If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- WooCommerce recurring payments: how to set up subscriptions & monthly orders with Fondy gateway

- WooCommerce credit card processing: add a plugin to accept Visa & Mastercard with Fondy’s low-fee payment gateway

- Apple Pay WooCommerce plugin: how to add fast payment gateway to your store

- Google Pay for Shopify: how to add GPay and why use Fondy

- Apple Pay Shopify integration: how to enable, setup & best practices from Fondy

- Shopify payment provider guide: third-party payment processors and split payments solutions

- Shopify payment processing fees: complete guide to transaction costs and international payments

- Wix payment processing fees: complete guide to Wix credit card processing costs in 2025

- Shopify payments: What it is, how it works and how UK ecommerce businesses accept credit card payments

- How to accept payments on Wix: why Fondy beats other Wix payment gateways

- How to create a payment link: step-by-step guide to make or generate it online

- How does a payment gateway work to process online payments: a complete guide with examples

- What is the cheapest payment gateway in the UK: compare online payments for Ecommerce

- Payment gateway fees comparison 2025: find the low cost payment gateway for your business

- Top 10 payment gateways in the UK, Europe, and the World: 2025 list of most popular providers

- Complete guide to payment gateway integration: connect, setup, and implementation process for your website

- 10 best payment gateways for e-commerce in the UK or Europe & Why Fondy leads the way

- What is a payment gateway: a guide for entrepreneurs interested in e-commerce

- How to accept mobile payments?

- How to integrate payment gateway APIs?

- How to accept international payments and transactions?

- How to choose the best payment gateway for small businesses?

Complete guide to payment gateway integration: connect, setup, and implementation process for your website

In today’s digital economy, accepting online payments isn’t just convenient — it’s essential for business growth. Whether you’re launching a new e-commerce website, upgrading your current payment system, or expanding into new markets, integrating the right payment gateway can make all the difference in customer satisfaction and sales conversion.

This comprehensive guide walks you through everything you need to know about payment gateway integration, from technical preparations to implementation strategies across different platforms. We’ll cover the practical aspects of connecting payment services to your website while keeping your customers’ data secure and their checkout experience smooth.

For those seeking to understand the fundamental concepts of payment gateways before diving into integration details, we recommend first reading our article: What is a payment gateway & how does it work in e-commerce?

Technical preparations and planning for payment gateway integration

Successful integration of a payment gateway begins with thorough planning. Assessing your website architecture is the first step. Custom-built websites demand tailored approaches compared to platforms like WordPress or Shopify. Evaluate your team’s expertise with payment APIs, estimate transaction volumes for scalability, and align the system with your business model, whether it’s subscriptions, one-time purchases, or a marketplace. Mapping the customer payment journey: from product selection to receipt delivery, clarifies where the payment gateway fits and highlights technical requirements. Gathering business registration documents, bank details, and expected transaction volumes streamlines account setup with payment providers, ensuring a smooth start to the payment gateway integration process.

Selecting the optimal integration method

Payment gateways offer multiple integration options, each with distinct advantages and technical requirements. Your choice significantly impacts development time, customer experience, and security responsibilities.

Before diving into specific integration methods, it’s helpful to understand the complete transaction flow from a technical perspective. For a detailed payment gateway example that illustrates step-by-step how payment data moves through the system: from the moment a customer clicks “pay” to the final settlement in your account — check out our comprehensive guide by clicking on the link above. Understanding these underlying processes will help you make more informed decisions about which integration approach best suits your technical capabilities and business requirements.

Direct API integration

Direct API integration provides maximum control over the checkout experience, ideal for businesses with unique requirements. It allows seamless branding and custom logic but demands significant development expertise and ongoing maintenance. Full PCI DSS compliance may be required, increasing security responsibilities. This method suits companies with dedicated teams capable of handling complex payment gateway implementation.

Plugin integration for e-commerce platforms

For platforms like WooCommerce, Shopify, or Magento, pre-built plugins simplify online payment gateway integration. These require minimal coding, enabling setup in under an hour. Plugin developers handle updates, and the solutions are pre-configured for common scenarios. This approach is perfect for small to mid-sized businesses seeking efficiency without sacrificing functionality in their website payment gateway integration.

Mobile SDK integration

Businesses with mobile apps benefit from SDKs optimized for iOS, Android, or cross-platform frameworks like React Native. These kits ensure a native mobile experience, supporting features like Apple Pay or Google Pay. Built-in security and touch-friendly interfaces enhance the payment gateway integration in mobile environments, catering to the growing mobile commerce trend.

iFrame and hosted payment pages

For businesses prioritizing security and speed, iFrame or hosted payment pages embed secure forms within your website. These reduce PCI compliance burdens and require less technical expertise, though they offer limited customization. This method is ideal for rapid deployment in payment gateway iframe integration, ensuring a secure yet efficient checkout process.

Payment links and no-code solutions

Payment links provide a zero-code option for businesses without websites or technical teams. Shareable via email or social media, they enable instant setup and include invoice generation. This is a practical solution for small businesses or service providers needing occasional payment collection without complex payment gateway software.

When evaluating integration methods, it’s equally important to consider the cost-effectiveness of your chosen payment gateway provider. While technical capabilities and integration ease are crucial, transaction fees and overall pricing can significantly impact your bottom line. For businesses operating in the UK market, finding the cheapest payment gateway that doesn’t compromise on features or security is essential for maintaining competitive margins. Our comprehensive comparison guide helps you evaluate providers based on both pricing and functionality to make an informed decision.

Businesses requiring deeper control over their website checkout experience might opt to integrate a fully custom solution. Choosing to integrate payment service directly into proprietary e-commerce software allows companies to tailor every aspect of their checkout flow, enhancing both functionality and customer experience. This method requires substantial technical expertise to integrate securely and efficiently, but it offers unmatched flexibility to match the exact needs of your website visitors. A custom approach ensures the payment gateway service fits seamlessly into existing systems, enabling businesses to uniquely position themselves in competitive markets.

For insights into the leading providers shaping the global payment gateway landscape in 2025, explore our recent analysis of the Top 10 payment gateways in the UK, Europe, and the World. Understand the strengths and key differentiators of today’s most popular gateways to inform your integration choice effectively.

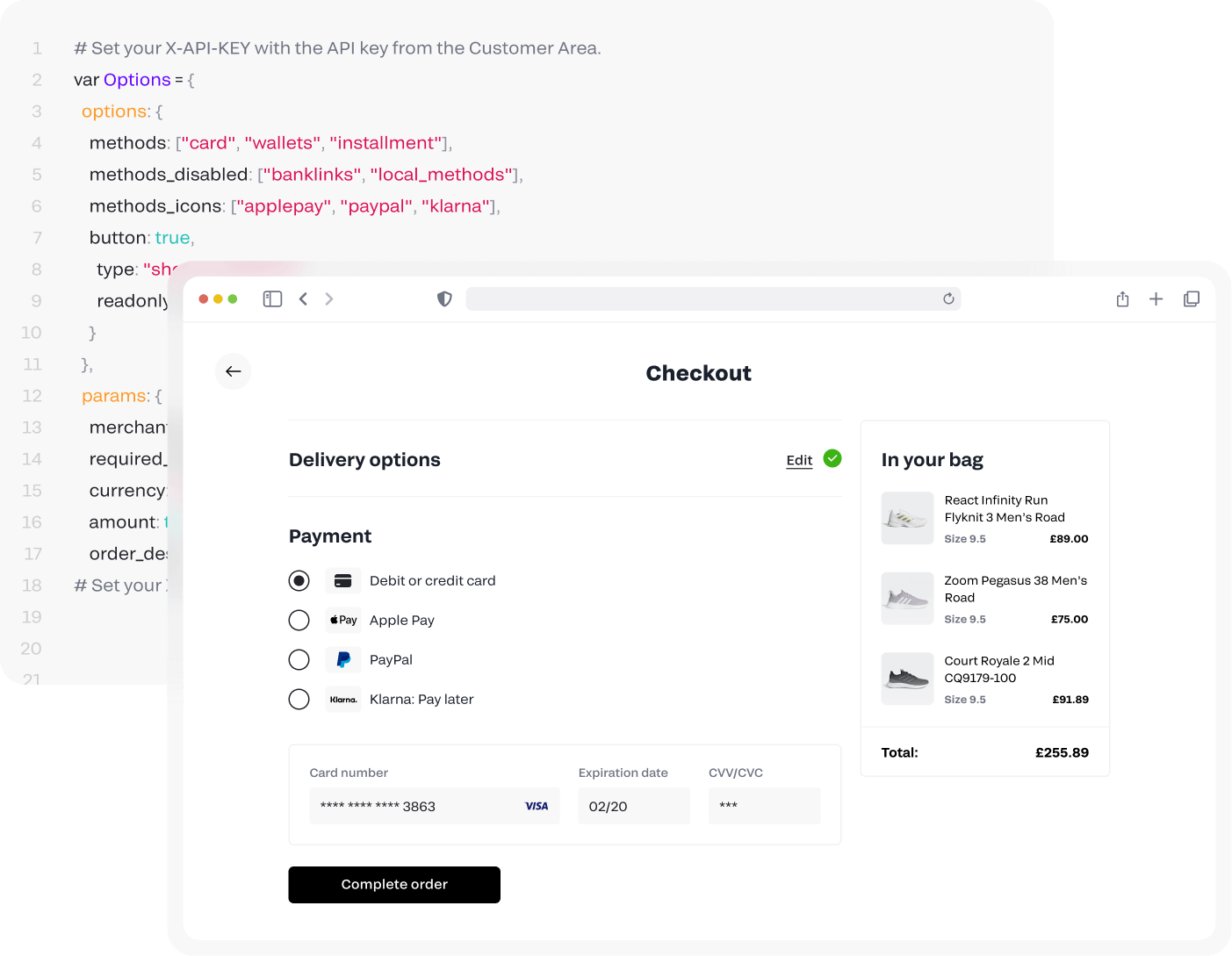

Technical specifications for API integration

Direct API integration requires a clear understanding of technical specifications. Most payment gateways use RESTful APIs with endpoints for authentication, payment creation, status checks, refunds, subscriptions, and customer data management. The process involves sending a payment request with details like amount, currency, and customer information, followed by synchronous and asynchronous (webhook) responses to confirm transaction status. A typical payment request includes fields like order ID, card details, and billing address, formatted for secure processing. Webhooks, essential for real-time updates, require a publicly accessible endpoint to receive and verify notifications, ensuring your system accurately reflects payment outcomes during the payment gateway integration process.

Authentication and security best practices

Security is non-negotiable in payment gateway implementation. APIs use authentication methods like API keys, OAuth 2.0, or HMAC signatures, with credentials stored securely to prevent exposure. Data encryption, using TLS 1.2 or higher, protects information in transit and at rest, while tokenization minimizes the need to store sensitive payment details. PCI DSS compliance varies by integration method – direct API integrations demand rigorous adherence, while iFrame or payment link solutions shift much of the burden to the provider. Implementing 3D Secure adds an extra authentication layer, reducing fraud liability through redirect, iFrame, or SDK flows, with modern versions using risk-based checks to maintain conversion rates.

Step-by-step API integration process

This section walks through the typical stages of implementing a direct API integration with a payment gateway.

Step 1: Environment setup and access configuration

Begin by establishing development and testing environments:

- Register for a developer account with your chosen payment gateway

- Generate API keys for your test environment

- Install necessary client libraries or SDKs

- Configure security credentials in your application (securely!)

- Set up testing tools and sandbox accounts

Step 2: Creating payment requests

Implement the code that initiates payment transactions:

- Build the payment request with all required fields

- Apply proper data validation and formatting

- Send the request to the gateway’s API

- Handle the initial response

- Store the transaction reference for future tracking

Step 3: Handling payment responses

Develop systems to process gateway responses:

- Parse the response data

- Handle different status codes and error conditions

- Implement appropriate retry logic for recoverable errors

- Update your order management system with payment status

- Provide appropriate feedback to the customer

Step 4: Setting up webhooks

Configure your server to receive asynchronous payment updates:

- Create a dedicated endpoint for webhook reception

- Implement signature verification to validate authentic notifications

- Process status updates based on event types

- Acknowledge receipt to prevent unnecessary retries

- Implement logging for troubleshooting and audit purposes

Step 5: Testing and validation

Thoroughly test your integration before going live:

- Test successful payment flows with various payment methods

- Verify error handling for declined cards, insufficient funds, etc.

- Test webhook reception and processing

- Perform security testing including penetration testing

- Conduct load testing for high-volume scenarios

Step 6: Production migration

When testing is complete, transition to the production environment:

- Generate production API credentials

- Update endpoint URLs and configuration

- Implement progressive rollout (start with a small percentage of transactions)

- Monitor closely for any issues

- Establish ongoing monitoring systems

CMS plugin integration

For CMS-based websites, plugins streamline payment gateway integration services. On WooCommerce, install the payment gateway plugin, enter merchant credentials, and configure options like currencies and checkout fields. Shopify payments integration involves adding a payment provider via the admin dashboard, entering credentials, and testing in draft mode. Magento users access payment methods in the admin panel, install the gateway module, and customize workflows for multi-store setups or tax integration. These plugins reduce PCI compliance burdens and accelerate setup, making them ideal for businesses using established e-commerce platforms.

Mobile payment integration

Mobile commerce demands optimized payment solutions. Native SDKs for iOS and Android integrate via package managers, initializing with merchant credentials and handling payment flows. These support card scanning, native payment sheets, and device-specific methods like Google Pay, ensuring a seamless payment gateway integration in mobile apps. Best practices include minimizing keyboard input, supporting biometric authentication, and designing touch-friendly interfaces to boost conversions.

Payment form design and optimisation

The payment form is critical to conversion. Simplify field requirements, group related inputs logically, and use progressive disclosure to show fields only when needed. Clear error indicators and visual security cues, like trust badges, build confidence. Ensure responsive design and accessibility per WCAG guidelines. Client-side validation, such as Luhn algorithm checks for card numbers or real-time card type detection, enhances user experience. For mobile, use appropriate input types, support autofill, and optimize for one-handed use to streamline the checkout in custom payment gateway setups.

Testing your payment gateway integration

Robust testing prevents issues that could erode customer trust. Set up a test environment with dedicated accounts, databases, and automated scripts. Test scenarios like successful payments, declines, 3D Secure flows, and network issues. Verify error handling for invalid inputs, duplicate transactions, or gateway downtime. Conduct user acceptance testing to ensure smooth purchase journeys, accurate notifications, and optimal performance across devices. Comprehensive testing ensures a reliable payment gateway integration in HTML or other frameworks.

Advanced integration scenarios

Modern businesses often need advanced capabilities. Recurring payments require secure token storage, scheduled billing, and retry logic for failed attempts, alongside user interfaces for subscription management. Marketplaces need sub-merchant onboarding, commission calculations, and automated funds distribution. Multi-currency processing involves dynamic currency detection, local payment methods, and regulatory compliance for international markets, enhancing the flexibility of third-party payment gateway solutions.

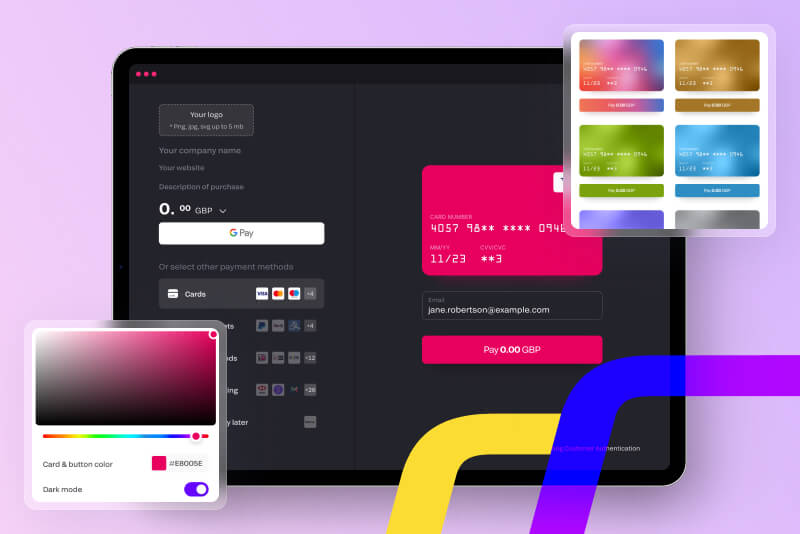

Fondy as a leading payment gateway solution

When evaluating payment gateway options, Fondy stands out as a comprehensive solution designed for modern businesses seeking global reach with local expertise.

Technical advantages of Fondy’s API ecosystem

Fondy’s developer-friendly approach includes:

- Modern RESTful API architecture: Clean, consistent endpoints with thorough documentation

- Robust webhook system: Reliable transaction notifications with automatic retries

- Flexible metadata support: Attach custom data to transactions for seamless system integration

- Comprehensive language support: SDKs and examples for PHP, Python, Ruby, Java, and more

- Developer sandbox: Full-featured test environment mimicking production

Quick integration tools for every business type

Fondy accelerates deployment with:

- Ready-made plugins: Over 30 pre-built integrations for popular platforms including Shopify, WooCommerce, Magento, and PrestaShop

- Mobile SDKs: Native development kits for iOS, Android, and React Native applications

- Customisable iFrame solutions: Secure hosted payment pages that maintain your brand identity

- Payment links: Zero-code solution for businesses without websites

Global commerce capabilities

Fondy powers international growth with:

- Support for 300+ payment methods: From major cards to local favourites like BLIK, iDEAL, and SEPA

- Intelligent geolocation: Automatically displays the most relevant payment options based on customer location

- Multi-currency processing: Accept payments in 150+ currencies while settling in your preferred currency

- Adaptive checkout pages: Available in 19 languages with localised payment flows

Bank-grade security infrastructure

Fondy prioritises security with:

- PCI DSS Level 1 certification: The highest security standard for payment processing gateway

- End-to-end encryption: Secure data transmission throughout the payment journey

- Tokenisation: Secure payment method storage without handling sensitive data

- Advanced fraud prevention: Real-time detection and customisable rules

- Regulatory compliance: Fully authorised by the UK Financial Conduct Authority (FCA)

Integrated business account capabilities

Unlike traditional payment gateways, Fondy offers:

- UK-based multi-currency business account: Included with every Fondy setup

- Unified dashboard: Single interface for payment processing and funds management

- Automated payouts: Programmable distribution to suppliers, partners, or your own accounts

- Instant notifications: Real-time updates on transaction status and account activity

Getting started with Fondy: simplified onboarding

Fondy streamlines the integration process with a straightforward onboarding experience:

Step 1: Create your Fondy account

Registration takes just minutes, with no paperwork or physical presence required. Businesses from anywhere in the world can establish a UK-based payment infrastructure quickly.

Step 2: Complete digital verification

The fully online KYC process typically completes within minutes, allowing same-day account activation for most businesses.

Step 3: Receive your UK business account

Upon verification, you’ll gain access to a multi-currency business account with a UK IBAN, enabling immediate funds management even before full payment gateway activation.

Step 4: Activate the payment gateway

Businesses registered in the UK or EU can enable Fondy’s complete payment gateway functionality, including card processing, automated checkouts, and all integration options.

Step 5: Choose your integration method

Based on your technical resources and business needs, implement Fondy using plugins, API, SDK, or payment links: all with comprehensive support from Fondy’s technical team.

Conclusion

Integrating a payment gateway is a critical step in establishing a successful online business. The right implementation balances technical considerations, security requirements, and user experience to create a seamless payment process that builds customer trust and maximises conversion.

From choosing the appropriate integration method to optimising your payment form and implementing advanced features, each decision impacts your business’s ability to process transactions efficiently and provide a frictionless checkout experience.

Fondy offers a complete payment solution that addresses these challenges with developer-friendly tools, comprehensive support, and global payment capabilities: all backed by bank-grade security and an integrated business account. This unique combination makes Fondy particularly well-suited for businesses looking to expand internationally while maintaining local payment relevance.

As online payment technologies continue to evolve, choosing a forward-thinking payment partner like Fondy ensures your business remains competitive in an increasingly digital marketplace.