If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- WooCommerce recurring payments: how to set up subscriptions & monthly orders with Fondy gateway

- WooCommerce credit card processing: add a plugin to accept Visa & Mastercard with Fondy’s low-fee payment gateway

- Apple Pay WooCommerce plugin: how to add fast payment gateway to your store

- Google Pay for Shopify: how to add GPay and why use Fondy

- Apple Pay Shopify integration: how to enable, setup & best practices from Fondy

- Shopify payment provider guide: third-party payment processors and split payments solutions

- Shopify payment processing fees: complete guide to transaction costs and international payments

- Wix payment processing fees: complete guide to Wix credit card processing costs in 2025

- Shopify payments: What it is, how it works and how UK ecommerce businesses accept credit card payments

- How to accept payments on Wix: why Fondy beats other Wix payment gateways

- How to create a payment link: step-by-step guide to make or generate it online

- How does a payment gateway work to process online payments: a complete guide with examples

- What is the cheapest payment gateway in the UK: compare online payments for Ecommerce

- Payment gateway fees comparison 2025: find the low cost payment gateway for your business

- Top 10 payment gateways in the UK, Europe, and the World: 2025 list of most popular providers

- Complete guide to payment gateway integration: connect, setup, and implementation process for your website

- 10 best payment gateways for e-commerce in the UK or Europe & Why Fondy leads the way

- What is a payment gateway: a guide for entrepreneurs interested in e-commerce

- How to accept mobile payments?

- How to integrate payment gateway APIs?

- How to accept international payments and transactions?

- How to choose the best payment gateway for small businesses?

How to integrate payment gateway APIs?

API means Application Programming Interface and is a written language or set of rules that allow at least two devices, databases, credit card networks, or applications to connect and share information. For example, imagine you tap your business credit card on a card reader when you pay for an online service such as an office business lunch.

An API can communicate this action to all your connected devices, which is how the amount then gets subtracted from your business bank account or card. Whether you’re aware of it or not, APIs are traveling and sharing information whenever you use business credit cards and debit cards, click or scan barcodes on apps or websites.

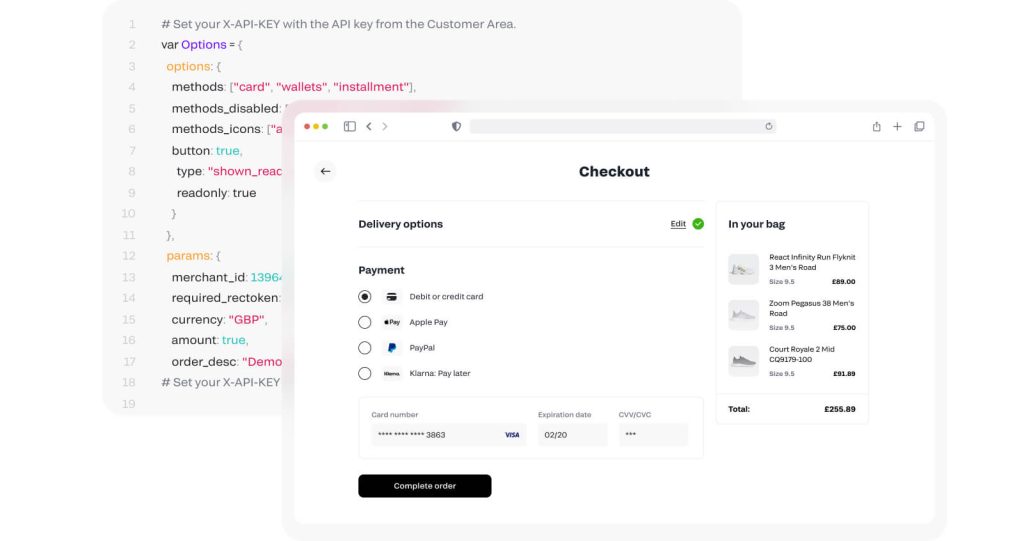

APIs help web developers integrate payment gateways directly into business applications and websites, thereby allowing companies to benefit from digital infrastructure owned by payment processors. This enables companies to build their own custom payment checkout flows without having to create the technology.

What is a payment gateway API?

Payment APIs (or payment gateway APIs) are APIs that connect your company’s checkout system to an external payment network. One of the main features of a payment gateway API is that all API communication takes place on one platform, meaning that your customers never have to leave your store website or checkout, for example, to complete a credit card payment.

Additionally, payment gateway APIs are a safer, faster, and more efficient alternative to hosted checkout pages traditionally used by traditional eCommerce websites.

Advantages of payment APIs

The benefits of payment APIs run deeper than just accepting payments, primarily with debit cards and credit cards.

Additional advantages of payment gateway APIs include that they:

- Are cheaper than building your own payment gateway

- Accept additional types of payments like international payment methods such as credit cards

- Enable recurring payments, bank transfers, cryptocurrency payments, credit card payments, business payment settlements, invoicing, and more

- Allow payment store checkout page customisation

- Are usually more secure than custom-made payment APIs

As a one-stop payment platform gateway, Fondy understands the need for businesses from the UK to the US to accept various online payment methods in various currencies. Want to know more about us? Great. Check out our about Fondy page and discover what inspires us and how that can benefit your business, no matter the size.

What are the disadvantages of creating your own online payment gateway API?

Despite the many benefits of payment APIs, there are some drawbacks to trying to create your own, especially as a small to medium-sized enterprise owner. Many businesses think that by creating their own payment gateway API. they’ll get to side-step certain processing and service fees. While this is true to an extent, having your own payment gateway API can be a complex and confusing route to head down.

As such, the main reasons to use a ready-made payment API and not to develop your own include that:

- It’s very time-consuming and can take anywhere from six months to several years

- Programming and coding knowledge is necessary

- Hiring a developer in-house can be expensive

- Hiring a freelance developer can be even more expensive

- Maintenance expenses are very pricey

How to integrate a payment gateway API

A payment gateway allows your online store or shop to accept many business payment methods, such as customer credit card and debit card payments. Most payment gateways cost money to integrate and charge per transaction. Thankfully, there are many API options available, ranging in price, features, and bank card functionality.

Picking the right gateway for your business can help save you time and money and keep your business running smoothly. And once you’ve chosen your payment gateway API, integrating it into your online or eCommerce store or shop can be a simple process, provided you have the appropriate help.

Integrating payment APIs depends on the payment gateway you use. Unfortunately, there’s no one-size-fits-all method of integrating payment gateway APIs across the board. Luckily, however, each method of integrating payment APIs does not vary that much from another.

With Fondy, for instance, our payment API provides everything you need to start processing payments straightaway. And if you want to customise the API solution to match the look and feel of your online store, you can do that easily too. Even better, Fondy’s team of in-house API experts can help with your custom business payment API integration.

From there, you’ll have access to Fondy’s full suite of payment products in one simple integration. Whether you’re an eCommerce trader, a store or shop retailer, a subscription-based business or platform, or a marketplace, our integration is tried and tested. You can benefit from simple integrations like checkout site widgets and redirect site checkouts to more complex API gateway payment integrations such as iFrame checkout page templates and mobile site payment checkouts.

Best online payment gateway APIs

There are many online payment gateway APIs for your website available on the market. Below are some of the most common payment APIs and a brief summary of their USPs, including which credit card networks they support and online site features.

- Create end-to-end payment solutions for P2P marketplaces, on-demand services, credit card networks, crowdfunding platforms, and more

- Build your own credit card payment program with Adyen’s customisable card-issuing site solutions and programs

- Compatible with several developer languages, including PHP, .NET, Java, and Node.js

- Amazon Pay APIs have throttling limits to protect against burst traffic and ensure continuing site service

- Features an Accept Suite feature that includes a host of PCI-compliant tools and card payment programs

- Includes an API live console environment that allows you to experiment with different snippets of code

- Provides sandbox accounts to explore and learn more about Braintree’s API functionality

- Includes a payment API reference section featuring quick reference cards for developers to verify certain integration methods

- Features a sandbox environment that provides a perfect platform for experimenting with the API payment site integration

- Includes optional access to Dwolla’s API Integration Partner Program

- High-scoring customer service, developer support, and an easy-to-use and learn API

- Features guaranteed rates and pricing for the lifespan of your API business account

- Scalable API that can adjust as your company’s payment site grows in size and begins to accept new methods like new international credit cards

- Includes code samples that can be added from a card deck to your shop’s site integration with just a click

- Offers several different APIs that allow developers to access various parts of Square’s site infrastructure

- Has an API Explorer feature that provides access to helpful documentation on its developer site, custom SDKs, and a sandbox

- Access to boilerplate API integration and projects you can copy and edit to your needs

- Supports several languages such as Ruby, Python, Java, PHP, Node.js, Go, and .NET

How to choose the best payment gateway APIs for your business

If you’re struggling to find out what is the most suitable payment API for your site, you’re not alone. While some APIs will suit certain company websites, there are others that won’t be a match.

To get the right payment API for your site, you should consider the factors below:

Payment methods

Any decent online payment API should offer the flexibility for you to add several payment methods to your customers, such as international bank cards and credit card networks like Visa and Mastercard.

Pricing

Find out if the payment gateway API’s fees, credit checks, and pricing fit with your shop or store’s transaction volumes, accepted credit cards, and payment methods.

Payment customisation

Research how much customisation the API allows if you plan on making major changes to your site, like adding new debit cards, credit cards, and loyalty cards.

Payment security

Make sure your API is PCI-compliant and includes additional security measures such as paying credit card tokenisation.

Documentation

Find out if the API documentation is public and that your developers can make sense of the API before swiping to your business card and jumping on board.

SDKs

SDK means software development kit, and they contain a library of information, programs, and tools, including card code samples and guides that help developers to create new software applications.

Public forums

Check if the payment API has an active developer community. If so, more help and assistance will be readily available to solve troublesome card payment integrations and pieces of code.