If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- What is pay-in and pay-out: a comprehensive guide to payment processes for online business

- Mastering delayed payouts: ensuring timely transactions with Fondy

- Streamline your payout process with our comprehensive payout system: low fees for outgoing financial transactions

- How to use payout gateway for outgoing payments on your platform

- How does split payment work for business with Fondy Flow

- A guide to eCommerce split payments

- What is split payment & how Flow Payments can help your business

- What are payouts: a guide to instant & global payouts for business

- How to split credit card payments online: solutions for platforms & marketplaces

- What are split payments, and how do they work on Flow Payments?

- The gig economy’s impact on traditional industries

- Integrating electronic health records with payment systems: advancing efficiency in MedTech billing

- The crucial role of payments in empowering gig platforms

- An introduction to recurring payments

- What is the Faster Payments Service (FPS)?

- A guide to eCommerce split payments

- A guide to instant and global payouts

- What is the SEPA payment method?

- What are quick payments in one click?

- What are cross-border payments?

- What is a payment link?

- What are open banking payments?

What are split payments, and how do they work on Flow Payments?

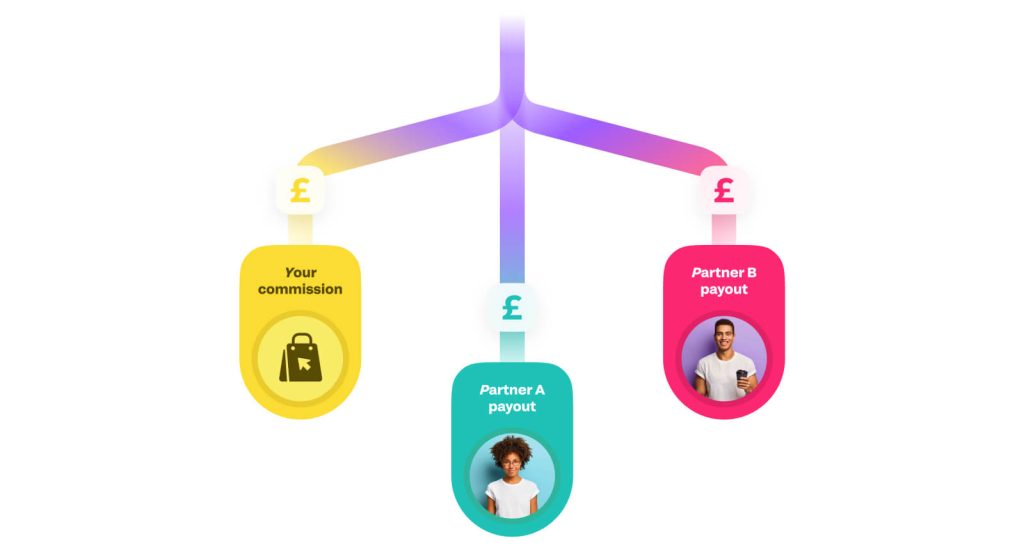

Flow Payments simplifies the management of split payments and payouts by automating the distribution of funds between your platform or marketplace and its partners, including customers, merchants, sellers, content creators, etc.

All while offering your platform or marketplace flexibility on how and what to charge as commissions and fees and the freedom of different payment schedules and timeframes.

Our solution enables marketplace and service platform owners to automatically split a single payment (or “mixed basket”) amount between multiple customers, merchants, sellers, content creators, etc.

Stay connected with split payments

The advantages of split payment transactions go well beyond putting funds where they belong as quickly as possible. That’s because split payments are a payment method key to platforms and marketplaces.

Saving time and resources

Automate splitting payments between your various partners, such as online sellers, content creators, tradesmen, drivers, customers, etc., saving essential time and resources.

Improve conversion rates

Split payment facilities help improve conversion rates by lowering cart abandonments and failed payments. The result is more customer satisfaction and improved conversion rates.

Having full financial flexibility

Give everyone, from yourself to your partners, complete flexibility with the best customisable commission models and fee structures.

Tapping into enhanced security features

Stay protected with the best security measures and fraud prevention tools, ensuring a safe and reliable split payment and payout experience.

Streamlining to success

Reduce operational costs and enhance user experiences, best practices for both merchants and customers when you streamline processes with split payments.

Counting on a business account

With split payment functionality, your partners can also open a GBP business accountEUR and USD IBAN accounts coming soon to receive funds instantly without any charges or currency conversion fees.

How split payment functionality works on Flow Payments

Flow Payments offers a convenient system for your marketplace or platform to receive, split, and settle business funds. That means for your partners, the split payment method helps them get paid instantly.

Let’s imagine that your EdTech platform, “Global Learning Pro (GLP)”, helps connect an online tutor to Student A based in the UK.

Once the acquirer has settled Student A’s card payment, Flow Payments then provides the API for GLP to take a percentage of the payment and send the rest to the tutor’s Wallet (or sub-account).

Alternatively, Flow Payments can collect the funds directly from Student A’s bank account and send the corresponding amount straight to the tutor’s Wallet.

This process is known as split payments and is how they work with Flow Payments. Finally, you can send the funds from the tutor’s Wallet to their chosen bank account or Fondy Flow account, which is what is known as a payout.

To meet marketplace requirements for seller split payments, you’ll need to comply with local and international regulations. That means verifying the identity of all sellers and/or their companies comply with Know Your Customer (KYC) and Know Your Business (KYB) due diligence procedures, which can vary from one country to another.

These procedures usually include the scanning of identity documents and the collecting of personal or company details such as legal names and addresses. This is a complex process, but the best news is that you can move the responsibility for this to Fondy Identity.

The best use cases for Split Payments

As well as the EdTech industry example above, Fondy’s split payments are especially beneficial to other industries and business models. Some of these include:

eCommerce platforms and marketplaces

Platforms like Amazon and eBay sell a variety of products from a wide range of different sellers. But when a customer pays for the items (from different sellers) in their shopping cart, the payments are directed to the sellers after a while.

Since your customers make the initial payment to the eCommerce marketplace, each seller needs a way to get paid regarding the product’s listed price. This is what split payments are for, as they’re especially helpful to marketplaces, platforms, and customers alike.

Ultimately, the whole process of splitting payments helps give businesses better, faster cash flow while simplifying payment settlement.

Aggregators

The aggregator business model is a network model that organises a variety of services or products for customers from different providers under one brand name.

Typically, aggregators operate without owning any physical infrastructure. For example, Uber, who don’t own any cars, and Airbnb, who don’t own any homes, which is what makes split payments popular within the taxi, hotel, travel, grocery, and food sectors.

Aggregators like Uber and Airbnb can use Fondy’s split payments to facilitate transactions to each driver using split payments. The payments are collected from different customers and then paid directly to the drivers.

Without features like split payments, unhappy sellers will leave your marketplace because they don’t get paid on time, while buyers may contact you with chargeback requests and payment disputes. That’s why offering timely seller split payment transactions and buyer fraud protection can be a powerful incentive for sellers to use your marketplace.

Why split payments

Transparent transaction records

Detailed records of all split payment transactions, ensuring clear transparency, tracking, and payment reconciliation.

Limits human errors

Automated split payments significantly reduce the chances of any errors being made by manual reconciliation and ensure a fair distribution of payments to each seller.

Scale without limits

Automated split payments are highly scalable to grow as your company does. So, no matter what business model you employ or how many sellers you onboard, you can easily split and distribute funds at any time of the day.

Custom commission and fee structures

Choose how, what, and when to charge your commissions and fees.

On-demand payouts

Decide when to initiate payout transactions to your partner’s bank account.