If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- How to create, build, set up, and start a crowdfunding platform with expert insights & Fondy’s payment solutions

- App vs platform: discover the difference between an application and a platform for business with Fondy’s solutions

- Simplify B2C payouts for marketplaces and the gig economy with Fondy

- Flexible payout schedules and seamless settlement payouts for two-sided platforms

- Boost your growth with automated payouts by implementing payout automation on your platform

- International payouts with our innovative system for two-sided platforms

- Product vs Platform: exploring the benefits and choosing the right payment solution

- How to accept payment on marketplaces: a guide to streamline your platform

- How to create a platform: step-by-step guide for building an online success

- What is an online platform or marketplace platform: key insights & payment solutions

- How does marketplace work: a focus on online payments and payouts

- How to create a marketplace website with payment solutions designed to build growth

- Ecommerce Platform vs Marketplace: key differences and how to choose the right payment solution

- What is a SaaS platform: meaning, examples, and payment solutions to boost their performance

- The role of advanced APIs in enabling seamless payment flows for MedTech innovators

- Maximising positive impact: the synergy of AI, sustainability, and comprehensive payment solutions

- Deconstructing payment processing

- How to accept payments on social networks?

- What are the best payment gateways for WooCommerce?

- What is the best payment gateway for marketplaces and platforms?

App vs Platform: discover the difference between an application and a platform for business with Fondy’s solutions

Introduction

Understanding the difference between an app and a platform is essential in today’s digital economy. In an era when businesses constantly seek competitive advantages and seamless integration of services, it is important to consider the app vs platform debate and determine which model best supports a company’s strategic goals. This article aims to explore what an application is and how it differs between an app and a platform, while also examining the implications for businesses – particularly those operating within two-sided models. At the same time, it introduces Fondy’s two-sided payment solutions as a comprehensive fintech service that addresses the unique challenges faced by both applications and platforms.

Defining the terms

What is an App?

An app, in its simplest form, is a software solution designed to perform specific tasks and address particular business needs. Typically, an app is focused on delivering a singular function – whether that involves processing orders, managing communications, or providing a dedicated service. The term application is often used interchangeably with app, though the context can sometimes imply a broader scope of functionality. A well-designed application can significantly enhance customer experience. This app represents a cutting-edge solution in the market.

What is a Platform?

On the other hand, a platform is a multi-faceted ecosystem that connects various stakeholders and facilitates a wide range of interactions. The platform model supports the creation of network effects by enabling seamless communication and transactions between different user groups, such as providers and end-users.

Core differences between apps and platforms

The core difference between an app and a platform lies in their intended purpose and operational design. While an app is typically a self-contained solution aimed at delivering a specific function, a platform acts as a framework within which multiple applications, services, and users can interact. The phrase app vs platform is not merely a comparison of two technical constructs; it represents a strategic decision that impacts business operations, customer engagement, and revenue models.

When a business opts for an app, it is often seeking a simple and direct way to address a specific need. In contrast, choosing a platform signifies a commitment to fostering a broader ecosystem where multiple parties can interact, collaborate, and transact. The integration of a robust application can bridge the gap between isolated functions and comprehensive service delivery. The modern app is evolving rapidly to meet diverse business needs.

The two-sided business model and its challenges

Many businesses today face the challenge of deciding what approach suits their needs best. For instance, a startup might develop a niche app to solve a particular problem in a targeted market segment, whereas a larger enterprise may choose to build a platform that integrates several services and connects different user groups to drive network effects. This decision becomes even more complex when considering the integration of payment solutions.

In a two-sided model, efficient payment processing is critical, as it must handle transactions between diverse parties and manage payouts in a seamless manner. The importance of understanding what the difference between an application and a platform is becomes apparent when considering the operational challenges and opportunities that arise from managing two distinct sides of a business.

Leveraging a flexible application framework can help businesses adapt to two-sided market dynamics. Integrating a reliable app can simplify the management of two-sided transactions

The critical role of payment solutions in two-sided models

One of the most significant challenges in two-sided models is the handling of payments. Businesses must not only accept payments securely and efficiently but also manage the distribution of funds through split payments, automated payouts, and real-time reconciliation. In this context, the role of a payment solution becomes paramount. A robust system should support various methods, including card payments, digital wallets, local payment options, and emerging methods such as BNPL (buy now, pay later). Multi-currency support is also essential, enabling businesses to accept payments in native local currencies without incurring excessive conversion fees.

Fondy’s two-sided payment solutions offer a seamless, all-in-one fintech approach designed specifically for platforms and applications alike. By providing features such as payment acceptance, split payments, instant or delayed payouts, and automated seller onboarding, Fondy addresses many of the operational challenges inherent in managing a two-sided model. The solution is designed to be user-friendly and scalable, making it suitable for both startups and larger companies. With a transparent pricing structure and easy integration options, whether through no-code solutions like payment links and invoices or via API and SDK integrations – Fondy ensures that businesses can implement efficient payment processes without encountering hidden charges or complex technical hurdles. A dedicated application for payment management can streamline complex financial operations.

Detailed USP for startups

For startups, Fondy offers a range of benefits that simplify the integration of payment systems. Transparent pricing without hidden charges means that small businesses can budget accurately and avoid unexpected costs. A user-friendly design, complete with an analytics dashboard and real-time export options, allows companies to monitor their financial operations with ease.

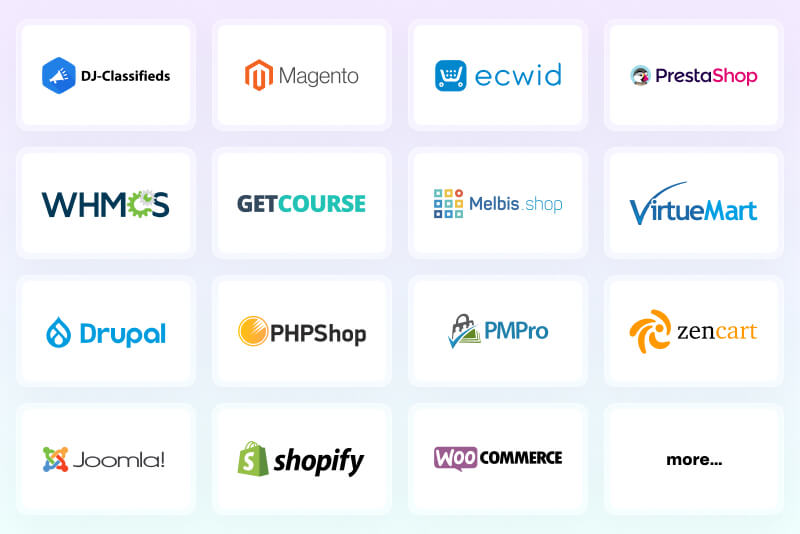

Fondy’s integration capabilities are designed for simplicity. With over 30 plugins available for popular platforms like Shopify, Wix, and WooCommerce, as well as straightforward API and SDK options, even those with limited technical expertise can implement a robust payment solution. This ease of integration, combined with features such as automated seller onboarding and flexible payout options, makes Fondy an attractive option for businesses that are just starting out and require a reliable payment system. A startup-friendly application design ensures rapid deployment and easy scalability. A user-friendly app can be a game-changer for startups.

Detailed USP for companies

Larger companies and established platforms also benefit from Fondy’s personalised payment solutions. These organisations often demand a higher level of customisation and dedicated support to manage their complex operational needs. Fondy’s cloud infrastructure ensures that the system can be upgraded rapidly, scaling up to meet increased transaction volumes without compromising performance. In addition, the provision of a dedicated manager during the migration process and the availability of VIP support ensure that larger enterprises receive the attention and customised service they require. For larger enterprises, a customizable application interface is crucial for managing high-volume transactions. An enterprise-grade app can boost operational efficiency significantly.

With clear pricing, a range of integration options, and features tailored to both application-based and platform-based business models, Fondy stands out as a comprehensive solution for modern payment processing challenges.

Future trends in digital payments and platform development

Looking ahead, the landscape of digital payments and platform development is set to evolve even further. Emerging trends such as the increasing use of artificial intelligence, enhanced data analytics, and the growth of mobile-first payment solutions are likely to shape the future of fintech. Businesses that are able to adapt to these changes by adopting flexible, scalable payment solutions will be well positioned to thrive in an increasingly competitive market.

Fondy’s approach to payment processing, which combines cutting-edge technology with a deep understanding of the unique challenges faced by both apps and platforms, is a strong indicator of how the industry is moving forward. Innovative application architectures are expected to drive future trends in fintech.

Best practices for integrating payment solutions with apps and platforms

Strategic considerations

When businesses evaluate the integration of payment solutions into their digital offerings, it is essential to consider strategic factors that align with overall business objectives. First, it is important to define what the business needs in terms of transaction volumes, currency support, and customer demographics. An effective payment solution should accommodate both an app and a platform, recognising that the app vs platform debate is not merely technical but also a matter of aligning the solution with the business model. Companies should analyse the specific functionalities required by their application and compare these with the broader ecosystem benefits that a platform can offer. This involves reviewing features such as split payments, automated payouts, and streamlined seller onboarding processes.

Another key strategic consideration is scalability. As businesses grow, the payment solution must be capable of handling increased transaction volumes without compromising speed or reliability. This is particularly important for two-sided platforms that serve both providers and end-users. It is advisable to choose a solution that offers cloud-based infrastructure, as this typically allows for rapid scaling and seamless upgrades. In addition, businesses should look for transparent pricing models, comprehensive documentation, and reliable technical support, as these factors can reduce the risk of unforeseen costs or integration challenges.

Moreover, the decision between developing a dedicated app and building an expansive platform can influence the payment solution’s integration strategy. A focused application may require a streamlined payment process that is quick and efficient, whereas a platform might benefit from more robust features to manage complex, multi-party transactions. Companies should therefore assess whether their primary objective is to deliver a specialised service via an app or to foster a dynamic ecosystem through a platform. Ultimately, aligning the payment solution with the business model ensures that the chosen system not only meets current needs but also supports future growth and diversification.

Technical & UX tips

On the technical side, smooth integration is critical to ensure that the payment process does not disrupt the overall user experience. A payment solution should offer easy-to-use APIs and plugins that allow for seamless incorporation into existing systems. This is particularly relevant for businesses implementing Fondy’s payment solutions, which are designed to support both applications and platforms with minimal friction. Developers should prioritise clear and concise documentation, which facilitates faster implementation and troubleshooting, ensuring that the system works reliably across different devices and operating systems.

From a user experience perspective, it is important that the payment interface is intuitive and responsive. Designing a checkout process optimised for both mobile and desktop users helps minimise friction during transactions. Features such as embedded and hosted checkouts can be employed to tailor the experience, ensuring that each step: from payment authorisation to confirmation is straightforward and secure. Clear visual cues and real-time feedback also play a critical role in reassuring users, thereby enhancing overall satisfaction.

Another technical aspect to consider is the integration of analytics and reporting tools. By incorporating real-time data monitoring, businesses can track transaction success rates, identify bottlenecks in the payment process, and implement data-driven improvements. A well-integrated analytics dashboard not only supports optimisation but also provides valuable insights into user behaviour across both an app and a platform.

Finally, maintaining regulatory compliance and robust security measures is essential. The payment solution should automatically incorporate fraud detection and compliance checks to ensure that all transactions adhere to legal standards. By combining these technical and user experience best practices with a clear strategic vision, businesses can create a seamless, efficient, and secure payment environment. This approach not only optimises financial operations but also enhances customer trust and paves the way for sustained growth in a competitive digital marketplace. Ensuring a seamless application integration is key to maintaining operational efficiency. An agile application strategy can significantly improve user satisfaction.

Conclusion

Ultimately, the decision between developing an app or building a platform hinges on a range of factors – from technical and operational considerations to strategic and user experience concerns. The app vs platform debate is not merely about choosing one model over the other; it is about understanding what the difference between an application and a platform truly is and aligning that understanding with a business’s broader goals.

As businesses navigate the complexities of the digital economy, it is imperative to recognise that the choice between an app and a platform carries significant implications. A well-designed app can deliver targeted functionality and a streamlined user experience, while a robust platform can foster broader engagement through the creation of a dynamic ecosystem. Regardless of the choice, the importance of integrating a secure, efficient payment solution cannot be overstated.

With Fondy’s all-in-one fintech solution, businesses can enjoy transparent pricing, simple integration, and a suite of features designed to support two-sided models. From accepting diverse payment methods and enabling split payments to automating seller onboarding and facilitating flexible payouts, Fondy provides the essential tools needed to optimise financial operations in today’s fast-paced market.