If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

What are payment methods?

What do animal skins, tea bricks, and salt all have in common? They were all once used as currencies in a barter system. In trade, barter is a system set up to have transactions where goods or services are exchanged for other goods or services without using money.

Although we now use money as currency, the invention of the internet means a wide range of ways to spend it. Discover more about online and electronic payment methods, including the safest ways to pay for goods and services with your debit or credit card.

What are the different payment methods?

Payment methods are simply the different ways in which merchants can collect payments from their customers. In eCommerce, payment methods can fall under one of two categories, either global or local payment methods.

Among the most popular payment global payment methods include:

- Cash.

- Direct Debit.

- Cheques and bank transfers.

- Debit and credit cards.

- Gift card vouchers.

- Prepaid cards.

Whereas local payment methods are payment methods specific to one country or region. Some well-known local payment methods include:

- BLIK – a mobile payment method (Poland).

- EPS – an online transfer system (Austria).

- Dankort – a local debit scheme (Denmark).

- iDEAL – a digital wallet connected to a bank account (Netherlands).

- Klarna – a buy now, pay later provider (Sweden).

Local payment methods are important because they help increase payment acceptance. For instance, imagine a Polish entrepreneur based in Warsaw booking a hotel in New York for an upcoming business trip. Offering the BLIK local payment method at the checkout stage increases the likelihood that they’ll complete the purchase.

How to add a payment method

When you’re running an online business, your customers need multiple payment options. That way, they get the flexibility of paying how they want, and in turn, you can attract worldwide trade. But how do you add payment methods?

The easiest way is via the admin panel of your payment service provider. From there, you can assign certain payment methods to different countries or regions and choose which currencies and payment instruments you accept on your payment page.

How to add a payment method to a marketplace

On a marketplace like Etsy, it’s as simple as clicking a button on the payment methods you want. When you start selling on Etsy, your shop is enrolled in Etsy Payments, where your buyers can choose from payment options such as:

- Debit and credit cards.

- Etsy Gift Cards and Etsy Credits.

- PayPal.

- Apple Pay & Google Pay.

- Klarna.

- iDEAL.

- Sofort.

How to integrate a payment method into a custom domain

Whereas if your business has a custom domain on a web host platform, you can add payment methods via code or no-code integrations. You can usually find this information on the web host’s control panel.

With coded integrations, you’ll need the services of a developer, either in-house or a contractor. While you can add as many payment methods as you want, coded integrations can take up precious resources like time and finances. You can add payment methods such as online payment links, invoices, and subscriptions with no-code integrations.

Many hosting providers offer payment services integration as a part of their service pack, charge you separately for it, or help with custom integration. The top web hosts for payment services are GoDaddy, Wix, and Squarespace.

How to add an online payment method via a payment gateway

Alternatively, you can integrate a payment gateway to your website with the support of the web host provider. This integration option will be available in the control panel.

There are two types of payment gateways. There are hosted and non-hosted payment gateways. A hosted gateway redirects your customer to another secure site to complete the bank payment and then sends the user back to your website.

A non-hosted payment gateway, on the other hand, has payment technology that can be added to your website, allowing the transaction to take place in one place.

These payment methods generally redirect your customers to a payment page hosted by a payment gateway. From there, they can check out smoothly and securely.

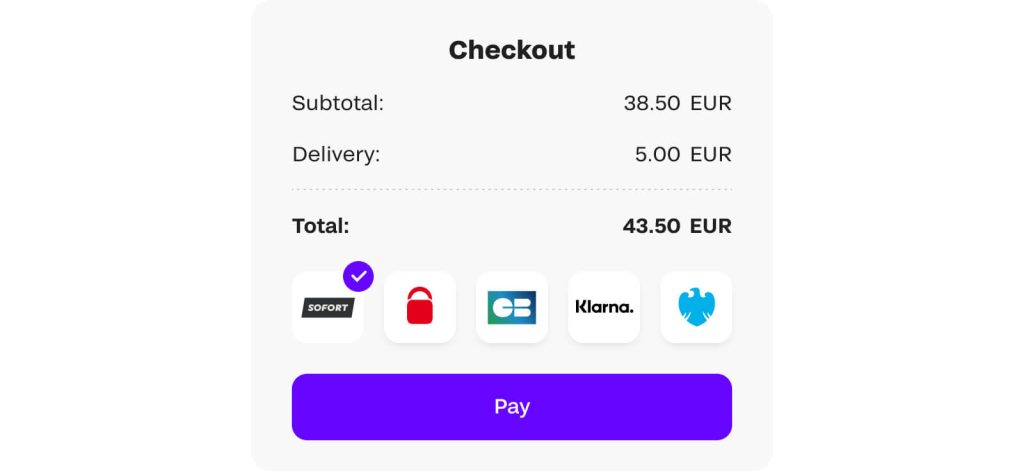

With a payment gateway like Fondy, with over 300 different payment methods, the most relevant methods relative to your customer’s location and currency can be set to appear at checkout.

What is the most common method of payment?

According to UK Finance, debit card payments account for around 40% of all online and in-person payments in the UK. This is followed by a mixture of cash, direct debit, and credit card payments. That said, US bank JP Morgan reports that mobile payments are growing at the highest rate among all payment methods.

On a wider scale, according to 2020 research from Global Payments Inc, the most popular payment methods in Europe were; debit and credit cards 43%, bank transfers 24%, digital wallets 21%, cash 6%, and others 6%. Whereas in Africa and the Middle East, cards account for 44%, cash 23%, bank transfers 14%, digital wallets 11%, and other 8%.

What is the safest method of payment?

That’s because each card payment must go through a card network like Visa or Mastercard to ensure that the payment is from a valid bank account. Additionally, both the merchant and the customer can contact the card network to resolve disputes.

What is the ideal payment method?

That’s a great question, but the answer depends on your business model. You might think, as long as buyers come through the proverbial door, does it matter how they pay? After all, money is money. Well, not really.

Ever wondered why some businesses don’t take American Express bank cards? The answer is simple – businesses want more revenue. Some payment methods, like American Express credit cards, charge merchants higher fees than other credit card networks like Mastercard and Visa. As a merchant, always do your research into which bank card networks work best for you in terms of charges, speed, and flexibility.

Although businesses like to offer multiple payment methods to their customers, there are some that they (secretly) prefer over others. These methods provide a mixture of cost-effectiveness and practicality with ease of use. These tend to be:

- Direct Debit.

- Bank card payments.

- Digital wallets.

- Cash and cheques.

- Payment gateways.

- Email invoices.