers must enter a password or code sent to their phone before the transaction completes. This dramatically reduces fraud because even if someone has stolen card details, they can’t complete a purchase without access to the cardholder’s phone or email.

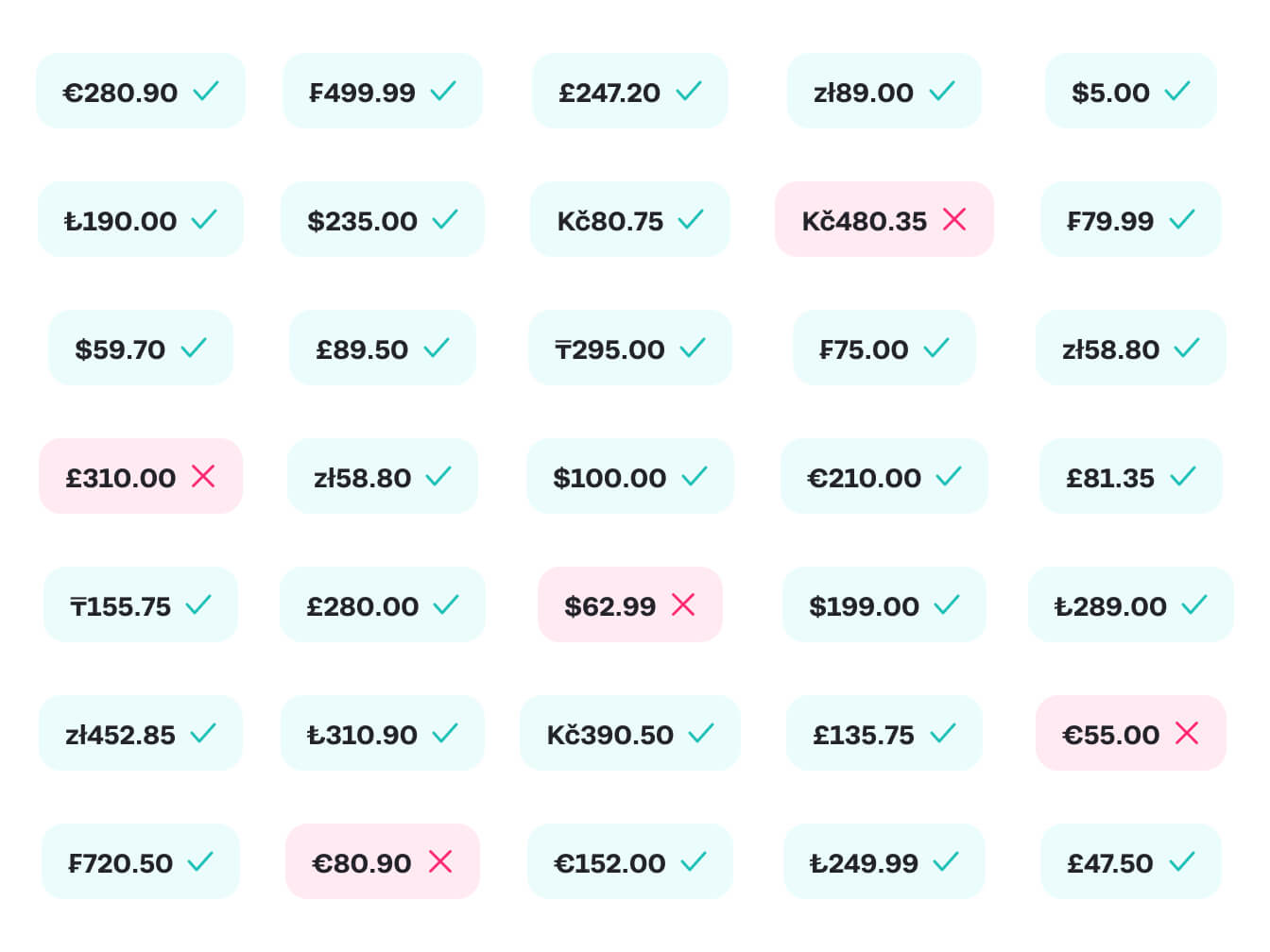

Real-time fraud detection

Modern payment gateways use machine learning algorithms to spot suspicious transactions in real-time. They analyse dozens of data points:

- Geographic location of the purchase

- Time since last transaction

- Unusual spending patterns

- Device fingerprinting

- Velocity checks (too many transactions too quickly)

If something seems off, the gateway can flag the transaction for manual review or automatically decline it based on predetermined rules.

Address Verification Service (AVS)

This security feature compares the billing address provided during checkout with the address on file at the card-issuing bank. Mismatches might indicate fraudulent use, allowing merchants to take additional verification steps.

Real-world payment gateway examples

Let’s look at how payment gateways work in different real-world scenarios to better understand their versatility:

E-commerce store checkout

When you shop on a typical online store, the payment gateway integrates directly with the shopping cart. As you move through checkout, the gateway:

- Pre-validates card numbers as you type

- Offers saved payment methods if you’re a returning customer

- Processes the payment without redirecting you away from the site

- Immediately updates inventory systems upon successful payment

- Triggers fulfilment processes in the warehouse

Subscription service recurring payments

Netflix, Spotify, and countless SaaS businesses rely on payment gateways to handle recurring payments. Here’s how the gateway manages this:

- Stores payment tokens (not actual card details) after the initial transaction

- Automatically processes payments on scheduled dates

- Handles failed payments with smart retry logic

- Updates payment methods when cards expire

- Manages upgrades, downgrades, and cancellations

Mobile app in-app purchases

When you buy extra lives in a game or upgrade to a premium app version, the payment gateway works slightly differently:

- Integrates with platform-specific payment methods (Apple Pay, Google Pay)

- Handles micro-transactions efficiently

- Manages currency conversions for international app stores

- Processes payments without leaving the app interface

- Syncs purchase status across multiple devices

International transaction example

Consider a customer in Japan buying from a UK-based merchant. The payment gateway handles:

- Currency conversion from JPY to GBP

- Displaying prices in the customer’s local currency

- Applying appropriate exchange rates

- Managing cross-border compliance requirements

- Adjusting for time zone differences in settlement

B2B payment scenarios

Business payments often involve larger amounts and more complex requirements:

- Higher transaction limits requiring additional authentication

- Invoice matching and purchase order integration

- Multiple approver workflows before payment processing

- Extended payment terms and net billing options

- Detailed reporting for accounting reconciliation

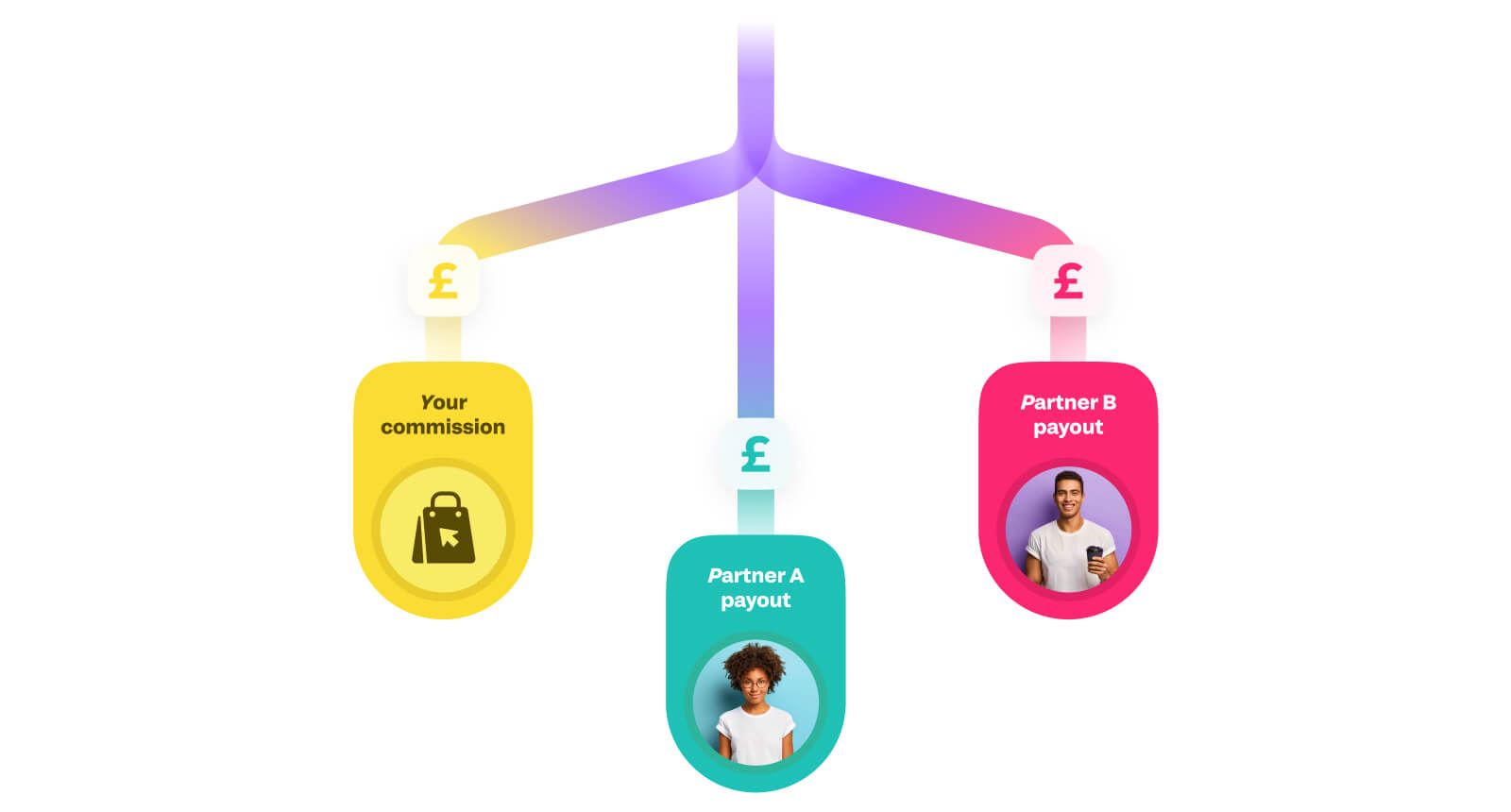

Marketplace split payments

Platforms like Etsy or Airbnb face unique challenges the payment gateway must solve:

- Accepting payment from the buyer

- Calculating marketplace fees

- Splitting payments between multiple sellers

- Handling refunds that affect multiple parties

- Managing tax implications across jurisdictions

Each scenario demonstrates how payment gateway functionality adapts to specific business needs while maintaining security and efficiency.

Choosing the right payment gateway: key considerations

Selecting a payment gateway isn’t just about finding one that works – it’s about finding one that works for your specific business needs. The decision impacts everything from your profit margins to customer satisfaction, making it crucial to evaluate multiple factors before committing.

Transaction fees and pricing models

Transaction fees vary significantly between providers and can dramatically affect your bottom line. Payment gateways typically charge using one of four main pricing structures:

- Flat rate – A fixed percentage plus a fixed fee per transaction (e.g., 2.9% + 20p)

- Interchange plus – The actual card network fee plus a markup

- Tiered pricing – Different rates for different card types

- Volume-based – Lower rates for higher transaction volumes

When evaluating costs, consider not just the current rates but how they’ll scale with your business growth. A seemingly small difference in percentage points can translate to thousands of pounds as your transaction volume increases. Some providers also charge additional fees for international cards, currency conversion, or chargebacks, so ensure you understand the complete fee structure.

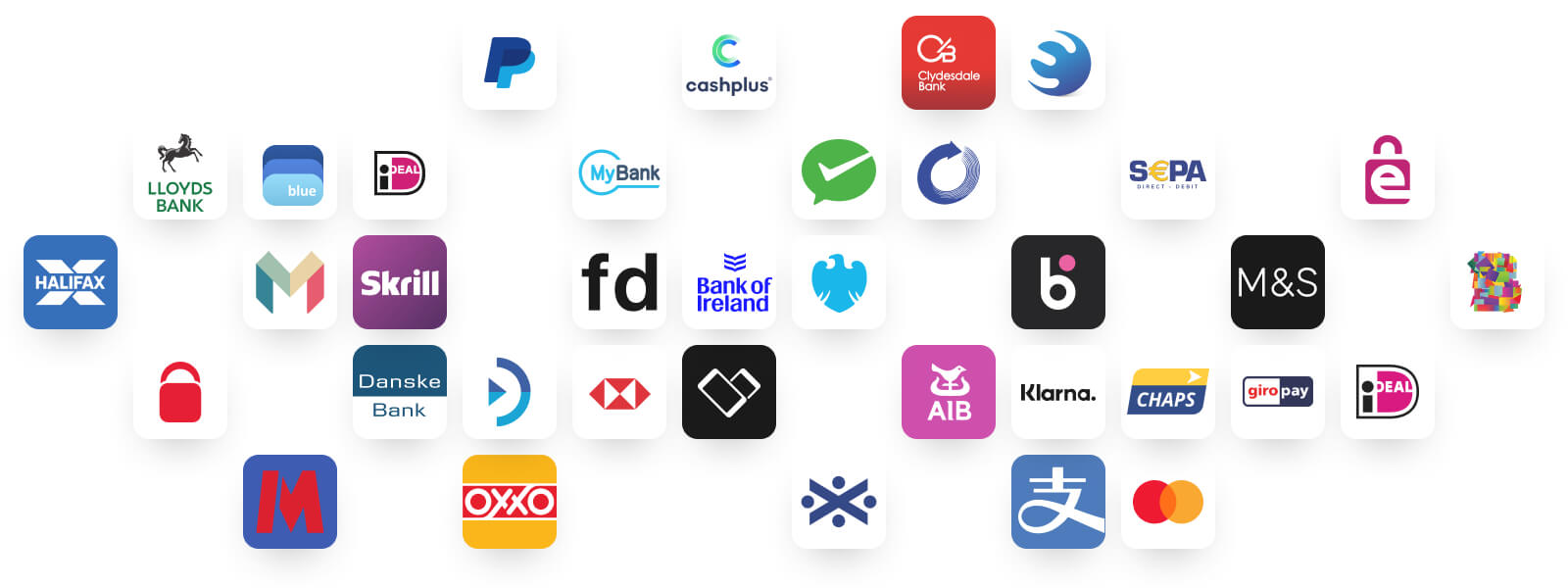

Supported payment methods

The range of payment methods your gateway supports directly impacts conversion rates. The question “how does online payment gateway work” becomes more complex when you need to accept everything from traditional credit and debit cards to digital wallets like Apple Pay and Google Pay. Modern customers expect choice at checkout, and limiting payment options means losing sales.

Consider whether you need to support local payment methods for your target markets, alternative payment options like buy-now-pay-later services or bank transfers, and even cryptocurrency if it’s relevant to your customer base. The broader your payment acceptance, the fewer customers you’ll lose at checkout due to their preferred payment method being unavailable.

Geographic coverage and international capabilities

If you’re selling internationally or planning to expand, geographic coverage becomes essential. Your chosen gateway must be able to accept payments from your target countries while supporting local payment methods in those regions. This isn’t just about accepting different currencies – it’s about understanding and adapting to local payment preferences and regulations.

Efficient currency conversion handling is crucial to avoid losing money on exchange rates. Look for gateways that offer competitive exchange rates and transparent conversion fees. Compliance with local regulations varies dramatically between jurisdictions, from data protection laws to tax requirements. Don’t forget to consider whether customer support is available in relevant time zones – a gateway with only UK business hours support won’t help much if most of your customers are in Asia.

Integration complexity and technical requirements

Integration complexity directly impacts both your initial setup time and ongoing maintenance burden. Consider your technical resources carefully when evaluating how a payment gateway works with your existing systems. Some gateways offer pre-built plugins for popular platforms that can have you up and running in hours, while others might require weeks of custom development.

Evaluate the quality of API documentation – clear, comprehensive documentation saves development time and reduces errors. Check whether testing environments are available to ensure everything works before going live with real customer payments. Consider what ongoing maintenance will be needed as you grow and evolve, and whether your team has the skills to handle it or if you’ll need external support.

Customer support and service quality

When payment processing fails, every minute of downtime costs you money and damages customer trust. Customer support quality becomes critical in these moments. Evaluate whether support is available 24/7 or only during business hours, and consider how this aligns with your peak trading times.

Response times for critical issues should be measured in minutes, not hours. The technical expertise of support staff matters too – they should understand both the gateway technology and common integration challenges. Quality self-service resources like documentation, video tutorials, and troubleshooting guides can help resolve issues quickly without waiting for support. For larger merchants, dedicated account management ensures you have expert help when scaling or implementing new features.

Settlement times and cash flow impact

Settlement times affect your cash flow and should align with your business model. Different gateways offer various options from standard settlement taking 2-3 business days to next-day or even same-day settlement, though faster access to funds often comes at additional cost.

Consider how quickly you need access to customer payments to pay suppliers, manage inventory, or simply maintain healthy cash flow. For some businesses, waiting three days for funds is acceptable; for others, especially those with tight margins or rapid inventory turnover, it’s a deal-breaker. Also consider how the gateway handles weekends and holidays – some pause settlements during these periods, which can create cash flow challenges.

Scalability and future growth

Your payment gateway should grow with your business without requiring disruptive migrations. Look for providers with no upper transaction limits that might force you to switch providers just as you’re gaining momentum. The gateway should handle traffic spikes during peak seasons, flash sales, or viral marketing campaigns without performance degradation or increased failure rates.

As you expand, you’ll want access to advanced features like sophisticated fraud tools, detailed analytics, or multi-currency accounts without needing to migrate to a different provider. Flexible contract terms matter too – avoid getting locked into long-term commitments that don’t allow for your business evolution. The best gateways offer month-to-month terms or reasonable exit clauses that protect your ability to adapt as your needs change.

Fondy as a superior solution: how does the payment gateway work

Understanding how Fondy works as a payment gateway reveals why it’s become the choice for modern businesses seeking more than just payment processing.

Fondy’s unique approach to payment processing

Unlike traditional payment gateways, Fondy operates as a complete online payment ecosystem. When a transaction is initiated, Fondy’s intelligent routing system automatically identifies the customer’s location and presents the most relevant payment methods from over 300 available options – from standard Visa and Mastercard to local favourites like BLIK in Poland or iDEAL in the Netherlands.

Advanced features that set Fondy apart:

- Smart geolocation technology automatically displays payment methods customers trust based on their location, significantly reducing cart abandonment. This means a customer in Germany sees SEPA and Giropay, while someone in Poland sees BLIK prominently displayed.

- Multi-currency processing allows you to accept payments from 200+ countries in 150+ currencies, while settling in your preferred currency (GBP, EUR, or USD). This eliminates the complexity of managing multiple currency accounts.

- The adaptive checkout system provides fully responsive payment pages available in 19 languages, optimised for all devices. Whether your customer is on a smartphone in Tokyo or a desktop in London, they get a seamless experience.

- One-click payments through saved card details make repeat purchases effortless, while built-in recurring billing supports subscriptions and instalment plans without additional plugins or complex configurations.

The Fondy advantage for your business:

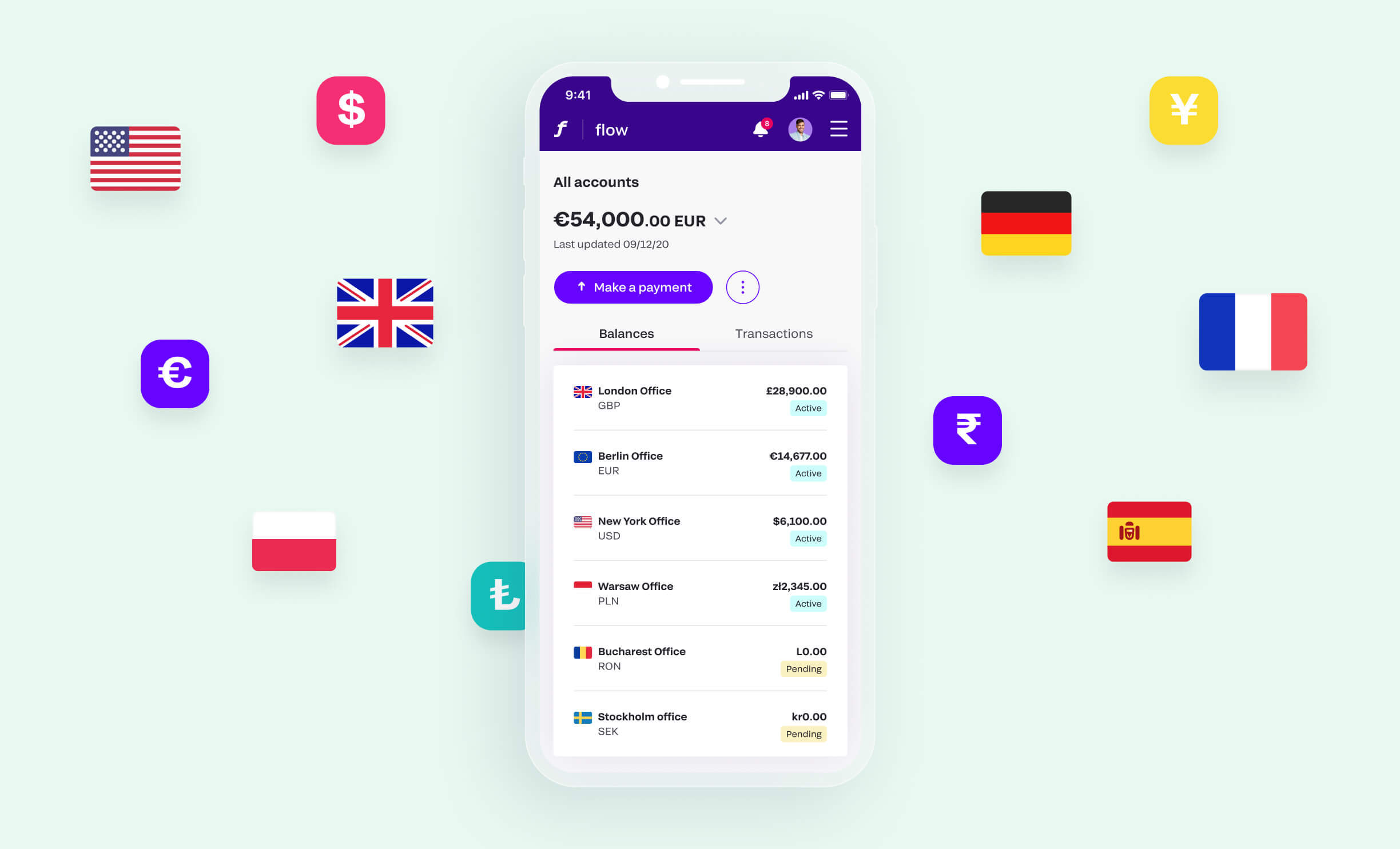

What truly distinguishes Fondy is the integrated UK business account that comes with every gateway setup. This means instant access to a multi-currency business account with UK IBAN, eliminating the need for multiple providers or complex banking relationships. This account is available to all businesses globally, including non-UK residents, with automated payouts to suppliers, freelancers, or partners using custom rules.

Security and compliance excellence:

Fondy maintains PCI DSS Level 1 certification – the highest security standard in the payment industry. As an FCA-regulated electronic money institution, all transactions are protected by end-to-end encryption, real-time fraud detection, rule-based transaction filtering, two-factor authentication, and segregated client funds.

Integration made simple:

Whether you’re a solo entrepreneur using payment links or an enterprise requiring custom API integration, Fondy adapts to your needs. With 30+ ready-to-use plugins for platforms like Shopify, WooCommerce, and Magento, mobile SDKs for iOS, Android, and React Native, and robust APIs with webhooks and callbacks for custom solutions, you can go live in just one day with instant verification.

The result is a payment gateway that doesn’t just process transactions – it becomes your complete financial operations hub, handling everything from customer payments to supplier payouts in one unified dashboard. When businesses ask “how do payment gateways work for complex operations?”, Fondy provides the answer through intelligent automation and seamless integration.

Let’s summarise

Understanding how payment gateways work empowers businesses to make informed decisions about their payment infrastructure. From the split-second encryption of customer data to the complex web of communications between banks and card networks, payment gateways orchestrate a remarkable technical symphony every time someone clicks “pay.”

The right payment gateway does more than just process transactions – it becomes a growth enabler for your business. Whether you’re handling simple one-time payments or complex international transactions with multiple currencies, the gateway you choose will impact your conversion rates, customer satisfaction, and operational efficiency.

As commerce continues to evolve, payment gateways are adapting to meet new challenges: emerging payment methods, stricter security requirements, and customer demands for faster, smoother experiences. The fundamentals of how payment gateways work remain constant, but the best providers continuously innovate to stay ahead of these trends.

For businesses ready to move beyond basic payment processing to a comprehensive payment gateway solution, the choice becomes clear. The best payment gateway should offer global reach with local expertise, bank-grade security with user-friendly integration, and the flexibility to grow with your business.