If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- What are split payments, and how do they work on Flow Payments?

- The gig economy’s impact on traditional industries

- Integrating electronic health records with payment systems: advancing efficiency in MedTech billing

- The crucial role of payments in empowering gig platforms

- An introduction to recurring payments

- What is the Faster Payments Service (FPS)?

- A guide to eCommerce split payments

- A guide to instant and global payouts

- What is the SEPA payment method?

- What are quick payments in one click?

- What are cross-border payments?

- What is a payment link?

- What are open banking payments?

A guide to instant and global payouts

Need information about payouts? You’ve come to the right place. Continue reading to discover more about payouts such as:

- What payouts mean

- The types of payout payments

- The benefits of payout payments

- Payout payment speed

- The difference between a payout and a payee

- And more

What is a payout?

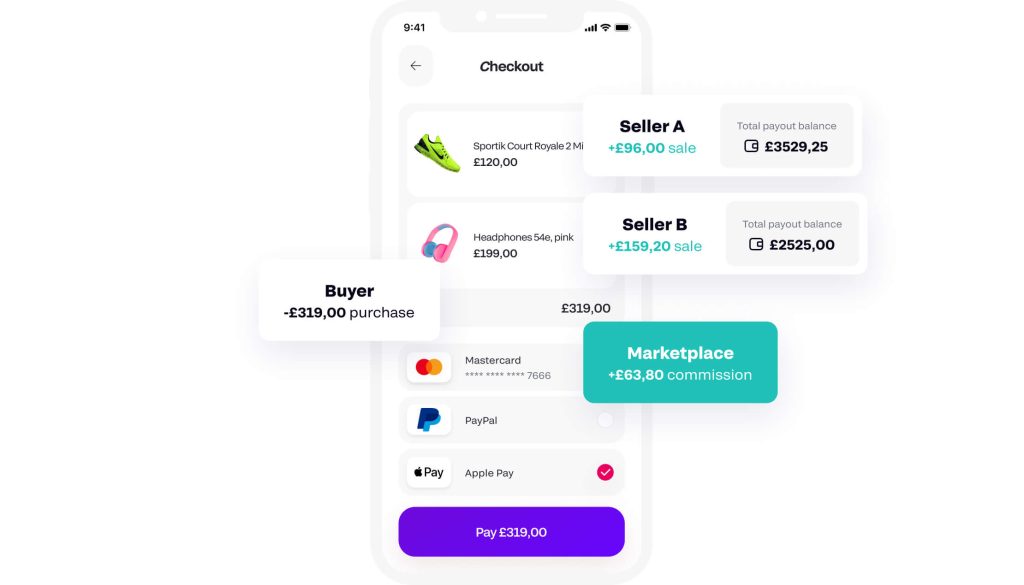

Payouts aren’t just another way of saying payments because payouts are frequent payments to individuals and companies that exist in a business ecosystem, such as service providers, gig workers, freelancers, on-demand workers, etc., by a company, such as marketplace solutions and platforms.

Take a global platform like Deliveroo. For every meal that gets ordered on the app account, the platform needs to send payouts to the bike courier’s account, the restaurant’s bank account, and possibly to a specific department within their own company.

Similarly, a company like Airbnb has to make payouts to their host’s account (homeowners) and, in some locations, to a local authority’s bank account, for instance, in order to pay city tax.

This is where a feature like payouts can be very helpful in streamlining and automating the process. That way, each member of the ecosystem can receive funds in their bank accounts promptly.

In certain cases, like refunds, you can use a payout feature to reimburse customers, suppliers, contractors, and partners. Payouts are also a great fit for any business dealing with instant, scheduled cross-border payouts to legal entities or individuals. That’s because payouts work with local banks and international and global bank cards and bank accounts across multiple countries and currencies.

The types of payment payouts

There are three common types of payouts:

- Single payouts.

- Mass payouts.

- Global payouts.

While a single payout is a single payment made from a single source to a single individual, a multiparty payout is a way to automate sending many payments, such as b2b and b2c payments, simultaneously.

Multiparty payouts are also initiated and sent from a single source and can save time and the expense of conducting the process manually. Multiparty payouts are useful for paying customers, freelancers, and partners in complex financial systems such as food delivery services, EdTech (educational platforms with different teachers), couriers, and ride-sharing apps.

Global payouts are cross-border payments that generally consist of a regular frequency of payments and are specific to the payout function of payment processing. Cross-border and global payouts are usually subject to a complex set of international laws and global tax regulations aimed at preventing the funding of terrorist activities and international bank account money laundering.

Payouts with Fondy

Payouts are a feature of both Fondy Flow accounts and the Fondy Gateway. Even better, our payouts can be instant, multicurrency, or multiparty (mass) in nature.

The Flow and Gateway accounts can be linked to supported bank accounts, to which you can then make instant payouts. At Fondy, you are able to make instant payouts to partners locally in 35 countries (only Fondy Gateway presently) using a single API. Simply set up automatic payouts from pre-selected wallets and accounts, whether yours, a partner, or a supplier’s account. You can request instant payouts any time or date, including weekends and public holidays, and fund amounts typically appear in the associated bank account within minutes.

With multicurrency payouts, companies can avoid the hassle of setting up multiple bank accounts in different currencies. With just one Fondy account, you can make multicurrency global payouts conveniently. That means paying your supplier and partner invoices in the local currency using local payment schemes and with the support of an IBAN.

How quick are payouts?

If you’ve heard of instant payouts, the good news is that they’re super quick. The other side is that they’re not exactly instant, as the name suggests. In the financial world, instant loosely means that a transaction can take as quickly as a couple of minutes instead of a number of hours or days.

While most payouts typically take several days to clear, instant payouts are usually complete in around 30 minutes. Instant payouts are a business feature that helps marketplaces and platforms manage the movement of funds from accounts when instant payouts have to be made to suppliers, customers, partners, etc.

Even better, the instant payouts feature usually includes an end-to-end account view of the funds. That means starting from received funds (settlements) until payments are sent (payouts), you’re always one step ahead when you use instant payouts in the same currency. That means that merchants can accept payments in their accounts in the same currency using local payment schemes.

The benefits of payouts

With a payment service provider like Fondy, wow the individuals and companies within your ecosystem with instant payouts. That means providing every entity involved a seamless experience, with funds or money in their account instantly within minutes. For entrepreneurs, marketplaces, and platforms, instant payouts are a cost-effective way to process payouts and digital or online disbursements.

Some other advantages of payouts include the following:

Real-time withdrawals

Give partners instant access to their funds across the UK and Europe.

Fast refunds

Automate sending instant refunds to your customer’s bank accounts.

No settlement anxiety

Payouts are unlikely to fail since account details are pre-checked via an API.

Low fees

Pay partners in your ecosystem in local currencies and save on fees and commissions.

Automation

Automate payouts, such as instant and mass payouts, to companies and individuals via a dashboard or API.

Marketplace and platform payouts

Give sellers and contractors immediate access to their earnings.

What is the difference between a payout and a payee?

A payout is an act of paying sellers, service providers, or gig workers by a company, such as marketplaces and platforms. However, a payee is the entity that receives the payout. For every payout, there is a payee.

The payee is a party in an exchange of goods or services who receives payment. These usually are sellers or service providers such as freelancers and gig workers. Payees can also be customers requesting refunds, users withdrawing their instant winnings from online casino accounts, or merchants accessing their earnings from a sale or transaction.