If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- WooCommerce recurring payments: how to set up subscriptions & monthly orders with Fondy gateway

- WooCommerce credit card processing: add a plugin to accept Visa & Mastercard with Fondy’s low-fee payment gateway

- Apple Pay WooCommerce plugin: how to add fast payment gateway to your store

- Google Pay for Shopify: how to add GPay and why use Fondy

- Apple Pay Shopify integration: how to enable, setup & best practices from Fondy

- Shopify payment provider guide: third-party payment processors and split payments solutions

- Shopify payment processing fees: complete guide to transaction costs and international payments

- Wix payment processing fees: complete guide to Wix credit card processing costs in 2025

- Shopify payments: What it is, how it works and how UK ecommerce businesses accept credit card payments

- How to accept payments on Wix: why Fondy beats other Wix payment gateways

- How to create a payment link: step-by-step guide to make or generate it online

- How does a payment gateway work to process online payments: a complete guide with examples

- What is the cheapest payment gateway in the UK: compare online payments for Ecommerce

- Payment gateway fees comparison 2025: find the low cost payment gateway for your business

- Top 10 payment gateways in the UK, Europe, and the World: 2025 list of most popular providers

- Complete guide to payment gateway integration: connect, setup, and implementation process for your website

- 10 best payment gateways for e-commerce in the UK or Europe & Why Fondy leads the way

- What is a payment gateway: a guide for entrepreneurs interested in e-commerce

- How to accept mobile payments?

- How to integrate payment gateway APIs?

- How to accept mobile payments?

- How to accept international payments and transactions?

- How to choose the best payment gateway for small businesses?

Shopify payment provider guide: third-party payment processors and split payments solutions

Running a successful Shopify store requires more than just great products and marketing. The backbone of your operation lies in how efficiently you process payments, distribute funds, and manage the complex financial relationships that modern ecommerce demands. While many merchants default to Shopify’s built-in payment solution, the evolving landscape of online commerce increasingly demands more sophisticated payment infrastructure, particularly for businesses operating marketplaces, managing multiple vendors, or expanding internationally.

The question of what payment processor does Shopify use reveals a more complex reality than most merchants initially expect. Behind the scenes, Shopify Payments operates on Stripe’s infrastructure, which explains both its capabilities and limitations. This arrangement works adequately for straightforward single-vendor stores selling in supported markets, but quickly shows its constraints when businesses need advanced features like automated split payments, true multi-currency processing, or integration with local payment methods across diverse geographic regions.

Understanding your options for payment providers on Shopify becomes crucial as your business scales beyond basic requirements. The right payment processor transforms from a simple transaction handler into a strategic asset that enables new business models, improves cash flow, and reduces operational complexity. This comprehensive guide examines the entire ecosystem of Shopify third party payment providers, with particular focus on split payment solutions that are revolutionising how merchants handle multi-party transactions.

What payment gateway does Shopify use: understanding the default setup

The architecture behind Shopify’s payment processing reveals why so many merchants eventually seek alternatives. Shopify Payments, the platform’s native solution, operates as a white-label version of Stripe, inheriting both its strengths and significant limitations. This relationship means that when you process payments through Shopify’s default system, your transactions flow through Stripe’s infrastructure, subject to their risk assessment algorithms, settlement schedules, and geographic restrictions.

Currently, Shopify Payments operates in just 17 countries, leaving merchants in the vast majority of global markets dependent on third-party solutions from day one. Even within supported countries, the system’s rigid structure creates challenges for businesses with complex needs. The inability to maintain multiple merchant accounts, restrictions on high-risk industries, and limited customisation options force many successful merchants to explore alternative payment processors for Shopify, despite the additional transaction fees imposed for stepping outside the native ecosystem.

The technical limitations become particularly apparent when examining the API capabilities. While Shopify Payments integrates seamlessly with the platform’s checkout flow, it offers minimal flexibility for custom payment workflows, advanced fraud rules, or sophisticated fund distribution. Merchants requiring features like:

- Dynamic payment routing based on transaction characteristics

- Custom fraud scoring algorithms

- Automated vendor payouts

- Multi-party fund distribution

- Advanced subscription logic with flexible retry rules

These capabilities simply don’t exist within Shopify Payments, regardless of your subscription tier or processing volume. This reality drives thousands of merchants annually to investigate how Shopify third party payment providers can address these gaps while maintaining smooth checkout experiences for customers.

The ecosystem of payment processors for Shopify

Traditional payment gateways and their limitations

The marketplace of Shopify payment providers has evolved dramatically over recent years, with processors differentiating themselves through specialised features rather than competing solely on rates. Traditional gateways like WorldPay and Authorize.net still maintain their presence in the Shopify ecosystem, primarily serving established businesses with existing merchant relationships. However, these legacy providers often struggle with the demands of modern ecommerce, particularly around real-time reporting, API reliability, and support for emerging payment methods. Their integration with Shopify typically involves redirecting customers to external checkout pages, creating friction that can reduce conversion rates by 15-20%.

Next-generation payment processors built for modern commerce

The new generation of payment processors for Shopify takes a fundamentally different approach. Providers like Fondy have built their platforms specifically for the needs of modern digital commerce, offering direct API integrations that maintain the native Shopify checkout experience while adding sophisticated capabilities beneath the surface. These platforms recognise that payment processing extends far beyond accepting cards, encompassing the entire financial operations of an online business.

Modern payment providers understand that merchants need comprehensive financial infrastructure, not just basic transaction processing. They offer features like intelligent payment routing, automated reconciliation, and real-time analytics as standard rather than expensive add-ons. This integrated approach eliminates the need for multiple third-party services and reduces the total cost of payment operations.

Regional specialists and local payment methods

Regional specialists have carved out important niches within the Shopify payment provider landscape. European merchants, for instance, require SEPA direct debit support and compliance with PSD2 regulations, while Asian markets demand integration with local wallets like Alipay and WeChat Pay. The most successful Shopify third party payment providers maintain global reach while providing these crucial local payment methods, understanding that payment preferences vary dramatically across markets.

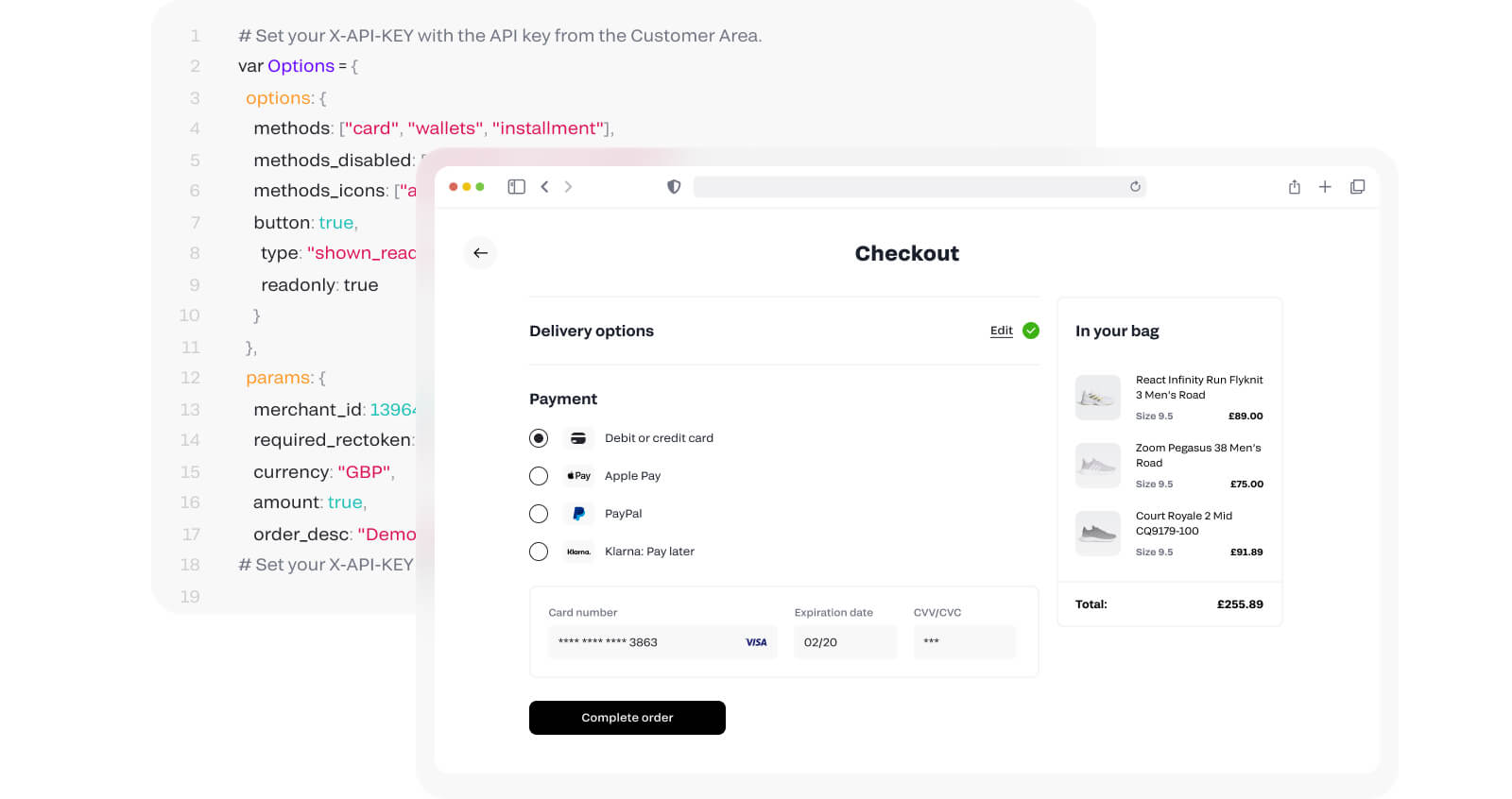

Technical integration approaches

The technical integration methods available for payment providers reveal another layer of complexity. While Shopify’s standard integration involves adding payment gateways through the admin panel, sophisticated providers offer multiple integration paths. Direct API integration enables custom checkout flows, hosted payment pages provide maximum security with PCI compliance simplified, and JavaScript SDKs allow for embedded payment forms that maintain site branding while processing transactions securely.

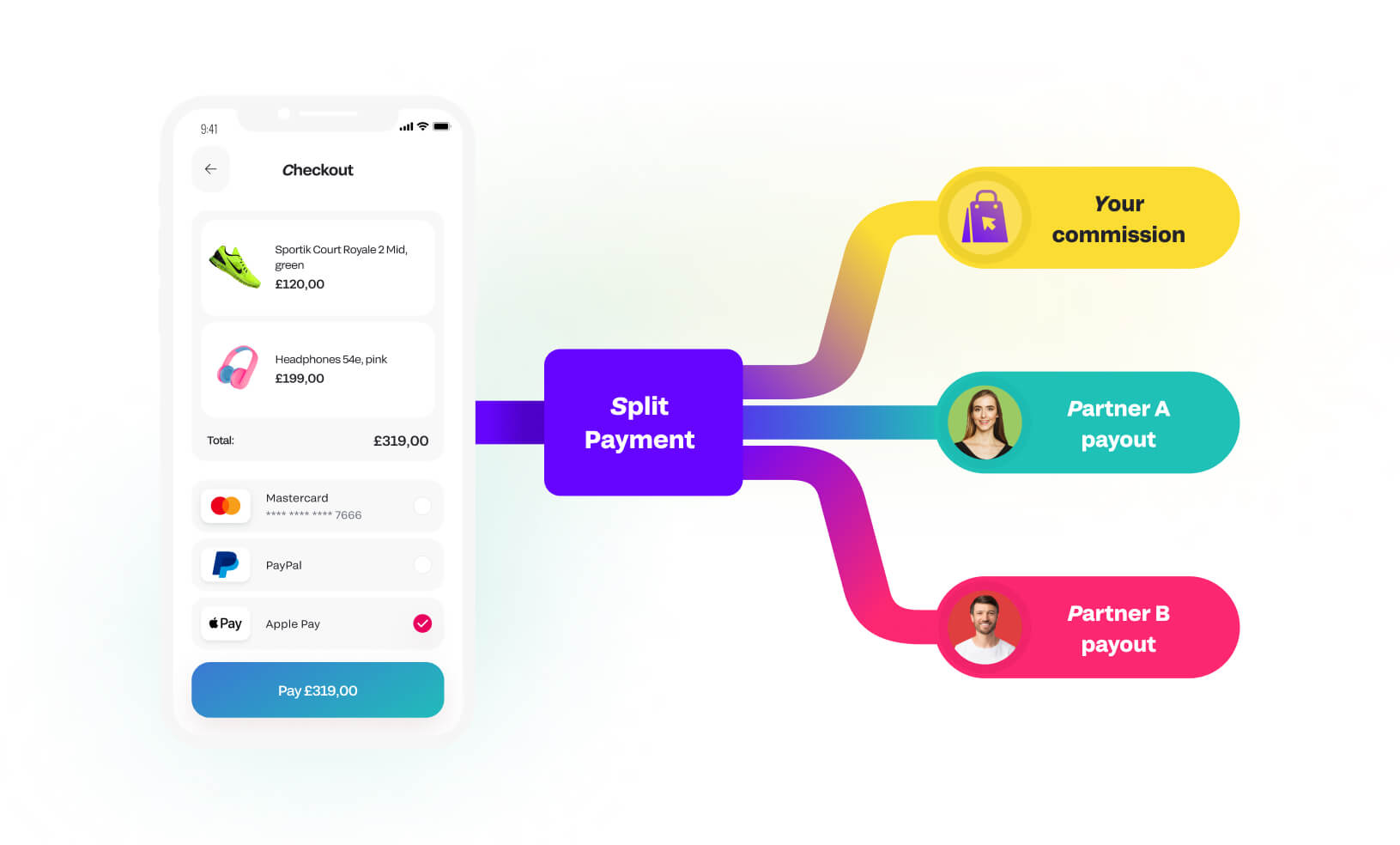

Shopify split payments: the missing piece for multi-vendor commerce

The absence of native Shopify split payments functionality represents one of the platform’s most significant limitations for marketplace operators and multi-vendor stores. Split payments automatically divide transaction proceeds between multiple parties according to predetermined rules, eliminating the manual reconciliation and separate transfers that otherwise consume hours of administrative time weekly.

Consider the operational complexity facing a Shopify marketplace with 50 vendors. Without automated split payments, each transaction requires manual calculation of commissions, individual transfers to vendor accounts, and detailed record-keeping for tax purposes. This process typically involves:

- Downloading transaction reports daily

- Calculating platform fees and vendor commissions in spreadsheets

- Initiating separate bank transfers to each vendor

- Tracking payment status and handling transfer failures

- Managing vendor queries about payment timing and amounts

This manual approach becomes unsustainable as transaction volumes grow, with the administrative burden often consuming more resources than the actual selling process. The lack of Shopify split payments forces many promising marketplace concepts to either abandon the platform entirely or invest heavily in custom development that replicates functionality readily available through advanced payment providers.

Modern split payment solutions transform this entire workflow through automation. When a customer completes a purchase, the payment processor automatically calculates and distributes funds according to your configured rules. Platform fees, vendor payments, affiliate commissions, and tax withholdings all happen instantaneously without manual intervention. Fondy’s split payment system, for example, handles unlimited recipients per transaction, supports complex commission structures including tiered rates and minimum fees, and provides real-time visibility into all fund flows for both platform operators and vendors.

The implications extend beyond operational efficiency. Automated split payments enable entirely new business models that would be impractical with manual processing. Dropshipping operations can pay suppliers instantly upon order confirmation, ensuring faster fulfilment and better supplier relationships. Subscription boxes can automatically compensate multiple product vendors based on customer selections. Service marketplaces can implement sophisticated revenue sharing agreements that incentivise quality and performance.

Technical architecture of modern payment processing

Understanding how Shopify payment processors integrate at a technical level helps explain the capabilities and limitations of different providers. The platform offers several integration methods, each with distinct implications for functionality, user experience, and maintenance requirements.

The standard integration through Shopify’s payment settings provides the simplest implementation but offers minimal customisation. Transactions process through Shopify’s checkout flow, with limited ability to modify the payment form, add custom fields, or implement specialised fraud rules. This approach works adequately for basic requirements but frustrates merchants needing more control over their payment experience.

Advanced providers like Fondy implement dual-path architectures that maximise flexibility while maintaining simplicity. Their Shopify app handles standard transactions through the native checkout, preserving the familiar customer experience and benefiting from Shopify’s conversion optimisation. Simultaneously, their direct API enables custom integrations for specialised use cases like split payments, subscription management, or B2B transactions with net terms.

The webhook infrastructure connecting payment processors to Shopify stores determines the real-time capabilities available to merchants. Basic integrations might only update order status upon payment completion, while sophisticated providers stream comprehensive event data enabling:

- Real-time inventory adjustments based on payment status

- Automatic fulfilment triggering for digital products

- Dynamic customer segmentation based on payment behaviour

- Instant vendor notifications for marketplace transactions

- Automated accounting entries for reconciliation

Payment processors that invest in robust webhook systems with automatic retry logic, event queuing, and comprehensive logging provide merchants with reliable, real-time payment data that powers automated business operations. This technical reliability becomes critical during high-volume periods when delayed or failed webhooks could disrupt order processing and customer communications.

Selecting the right Shopify payment provider for your business model

Choosing among Shopify third party payment providers requires evaluating far more than transaction fees. The optimal provider aligns with your business model, growth trajectory, and operational requirements while providing the technical capabilities and support necessary for sustainable scaling.

Start by mapping your current and anticipated payment requirements. Consider not just what you need today, but where your business will be in 12-24 months. Key evaluation criteria include:

- Geographic coverage and expansion potential. While you might only sell domestically today, choosing a payment provider with global reach eliminates the need for painful migrations when you’re ready to expand. Fondy’s support for 200+ countries and 30+ currencies provides this flexibility from day one, with local payment methods automatically available as you enter new markets.

- API documentation and developer resources. The depth of technical documentation directly impacts your ability to customise and extend payment functionality. Providers with comprehensive documentation, SDKs in multiple programming languages, and active developer communities enable your technical team to implement sophisticated payment flows without extensive support interactions. This self-service capability becomes invaluable when you need to move quickly on new initiatives.

- Support quality and availability. Payment issues don’t follow business hours, and delayed responses can mean lost sales and frustrated customers. Providers offering 24/7 support with technical expertise, not just basic customer service, prove their value during critical moments. Fondy’s round-the-clock support team includes payment specialists who understand both the technical and business implications of payment processing challenges.

- Feature completeness vs total cost. Calculate the true cost including transaction fees, monthly subscriptions for required features, and potential lost sales from limited payment options. Advanced providers like Fondy include features that cost hundreds monthly with other processors, often making them more economical despite potentially higher base rates.

- Integration complexity and timeline. Evaluate how quickly you can implement the provider and begin realising benefits. Solutions requiring extensive development or creating technical debt should be carefully weighed against those offering rapid deployment with progressive enhancement options.

Fondy: comprehensive payment infrastructure for ambitious merchants

Native split payment functionality that scales

After examining the landscape of payment processors for Shopify, it becomes clear why leading merchants choose Fondy as their payment infrastructure provider. The platform’s native split payment functionality stands out as a game-changer for marketplace operators and multi-vendor stores. Unlike competitors who treat split payments as an expensive add-on or require complex custom development, Fondy includes unlimited split payment recipients in their standard offering.

Configuration happens through an intuitive interface where you define commission structures, payment schedules, and distribution rules without writing code. The system handles everything from vendor onboarding with integrated KYC verification to automated tax withholding and year-end reporting. This comprehensive approach eliminates the operational overhead that typically constrains marketplace growth.

Seamless technical integration with progressive enhancement

Technical integration with Shopify demonstrates Fondy’s commitment to merchant success. The one-click installation through Shopify’s app store gets you processing payments in under 15 minutes, while the advanced API enables progressive enhancement as your needs evolve. This dual approach means you can start simply and add sophistication without changing providers or disrupting operations.

The platform maintains 99.95% uptime through redundant processing infrastructure, ensuring your payment processing never becomes a bottleneck. Intelligent routing increases acceptance rates by 7-12%, while advanced fraud prevention reduces chargebacks by 40%. These technical advantages translate directly into improved revenue and reduced operational costs.

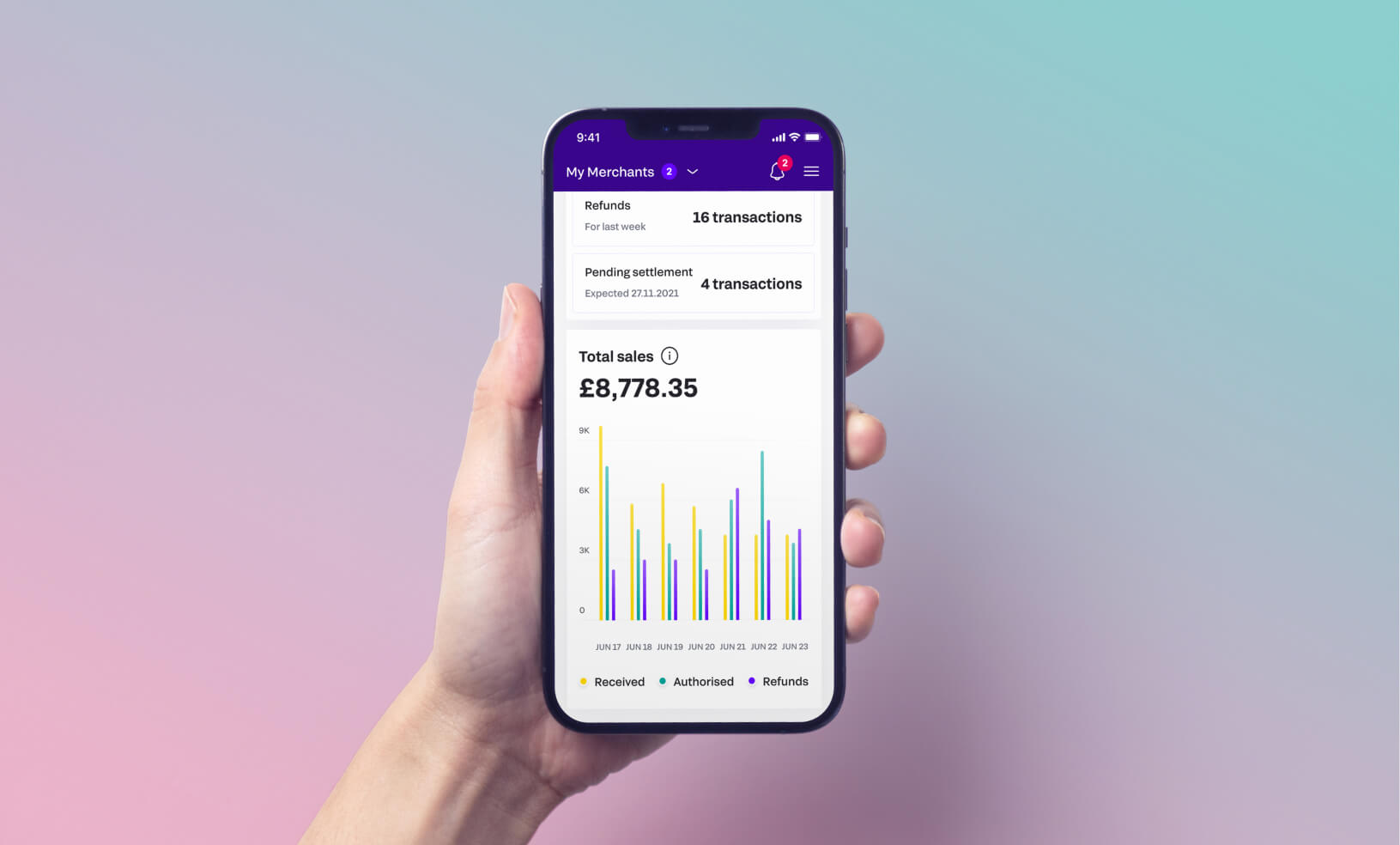

Real-time analytics and business intelligence

The real-time reporting and analytics dashboard provides unprecedented visibility into your payment operations. Track acceptance rates by payment method, monitor split payment distributions, identify fraud patterns, and analyse customer payment preferences through a single interface. These insights enable data-driven decisions about payment strategy, pricing optimisation, and expansion opportunities.

Performance metrics validate Fondy’s technical superiority:

- 15-20% decrease in cart abandonment with one-click checkout

- 30% recovery rate on failed recurring payments

- Instant settlement options for verified merchants

- Support for 200+ payment methods globally (Apple Pay & Google Pay for Shopify included)

- Automated compliance with PSD2 and other regulations

UK market advantages and local expertise

For UK merchants, Fondy’s competitive advantage becomes even more pronounced. Local acquiring relationships ensure optimal acceptance rates for UK cards, while FCA compliance and adherence to Consumer Rights Act requirements provide the regulatory confidence necessary for sustainable growth. The platform’s instant settlement option for verified merchants transforms cash flow management, providing immediate access to funds rather than waiting days for traditional settlement cycles.

Implementation best practices and migration strategies

Transitioning to a new Shopify payment provider requires careful planning to minimise disruption while maximising the benefits of enhanced capabilities. Successful migrations follow a structured approach that maintains business continuity while progressively adopting advanced features.

Begin with parallel processing, running your new provider alongside existing systems for a subset of transactions. This approach allows you to verify integration stability, train staff on new interfaces, and identify any edge cases requiring attention. Fondy’s implementation team guides merchants through this process, providing technical support and best practice recommendations based on thousands of successful migrations.

Customer communication plays a crucial role in smooth transitions. While backend payment processing changes remain invisible to most customers, those with saved payment methods or active subscriptions require careful handling. Fondy’s migration tools include customer notification templates and automated payment method updates that maintain continuity for recurring transactions.

Conclusion: positioning for sustainable growth

The evolution of ecommerce demands payment infrastructure that extends far beyond basic transaction processing. As marketplaces proliferate and business models become increasingly sophisticated, the limitations of traditional payment processors become barriers to growth rather than mere inconveniences. The question isn’t whether you need advanced payment capabilities, but when current limitations will force you to seek alternatives.

Shopify third party payment providers like Fondy demonstrate that accepting higher payment functionality doesn’t mean accepting higher costs or complexity. Through intelligent platform design, automated workflows, and comprehensive feature sets, modern payment processors enable business models that would be impossible with traditional solutions. The ability to automatically split payments among multiple vendors, maintain multi-currency accounts, and access funds instantly transforms payment processing from an operational necessity into a competitive advantage.

The investment in proper payment infrastructure pays dividends across multiple dimensions. Reduced manual processing frees staff for revenue-generating activities. Enhanced fraud prevention and higher acceptance rates directly impact top-line growth. Faster settlements improve cash flow and reduce working capital requirements. These benefits compound over time, creating sustainable advantages that become increasingly difficult for competitors to match.