If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

How seamless payment integrations can boost your SaaS performance

In 2025, simply delivering a functional SaaS product isn’t enough. With so many great options out there, users won’t settle for anything less than a completely flawless customer experience, from signup to subscription renewal, and your payment system is at the heart of the user journey.

Whether it’s enabling quick onboarding, supporting global transactions, or offering flexible billing models, seamless payment integrations play a critical role in shaping customer satisfaction and driving revenue growth. The online payment industry has been growing steadily for years and shows no signs of slowing down, so it’s not a question of whether or not you need to integrate payments in SaaS software — it’s a question of how to do it correctly.

Find out why integrated payment solutions are crucial for SaaS success and how to get your product’s payment experience just right from our article.

What is seamless payment integration and why does it matter?

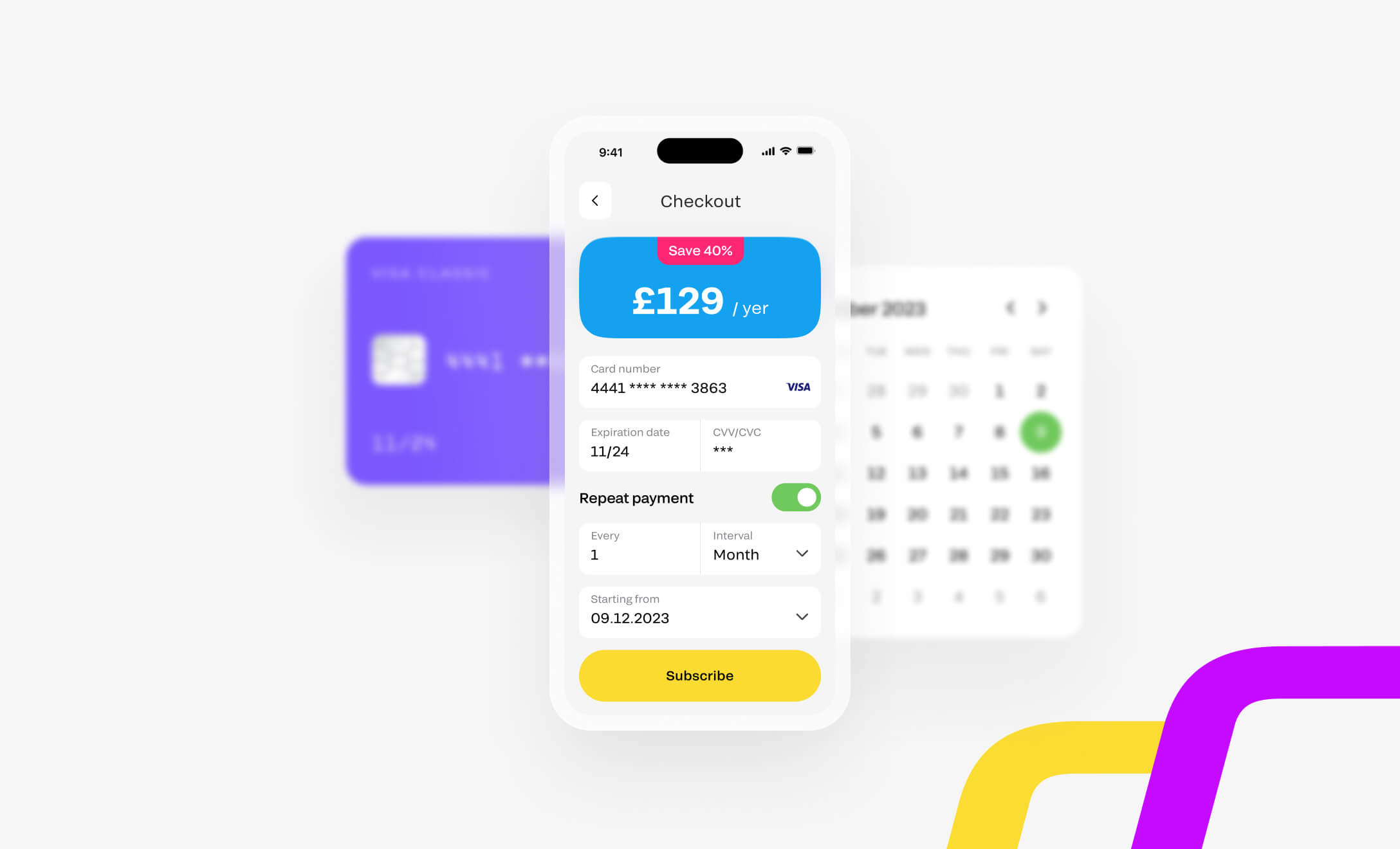

Let’s start with the basics and give an answer what seamless payment integration is for a SaaS business. This term refers to the smooth implementation of payment functionality directly into the SaaS product without additional manual steps, unnecessary redirects or delays. It ensures that the payment process is efficiently connected both to the user interface and to the application’s backend. Whether it’s a one-time fee or a subscription plan.

Seamless payment functionality is vital for all businesses that involve online transactions, but it’s absolutely essential for SaaS platforms. In the SaaS industry, a flawless payment solution is more than just about accepting credit cards. It’s about handling everything from user authentication and multi-currency support to billing, invoicing, and taxes, all while remaining invisible to the customer. When done correctly, payment integration for SaaS creates a smooth checkout experience and cements user trust; when done poorly, it leads to failed payments, customer frustration, and significant damage to the brand.

Benefits of spotless payment integration for SaaS products

What’s the difference between spotless payment integrations and ones that simply do their job? The former ones don’t just work well — they work so well that users barely notice that they’re there. This is exactly what SaaS business owners should be aiming for when they approach the payment platform integration process. Here is what else you get by seamlessly integrating payment gateway functionality into your SaaS solution.

1. Better user experience and higher conversion rates

Payment flow optimization keeps users within your platform, eliminating unnecessary redirects and reducing friction that could otherwise discourage customers from continuing to use the platform. This leads to higher sign-up and upgrade conversions, which is especially critical in a competitive SaaS market where ease of use can be a top selling point.

2. Streamlined operations and fewer errors

Seamless payment integration allows SaaS companies to automate invoicing, billing, refunds, and tax calculations, which reduces manual work and improves accuracy. This not only lightens the load on your development and testing teams, but also minimizes costly errors and support tickets.

3. Reaching users who are ready to spend online

In the last few years, consumer behavior has shifted dramatically toward digital and card-based payments. A Forbes study found that people are twice as likely to spend when using a card compared to cash. SaaS companies that offer smooth, card-friendly digital payments are better positioned to capture this growing popularity of online transactions.

4. Faster and easier global expansion

The global SaaS market is full of lucrative opportunities. However, scaling a SaaS business internationally means navigating different currencies, regulations, and payment preferences. With a robust, integrated system, you can offer localized payment experiences without building separate flows for each region, speeding up your go-to-market efforts.

5. Lower churn from reliable billing

Failed payments that lead to customers abandoning the application are one of the biggest hidden threats for recurring revenue of a SaaS platform. Spotless integration includes automated retries, card update logic, and dunning workflows, helping to recover failed payments and retain customers who might otherwise be lost due to simple technical issues.

6. Increased brand credibility and trust

For SaaS businesses, brand recognition and universal trust may be even more important than for other online ventures because SaaS platforms rely on recurring revenue to survive and thrive. The rule here is simple: when payments work effortlessly and securely, users feel confident in your product. This helps you turn free trial users into paying subscribers, which is exactly what you need for long-term success.

7. Less revenue waiting time

In SaaS, speed matters, and not just when it comes to the functionality you deliver, but also turning new users into loyal customers. A well-integrated payment system reduces delays between sign-up, onboarding, and revenue generation by automating key processes like conversion from trial to paid plans and instant access to functionality after payment.

Challenges of integrating payment solutions in SaaS

For SaaS business owners, frictionless checkout is the ultimate goal. However, things don’t always work out easily in that regard, and businesses can face certain challenges when working on seamless payment integrations. Below are the most common challenges organizations encounter.

1. Integration effort and technical debt

Adding a payment system involves multiple parts of a SaaS platform, including frontend UI, backend APIs, databases, invoicing, and analytics. If integration is rushed or poorly documented, it can lead to technical debt and brittle systems that are hard to maintain or scale.

2. Compliance and data security

Processing payments means handling sensitive data, which brings significant legal and compliance responsibilities. From PCI DSS requirements to GDPR and local tax regulations, SaaS companies must ensure that payment systems are secure, encrypted, and regularly audited. Failing to do so can result in fines, reputational damage, or even authorities suspending the service altogether.

3. Complexity of recurring billing

Unlike one-time purchases, SaaS products often feature subscriptions, free trials, tiered pricing, and usage-based billing. Managing this variety requires a flexible and well-architected payment system that offers solutions specifically tailored to SaaS business requirements. Without it, organizations can face billing errors, customer confusion, and loss of revenue.

4. Globalization and localization difficulties

Expanding into new regions is a highly tempting opportunity, but it also adds layers of complexity to already intricate SaaS systems. Different currencies, tax rates, banking systems, and user expectations need to be taken into account when creating solutions for the global market. Plus, supporting local payment methods like SEPA in Europe or UPI in India often requires additional development and coordination with multiple providers.

5. Edge cases and error handling

Payment flows include many edge cases. This includes expired cards, declined transactions, timeouts, double charges, as well as a myriad of unexpected outcomes of using the solution on different devices in different network conditions. Without robust error handling and automated recovery paths, these issues lead to frustrated users, support load, and, ultimately, revenue loss.

How to ensure seamless payment integration: tips and best practices

Strong and stable integrated payment solutions rely on several things: a thoughtful design, masterful engineering, and comprehensive testing. Here is how SaaS businesses need to approach the implementation and maintenance of payment systems.

1. Choose the right vendor for your model

Don’t just go for the first payment gateway provider you come across during your research — make sure your provider supports the nuances of your SaaS business. This can include things like recurring billing, free trials, or metered usage. Other features to look for are integration ease, global payment support, API quality, and built-in functionality like fraud protection or tax automation.

2. Stay up-to-date with compliance

Payment regulations evolve, especially when operating in multiple regions. Keep your integration aligned with standards like PCI DSS, SCA in Europe, and tax laws like VAT. Your payment provider can help, but ultimately, the responsibility lies with your business.

3. Rely on quality assurance to ensure stability

Software testing is an integral part of developing and updating any solution, and this is even more true for seamless payment integration. Testing plays a critical role in making sure that your payment workflows are robust, secure, and future-proof. A comprehensive fintech solutions testing strategy should include:

4. Prioritize user experience

According to one research, 9% of customers are ready to abandon the checkout process if their preferred payment method is not available, and 4% will quit if the payment fails. This means that the payment gateway needs to contribute to a flawless UX of your platform, not take away from it. Embed payments directly into your platform to keep the checkout journey smooth and on-brand. Reduce friction with prefilled forms, mobile-friendly design, and support for digital wallets or one-click payment options. This creates a seamless experience that encourages conversions and reduces cart abandonment.

- Mocking and stubbing third-party APIs to isolate your system and simulate various external responses like card declines, authorization timeouts, or server errors without triggering real transactions. This helps verify how your app responds under various conditions.

- End-to-end test cases with real-world payment flows, using sandbox environments provided by your payment provider or testing partner. These tests validate the full transaction lifecycle, including sign-up, payment processing, retries, refunds, and subscription renewals.

- Load testing to ensure your system performs reliably under high traffic, especially during promotions or billing cycles.

5. Monitor and log everything

Set up detailed logging and real-time monitoring for all payment-related events: transactions, errors, retries, chargebacks, and performance of third-party solutions you use for payment functionality. This gives your team full visibility into how the system behaves in production and helps identify issues before they escalate. Remember that proactive alerts can minimize downtime and revenue loss.

Fondy as a flexible payment solution for SaaS growth

If you’re looking for a reliable partner to handle payments at scale, Fondy offers an all-in-one payment gateway built specifically with SaaS businesses in mind. From subscription billing and instant payouts to multi-currency support and real-time analytics, Fondy helps you reduce churn, automate financial workflows, and expand into new markets faster — all through a single, easy-to-integrate platform.

Final thoughts

For SaaS businesses, a strong, reliable, and secure payment system is not just a technical convenience — it’s a full-on strategic advantage and one of the key elements of not just attracting but also retaining paying customers. Whether you are working hard to acquire new users, want to expand your business globally, or scaling your operations, the link between smooth payment integration for SaaS and business success is undeniable. Make sure your checkout flow is up to the task with a well-thought-out, flawlessly implemented, and thoroughly tested payment solution.