If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- What is pay-in and pay-out: a comprehensive guide to payment processes for online business

- Mastering delayed payouts: ensuring timely transactions with Fondy

- Streamline your payout process with our comprehensive payout system: low fees for outgoing financial transactions

- How to use payout gateway for outgoing payments on your platform

- How does split payment work for business with Fondy Flow

- A guide to eCommerce split payments

- What is split payment & how Flow Payments can help your business

- What are payouts: a guide to instant & global payouts for business

- How to split credit card payments online: solutions for platforms & marketplaces

- The gig economy’s impact on traditional industries

- Integrating electronic health records with payment systems: advancing efficiency in MedTech billing

- The crucial role of payments in empowering gig platforms

- An introduction to recurring payments

- What is the Faster Payments Service (FPS)?

- What is the SEPA payment method?

- What are quick payments in one click?

- What are cross-border payments?

- What are open banking payments?

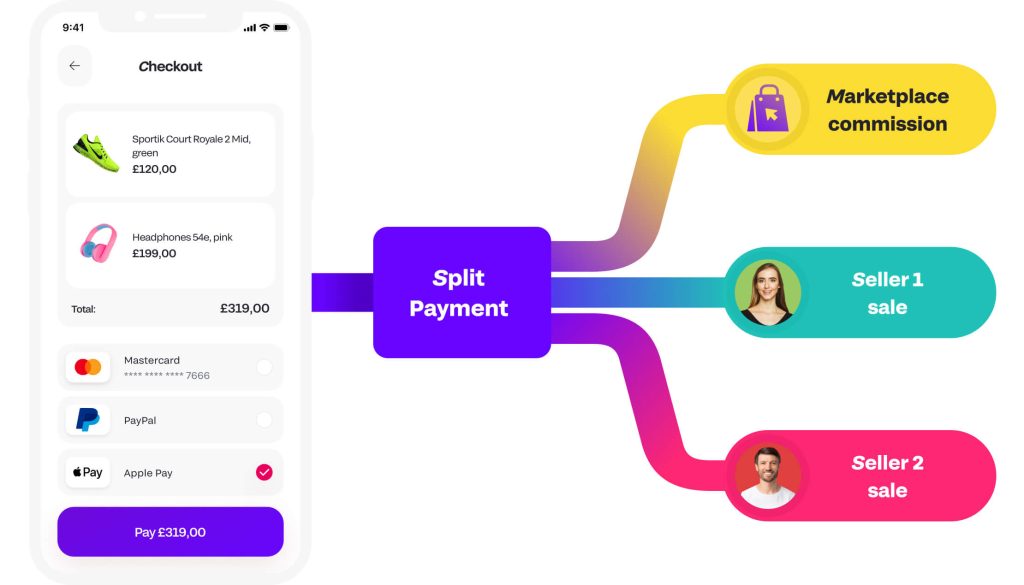

How does split payment work for business with Fondy Flow

Understanding split payments

Split payments refer to a versatile transaction model where the total amount from a single purchase or order is automatically allocated among multiple recipients. This distribution could involve marketplaces, digital content producers, logistics suppliers, or any other collaborators who depend on punctual and accurate payments. By integrating automated solutions, you remove complicated manual splitting tasks and minimise errors that can arise during payment reconciliation. Meanwhile, your platform’s finance teams gain a clearer view of income streams, helping them stay on top of revenue reporting and forecasting.

Beyond the simple act of allocating funds, split payments also serve as a strategic asset for businesses that must rapidly adapt to market changes. If your marketplace introduces new product categories or partners, you can easily set up fresh split rules without undertaking laborious systems overhauls. This means your platform remains agile, welcoming fresh opportunities to collaborate with a broader network of suppliers, influencers, or service providers. In turn, your users benefit from a smoother experience, as everyone involved sees how the transaction flow works in real time, leading to greater trust and transparency.

If you’re curious to dive deeper into what split payment means, how it can transform your business operations, and why it’s essential for modern marketplaces, check out our dedicated guide:

“What is split payment & how Flow Payments can help your business“.

Staying ahead with split payments

Modern marketplaces thrive on collaboration. Split payment functionality enables you to offer each partner a direct stake in every transaction, which fosters confidence and loyalty. Because you automate how funds are divided, partners need not fret about late or missing payments. As a result, they can focus on enhancing their offerings and boosting customer satisfaction.

By adopting an automated split payment approach, you open doors for faster settlements while simultaneously simplifying your internal procedures. Traditional manual processes can create bottlenecks, especially during periods of rapid growth. Thanks to automated flows, high-volume demands become easier to manage, preventing delays and reducing the risk of operational hiccups. This contributes to a marketplace environment where every participant is happy to continue their collaboration.

Saving time and effort

Automatically break down and distribute funds to each participant, eliminating lengthy reconciliations and reducing administrative tasks. With every split transaction clearly documented, you have full visibility over your platform’s payment landscape.

Boosting conversion rates

A straightforward checkout flow often leads to fewer abandoned baskets. With a consistent payment experience, you can increase customer satisfaction and subsequently boost your overall conversion rate. Split tools reduce the likelihood of confusion or failed transactions.

Achieving financial agility

Adapt your fee structures and commissions to match each partner’s requirements. This flexibility allows you to manage various financial models with ease, including innovative split options that keep pace with changing business environments.

Enhancing security measures

Leverage advanced payment security tools for accurate tracking and fraud prevention. Your partners can enjoy confidence in the integrity of every payment. Detailed split records also provide clarity and help resolve disputes swiftly.

Driving operational efficiency

Consolidate payment processes, reduce overheads, and streamline settlements to ensure a smoother experience for everyone involved. Relying on split automation lowers the chance of delays when distributing funds.

Empowering a dedicated business account

Enable your partners to open a GBP business account for instant, fee-free transfers. As a result, funds are accessible more quickly, without unnecessary currency conversion costs. Additionally, this accelerates split payouts by ensuring each party’s earnings arrive without hindrance.

How does split payment work on Fondy Flow

Fondy Flow incorporates a user-friendly API that enables your platform to direct funds to the right people as soon as the payment clears. Let’s say a marketplace specialising in virtual fitness classes receives a payment from a user in the UK. The system deducts a pre-set commission for the marketplace, then routes the balance to the appropriate trainer. It all happens behind the scenes, leaving both the trainer and the marketplace with a neat summary of each transaction.

What’s more, you can expand these functionalities based on your marketplace’s individual demands. Whether you need real-time payouts, customised commissions for different partner tiers, or scheduled payments that occur weekly or monthly, Fondy Flow’s robust framework can scale to meet your needs. This adaptability is especially handy when you’re managing dozens or even hundreds of daily transactions, helping your marketplace remain nimble and prepared to capitalise on fresh opportunities. A well-planned split strategy ensures you can organise your transaction flows without hassles.

The best use cases for split payments

Split payments excel in any scenario where multiple parties require timely and proportionate compensation. This goes beyond traditional eCommerce stores and extends to online service platforms, subscription networks, multi-vendor holiday booking sites, food delivery apps, and more. Essentially, if your business model involves distributing funds to more than one recipient, automated splitting can streamline those activities.

Consider a platform organising local tours or trips. Travellers book a single holiday package featuring several experiences provided by different local guides. Once payment is processed, each guide immediately receives their share, minus any commission fee for the platform. Such swift, transparent distribution fosters trust among local partners, encouraging them to offer more unique experiences, which in turn strengthens your platform’s offering. Everyone benefits from a fair and rapid split, allowing your business to flourish.

Why split payments

Transparent transaction histories

With an automated split payment approach, each payment has a clearly documented trail, outlining how much of the original sum was allocated to each partner. This clarity prevents disputes and helps everyone understand precisely how revenue is divided.

Reducing human error

Manual calculations for splitting funds across multiple parties are prone to oversight. By using an automated solution, you diminish the likelihood of mistakes, leading to improved accuracy and a more positive experience for all parties involved. You can also rely on split technology to ensure consistent fund allocation.

Scaling with ease

The more your business grows, the more complex your payment distributions can become. With split payments, adding new partners or revenue channels is straightforward, as the automation adjusts to accommodate higher transaction volumes and more intricate commission structures. Each new split setup can be configured in just a few steps.

Flexible fee management

Because automation manages how does split payment work in your ecosystem, it’s simpler to introduce new commission tiers or special deals for partners. This could include setting a lower fee percentage for newcomers or offering premium partners a smaller commission fee. In turn, you have full control over how your revenue strategy evolves while ensuring your split standards remain consistent.

On-demand payouts

Access to on-demand or time-scheduled payouts can set your platform apart from competitors. Partners can select how quickly or how often they receive their funds, minimising financial worries and incentivising them to continue using and promoting your services. Fast, convenient split payouts are a key selling point in today’s market.

Instant withdrawals

For a nominal fee, partners can receive their funds immediately, ensuring they never have to delay their business operations while waiting on slow-moving transfers. This is invaluable for freelancers, gig workers, and small businesses needing regular liquidity. Whether you’re working with one partner or a hundred, quick split transfers can make all the difference.