If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- What is pay-in and pay-out: a comprehensive guide to payment processes for online business

- Mastering delayed payouts: ensuring timely transactions with Fondy

- Streamline your payout process with our comprehensive payout system: low fees for outgoing financial transactions

- How to use payout gateway for outgoing payments on your platform

- How does split payment work for business with Fondy Flow

- A guide to eCommerce split payments

- What is split payment & how Flow Payments can help your business

- What are payouts: a guide to instant & global payouts for business

- How to split credit card payments online: solutions for platforms & marketplaces

- The gig economy’s impact on traditional industries

- Integrating electronic health records with payment systems: advancing efficiency in MedTech billing

- The crucial role of payments in empowering gig platforms

- An introduction to recurring payments

- What is the Faster Payments Service (FPS)?

- What is the SEPA payment method?

- What are quick payments in one click?

- What are cross-border payments?

- What are open banking payments?

How to use payout gateway for outgoing payments on your platform

Introduction

When running a two-sided platform, you often handle two distinct financial processes: receiving money from customers (through a payment gateway) and distributing funds to providers, sellers, or other partners (through a payout gateway). While both processes are vital, they serve different purposes and require dedicated solutions. A payment gateway focuses on helping you accept payments, whereas a payout gateway enables you to issue outgoing payments swiftly and securely. Fondy Flow is an all-in-one fintech solution that covers both aspects, yet the primary goal here is to explore how you can leverage its payout gateway features to enhance your platform’s outgoing payments.

Although the capacity to accept card payments, Apple Pay, Google Pay, or local methods remains an essential part of running a marketplace, many businesses struggle more with the mechanics of distributing funds to multiple parties. Whether you oversee a freelance platform, a rental marketplace, or a delivery service, having a robust payout system is critical for keeping partners satisfied and ensuring that everyone receives funds on time. By mastering the distinction between receiving payments and managing payouts, you can streamline your financial operations and maintain the trust of those who rely on your services.

Why your platform needs a dedicated payout gateway

Focusing on a specialised payout gateway can significantly benefit any marketplace or two-sided platform. Providers and sellers often prioritise how quickly and efficiently they can access their funds after a customer completes a booking or purchase. Delays or confusion around outgoing payments may frustrate your partners, leading to possible churn and reputational damage. With Fondy’s payout payment gateway, you can automate many of these processes and let your partners choose when and where they receive funds.

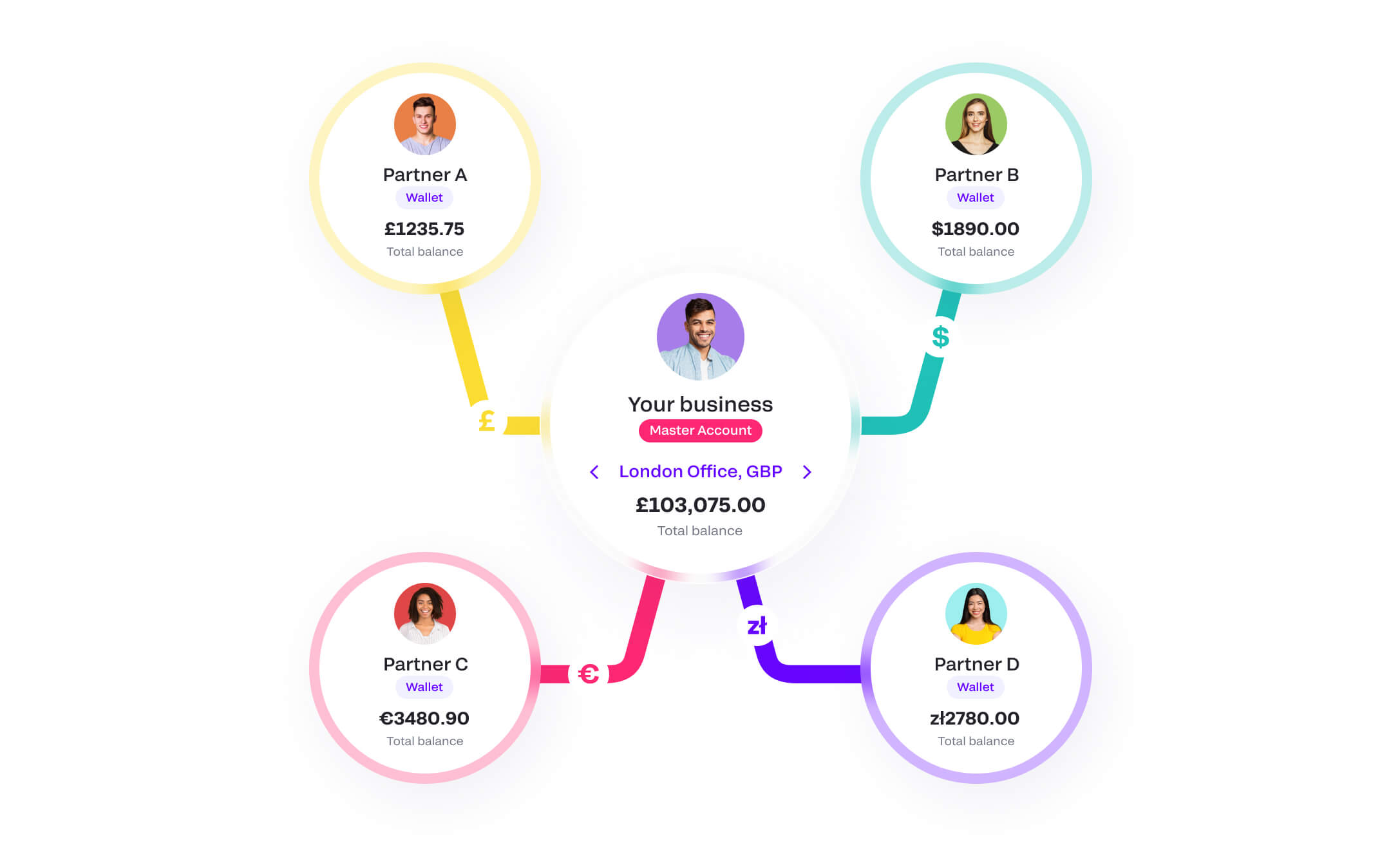

Another advantage of having a dedicated system is the flexibility to split payments among multiple parties, even when dealing with recurring subscriptions or complex billing scenarios. Some organisations need instant payouts, particularly if they work with contractors who expect immediate compensation, while others might prefer a delayed schedule that allows them time to manage potential refunds. A tailor-made payout gateway lets you configure these settings to match your business model and the expectations of your users.

With Fondy’s payout payment gateway, you can automate many of these processes and let your partners choose when and where they receive funds. This is particularly beneficial for gig economy platforms and marketplaces that handle B2C payouts. If you’re managing freelancer payments or need to simplify vendor payouts, check out our guide at the link above.

Setting up Fondy’s payout gateway

One of the first steps to ensuring a smooth flow of outgoing payments is choosing the right integration method. Fondy supports multiple approaches, including API connections, no-code solutions like payment links or invoices, and a wide range of plugins that work well with Shopify, Wix, WooCommerce, and other major e-commerce platforms. This flexibility allows you to set up your payout gateway in a manner that aligns with your platform’s technical capabilities and your team’s resources.

If you are a startup, you might prefer a quick, no-code integration that lets you manage payouts with minimal development effort. For larger companies, Fondy’s API and SDK facilitate a more customisable approach. In both cases, you have clear documentation and technical support, which reduce the potential for errors or delays in implementation. Once your payout gateway is integrated, you can configure how to issue payments to partners, decide whether to split them instantly or on a specific timeline, and ensure that multi-currency capabilities are in place for international transactions.

Automating compliance and onboarding

When dealing with outgoing payments, regulatory compliance is just as important as it is for receiving money from customers. Fondy includes automated KYC and AML checks to help you onboard providers while adhering to the relevant laws. By integrating these checks into your platform’s registration process, you lower the risk of unwittingly partnering with fraudulent or non-compliant individuals. This step is vital for both startups and established businesses, particularly those operating in multiple regions with diverse regulations. Once a seller or provider has passed the necessary checks, they can seamlessly receive payouts through your platform.

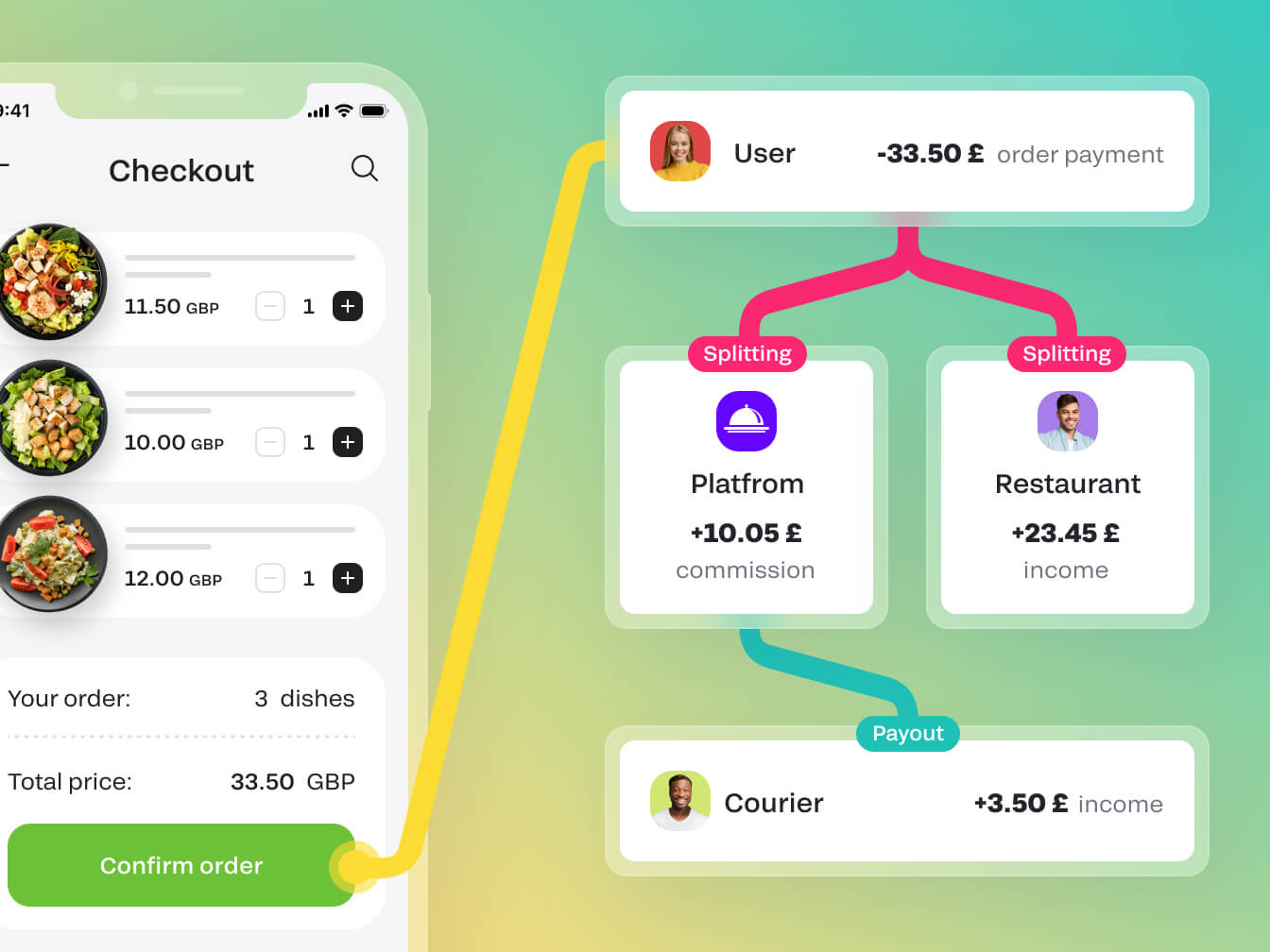

Managing split payouts for different business models

A payout gateway must accommodate different types of business models and transaction flows. If your marketplace handles single bookings or purchases, it may only need a straightforward approach, where one provider receives funds from each completed transaction. However, more complex operations might require splitting a single payment among multiple parties. A good example is a travel booking platform where funds must be distributed not only to the property owner but also to a local agent or cleaning service. Fondy’s split payments feature allows you to customise who receives what share and when they receive it, removing the need to juggle manual calculations and multiple transfers.

Recurring payments present another scenario that benefits from robust payout management. If your platform deals with subscription-based services, you want assurance that monthly or yearly fees are distributed accurately and on schedule. Automating these recurring payouts with Fondy helps you avoid time-consuming reconciliations and ensures that all parties involved receive funds according to the terms set. This system also offers real-time analytics, giving you immediate insight into where each payout goes and how often it occurs.

Maintaining transparency

Real-time tracking is a major factor in building trust with your users. When providers or sellers can see exactly when a payout is initiated and the amount they should receive, they are more confident in the platform’s reliability. Fondy’s dashboard lets you track payments and payouts in one place, and you can export this information for audits or in-depth financial analysis. The ability to generate custom reports simplifies the process of sharing data with stakeholders, whether they are accountants, investors, or external partners.

Payout methods to suit every need

Choosing how partners receive their funds can greatly influence user satisfaction. Fondy’s payout gateway offers several methods, including direct bank transfers via IBAN, card payouts, or the option to hold funds in a virtual IBAN account called Fondy Wallets. This variety is useful if you operate in regions where specific payout methods are more common or more convenient for your providers. For instance, card payouts can be particularly appealing for freelancers who may lack a traditional bank account, whereas some business-focused marketplaces may prefer routing all outgoing payments through IBAN transfers.

You can also determine if your platform needs to allow instant payouts, where providers receive funds as soon as a transaction is complete, or delayed payouts, which might be more appropriate for industries with high levels of returns or disputes. If you run a booking platform, you might prefer to release funds only after a grace period. In contrast, on-demand services might benefit from quick turnaround times that encourage providers to remain active.

How payment gateway fits in

Although accepting payments from customers is not the main focus of this discussion, it is worth noting that Fondy Flow does incorporate a powerful payment gateway alongside its payout functions. This aspect becomes particularly useful if you wish to consolidate all your financial transactions in a single system. Your platform can receive money through credit cards, Apple Pay, Google Pay, BNPL, or local payment methods, and then distribute funds via the same integrated dashboard.

For many two-sided platforms, combining both capabilities under one provider simplifies reconciliation and reporting. Multi-currency support also helps you expand internationally without partnering with multiple banks or financial institutions. While the emphasis here is on how to streamline outgoing payments, having a seamless payment gateway at your disposal can still enhance your operations by reducing the complexity of managing multiple vendors.

Scaling your outgoing payments

As your platform grows, your payout gateway infrastructure should be prepared to scale. Fondy’s cloud-based architecture can accommodate sudden increases in the volume of transactions, meaning you do not have to worry about system outages or delays that might occur during high-demand periods. For established companies, this reliability is crucial for maintaining confidence among sellers and other stakeholders, particularly if your platform experiences seasonal spikes in activity.

A dedicated account manager and VIP-level support can further assist in managing large transaction volumes and complex requirements. If you foresee major growth or plan to branch into new verticals, you can customise the system to accommodate these changes. This flexibility ensures your platform can keep delivering reliable payouts even when faced with evolving market demands.

Final thoughts on effective payout management

Ensuring timely and transparent outgoing payments is a hallmark of a trustworthy two-sided platform. By focusing on a payout gateway, rather than relying solely on a payment gateway, you can better serve the needs of your providers and partners who expect to be paid accurately and on schedule. Fondy Flow brings together the essential elements: split payouts, automated KYC and AML checks, and real-time analytics – under one solution that remains flexible for startups and established businesses alike.