If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- What is pay-in and pay-out: a comprehensive guide to payment processes for online business

- Mastering delayed payouts: ensuring timely transactions with Fondy

- Streamline your payout process with our comprehensive payout system: low fees for outgoing financial transactions

- How to use payout gateway for outgoing payments on your platform

- How does split payment work for business with Fondy Flow

- A guide to eCommerce split payments

- What is split payment & how Flow Payments can help your business

- What are payouts: a guide to instant & global payouts for business

- How to split credit card payments online: solutions for platforms & marketplaces

- The gig economy’s impact on traditional industries

- Integrating electronic health records with payment systems: advancing efficiency in MedTech billing

- The crucial role of payments in empowering gig platforms

- An introduction to recurring payments

- What is the Faster Payments Service (FPS)?

- What is the SEPA payment method?

- What are quick payments in one click?

- What are cross-border payments?

- What are open banking payments?

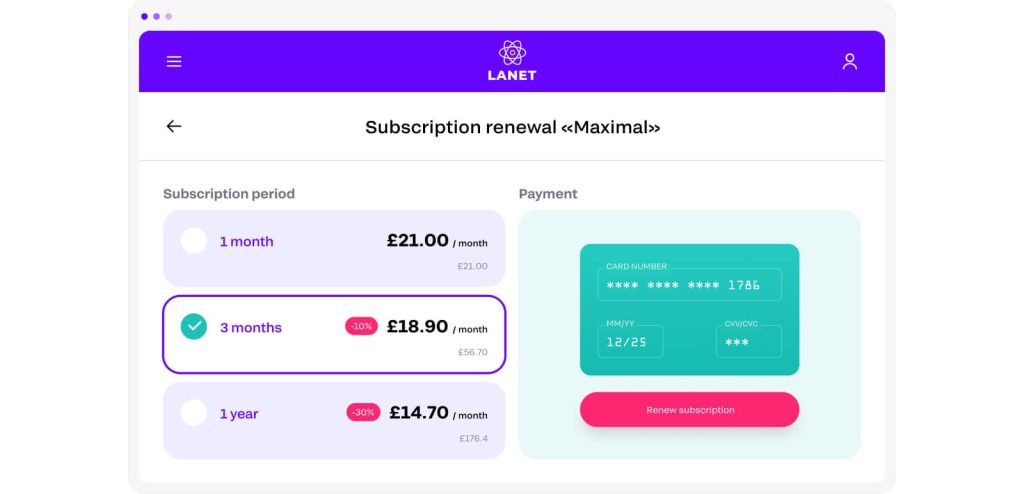

An introduction to recurring payments

Need information about using recurring payments? Look no further. Discover all you need to know about recurring payments and where Fondy fits in, including:

- The meaning of recurring payments

- The different types of recurring payments

- How recurring payments work

- How recurring payments work at Fondy

- How to accept recurring payments

- The benefits of recurring payments

- What types of businesses use recurring payments

What do recurring payments mean?

A recurring payment is a payment or transaction model where customers authorise merchants and platforms to withdraw funds from their bank accounts at regular intervals for goods and services on an ongoing basis.

Once the customer grants permission for the service provider to withdraw the money, the amount is automatically deducted at predefined intervals, such as at the beginning or the end of the month or quarterly, until the customer retracts their permission or the contract or service ends.

Types of recurring payments

Recurring payments are usually divided into two main categories: regular and irregular. Also known as fixed recurring payments, regular payments are those in which customers are charged the same amount at regular intervals for a predetermined length, such as an internet service provider deal for £25 for 18 months. On the other hand, irregular or variable payments are transactions where the amount charged is subject to change based on the product or service usage. For example, quarterly energy bills are determined by how much gas and electricity has been consumed during that period or by estimating a customer’s average use.

How do recurring payments work?

The best way to accept recurring payments is with an all-in-one payment service provider like Fondy or via a merchant account with the software to manage the billing process and ensure the necessary security features are in place to protect customer data and information.

Recurring payments are automatically collected from bank accounts via payment cards or other payment schemes like standing orders (STOs), automated clearing houses (ACH), and Direct Debits. The business or service provider collecting the recurring payment must have at least a merchant account and a payment service provider like Fondy to process payments like recurring transactions via a billing system.

A billing system is a complex software that creates and automates items such as payments, invoices, and revenue. Billing systems or logic enables insightful analytics like reviews of recurring revenues, business data, and reports.

In addition, having a billing system in place helps many marketplaces and platforms monitor incoming revenues in detail. That way, managing touchpoints such as activation, invoicing, and collections are all monitored effectively.

A merchant account is a type of bank account used by merchants or businesses to accept credit card payments. Business owners can usually apply for a merchant account with their existing bank, but it’s often more convenient to use one that comes as part of a payment processor or processing provider.

For example, a Fondy Flow Payments account includes an IBAN account with all the best functionalities, integrations, and benefits of a merchant account solution. Read more about the role of merchant accounts and payment service providers on the Fondy guide to payment processing.

How recurring payments work at Fondy

Flow Payments enables marketplaces and platforms to set up recurring payments such as subscriptions, utility billing, and memberships. That way, your customers can benefit from payment flexibility and peace of mind that their goods, like online grocery orders or services such as medical treatments, continue without interruptions.

The recurring payment models are ideal for both customers and marketplaces. That’s because they promote better customer experience by removing the friction and delays that happen with repeated manual payments, thereby promoting stable cash flows. For businesses that collect payments repeatedly from regular customers, the recurring payment model is worth investing in. For platforms and marketplaces, Flow Payments can help in collecting, monitoring, and processing recurring payments, making the whole process straightforward.

Even better, you can integrate Flow Payments with various CRM systems, accounting software, and more so that your main insights and data points are on one convenient platform.

How to accept recurring payments

Setting up advanced payment features like recurring payments is best done on payment service providers (PSPs) like Fondy. That way, you can bypass the time, manpower, and cost of setting them up on your website or online store.

Payment service providers such as Fondy have the technology to encrypt sensitive card details and pass them securely from the customer to the bank via the merchant account, ensuring the smooth initiation of payment options like recurring payments.

To manage recurring billing, recurring payments, or automatic payments, you need a billing software or application that enables features like creating invoices, setting up recurring billing schedules, and tracking the progress of each payment. You could also consider using a payment processor with a built-in recurring billing feature to manage transactions from a single system.

Some important factors for choosing a payment service provider include:

- Find out what type of billing logic the PSP uses. Billing logic is the technology that makes recurring payments work.

- How long does it take to transfer funds from customer bank accounts to your business account?

- Do customers have to complete the checkout process on your platform or direct their clients to a website of their own, or can they choose?

- How many different currencies and payment methods does the PSP support?

If you’re looking for a PSP with recurring and subscription-based payment options, don’t hesitate to get in touch via the Fondy contact page or at support@fondy.io, where a member of our team will help whether you want to request a callback, a demo, or even to meet us in person.

The advantages of recurring payments to marketplaces and platforms

Recurring payments offer some excellent benefits to customers and businesses alike. Among those are marketplaces and platforms that can enjoy:

Eliminates late payments

Simply put, late payments are bad for business. They can affect marketplace and platform cash flow while worsening business and customer relationships. Recurring payments take the manual element out of payments, meaning that marketplaces, platforms, and their customers can arrange payments just once and take the uncertainty of missed or late payments out of the equation. Late payments are also costly, meaning more manpower and admin are needed.

Protects against fraud

Recurring payments occur with the help of payment gateways and payment service providers (PSPs). These payment platforms protect against fraud and scams with advanced methods and safety features like tokenisation and Payment Card Industry Data Security Standard (PCI DSS). These fraud detection and prevention technologies boost customer confidence and can guide them towards signing up for subscription services.

Improve customer relationships

Recurring payments are convenient for customers and businesses because billing information is only submitted and collected once. After that, recurring payments take complete control, meaning businesses can get on with other activities, and customers can enjoy the product or services without worrying about getting cut off.

Which type of businesses use recurring payments?

Recurring business models aren’t for everyone. From some marketplaces and platforms like food delivery services to certain individuals like one-time customers, recurring payments are a convenient way to collect payments. But for plenty of other industries and individuals, recurring payments are a game-changer, offering a mixture of simplicity, peace of mind, and even cost-effective pricing where recurring payments trigger discounts on certain products and services. These businesses include services like:

Energy providers

When it comes to household essentials, there’s nothing better than recurring payments to ensure a smooth continuation of services such as water, gas, electricity, phone, and internet providers. Companies like energy providers operate using irregular or variable recurring payments, i.e., as the amounts vary from one payment date to another. Not only are recurring payments convenient for customers and platforms alike, but they can also be more cost-effective in terms of discounts and savings on payment processing fees.

Membership-based services

From gyms, part-time educational courses, multi-ticket cinema passes, and beyond, services like this usually charge a fixed amount for their memberships or subscriptions monthly, quarterly, yearly, or at a predetermined rate. Interestingly, recurring payments are the preferred method of payment for memberships and donations to charitable organisations like the Red Cross and the Dogs Trust.

Financial services

Recurring payments are used in personal financial services all the time. For example, in circumstances where a fixed amount is deducted from the customer’s account or salary to pay for things such as pensions, mortgages, vehicles bought on finance, student loans, etc., at regular intervals. Recurring payments are great for certain business models, including software as a service (SaaS companies), online advertising firms, gaming products, virtual service providers, and mobile apps.

Technology companies

Technology or “tech” can refer to a variety of industries. Where recurring payments are concerned, examples of tech companies that benefit the most include educational technology (EdTech) companies like Bloomlife or MedTech providers such as Quanta or deltaDOT. Recurring payments help spread out their payments over time, easing the burden of upfront costs whilst providing platforms with better ways to receive payments more efficiently than before.