If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- WooCommerce recurring payments: how to set up subscriptions & monthly orders with Fondy gateway

- WooCommerce credit card processing: add a plugin to accept Visa & Mastercard with Fondy’s low-fee payment gateway

- Apple Pay WooCommerce plugin: how to add fast payment gateway to your store

- Google Pay for Shopify: how to add GPay and why use Fondy

- Apple Pay Shopify integration: how to enable, setup & best practices from Fondy

- Shopify payment provider guide: third-party payment processors and split payments solutions

- Shopify payment processing fees: complete guide to transaction costs and international payments

- Wix payment processing fees: complete guide to Wix credit card processing costs in 2025

- Shopify payments: What it is, how it works and how UK ecommerce businesses accept credit card payments

- How to accept payments on Wix: why Fondy beats other Wix payment gateways

- How to create a payment link: step-by-step guide to make or generate it online

- How does a payment gateway work to process online payments: a complete guide with examples

- What is the cheapest payment gateway in the UK: compare online payments for Ecommerce

- Payment gateway fees comparison 2025: find the low cost payment gateway for your business

- Top 10 payment gateways in the UK, Europe, and the World: 2025 list of most popular providers

- Complete guide to payment gateway integration: connect, setup, and implementation process for your website

- 10 best payment gateways for e-commerce in the UK or Europe & Why Fondy leads the way

- What is a payment gateway: a guide for entrepreneurs interested in e-commerce

- How to accept mobile payments?

- How to integrate payment gateway APIs?

- How to accept international payments and transactions?

- How to choose the best payment gateway for small businesses?

What is the cheapest payment gateway in the UK: compare online payments for Ecommerce

Finding the right payment gateway for your ecommerce business can feel overwhelming, especially when transaction fees eat into your profit margins. With processing costs ranging from less than 1% to over 3% per transaction, choosing the cheapest payment gateway in the UK could save your business thousands of pounds annually. But what exactly makes one payment gateway cheaper than another, and how do you compare the true costs beyond the advertised rates?

The true cost of cheap payment gateways

When searching for the cheapest online payment gateway, many UK businesses make the mistake of looking only at headline transaction rates. The reality is far more complex. Payment processing costs include various components that can significantly impact your bottom line. Transaction fees represent just one piece of the puzzle, alongside monthly account fees, setup costs, currency conversion charges, and often overlooked expenses like chargeback fees and PCI compliance costs.

The cheapest payment gateway for your specific business depends on several factors. Your monthly transaction volume plays a crucial role, as does your average order value. A gateway charging 2.9% plus 30p per transaction might seem expensive, but if you process high-value orders, the percentage fee matters more than the fixed cost. Conversely, businesses selling low-value items need to pay careful attention to those fixed per-transaction charges.

Customer payment preferences also influence costs. While card payments remain dominant, alternative payment methods like Open Banking and digital wallets often offer lower processing fees. The geographical spread of your customer base matters too, as international transactions typically incur additional charges that can double or triple your effective rate.

Breaking down payment gateway pricing models

Payment gateways employ various pricing structures that significantly impact your overall costs. Understanding these models helps identify which providers genuinely offer the cheapest rates for your business type.

Flat-rate pricing offers simplicity and predictability:

- Same percentage and fixed fee for every transaction

- No variation based on card type or issuing bank

- Easy to calculate monthly costs

- Best suited for small businesses valuing simplicity over savings

- Typically ranges from 1.5% to 2.9% plus 20-30p per transaction

Interchange-plus pricing provides transparency and potential savings:

- Shows exact interchange fees charged by card networks

- Processor markup clearly separated from base costs

- Rates vary based on card type and transaction method

- Often cheapest for established businesses with good volumes

- Requires more complex reconciliation but offers better value

Tiered pricing categorises transactions into rate buckets:

- Qualified rates for standard debit cards

- Mid-qualified rates for rewards cards

- Non-qualified rates for corporate or international cards

- Often results in higher costs than advertised

- Least transparent model with unpredictable monthly charges

The subscription-based model represents an emerging alternative where businesses pay a fixed monthly fee plus minimal per-transaction costs. This structure can prove extremely cost-effective for high-volume merchants but may not suit smaller operations.

The current UK payment gateway landscape making payments cheaper

The UK payment processing market has evolved dramatically in recent years. Traditional banking giants once dominated, but fintech innovation has introduced numerous competitors offering more competitive rates and better technology. This competition benefits businesses seeking the cheapest ecommerce payment gateway, as providers continually refine their offerings to attract merchants.

Open Banking has emerged as a game-changer, enabling direct bank-to-bank payments that bypass card networks entirely. This technology offers some of the lowest transaction fees available, making it an essential consideration when evaluating what is the cheapest payment gateway for your business. Not all providers offer Open Banking integration, creating a clear distinction between modern, cost-effective solutions and legacy systems.

The rise of embedded finance means payment gateways now offer additional services like business accounts, lending, and expense management. These integrated ecosystems can reduce overall costs by eliminating the need for multiple providers. When evaluating the cheapest options, consider the total value proposition beyond simple transaction fees.

Comparing the major UK payment providers

Let’s examine how the leading payment gateways stack up in terms of pricing and features. Each provider targets different market segments, and their fee structures reflect these strategic choices.

Fondy leads with the cheapest rates

Fondy has disrupted the UK payment gateway market by offering genuinely competitive rates without compromising on features. The platform charges from 0.9% for standard card transactions, immediately positioning itself as the cheapest option among major providers. Unlike competitors who advertise low rates but add numerous fees, Fondy maintains transparent pricing across all transaction types.

The authorisation fee of just £0.2 represents one of the lowest in the industry, particularly important for businesses processing high volumes of small transactions. Fondy’s approach to international payments also stands out, with consistent rates regardless of card origin, eliminating the surprise charges common with other gateways. The platform processes transactions in real-time with 99.9% uptime, ensuring reliability doesn’t suffer despite the low costs.

What sets Fondy apart is its modern infrastructure built specifically for today’s ecommerce needs. The platform launched with Open Banking integration from day one, unlike legacy providers retrofitting old systems. This forward-thinking approach enables Fondy to operate more efficiently and pass savings to merchants. The company’s lean operational model focuses on automation and self-service, reducing overhead costs that traditional providers pass to customers.

Stripe’s pricing structure for UK merchants

Stripe has built a reputation as a developer-friendly platform with transparent pricing. UK businesses pay 1.5% plus 20p for domestic card transactions, rising to 2.9% plus 20p for international cards. While these rates seem reasonable, additional charges quickly accumulate. Currency conversion adds 2% to international transactions, and instant payouts cost an extra 1% of the transfer amount.

The platform charges no monthly fees or setup costs, making it attractive for startups. However, businesses processing significant volumes often find Stripe’s flat-rate model expensive compared to negotiated rates available elsewhere. The lack of built-in business banking features means you’ll need separate solutions for managing funds, adding complexity and potential costs.

Stripe’s extensive feature set includes sophisticated subscription management and marketplace capabilities, but these come at a premium. Recurring billing adds 0.5% to transaction costs, while Stripe Connect for platforms starts at £2 per active account monthly. These additional fees can significantly impact the total cost for businesses leveraging advanced features.

Braintree fees – not the cheapest option

PayPal’s Braintree positions itself as an enterprise solution, but its pricing doesn’t always reflect enterprise-friendly rates. Standard merchants face charges of 2.59% plus $0.49 per transaction, considerably higher than many competitors. The platform’s strength lies in its PayPal integration, though Venmo transactions cost even more at 3.49% plus $0.49.

ACH direct debit offers some relief at 0.75% capped at $5, but this payment method suits only specific business models. The $15 chargeback fee adds another layer of cost that businesses must factor into their calculations. For UK businesses seeking the cheapest payment gateway, Braintree’s rates often prove prohibitive unless you’re leveraging specific PayPal ecosystem benefits.

The platform’s value proposition centres on brand recognition and customer trust rather than competitive pricing. Many consumers prefer PayPal for online purchases, potentially increasing conversion rates. However, this benefit must be weighed against the substantially higher processing costs compared to newer, more affordable alternatives.

Worldpay’s complex fee structure

Worldpay operates on a different model, combining transaction fees with monthly charges. Online transactions cost 2.75% plus 20p, while in-person payments enjoy a lower 1.5% rate. However, the true cost includes monthly terminal rental fees ranging from £17.95 to £49.99, plus gateway fees of £19 to £45 monthly.

Additional charges compound these base costs. PCI compliance adds £5 monthly, while chargeback fees range from £15 to £20 per incident. The minimum monthly service charge and various other fees make Worldpay expensive for smaller businesses, though high-volume merchants may negotiate better terms.

Despite the complex pricing, Worldpay offers robust features including extensive fraud protection and multi-currency support. Their long-standing presence in the UK market provides stability and reliability that some businesses value over pure cost savings. The 24/7 UK-based support also justifies higher fees for merchants requiring consistent assistance.

Checkout.com’s custom pricing

Checkout.com takes a different approach with customised pricing based on business profile and risk assessment. While they advertise no setup or maintenance fees, the lack of published rates makes comparison challenging. Industry reports suggest typical rates between 2.3% and 2.9% plus $0.30 per transaction.

The platform uses interchange-plus pricing for transparency, potentially offering savings for businesses with favourable risk profiles. However, customer reviews frequently mention unexpected fees and poor support for smaller merchants, suggesting the cheapest online payment gateway claims don’t always match reality.

Checkout.com excels in international payment processing with support for 150+ currencies and local payment methods. This global reach can justify higher fees for businesses with significant international sales. Their advanced API and customisation options appeal to technical teams seeking flexibility over simplicity.

Why Fondy offers the cheapest total cost

After analysing the UK’s payment gateway landscape, Fondy emerges as the genuinely cheapest payment gateway for most businesses. Starting at just 0.9% for card transactions, Fondy’s rates significantly undercut established competitors. But low transaction fees tell only part of the story.

Fondy’s Open Banking integration offers rates as low as 0.7%, providing the cheapest online payment gateway UK businesses can access for bank-to-bank transactions. This technology reduces costs while improving security and eliminating chargeback risk. Digital wallet transactions start at 0.9%, maintaining competitive pricing across all payment methods.

The platform’s transparent pricing model eliminates hidden fees that plague other providers. No setup costs, no monthly minimums, and clear, published rates for all services. This transparency makes Fondy particularly attractive for small and medium businesses tired of discovering unexpected charges on their statements.

Local payment methods through Fondy start at 1.9%, still considerably cheaper than competitors who often charge 3% or more for alternative payment options. This comprehensive payment method support ensures businesses can offer customer choice without sacrificing margins.

Fondy’s comprehensive payment ecosystem

Beyond offering the cheapest ecommerce payment gateway rates, Fondy provides an integrated financial ecosystem that adds substantial value. The platform combines payment processing with business banking and financial management tools:

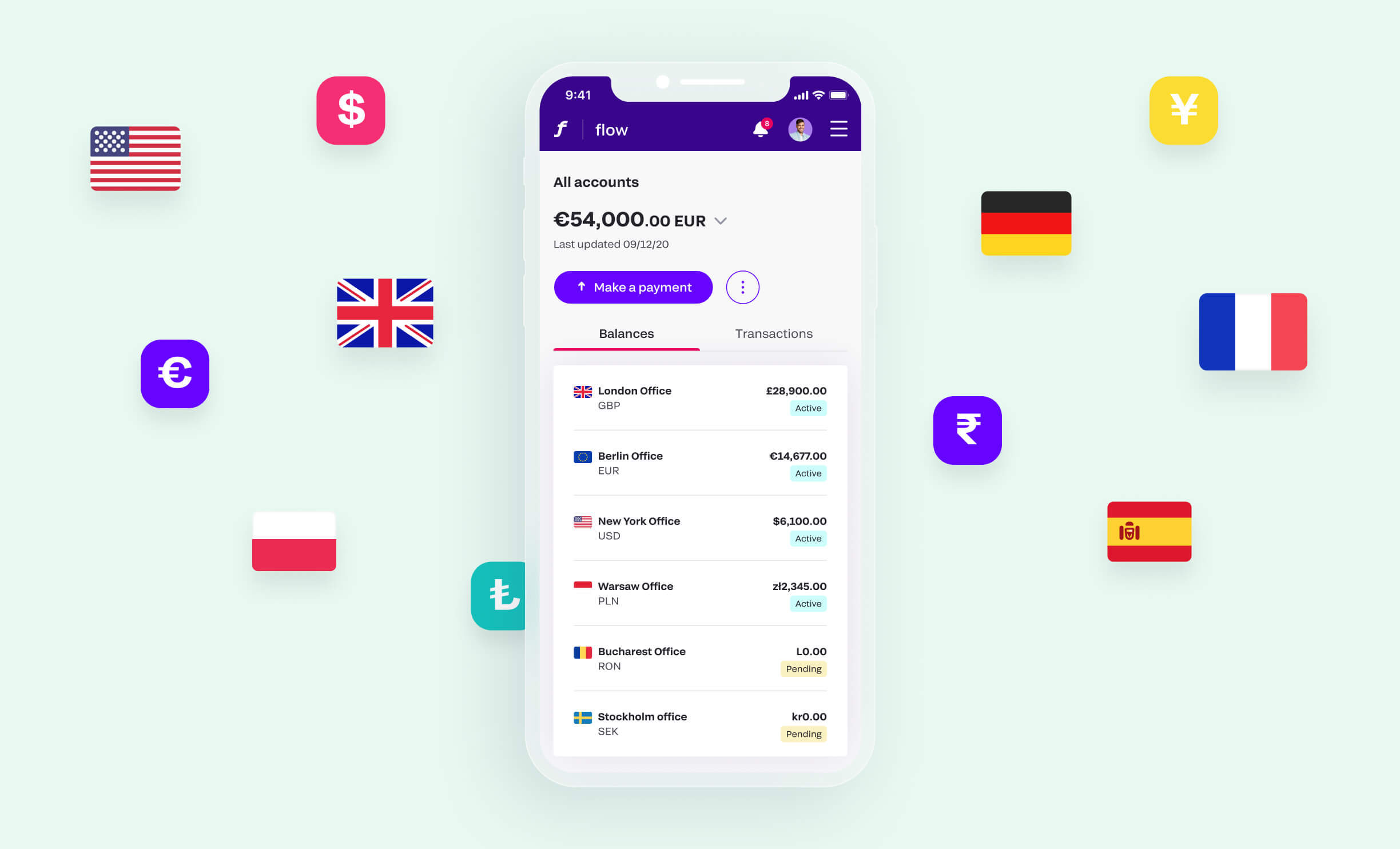

Integrated UK business accounts include:

- Dedicated UK IBANs for seamless payment collection

- Multi-currency accounts starting at just £10 monthly

- Support for GBP, EUR, and USD without hidden conversion fees

- Real-time balance visibility and transaction tracking

- No minimum balance requirements or hidden maintenance charges

Advanced payment features provide:

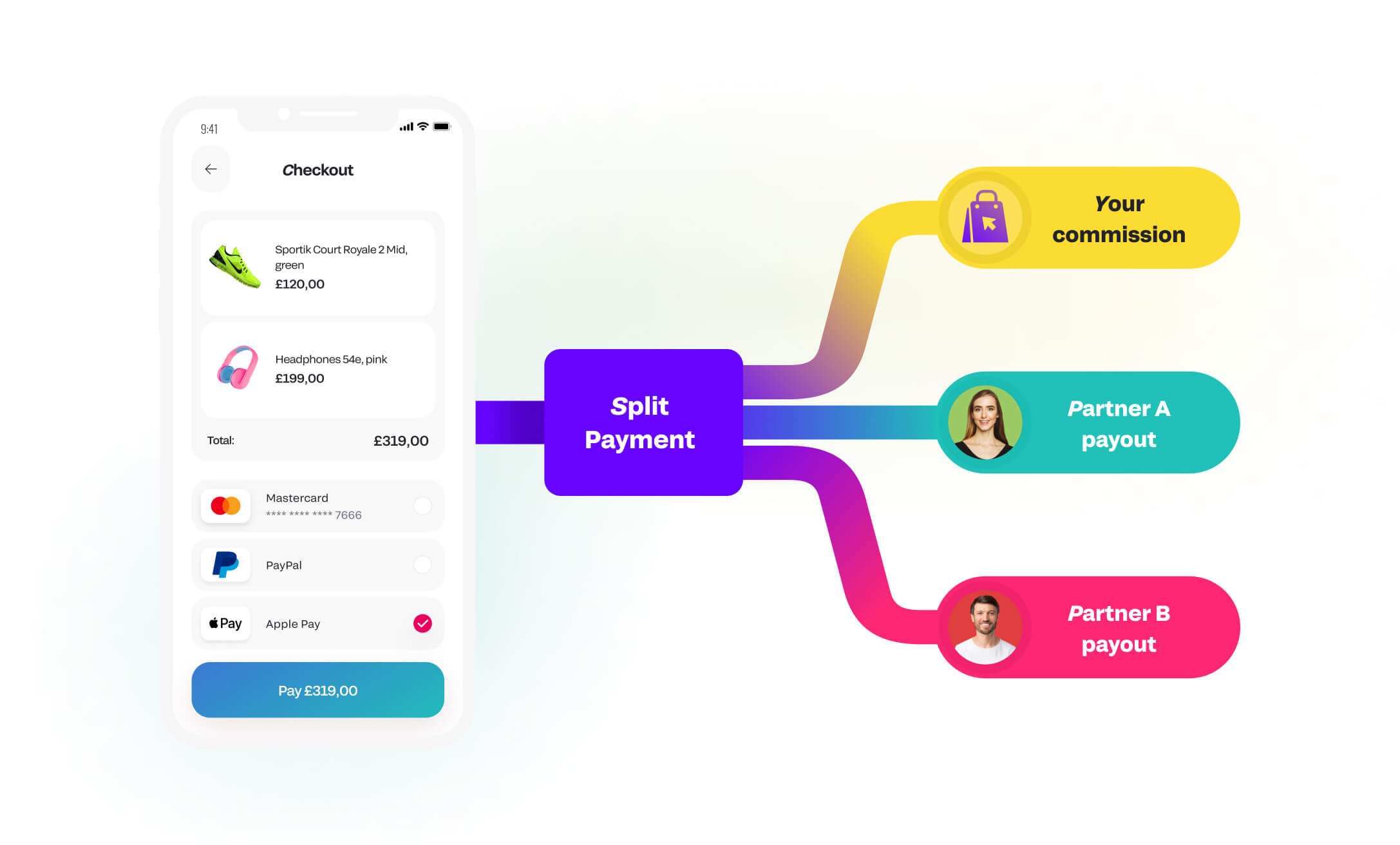

- Split payment functionality from £0.2 per transaction

- Automated fund distribution for marketplaces and platforms

- Subscription and recurring payment management

- Smart retry logic for failed payments

- Comprehensive webhook system for real-time updates

Compliance and verification services offer:

- KYC verification at competitive £2.5 per check

- KYB verification for business customers at £15

- Built-in fraud prevention and risk scoring

- PCI DSS Level 1 compliance included

- GDPR-compliant data handling and storage

The platform handles complex payment scenarios that typically require multiple providers. Whether you’re running a marketplace needing split payments, a SaaS platform with recurring billing, or an international ecommerce store requiring multi-currency support, Fondy provides everything within one integrated system.

Making payment processing cheaper for your business

Selecting the cheapest payment gateway requires careful analysis of your specific business needs. Transaction volume, average order value, customer geography, and payment method preferences all influence which provider offers the best value. While headline rates matter, the total cost of ownership includes factors like integration complexity, support quality, and additional features.

For most UK ecommerce businesses, Fondy represents the optimal balance of low costs, comprehensive features, and modern technology. The platform’s transparent pricing, integrated financial services, and competitive rates across all payment methods make it the cheapest online payment gateway without compromising on capabilities.

Consider your growth trajectory when choosing a payment provider. A gateway that seems cheap today might become expensive as your business scales. Fondy’s volume-based discounts and lack of hidden fees ensure costs remain predictable and competitive as transaction volumes increase.

The integration process also impacts total costs. While some providers advertise low rates, complex technical requirements can result in thousands of pounds in development expenses. Fondy’s pre-built plugins and clear API documentation minimise implementation costs, providing faster time-to-value.

Conclusion

The search for what is the cheapest payment gateway in the UK reveals a complex landscape where advertised rates tell only part of the story. While established providers like Stripe, PayPal, Worldpay, and Checkout.com offer reliable services, their fee structures often include hidden costs that significantly impact total expenses.

Fondy emerges as the genuinely cheapest payment gateway UK businesses can choose, combining market-leading transaction rates with transparent pricing and comprehensive financial services. From 0.7% Open Banking transactions to integrated business accounts and split payment capabilities, Fondy provides everything modern ecommerce businesses need at prices that protect profit margins.

The platform’s commitment to transparency, modern technology, and customer-focused features makes it the clear choice for businesses seeking to minimise payment processing costs while maximising operational efficiency. In an industry notorious for hidden fees and complex pricing structures, Fondy’s straightforward approach and competitive rates set a new standard for value in payment processing.