Use cases

Payments features

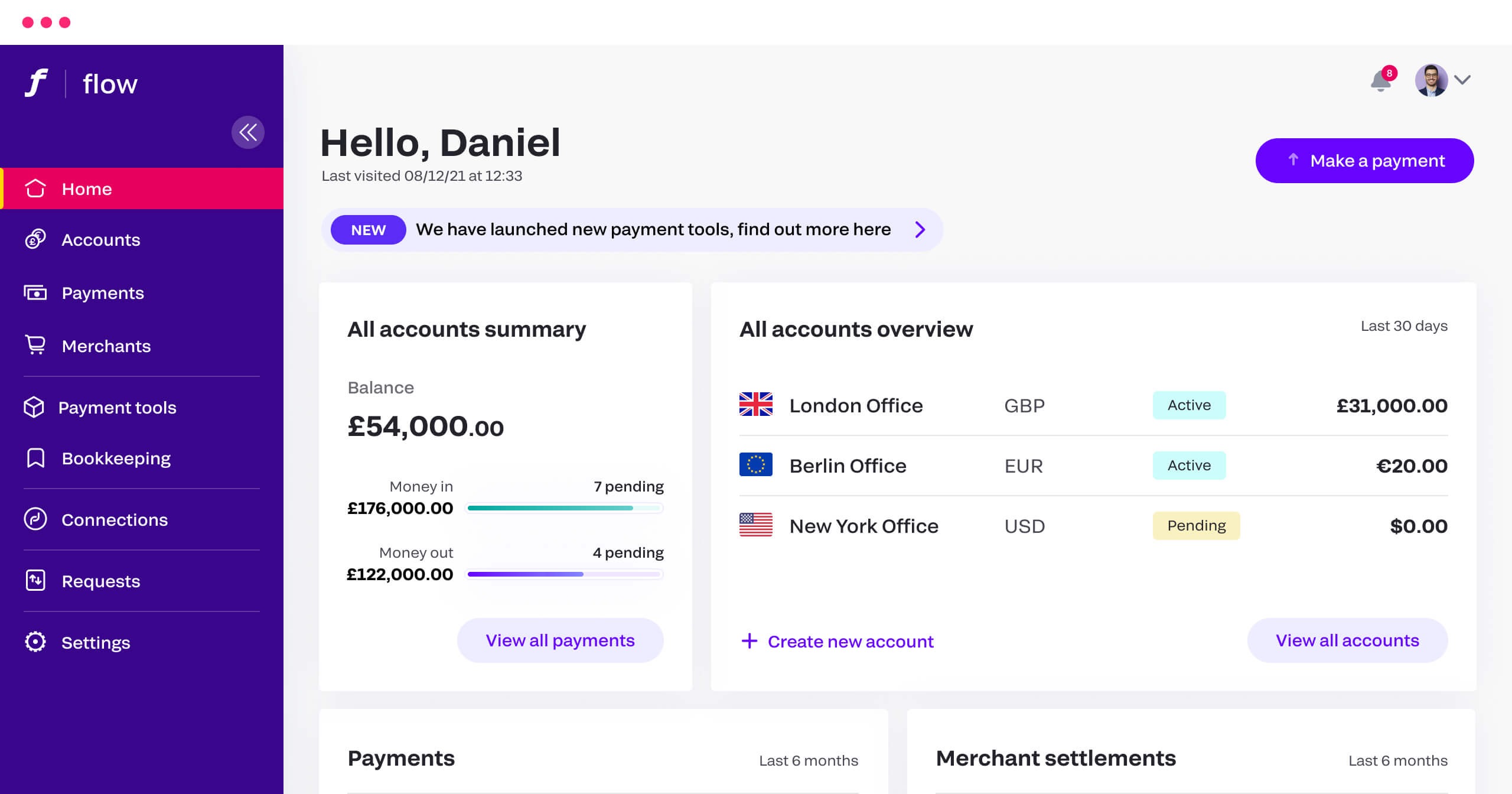

Create & manage business accounts

Open business accounts online: simply create new or switch existing ones with ease

Open multiple business accounts instantly and manage all your finances from one secure platform. No paperwork, no hassle – just smart banking designed for modern businesses.

Why businesses choose to open accounts with Fondy

Tired of traditional banking limitations? Fondy provides a refreshing alternative for companies seeking efficient financial management solutions. Our online business accounts give you the freedom to operate locally and globally without constraints.

Traditional banks often make opening business accounts unnecessarily complex, with lengthy application processes, branch visits, and extensive paperwork. Fondy changes this experience entirely by offering a digital-first approach that respects your time and business needs.

Simple setup process

Register your company details through our secure portal

Complete a streamlined verification process

Access your new account immediately and start transacting

Skip the branch visits and complicated paperwork. Quickly open your first business account online

Most businesses are verified and ready to go within minutes – not days or weeks as with traditional banks!

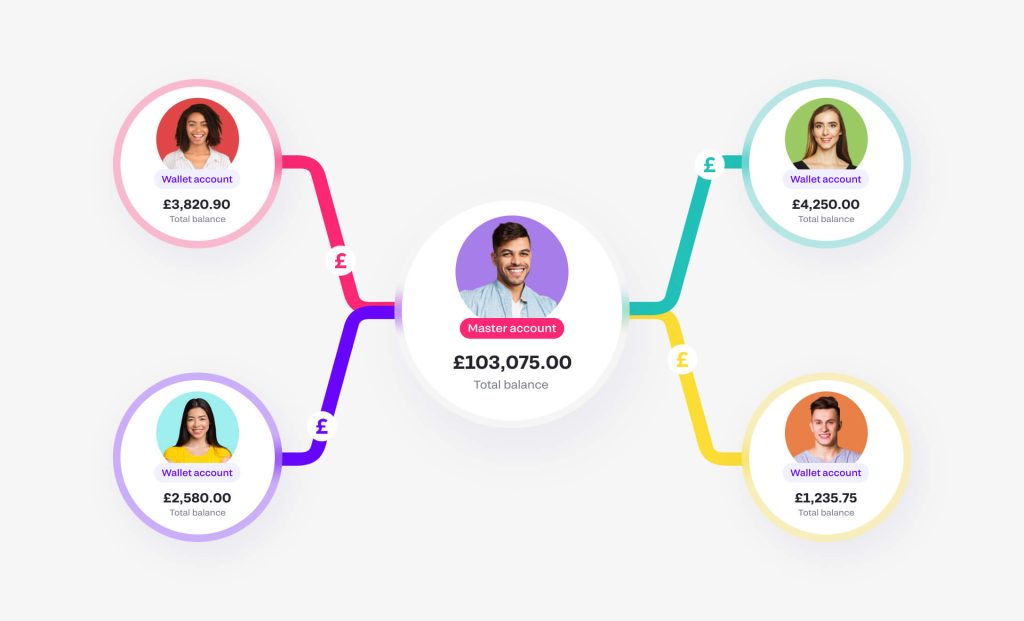

Multiple accounts for better organisation

Creating separate accounts for different purposes helps maintain financial clarity and simplifies reporting

With Fondy, you can establish a tailored account structure that matches your business operations perfectly.

Key benefits of multiple accounts include:

- Clear separation of funds for different business areas

- Simplified accounting and tax reporting

- Better cash flow visibility for each department or project

- Reduced errors in financial allocations

Each account comes with its own details, making it easy to track incoming and outgoing payments without confusion or misallocations.

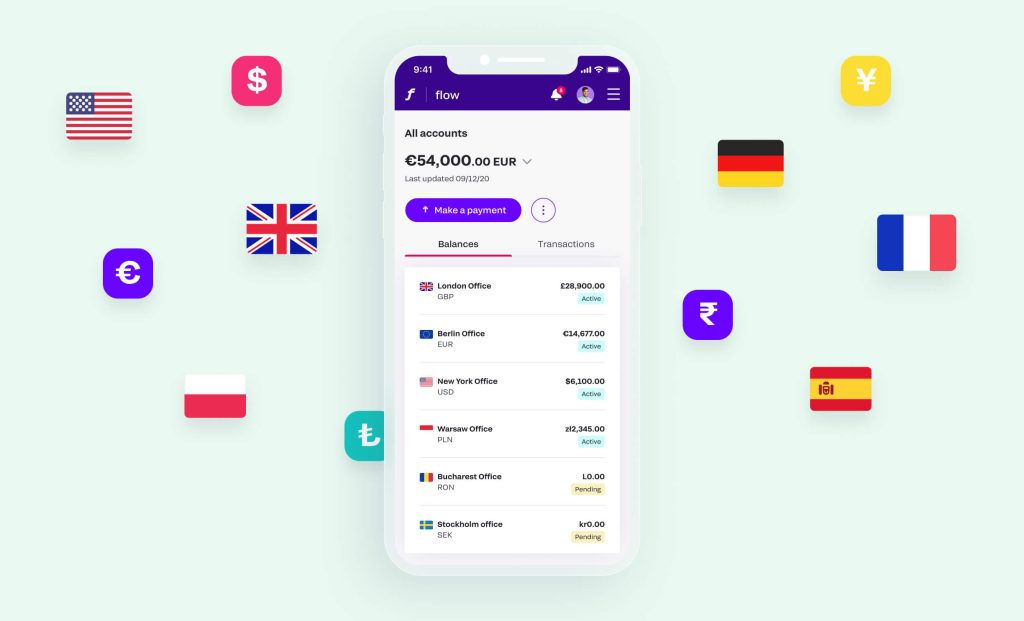

UK business accounts with global reach

Every Fondy business account includes full UK banking details while offering truly international capabilities. This combination gives businesses the best of both worlds – local financial presence with global transaction abilities.

Your accounts come with standard UK account numbers and sort codes, making domestic transactions seamless. Additionally, you receive international IBAN numbers that facilitate global transfers without complications. The ability to hold and exchange multiple currencies – including GBP, USD, and EUR – happens within the same platform, eliminating the need for multiple banking relationships.

How to open new business accounts that work harder for you

Opening business accounts should be straightforward – but they should also provide the functionality modern companies need. Fondy delivers both simplicity and power through its innovative approach to business banking.

Traditional financial institutions often force businesses into rigid account structures that don’t align with how companies actually operate. We’ve taken a different path, creating flexible account options that adapt to your business model rather than forcing you to adapt to banking limitations.

Why opening an account with Fondy is different

Unlike conventional banks, we’ve reimagined the entire account opening experience. No appointments needed, no waiting periods, and no frustration – just efficient business banking when you need it.

Our digital-first approach eliminates unnecessary delays:

- Complete application process entirely online

- Upload verification documents digitally

- Receive immediate notification when your account is ready

- Begin using your account the same day in most cases

This streamlined process respects your time while maintaining full compliance with financial regulations – proving that security doesn’t have to mean complexity.

Create additional accounts whenever you need them

As your business grows or your needs change, you shouldn’t face barriers to establishing new financial structures

With Fondy, expanding your account framework happens instantly, directly from your dashboard.

Your options include:

- Standard accounts with separate IBANs for distinct business functions

- Sub-accounts within a master account for departmental budgeting

- Multi-currency accounts for international operations

- Team accounts with customized access permissions

All of these options remain available through one intuitive dashboard, giving you complete visibility and control over your entire financial ecosystem without juggling multiple banking platforms.

Switch your business accounts with minimal disruption

Moving from your current bank to a new provider often creates anxiety about potential disruption to business operations. Fondy understands this concern and has created a switch process designed for maximum continuity.

Our practical switching approach includes:

- Keeping your old accounts active during transition

- Sharing new account details at your own pace

- Gradually moving recurring payments across

- Using both systems until you’re completely comfortable

This approach lets you switch at your own pace for a stress-free transition that prioritizes business stability.

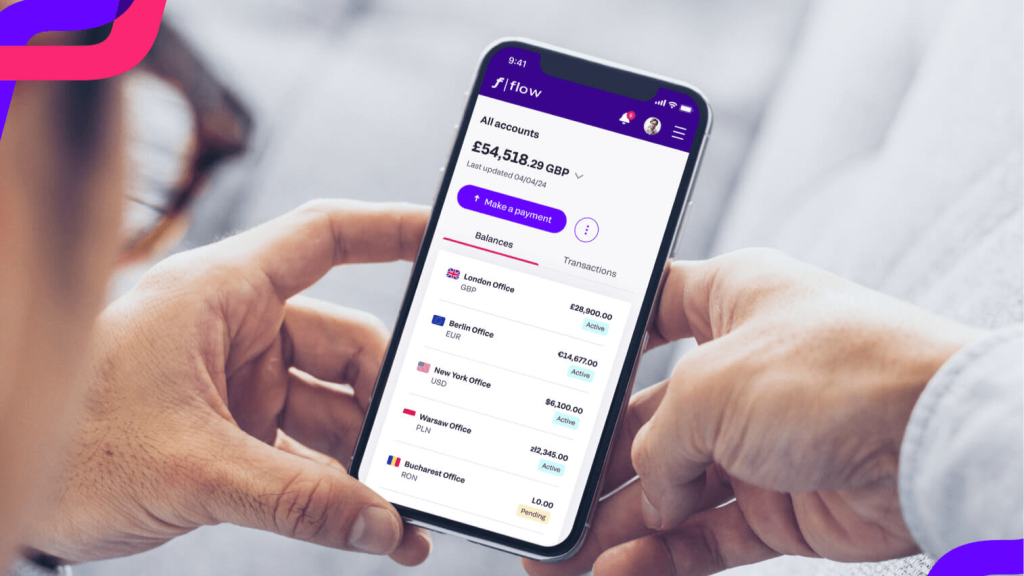

Virtual business accounts for the digital economy

In today’s digital landscape, physical banking infrastructure often creates more limitations than benefits. Fondy provides virtual business accounts specifically built for digital enterprises that operate at internet speed rather than banking hours.

Our virtual accounts offer all the functionality of traditional bank accounts while adding digital-first capabilities that align with how modern businesses actually operate. This approach eliminates legacy constraints while enhancing security, accessibility, and integration options.

Better than conventional business banking

Virtual doesn’t mean limited – quite the opposite

Our accounts provide enhanced functionality compared to traditional business bank accounts.

Key advantages include:

- Immediate access to incoming funds

- Real-time transaction visibility

- 24/7 online account management

- Streamlined international payments

- Enhanced digital security protocols

The absence of physical branches becomes an advantage rather than a limitation, with round-the-clock digital access replacing restricted banking hours.

Integrated with your business operations

Modern businesses operate as interconnected systems, yet traditional banking often sits apart from these workflows. Fondy changes this dynamic by making your accounts directly connectable to your business systems.

Link your accounts to your payment gateway for seamless revenue management that eliminates reconciliation headaches. Integration with popular accounting software creates automatic financial record-keeping that reduces manual data entry and potential errors.

This integrated approach transforms your finances from a separate management task into a natural part of your business infrastructure – saving time, reducing errors, and providing better financial visibility across your organization.

How businesses use Fondy accounts in practice

The true test of any business banking solution is how it performs in real-world scenarios. Across various industries, companies are transforming their financial operations with Fondy’s flexible business accounts.

E-commerce businesses

Online retailers leverage Fondy’s account structure to optimize their financial operations in several ways:

They separate marketplace revenue from direct website sales to track performance accurately. With dedicated accounts for handling customer refunds, they ensure these transactions don’t affect primary revenue reporting. Many also create supplier payment accounts to maintain clear records of inventory costs.

The ability to hold funds in multiple currencies streamlines international purchasing without constant conversion calculations – a significant advantage for businesses sourcing products globally.

Service businesses and agencies

Consultancies and professional service firms find different advantages in our system. Many establish client-specific accounts that ensure transparent project billing and financial segregation.

This approach simplifies expense tracking for client work and clarifies profitability on a client-by-client basis. Quick access to incoming funds enables timely supplier payments that maintain vendor relationships. For those with international clients, currency accounts eliminate exchange rate complications in both billing and reporting.

Startups and scale-ups

Growing businesses face unique banking challenges that Fondy directly addresses:

- Quick account setup without extensive company history

- Flexible structure that adapts as the business evolves

- Integrated payment acceptance for new products/services

- Cost-effective international capabilities from day one

These features support rapid growth without the banking constraints that often slow down expanding companies.

Open business accounts that grow with you

Business banking should never be a limiting factor in your company’s development. Fondy’s accounts adapt seamlessly as your business evolves, providing exactly what you need at each stage of growth.

Start with what you need today

Many businesses initially need straightforward financial tools rather than complex systems. Fondy lets you begin with a clean, simple structure that meets your current requirements without unnecessary complications.

A single business account provides complete functionality for basic transaction needs. Standard payment capabilities cover essential money movement without feature overload. Clear reporting gives you necessary visibility without creating information overwhelm.

This streamlined approach ensures you don’t pay for unused features or struggle with unnecessary complexity during your crucial early business phases.

Expand when your business requires more

As your business develops, your financial management needs naturally become more sophisticated. When this evolution happens, Fondy scales alongside you with advanced features that activate when you need them.

Your expansion options include:

- Multiple accounts for different business areas

- Team access with custom permissions

- Sophisticated payment workflows

- Custom integrations via our API

This scalable approach ensures your account structure remains aligned with your business reality at every stage – never constraining growth but always providing appropriate financial infrastructure.

Security and compliance when you open business accounts

Opening new business accounts inevitably raises questions about security and regulatory compliance. Fondy addresses these concerns comprehensively, maintaining robust protection while delivering modern banking functionality.

Protected by robust safeguards

Your funds and data remain secure with our multi-faceted protection strategy. As an FCA regulated financial institution, we operate under strict UK financial oversight that ensures appropriate controls and practices.

Our comprehensive security approach includes:

- Segregated client funds in protected accounts

- Advanced encryption for all transactions

- Multi-factor authentication for account access

- Real-time fraud monitoring systems

- Regular security audits and updates

This combination of bank-level security fundamentals with modern technological protection creates a defense-in-depth strategy for your business finances.

Compliant with financial regulations

Operating with full regulatory compliance isn’t just about security – it ensures your business banking meets all legal requirements and follows best practices in financial management.

Our KYC and AML procedures satisfy all UK requirements without creating unnecessary friction in account opening and operation. Ongoing transaction monitoring aligns with current financial regulations, protecting your business from inadvertent compliance issues.

Transparent audit trails record all account activities, providing verification capabilities when needed. Regular security and compliance reviews keep our systems updated with evolving requirements and threats.

The practical benefits of online business accounts

Moving beyond traditional banking brings tangible advantages to your daily operations. Companies that switch to Fondy’s online business accounts report immediate improvements in financial management efficiency.

Time savings become immediately apparent. Tasks that previously required branch visits or phone calls now happen instantly through your online dashboard. Payment authorizations that once needed physical signatures now complete in seconds with secure digital approval. Account statements and transaction histories are available on demand rather than waiting for monthly mailings.

Cost reduction represents another significant benefit. With lower fee structures than traditional banks, Fondy helps improve your bottom line directly. The ability to create multiple accounts without additional charges means you can implement ideal financial organization without cost penalties. International transactions cost a fraction of conventional bank rates, particularly beneficial for businesses with global operations.

Enhanced visibility into your finances provides strategic advantages beyond day-to-day convenience. Real-time balance information and instant transaction notifications help prevent cash flow surprises. Detailed categorization of income and expenses simplifies reporting and decision-making. The ability to grant selective access to team members improves collaborative financial management without compromising security.

Simple pricing with no hidden costs

- Business accounts from £10/month

- Transparent transaction fees

- No charges for account creation

- Cost-effective international transfers

- Volume discounts for growing businesses

Ready to open your business account?

Opening business accounts with Fondy takes just minutes. Experience the difference that purpose-built financial tools make to your operations.

Join thousands of forward-thinking companies who have already switched to Fondy’s business accounts. Our simple pricing structure eliminates surprises while providing full functionality.

Need help deciding? Our team is ready to answer your questions and guide you through the process.

Gateway

- Go borderless and accept payments from anywhere, anytime and anyhow

- Enable your customers to pay how they want wherever they are

- Enjoy full transparency with cost-effective pricing and zero hidden costs

Flow

- Access faster settlements with multicurrency IBAN accounts

- Enjoy multiple benefits and features including recurring payments and payouts

- Manage all the movement of funds from one convenient platform without a third party

We use cookies to ensure our web-based products are functioning properly while continuing to improve your browsing experience, offering social media functionality, personalising our marketing and advertising content to suit your needs. We sometimes share cookie data with our partners for these purposes. Our cookies remember your preferences and the data you fill out on forms on our web products. As well as analysing traffic, our cookies register how you found us and collect information about your browsing habits. By continuing to use our web products, you agree to our use of cookies.