If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

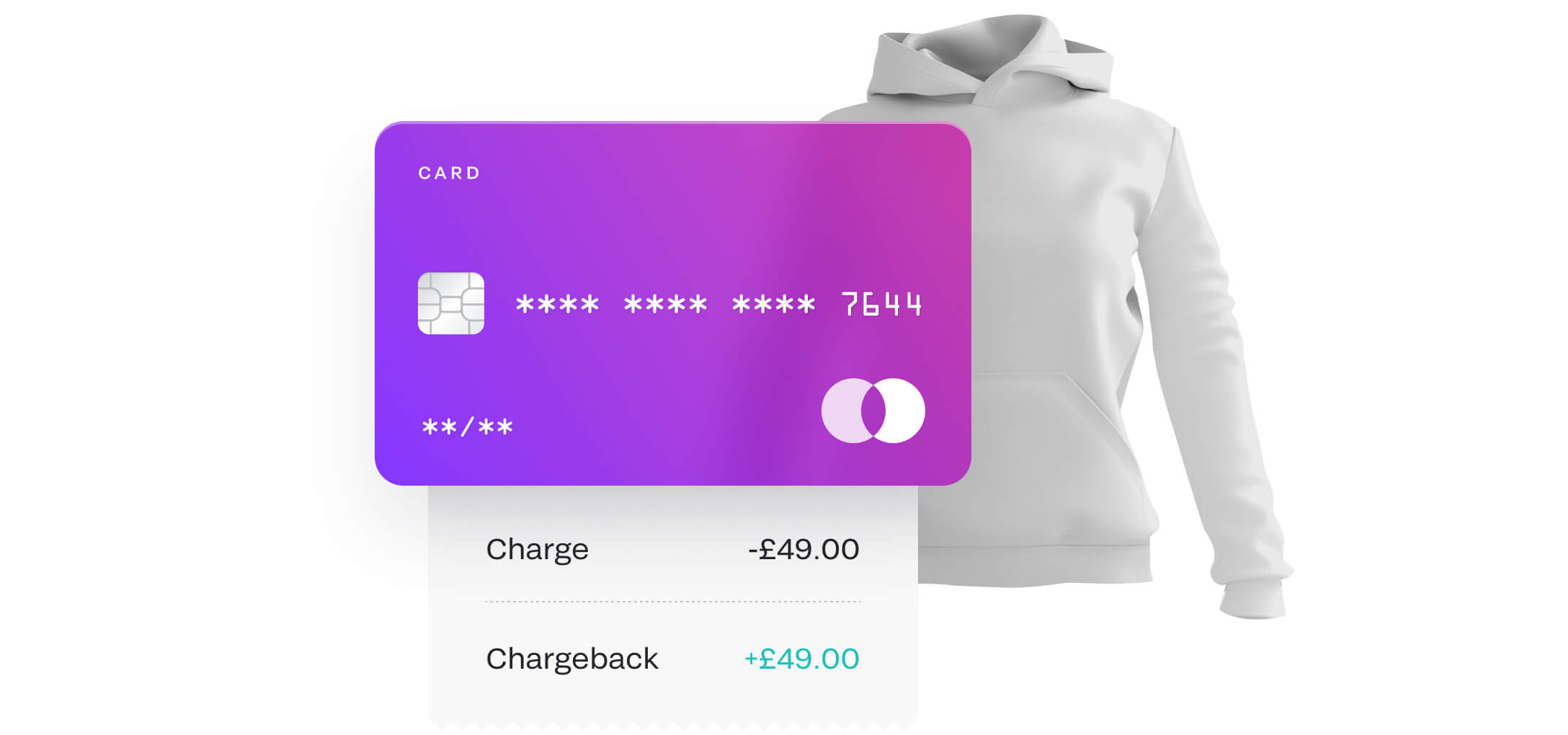

What are chargebacks and refunds?

If you’re wondering what chargebacks are and how they differ from refunds, you’re not alone. Continue reading our guide to refunds and chargebacks to discover more.

Difference between chargebacks and refunds

A chargeback is a sum of money that is returned to a debit card or credit card after a customer successfully disputes an item on their bank account statement or card transaction website report. Disputes usually arise if the goods or services you bought in-store or online don’t arrive, are faulty, you didn’t order them with your credit card, or don’t match the description or guide of what you ordered.

Refunds and chargebacks are similar because they both begin as disputes from fraud, card processing errors, or some dissatisfaction between the buyer and their purchase. In an ideal world, the dispute is taken to the merchant directly, and it becomes a refund. If not, your claim for a card refund might turn into a claim for a chargeback.

The key difference between chargebacks and refunds is who issues them to the customer. In the case of a refund, the merchant gives the customer the money back directly, whereas, for chargebacks, the consumer receives the funds from their debit card or credit card issuer.

Chargebacks could also be used if a retailer has charged your credit card or debit card multiple times for the same item or service or if you have been the victim of website bank credit card fraud.

How do chargebacks work?

As previously mentioned, if the goods you bought with your credit card or debit card don’t meet your expectations, you may have a case to make a chargeback claim. Your first port of call should be to request a refund from the retailer either in-person or on their online website. If they refuse or if they have ceased trading, you can then contact your debit card or credit card provider, who will then contact the retailer’s bank to make the card chargeback claim.

Chargebacks take place when the bank removes the funds from the retailer’s bank account and returns them to you. Sometimes, however, chargebacks can be challenged by the merchant if they feel the claim is unjustified.

Chargebacks with Mastercard

Merchants who accept customer payments using Mastercard credit cards need to be familiar with their chargeback process.

The chargeback process involves the following guide steps:

- The first presentment – the original transaction is the first time the charge is “presented” to the bank, hence, the initial presentment. The amount in question is taken from the credit cardholder’s bank account and credited to the merchant or seller.

- A request for information (optional) – if the cardholder doesn’t recognise a charge or doesn’t agree with the billed card amount, the bank may pass on a request for more information to the merchant.

- The first chargeback – if the merchant doesn’t respond to a request for information, the bank chooses not to send one, or the information provided doesn’t resolve the issue, the dispute will proceed to a chargeback. The first chargeback initiates the money credited back to the bank card holder from the merchant’s bank account. The first chargeback, if not challenged by the merchant, will normally signal the end of the card dispute.

- The second presentment – the merchant can fight the chargeback by re-presenting the charge to the bank. For the bank to accept the presentment and reverse the credit card chargeback amount, the merchant must submit website evidence that proves the chargeback is not valid.

- The pre-arbitration – if the issuer doesn’t find the merchant’s evidence convincing enough to reverse the chargeback, or if the credit cardholder presents new evidence supporting their claim, the case may go to pre-arbitration. At the pre-arbitration stage, the merchant can accept defeat in the dispute or decline the pre-arbitration stage. If they do decline the pre-arbitration stage, the credit card issuer can either return the chargeback or proceed to arbitration.

- The arbitration – once a case goes to arbitration, Mastercard will step in, review the evidence, and make a final decision on the credit card refund dispute. The losing party will also be charged a credit card fee. At the arbitration stage, the merchant could concede defeat in the credit card refund dispute at any time prior to Mastercard making a ruling. In this case, the credit card fee amount involved is normally reduced.

As an online one-stop payment platform, Fondy understands how business websites need to be flexible and accept various payment methods, including local card payments. Want to know more about us? Great! Check out how we do it on our About Fondy page on our website and discover what makes us tick. Alternatively, you can contact us on our Contact page.

Chargebacks with Visa

Most Visa chargebacks start similarly to Mastercard chargebacks, except with a few key differences:

- The first presentment – the original transaction. The charge is presented to the bank by the merchant after purchase and credited to the merchant’s store account.

- The dispute – the credit card holder has an issue with the transaction. This could be for a number of reasons, including that the credit card holder might not recognise the transaction or that the item or service arrived faulty or not as described. In response, the buyer calls the bank or credit card guide network.

At this point, the Visa chargeback process differs from other card networks due to VCR. Visa Claims Resolution (or VCR) is a credit card dispute initiative created in 2018 to reduce website procedure timelines and simplify online processes.

As VCR is a Visa-only initiative, it meant merchants and banks had to initially comply with an unfamiliar credit card website dispute process.

This caused confusion for many financial institutions that now had the following new steps and procedures:

- The bank investigation – a bank agent investigates the customer’s claim by asking for more transaction information on Visa’s VROL system. Meaning Visa Resolve Online, VROL helps the credit card network resolve online transaction disputes.

- The bank’s decision – the VROL system includes a program called Order Insight which helps in responding to bank queries and sending transaction information. Order Insight can help initially check if a complaint is invalid or illegitimate. If invalid, the credit card case is rejected and closed. If the claim is valid, though, the bank will proceed to the next step of the process.

- Bank designates a workflow – the bank feels the claim is valid, and the merchant can opt to issue a credit notice through Order Insight. Otherwise, the claim will be escalated to a full dispute. In the case of a full dispute, the bank in question will forward it to either an allocation workflow or a collaboration workflow.

The most noticeable difference between the two workflows is an additional round of communication between the parties before the credit card dispute goes to Visa for arbitration.

What is Visa Arbitration?

Visa Arbitration is reserved for when the banks, the credit cardholder, and the merchant are unable to resolve a dispute. At this point, Visa will review all the evidence and make a determination on the matter. Visa’s ruling is usually the close of the dispute process. The only time this isn’t the case is if one of the parties can provide more evidence in the case. In situations like this, the credit card dispute is then sent back to arbitration.

The step before arbitration is known as pre-arbitration. Allocation workflows and collaboration workflows need a pre-arbitration stage before arbitration can be requested.

As there’s no avenue to dispute a chargeback in the allocation workflow channel, the merchant must be sure that they can provide enough evidence to win a case before proceeding. That’s because whichever party loses the arbitration will have to pay a hefty fee amount.

Google Pay chargebacks

Google Pay takes on a role similar to a merchant’s payment service provider when it comes to handling credit card chargeback cases and return disputes.

When a credit card dispute claim is made, the customer’s bank will contact the credit card network, which will, in turn, contact Google Pay initially. Google Pay will then contact the merchant service requesting the chargeback and ask for additional online documentation.

Google Pay will then verify the new information, and if they decide in favour of the merchant, they’ll present the evidence to the card issuer, who’ll make a ruling on the matter.

If Google Pay rules against the merchant’s claim, they’ll pay the customer with credit taken from the merchant’s bank account. The merchant will also be liable for a chargeback fee.

Chargebacks on Google Pay are more complex because of the need for customer data. Most banks and financial institutions perceive this lack of information as proof that the customer’s claim is valid.

How to eliminate chargebacks with Open Banking

If you’re already familiar with Open Banking, you’ll know that one of the benefits of its functionality is that there’s no need for a card network. And without credit card networks involved, that means that merchants can remove the issue of chargebacks and costly processing fees.

As well as removing the costs of chargebacks, Open Banking offers a safer passage for funds and financial data. Unlike credit card and debit card payments, as there are no chargebacks with Open Banking, there’s no chargeback-associated fraud. Therefore Open Banking is a relatively more secure system for handling financial transactions.

How do credit card refunds work?

Credit card refunds tend to work differently than debit card refunds. That’s because, with debit cards or cash, the sale is made with your own money or funds. With credit cards, though, the purchase is made with credit, i.e., money that isn’t yours or the buyer’s, to begin with. As a result, any credit card refunds will, therefore, not be made out to you directly.

When you use a credit card to pay for goods or a service, the merchant requests payment from your credit card company but not from you directly. Your credit card service or provider will then settle the transaction by paying the merchant and will adjust your credit card balance to reflect the recent sale or purchase. You will eventually pay the credit card issuer back at the end of the month or whenever your credit card bill is next due.

If you change your mind about a product or service, the merchant will refund the credit card provider instead of you directly. Your credit card issuer will then credit your credit card account balance for the cost of any online refund or returned items or service.

Credit card refund payments

If you’re claiming a refund on an in-store or online credit card purchase, the good news is that there’s normally excellent legal protection involved with your claim. That’s because credit cards also provide several extra benefits related to online consumer protection services, guides against fraud, etc, making them a popular choice for large online or in-store purchases.

If the goods you receive are faulty or damaged, or the service you paid for was never provided, then you should be able to claim your money back through your credit card provider. In the UK, this protection falls under Section 75 of the Consumer Credit Act 1974.

Section 75 is a form of legal protection that protects you when using your credit card for purchases that cost between £100 and £30,000. The protection is that your credit card provider is as liable for any breach of contract as the seller. For instance, if a washing machine you bought in-store or online is faulty and you’re unable to get a refund from the seller, you can ask your credit card service for a refund or return it instead.

Section 75 can also help in unusual scenarios, including the merchant’s store going out of business before you receive your goods or you closing your credit card after the original purchase.

To claim your credit card refund, it’s best to contact the retailer first and ask about their refund and returns policy. Most merchants provide their own returns policies. These policies will usually include processes to issue refunds if you’ve changed your mind. You’ll normally need proof of purchase, such as a credit card receipt, store receipt, or online invoice, and be able to return the item in unused condition. If the product is faulty or broken, you have the right to a full cash refund or credit card refund within a calendar month.