If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- What is pay-in and pay-out: a comprehensive guide to payment processes for online business

- Mastering delayed payouts: ensuring timely transactions with Fondy

- Streamline your payout process with our comprehensive payout system: low fees for outgoing financial transactions

- How to use payout gateway for outgoing payments on your platform

- How does split payment work for business with Fondy Flow

- A guide to eCommerce split payments

- What is split payment & how Flow Payments can help your business

- What are payouts: a guide to instant & global payouts for business

- How to split credit card payments online: solutions for platforms & marketplaces

- What are split payments, and how do they work on Flow Payments?

- The gig economy’s impact on traditional industries

- Integrating electronic health records with payment systems: advancing efficiency in MedTech billing

- The crucial role of payments in empowering gig platforms

- An introduction to recurring payments

- What is the Faster Payments Service (FPS)?

- A guide to eCommerce split payments

- A guide to instant and global payouts

- What is the SEPA payment method?

- What are quick payments in one click?

- What are cross-border payments?

- What is a payment link?

- What are open banking payments?

What is a payment link?

If you sell goods or services online, you’ll need different methods to accept payments. But creating your own payment page or gateway and adding certification for accepting payments can be complex, time-exhausting, and expensive. So what is the solution? Fortunately, you can use payment links instead of traditional card options.

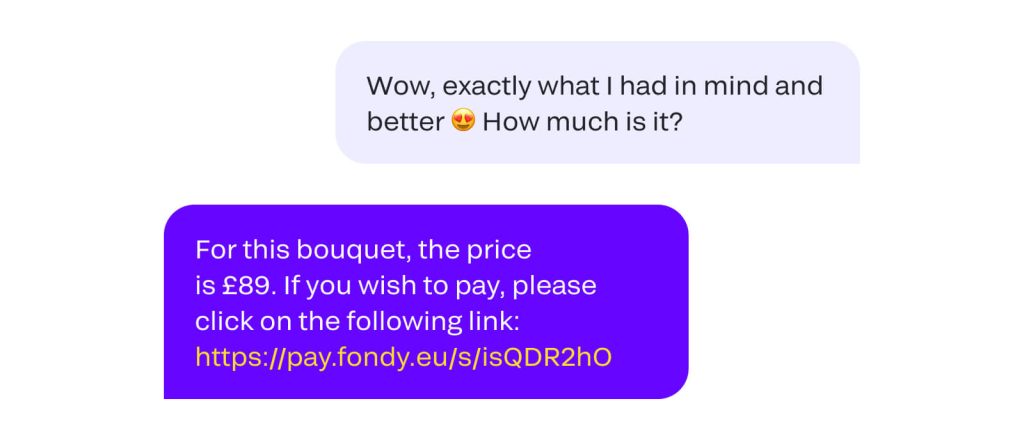

A payment link is any one-time link or Uniform Resource Locator (URL) sent over SMS (or text), email, chat message, social media, or other means, such as Facebook Messenger, to allow the recipient to enter their card payment details online. Payment links are usually time-sensitive or only valid until the payment is made.

Payment links also take the form of email invoices or buy buttons that can be attached to any online communications that redirect to the full invoicing page or eCommerce website’s checkout page.

How to create a payment link

The process of creating payment links varies from one payment gateway to another. That said, the process, no matter what the gateway is, should be easy to pick up once you get the hang of it. To create a payment link with Fondy, you can create a payment link in just a few minutes in your personal account. Simply:

- Head to Payment buttons > Button designer.

- Choose the language you want your button to appear in.

- Specify whether you want a ‘Payment’ or ‘Regular payment’ button.

- Complete your ‘Description of payment’ field to include the name of the product or service.

- If you have chosen ‘Regular payment’, you’ll need to specify the amount, frequency, and start of the recurring payment.

- Click the ‘Generate Button’ button, and you’ll see a short version of the link.

Payment links look exactly like normal URLs. Once the customer clicks on it, he or she will then get redirected to a pre-configured payment page. With a payment gateway like Fondy, you even have the option of customising the page to match your company’s branding, such as its colours, logo, voucher cards, loyalty cards, and other elements.

At this point, the customer can then choose a payment method. By default, most payment gateways will offer the customer the option of paying by debit card, credit card, Apple Pay, or Google Pay. With these default methods, each transaction should take no more than a minute.

That’s it. You can then track the payments received via the link in your Fondy personal account.

As a one-stop payment platform, Fondy understands the need for businesses to be flexible and to accept various payment methods in a variety of currencies. Want to know more about us? Great! Check out our About Fondy page and discover what inspires us and how that can benefit your business, no matter the size.

Advantages of payment links

Payment links are beneficial for all types of businesses. From freelancers to small to medium-sized enterprises (SMEs) to large-scale corporations, there’s an advantage to having payment links as a payment option for your clients.

- Payment links allow you to offer flexible payment methods, including mobile wallets, debit and credit cards, and Direct Debit.

- Companies that don’t have a shopping cart on the website can use payment links instead of card payment checkouts.

- Payment links make future payments run more smoothly by saving customer data to enable recurring purchases. Additionally, they can help build customer relationships and trust.

- Full transactions can be finalised on a smartphone or tablet without the need to download additional apps or software.

- Payment links are a great option for small businesses that sell to individuals or sole traders.

- For content creators, payment links are a great way of requesting donations from their subscribers.

- Payment links are convenient for enterprises with a small set of goods or services, as you’ll need to create a separate payment link for each product.

- Using the payment link does not require additional certificates and licenses from the business.

Payment links with Fondy

A payment link is a convenient tool for businesses operating on social networks and messengers or collecting donations. You only need seconds to create the payment link in your account and forward it to customers using the preferred channel of communication. You can even add them directly to any promotional channel. Payment links are similar to our payment button feature, with the only difference being that there’s no need for you to have a website to accept payments via link.

Once the payment has been initiated, you will receive funds in your payment account with Fondy the next day. Also, you can control all sent payment links and paid matching the received funds.

Features of Fondy’s payment links include:

- They’re easy to create and use.

- Unlimited number of payments per link.

- One-time or scheduled regular withdrawal.

- Fixed or required payment amount.

- Create multicurrency links.

- Unlimited or customizable expiration period.

- Add page addresses for redirection after successful or unsuccessful payments.

- Link to the customised payment page.

- Set up additional fields on the payment page.

- Fiscalisation of payments on State Tax Service servers.

- Eliminate the no to input debit card or debit card information for every transaction.

Are payment links safe and secure like card payments?

In short, yes. That’s because, with payment links, the customer’s payment data is tokenised, which means it’s turned into encryption that only the payment system “understands” but which has no value if intercepted by cybercriminals. All this ensures that the merchant has no access to the payment data entered by the client during payment.

Payment links also reduced the likelihood of incurring chargebacks. That’s technologies like 3D Secure, like the type used by debit cards and credit cards, buyers have to authorise each transaction by way of a one-time password or OTP, making accidental or fraudulent card sales unlikely.

Payment links can be used multiple times and by different buyers, but if you alter the price of any of your goods or services or the terms of sale, you’ll need to generate a new link and replace it wherever you have it posted.

By default, most payment pages ask for the buyer’s email address to send them a receipt, and this acts as a way of saving the buyer’s debit card and credit card, and contact information.