If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- What is the cheapest payment gateway in the UK: compare online payments for Ecommerce

- Payment gateway fees comparison 2025: find the low cost payment gateway for your business

- Top 10 payment gateways in the UK, Europe, and the World: 2025 list of most popular providers

- Complete guide to payment gateway integration: connect, setup, and implementation process for your website

- 10 best payment gateways for e-commerce in the UK or Europe & Why Fondy leads the way

- What is a payment gateway & how does it work in e-commerce?

- How to accept mobile payments?

- How to create a payment link for receiving online payments

- How to integrate payment gateway APIs?

- How to accept international payments and transactions?

- How to choose the best payment gateway for small businesses?

What is a payment gateway & how does it work in e-commerce?

As global e-commerce sales are projected to surpass $8.1 trillion by 2026, businesses need robust solutions to process payments securely and efficiently. If you’re looking for insights into payment gateways and providers, you’ve come to the right place. This guide covers everything you need to know, including:

- What is a payment gateway and why it matters?

- How does a payment gateway work?

- Types of payment gateways and providers

- The role of payment gateways in e-commerce

- Fondy as your payment gateway solution

- Key benefits and trends for 2025

What is a payment gateway?

A payment gateway is a technology service platform that enables merchants to accept electronic payments from customers, both online and in-store. It securely collects and transfers payment information: such as credit card details, digital wallet credentials, or bank account data between the customer, the merchant, and the financial institutions involved in the transaction. Think of it as the digital equivalent of a point-of-sale (POS) terminal in a physical store, but with the added complexity of handling online and mobile transactions.

Why do you need a payment gateway?

In today’s digital economy, an online payment gateway service is essential for businesses looking to thrive. Here’s why:

- Global reach: Accept payments from customers worldwide in multiple currencies and payment methods, including cards, digital wallets, and local options.

- Customer convenience: Offer a seamless checkout experience with one-click payments, recurring billing, and mobile-friendly options.

- Security: Protect sensitive data with encryption, tokenization, and compliance with standards like PCI DSS and 3D Secure.

- Efficiency: Automate payment processing, reducing manual work and errors.

- Scalability: Support low-volume startups or high-volume enterprises with flexible integrations.

With online payment fraud projected to cost merchants over $362 billion globally between 2023 and 2028, a secure payment gateway is critical to safeguarding your business and customers.

How does a payment gateway work?

Understanding how a payment gateway works is key to appreciating its role in e-commerce. The process involves multiple parties: customers, merchants, banks, and payment networks, working together seamlessly. Here’s a step-by-step breakdown:

- Transaction initiation: A customer selects products or services on your website or app and proceeds to checkout. They enter their payment details, such as credit card numbers, digital wallet credentials, or bank information.

- Data encryption: The payment gateway encrypts the data using Secure Sockets Layer (SSL) or Transport Layer Security (TLS) protocols to protect it from unauthorized access during transmission.

- Data transmission: The encrypted information is sent to the merchant’s server, which forwards it to the payment gateway for processing.

- Fraud checks: The gateway performs security checks, such as Address Verification Service (AVS), Card Verification Value (CVV) validation, and AI-powered fraud detection, to ensure the transaction is legitimate.

- Authorization request: The gateway sends the transaction details to the merchant’s acquiring bank, which routes it through card schemes (e.g., Visa, Mastercard) or payment networks to the customer’s issuing bank.

- Transaction verification: The issuing bank verifies the customer’s account balance, card validity, and other details. It then approves or declines the transaction.

- Response delivery: The approval or decline message is sent back through the payment network, acquiring bank, and gateway to the merchant’s server.

- Customer notification: The gateway communicates the transaction status to the website or app, displaying a confirmation or error message to the customer.

- Settlement: If approved, the acquiring bank collects funds from the issuing bank and deposits them into the merchant’s account, typically within 1–3 business days, depending on the agreement.

This process, which takes seconds, ensures secure and efficient payment processing. Fondy’s gateway enhances this with features like real-time analytics, tokenization for repeat purchases, and support for recurring payments.

Payment gateway vs. payment processor: what’s the difference?

The terms payment gateway and payment processor are often confused, but they serve distinct roles:

- Payment gateway: Acts as the front-end technology that securely collects and encrypts customer payment data, facilitates authorization, and communicates transaction status. It’s the interface between your business and the payment ecosystem.

- Payment processor: Handles the back-end processing, including authorizing transactions, settling funds, and transferring money between the customer’s and merchant’s banks. It works with card schemes and financial institutions to complete the transaction.

For example, Fondy provides an integrated service solution that combines a secure payment gateway with processing services, simplifying setup for merchants. Unlike standalone gateways, our platform offers end-to-end support, from checkout to settlement.

Types of payment gateways

Payment gateway for websites may come in different forms to suit various business needs. Here are the main types:

- Hosted payment gateways: Customers are redirected to a third-party payment page to enter their details. These are secure and easy to set up, ideal for small businesses, but the extra step may lead to cart abandonment (22% of customers cite slow checkout as a reason for abandoning carts).

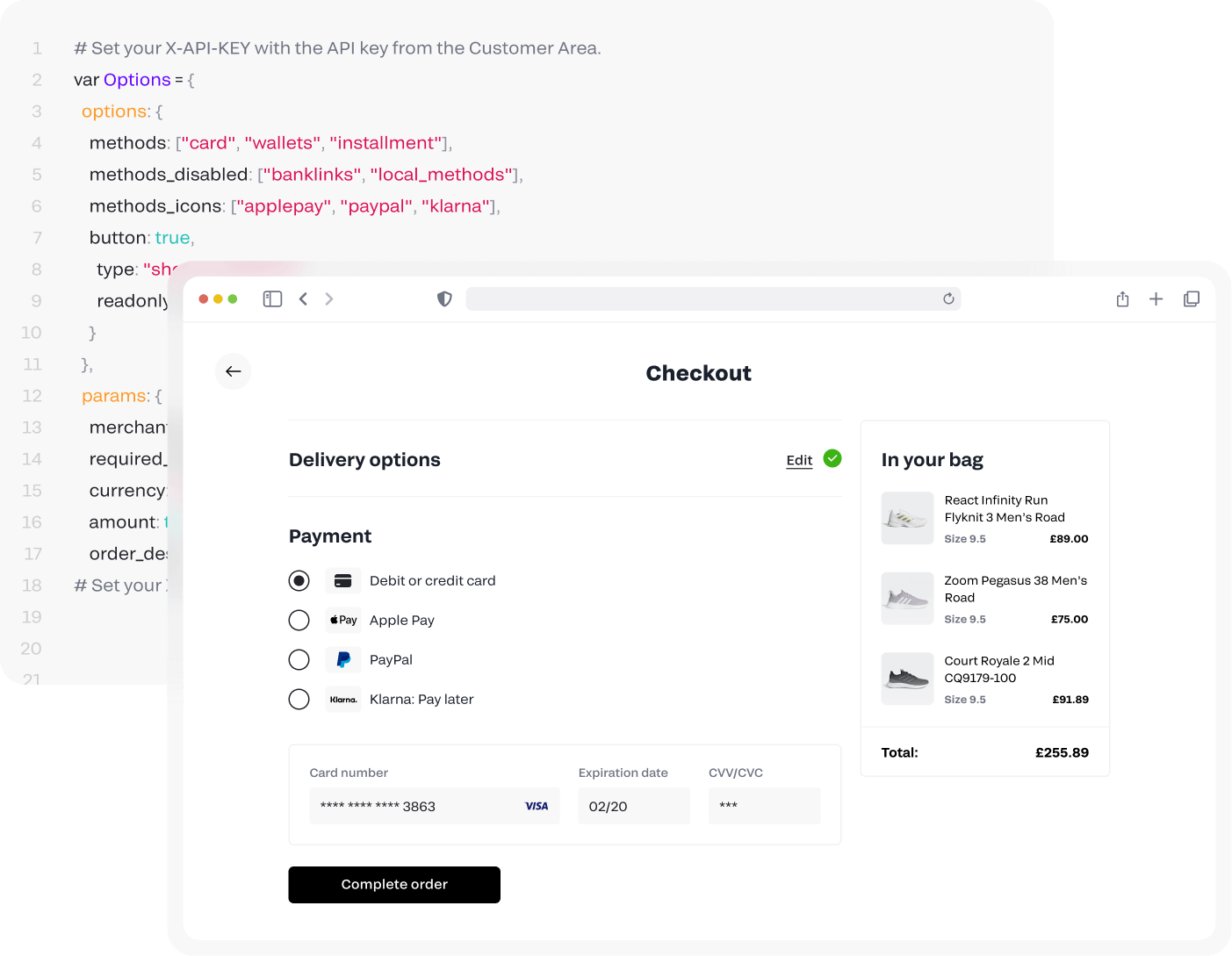

- Non-hosted (API-hosted) gateways: Payments are processed directly on your website or app, offering a seamless customer experience. These require more technical setup and PCI DSS compliance but provide greater control over the checkout process.

- Self-hosted gateways: The merchant’s website collects payment details, which are encrypted and sent to the gateway for processing. These balance customization with reduced PCI compliance burdens.

Fondy supports all three types, allowing you to choose the best fit for your business – whether you’re a startup seeking simplicity or an enterprise needing full control.

The role of a payment gateway in e-commerce

In e-commerce, a payment gateway is the backbone of online transactions. It enables businesses to:

- Accept diverse payment methods: Support credit/debit cards, digital wallets (Apple Pay, Google Pay), Buy Now, Pay Later (BNPL) options like Klarna, and local methods like iDEAL or Giropay.

- Enhance customer experience: Offer one-click checkouts, recurring billing, and mobile-optimized payment pages to reduce cart abandonment (18% of abandoned carts are due to cumbersome checkouts).

- Ensure security: Protect against fraud with 3D Secure, tokenization, and AI-driven risk management, critical as cybercrime continues to rise.

- Expand globally: Process payments in over 150 currencies across 200+ countries, tailoring the experience to local preferences.

- Streamline pperations: Automate refunds, chargebacks, and analytics, saving time and resources.

Fondy’s ecommerce payment gateway integrates seamlessly with platforms like WooCommerce, Shopify, and Magento, ensuring your store is ready to sell from day one.

Benefits of using a payment gateway

A payment gateway offers numerous advantages for businesses and customers alike:

1. Enhanced security

Security is paramount in online payments. Fondy’s gateway is PCI DSS Level 1 compliant, employing:

- Encryption: SSL/TLS protocols protect data during transmission.

- Tokenization: Replaces sensitive card details with unique tokens for secure repeat purchases.

- 3D Secure: Adds an extra authentication layer for card transactions.

- Service-based fraud detection: Monitors transactions for suspicious activity, reducing chargebacks.

These measures protect your business and build customer trust, especially as online fraud is expected to grow.

2. Seamless customer experience

A payment gateway simplifies checkout, reducing friction:

- One-click payments for returning customers.

- Mobile-optimized interfaces for purchases on any device.

- Customizable checkout pages to match your brand.

- Support for recurring subscriptions and BNPL, popular services in 2025.

3. Global expansion

Reach new markets with Fondy’s support for:

- 150+ currencies and 300+ banks via Open Banking.

- Local payment methods like SEPA, Sofort, and Alipay.

- Multi-language interfaces for a localized experience.

4. Scalability and flexibility

Whether you process 10 or 10,000 transactions daily, Fondy scales with you, offering:

- API integrations for custom setups.

- Plugins for platforms like PrestaShop and OpenCart.

- Virtual terminals for phone or email payments (Pay by Link).

5. Comprehensive analytics

Gain insights with real-time reports on:

- Transaction volumes and statuses.

- Customer payment preferences.

- Revenue trends and chargeback rates.

Fondy as a payment gateway provider

Fondy stands out as a leading online payment gateway provider, offering a robust platform that combines security, flexibility, and global reach. Here’s what sets us apart:

- All-in-one solution: Integrate payment gateway, merchant account, and processing services through a single API.

- Diverse payment methods: Accept Visa, Mastercard, Apple Pay, Google Pay, Klarna, crypto wallets, and local options like iDEAL and Giropay.

- Advanced features:

- Tokenization for secure recurring payments.

- Split payments as the main feature of our marketplace payment gateway solution.

- Instant settlements for faster access to funds (learn more).

- Abandoned cart notifications to recover lost sales.

- Global coverage: Process transactions in 200+ countries with multi-currency support.

- Easy integration: Use pre-built plugins for Shopify, WooCommerce, or custom APIs for bespoke solutions (explore integrations).

- 24/7 support: Dedicated account managers and technical support ensure your success.

Discover more on Fondy’s international payments homepage.

Case study: A European e-commerce retailer increased conversions by 15% after switching to Fondy’s one-click checkout and localized payment methods. Request a demo to see how we can help your business.

Discover more plugins, platforms, and marketplaces Fondy supports. Don’t see your preferred integration? Contact us at support@fondy.io for custom solutions.

What are payment gateway charges?

Understanding payment gateway charges is crucial for budgeting. Fees typically include:

- Transaction fees: A percentage (e.g., 1–3%) plus a fixed amount (e.g., $0.10–$0.30) per transaction.

- Setup fees: One-time costs for integration, often waived for simple setups.

- Monthly fees: For access to advanced features like analytics or fraud tools.

- Chargeback fees: Applied when customers dispute transactions.

- Currency conversion fees: For international payments.

With transaction fees being a significant factor in your payment processing costs, it’s essential to compare different providers to find the most cost-effective solution for your business. If you’re operating in the UK market and looking to minimize your payment processing expenses, we’ve created a comprehensive guide that analyzes what is the cheapest payment gateway in the UK. This detailed comparison covers online payment options for e-commerce businesses, helping you make an informed decision based on your transaction volume and business needs.

Fondy offers transparent pricing tailored to your business size and industry. Contact our team for a custom quote or visit our pricing page for details. And if you want to compare a payment gateway fees of the top providers, you can read the article at the link below.

Trends shaping payment gateways in 2025

The payments landscape is evolving rapidly. Here are key trends to watch:

- Buy now, pay later (BNPL): BNPL options like Klarna and Afterpay are expected to account for 5% of global e-commerce transactions by 2026.

- Digital wallets: Apple Pay, Google Pay, and Alipay dominate, with 50% of online transactions in some markets.

- Cryptocurrencies: Acceptance of Bitcoin and stablecoins is growing, especially for cross-border payments.

- AI and personalization: AI-driven fraud detection and personalized checkout experiences improve conversions.

- Social commerce: Payment gateways now integrate with Instagram Checkout and TikTok Shop, tapping into social media sales.

Fondy stays ahead by supporting these trends, ensuring your business is future-proof.

How to choose the right payment gateway

Selecting a payment gateway depends on your business needs. Consider these factors:

- Security: Ensure PCI DSS compliance, 3D Secure, and fraud protection.

- Payment methods: Support cards, wallets, BNPL, and local options.

- Integration: Look for easy setup with your platform (e.g., Magento, Shopify).

- Cost: Balance transaction fees, setup costs, and monthly charges.

- Global support: Check for multi-currency and international payment capabilities.

- Customer support: Prioritize 24/7 assistance and dedicated account managers.

Fondy ticks all these boxes, offering a flexible, secure, and scalable solution. To explore why Fondy stands out among the top options, check out our article “10 best payment gateways for e-commerce in the UK or Europe & Why Fondy leads the way”, which breaks down the best providers and highlights Fondy’s unique advantages for businesses in the region.

Frequently asked questions

What is an online payment gateway?

An online payment gateway is a service that processes electronic payments for online businesses, securely transferring data between customers, merchants, and banks. It supports various methods, from cards to digital wallets, ensuring a smooth checkout experience.

What is a secure payment gateway?

A secure payment gateway uses encryption, tokenization, 3D Secure, and fraud detection to protect transactions and customer data. Fondy’s gateway is PCI DSS Level 1 compliant, safeguarding your business against cyber threats.

What are payment gateway charges?

Payment gateway charges vary but typically include per-transaction fees (e.g., 1–3% + $0.10–$0.30), setup fees, and monthly fees for advanced features. Fondy offers competitive, transparent pricing. Contact us for details.

How long does it take to set up a payment gateway?

With Fondy, setup can take as little as a few hours using pre-built plugins or 1–2 days for custom API integrations. Our team guides you every step of the way.

Does Fondy support international payments?

Yes, Fondy supports payments in 150+ currencies across 200+ countries, with local methods like SEPA, Sofort, and Alipay for a tailored experience.

Can Fondy handle recurring payments?

Absolutely. Fondy’s gateway supports subscriptions and recurring billing with secure tokenization, ideal for SaaS, memberships, and utilities.