If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- WooCommerce recurring payments: how to set up subscriptions & monthly orders with Fondy gateway

- WooCommerce credit card processing: add a plugin to accept Visa & Mastercard with Fondy’s low-fee payment gateway

- Apple Pay WooCommerce plugin: how to add fast payment gateway to your store

- Google Pay for Shopify: how to add GPay and why use Fondy

- Apple Pay Shopify integration: how to enable, setup & best practices from Fondy

- Shopify payment provider guide: third-party payment processors and split payments solutions

- Shopify payment processing fees: complete guide to transaction costs and international payments

- Wix payment processing fees: complete guide to Wix credit card processing costs in 2025

- Shopify payments: What it is, how it works and how UK ecommerce businesses accept credit card payments

- How to accept payments on Wix: why Fondy beats other Wix payment gateways

- How to create a payment link: step-by-step guide to make or generate it online

- How does a payment gateway work to process online payments: a complete guide with examples

- What is the cheapest payment gateway in the UK: compare online payments for Ecommerce

- Payment gateway fees comparison 2025: find the low cost payment gateway for your business

- Top 10 payment gateways in the UK, Europe, and the World: 2025 list of most popular providers

- Complete guide to payment gateway integration: connect, setup, and implementation process for your website

- 10 best payment gateways for e-commerce in the UK or Europe & Why Fondy leads the way

- What is a payment gateway: a guide for entrepreneurs interested in e-commerce

- How to accept mobile payments?

- How to integrate payment gateway APIs?

- How to accept international payments and transactions?

- How to choose the best payment gateway for small businesses?

Shopify payments: What it is, how it works and how UK ecommerce businesses accept credit card payments

Running an online business in the UK requires a reliable way to process customer payments. For thousands of merchants using Shopify’s ecommerce platform, the choice often comes down to using Shopify Payments or connecting an alternative payment gateway. This decision affects everything from transaction fees and payout schedules to the range of payment methods available to customers.

The payment system you choose for your Shopify business directly impacts your bottom line. Shopify payment processing fees, holding periods, and payout delays can significantly affect cash flow, particularly for growing businesses that need quick access to their funds. Moreover, the ability to accept various payment methods can make the difference between completing a sale and losing a customer at checkout.

While Shopify Payments offers a straightforward solution for many merchants, it’s worth understanding both its capabilities and limitations before committing to this payment platform. Alternative providers like Fondy often provide more flexibility, faster payouts, and broader payment options that might better suit your business needs.

What is Shopify Payments: understanding the integrated payment solution

Shopify Payments is the platform’s built-in payment processing service, designed to simplify how merchants accept payments on Shopify stores. Rather than requiring a separate merchant account and payment gateway, this solution combines both services into one integrated system. When you activate Shopify Payments, your store gains the ability to process debit and credit card transactions directly through the Shopify admin panel.

The payment system operates as a fully managed service, meaning Shopify handles the technical infrastructure, security compliance, and banking relationships on behalf of merchants. This approach removes much of the complexity traditionally associated with setting up online payment processing. However, this convenience comes with certain trade-offs in terms of control and flexibility.

For UK merchants, Shopify Payments became available several years after its initial launch in North America, and it still doesn’t offer the same range of features available in other markets. The service processes standard card payments from major networks, but lacks support for many local payment methods that UK customers frequently use. This limitation can be particularly challenging for businesses targeting specific customer segments or those operating in niches where alternative payment methods are common.

The integration between Shopify Payments and the broader Shopify ecommerce platform creates a seamless experience within the ecosystem. Transaction data flows automatically into your reports, inventory updates happen in real-time, and order management stays synchronised. Yet this deep integration also means you’re locked into Shopify’s way of doing things, with limited ability to customise payment flows or implement advanced features that might benefit your specific business model.

It’s important to note that Shopify Payments isn’t actually a payment processor in the traditional sense. Behind the scenes, Shopify partners with established payment processors like Stripe to handle the actual transaction processing. This arrangement means you’re essentially paying for a middleman service, which explains why transaction fees through Shopify Payments often exceed those available when working directly with payment providers or through specialised gateways like Fondy.

How does Shopify Payments work: the technical process explained

Transaction flow and authorisation

When a customer makes a purchase through your Shopify store using Shopify Payments, the transaction follows a specific flow that begins the moment they enter their card details. The payment information gets encrypted and sent to Shopify’s servers, which then communicate with the underlying payment processor. This processor contacts the customer’s bank to verify funds and approve or decline the transaction.

The authorisation process typically takes just a few seconds, but several factors can affect transaction success rates. Shopify’s payment system uses basic fraud detection rules that sometimes flag legitimate transactions as suspicious, particularly for new businesses or those processing high-value orders. These false positives can result in lost sales and frustrated customers who find their payments unexpectedly declined.

These aren’t theoretical benefits; they’re practical tools that save hours of manual administration whilst reducing disputes and chargebacks. Settlement speed matters for cash flow, and Fondy delivers with rapid access to funds that helps businesses maintain healthy operations without the cash flow constraints that plague many growing companies.

Settlement and fund availability

Once a transaction receives approval, the funds don’t immediately appear in your account. Instead, they enter a settlement period where the money moves from the customer’s bank through various intermediaries before reaching your business bank account. During this time, the transaction remains in a pending state, visible in your Shopify admin but not yet available for withdrawal.

The settlement process for UK merchants typically involves a two to five day waiting period, during which your funds remain inaccessible. This delay can create significant cash flow challenges, especially during peak trading periods when you need immediate access to revenue for inventory purchases or operational expenses. Understanding what is Shopify Payments and its settlement timeline is crucial for proper cash flow management in your business.

Technical limitations and constraints

The technical architecture of Shopify Payments means all payment data stays within Shopify’s infrastructure. While this provides consistency, it also limits your ability to implement custom payment flows or integrate with external systems. For instance, if you need to split payments between multiple parties or implement complex subscription billing logic, you’ll find Shopify Payments lacks the necessary flexibility.

For businesses requiring more sophisticated payment processing capabilities, this closed system becomes a significant constraint. Payment platforms designed specifically for flexibility, such as Fondy, provide APIs and webhooks that enable custom integrations, automated workflows, and advanced features like payment holds, splits, and multi-currency processing with real-time conversion rates.

How to accept credit card payments on Shopify: setup and configuration

Setting up credit card processing through Shopify Payments requires careful attention to eligibility requirements and configuration details. Here’s the complete process for UK merchants:

- Verify your eligibility before starting: Your business must be registered in the UK with a valid company number, operate in an approved industry category, and maintain a UK business bank account. Check Shopify’s prohibited business list to ensure your products or services qualify for payment processing.

- Access the Payments section in Shopify admin: Navigate to Settings, then Payments in your dashboard. Click on “Choose provider” if you’re setting up payments for the first time, or “Manage” if you’re switching from another provider.

- Complete the business verification process: Provide your company registration details, VAT number if applicable, business address, and website information. Upload required documents including proof of business registration and bank account details. The verification typically takes 24-72 hours but can extend longer for certain business types.

- Configure your accepted payment methods: Select which credit cards to accept – Visa and Mastercard are standard, while American Express incurs higher fees. Note that you cannot selectively disable specific card types without completely removing credit card processing capabilities.

- Set up your payout schedule and preferences: Choose between daily, weekly, or monthly payouts (though actual receipt of funds still takes 2-5 business days). Configure your notification preferences for payment events and failed transactions.

- Implement fraud prevention settings: Adjust the automatic fraud analysis settings based on your risk tolerance. Decide whether to automatically capture payments or manually review orders above certain thresholds.

- Test the payment system: Process test transactions using Shopify’s test mode before going live. Verify that payment confirmations, inventory updates, and customer notifications work correctly.

For merchants who need to accept credit card payments beyond what Shopify Payments offers, connecting an alternative payment gateway provides more options. Services like Fondy integrate with Shopify through dedicated apps, offering the same seamless checkout experience while supporting over 200 payment methods including local UK options that Shopify Payments doesn’t provide.

Shopify payout methods and receiving money from sales

Understanding how and when you’ll receive money from Shopify sales is essential for managing business cash flow. With Shopify Payments, payouts follow a fixed schedule that varies based on your location and account standing. UK merchants typically wait two to five business days after a transaction before funds become available, though new accounts often experience longer delays during an initial review period.

The payout schedule in Shopify Payments operates on a rolling basis, meaning transactions from different days get bundled into single deposits. This consolidation can make accounting more complex, as you’ll need to reconcile multiple orders against each bank deposit. The system doesn’t allow you to request immediate payouts or adjust the schedule to match your business needs, which can create cash flow challenges during busy periods.

Shopify payments payouts go directly to your linked bank account, with no option to split funds between multiple accounts or redirect portions to different recipients. This limitation affects businesses with complex financial structures or those needing to automatically distribute revenue among partners or suppliers. The inability to control payout timing also means you can’t optimise for currency fluctuations if you’re processing international transactions.

The methods available for receiving payments through Shopify are limited to bank transfers, with no support for alternative payout methods like digital wallets or prepaid credit cards. This restriction might not affect established businesses with traditional banking relationships, but it can exclude merchants who prefer or require alternative financial services. Additionally, Shopify’s payout system doesn’t accommodate instant bank transfers, even when your bank supports faster payment rails.

Alternative payment solutions designed for modern ecommerce provide more flexibility in how merchants receive their funds. Fondy, for instance, offers payouts within one to two business days as standard, with options for same-day transfers in certain circumstances. The platform also supports multiple payout methods and currencies, allowing businesses to optimise their cash flow management and reduce currency conversion costs.

Common issues: Shopify Payments on hold and delayed access to funds

One of the most frustrating experiences for Shopify merchants involves having payments placed on hold without warning. Shopify payments holding money can occur for various reasons, from suspicious transaction patterns to changes in your business model. These holds can last days or even weeks, leaving businesses without access to funds they need for operations.

The automated risk systems that trigger payment holds often lack transparency, making it difficult to understand why your funds are frozen or what steps you need to take to release them. New businesses face particular scrutiny, with Shopify payments on hold becoming a common occurrence during the first few months of operation. Even established merchants can suddenly find their payments frozen if they experience rapid growth or change their product offerings.

When Shopify places a hold on your payments, the review process can be lengthy and opaque. You might need to provide extensive documentation about your business, supply chains, and customer relationships. During this time, you continue accepting orders and incurring costs, but without access to the revenue needed to fulfil them. This situation can quickly spiral into serious cash flow problems, especially for businesses operating on thin margins.

The criteria Shopify uses to evaluate risk often penalises legitimate business activities. Processing a large order from a new customer, expanding into new markets, or running successful marketing campaigns can all trigger holds. The system doesn’t distinguish between genuine growth and potentially fraudulent activity, applying the same restrictive measures regardless of your business history or relationship with Shopify. Many merchants researching what is Shopify Payments discover these limitations only after experiencing payment holds firsthand.

Many UK merchants have discovered that working with dedicated payment providers offers more predictable access to funds. Companies like Fondy maintain transparent policies about payment holds and provide direct support channels to resolve issues quickly. Their PCI DSS Level 1 certification and established relationships with UK banks mean fewer unexpected holds and faster resolution when questions arise.

Shopify Payments UK: specific features and limitations for British merchants

The UK version of Shopify Payments operates under different regulations and restrictions compared to other markets. British merchants face several specific challenges and limitations:

- Higher transaction fees for UK cards: Starting at 1.6% plus 20p for online transactions, rising to 2.5% plus 20p for manual entry payments, with international cards incurring additional charges that can push total fees above 3%

- Limited payment method support: No access to popular UK options like bank transfers, Open Banking payments, or UK-specific Buy Now Pay Later services that many British consumers prefer

- Strict compliance requirements: Mandatory adherence to Financial Conduct Authority regulations, requirement for specific business insurances, and complex consumer protection laws affecting payment processing and refunds

- Currency conversion challenges: Unfavourable exchange rates for international transactions, additional fees for multi-currency features, and lack of transparency in conversion costs that can significantly impact margins

- Restricted business categories: Many legitimate UK businesses fall into Shopify’s prohibited categories, including certain financial services, membership organisations, and businesses selling age-restricted products

- Geographic limitations: Unable to process payments from certain countries, restrictions on selling to specific regions, and complications for businesses operating across multiple UK entities

- Delayed access to features: New payment features and methods typically launch in the US market first, with UK merchants waiting months or years for access to innovations

These limitations become particularly problematic for growing businesses that need flexibility to adapt to market demands. The inability to offer preferred payment methods can directly impact conversion rates, while restrictive policies around holds and payouts create operational challenges that competitors using alternative Shopify payment providers don’t face.

For UK businesses seeking comprehensive payment solutions, platforms specifically designed for the British and European markets offer distinct advantages. Fondy’s direct UK integration provides access to local payment methods, competitive exchange rates for international transactions, and support tailored to British business needs.

Additional payment methods: expanding beyond basic card processing

Modern ecommerce success often depends on offering customers their preferred payment methods. While knowing how to accept Apple Pay on Shopify has become increasingly important, Shopify Payments provides only basic support for digital wallets. The integration lacks customisation options and doesn’t support the full range of features these payment methods offer.

The process of accepting payments on Shopify through alternative methods requires careful consideration of customer preferences and technical capabilities. Apple Pay and Google Pay integration through Shopify Payments works adequately for basic transactions, but doesn’t support advanced features like loyalty programmes, promotional offers, or custom payment flows that can enhance the customer experience and increase conversion rates.

European customers increasingly expect access to local payment methods like SEPA transfers, national banking systems, and region-specific digital wallets. Shopify Payments doesn’t support these options, potentially excluding large customer segments. For UK businesses selling to European markets post-Brexit, this limitation becomes even more significant as customers prefer payment methods that avoid international card fees.

The inability to accept certain payment types through Shopify Payments forces merchants to either lose potential customers or implement complex workarounds. Some businesses resort to managing multiple payment systems simultaneously, which creates reconciliation challenges and increases the risk of errors. Others simply accept the lost sales, not realising how much revenue they’re leaving on the table.

Payment platforms built for international commerce provide a more comprehensive solution. Fondy supports over 200 payment methods including credit cards, digital wallets, bank transfers, and local payment options across Europe and beyond. The platform automatically detects customer location and presents relevant payment methods, improving conversion rates while maintaining a seamless checkout experience. This intelligent payment routing ensures customers always see familiar, trusted payment options regardless of their location.

Fondy as the optimal payment solution for Shopify merchants

Quick and straightforward integration

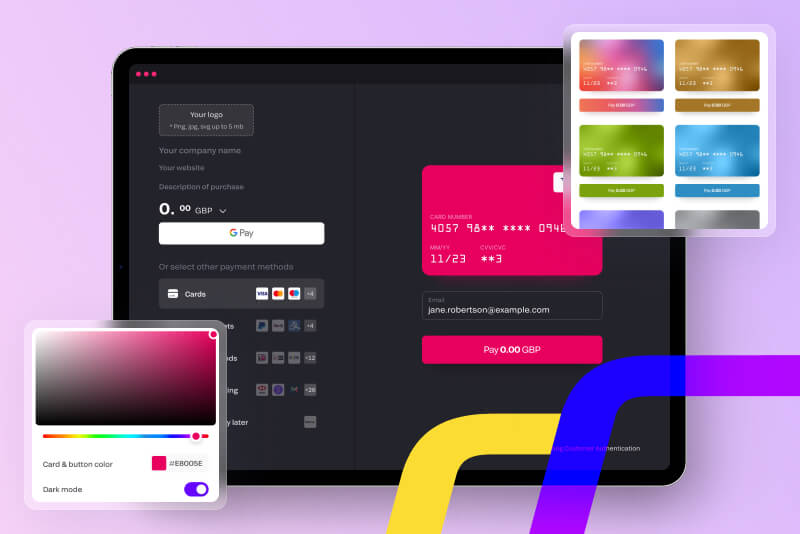

When evaluating payment solutions for your Shopify business, the ease of implementation matters as much as the features available. Fondy has been designed to get merchants up and running quickly, with a streamlined integration process that takes less than an hour. After creating your merchant account – which can be completed in minutes rather than days – you simply install the Fondy app from the Shopify App Store, enter your merchant ID and payment key, and configure your preferred settings.

The platform’s approach stands in stark contrast to the lengthy verification and setup required for Shopify Payments. There’s no waiting period for account approval, no complex documentation requirements, and no restrictions based on your business model. This means you can literally sign up in the morning and be processing payments with better terms by the afternoon.

Advanced checkout optimisation

Fondy’s checkout experience has been refined through processing over one billion transactions, resulting in a system that maximises conversion rates while minimising cart abandonment. The ClickToPay feature revolutionises the returning customer experience, allowing purchases to be completed with a single click. This eliminates the friction that causes many shoppers to abandon their carts at the final step.

The checkout automatically adapts to display relevant payment methods based on customer location, supports over 30 languages, and provides a mobile-first experience that works flawlessly across all devices. The intelligent routing system ensures customers always see familiar payment options, whether they’re in London, Berlin, or Warsaw. This localisation extends beyond just language – the entire payment flow adapts to local preferences and expectations.

Superior financial operations

For UK businesses concerned about cash flow, Fondy’s payout schedule provides significant advantages over standard Shopify Payments. Funds typically arrive in your account within one to two business days, compared to the two to five day wait with Shopify Payments. The platform also offers flexible payout options, allowing you to choose schedules that match your business needs rather than being locked into rigid timelines.

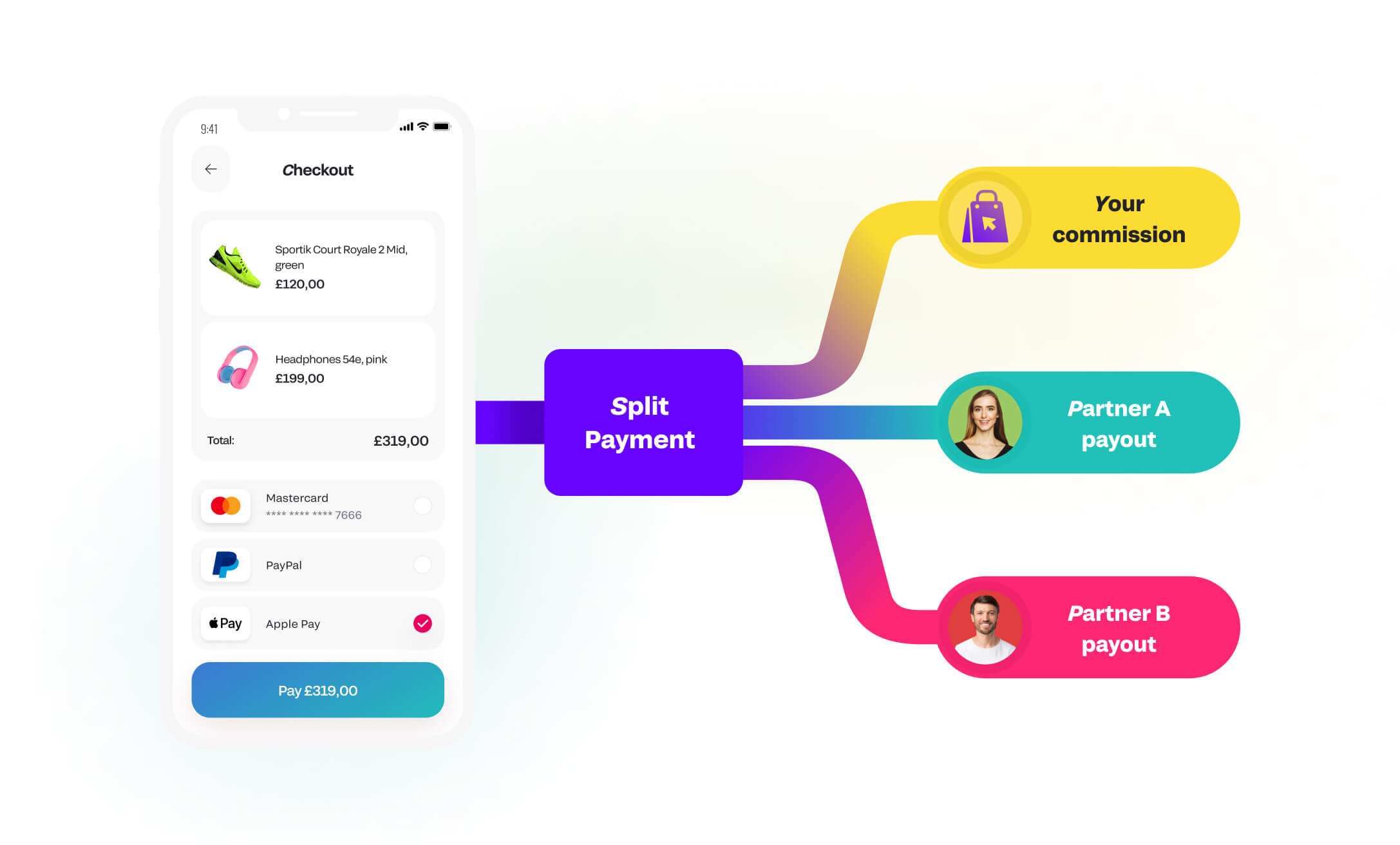

The platform supports sophisticated financial operations that Shopify Payments simply cannot match. Split payments allow marketplace operators to automatically distribute funds between multiple parties. Hold payments enable reservation-based businesses to secure funds without immediate capture. Subscription billing handles complex recurring revenue models with ease. These features come standard with Fondy, requiring no additional development or integration work.

Comprehensive multi-currency and international support

Multi-currency support through Fondy goes well beyond basic conversion services. The platform enables you to display prices in local currencies, process payments without forcing conversion, and manage foreign exchange exposure effectively. For UK businesses selling internationally, this capability can significantly improve conversion rates while reducing the cost of cross-border transactions.

The transparent pricing model means you always know exactly what fees you’re paying, with no hidden charges or surprise deductions. Unlike Shopify Payments, which buries currency conversion fees in unfavourable exchange rates, Fondy provides clear, competitive rates with full visibility into all costs. This transparency extends to all aspects of the service, from transaction fees to payout schedules.

Enterprise-grade security and support

As a PCI DSS Level 1 certified provider, Fondy maintains the highest security standards while keeping the payment process smooth for legitimate customers. The fraud detection systems use advanced analytics to identify genuine risks without flagging legitimate transactions, reducing the false declines that cost merchants valuable sales. The platform’s webhooks provide real-time updates on transaction status, enabling automation and integration with other business systems.

Perhaps most importantly, Fondy operates as a true partner rather than just a service provider. The platform offers dedicated support for UK merchants, with teams that understand local market requirements and can assist with everything from technical integration to optimising payment flows. The merchant portal and mobile app give you complete visibility and control over your payments, wherever you are.

Making the right payment choice for your business

Selecting the right payment solution for your Shopify store requires careful consideration of both current needs and future growth plans. While Shopify Payments offers convenience for basic payment processing, its limitations in terms of payment methods, payout flexibility, and international capabilities can constrain business growth. The platform works adequately for simple domestic transactions but struggles to support the diverse needs of modern ecommerce.

The true cost of payment processing extends beyond transaction fees. Delayed payouts affect cash flow, limited payment methods reduce conversion rates, and unexpected holds can disrupt operations. When evaluating payment providers, consider the total impact on your business including the opportunity costs of lost sales, the administrative burden of payment management, and the flexibility to adapt as your business evolves.

For UK merchants serious about growth, partnering with a specialised payment provider like Fondy provides clear advantages. The combination of faster payouts, broader payment method support, transparent pricing, and superior technical capabilities creates a foundation for sustainable business growth. The platform’s focus on the UK and European markets means you’re working with a provider that understands your specific needs and challenges.

The migration from Shopify Payments to an alternative provider is simpler than many merchants expect. Fondy’s support team can guide you through the process, ensuring continuity of service while upgrading your payment capabilities. Most businesses find they can complete the switch without any disruption to sales, immediately benefiting from improved features and better terms.

Conclusion

Your payment infrastructure shouldn’t hold your business back. With Fondy, you can create a merchant account this morning and be processing payments with improved terms by this afternoon. The platform’s no-obligation signup means you can explore the features and test the integration without commitment, seeing first-hand how professional payment processing can transform your business.

Whether you’re just starting your Shopify journey or looking to optimise an established store, Fondy provides the payment capabilities you need to succeed. Request a demo to see how the platform can reduce your payment costs, improve cash flow, and increase conversion rates. The Fondy team will explain how everything works, demonstrate the features most relevant to your business, and assist with the integration process.