If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- What is pay-in and pay-out: a comprehensive guide to payment processes for online business

- Mastering delayed payouts: ensuring timely transactions with Fondy

- Streamline your payout process with our comprehensive payout system: low fees for outgoing financial transactions

- How to use payout gateway for outgoing payments on your platform

- How does split payment work for business with Fondy Flow

- A guide to eCommerce split payments

- What is split payment & how Flow Payments can help your business

- What are payouts: a guide to instant & global payouts for business

- How to split credit card payments online: solutions for platforms & marketplaces

- What are split payments, and how do they work on Flow Payments?

- The gig economy’s impact on traditional industries

- Integrating electronic health records with payment systems: advancing efficiency in MedTech billing

- The crucial role of payments in empowering gig platforms

- An introduction to recurring payments

- What is the Faster Payments Service (FPS)?

- A guide to eCommerce split payments

- A guide to instant and global payouts

- What is the SEPA payment method?

- What are quick payments in one click?

- What are cross-border payments?

- What is a payment link?

- What are open banking payments?

The gig economy’s impact on traditional industries

The increasing use of contingent or gig economy workforce was once thought of as a distraction to the global economy. But nowadays, that distraction has become the norm and a disruption of the status quo, causing labour markets and economies worldwide to sit up and take notice of its rapid growth.

Hence, there is an opportunity for the gig economy to disrupt traditional employment sourcing and management. But for “successful disruption” to take place, human resources leaders will play a vital role in protecting their companies from the surrounding uncertainty.

Unofficially known as the gig economy, it broadly refers to networks of individuals who work without any formal employment contract. Additionally, these employment agreements are commonly known as zero-hours contracts. A relatively “newish” concept, the gig economy has operated without many rules and regulations in favour of the gig workers.

However, its growth has brought more exposure to the sector, which has highlighted some of its irregularities, such as a lack of overtime pay, employment status, low minimum wage rates, and uncertain rules for part-time workers.

Globally, more than two-thirds of full-time gig economy workers see gig work as more secure than traditional employment contracts. And predictions are that the value of the gig economy will reach over $450 billion by 2024.

Popular names like Airbnb and Lyft aren’t the only organisations benefiting from the “gig economy” around the world. Companies in all sectors, from hospitality to accounting, are tapping into gig workers as a regular, reliable part of their workforces. One reason why the gig economy is popular amongst workers and customers is the cost structure, with some companies preferring to pay per purchase instead of salaries.

The benefits of payment service providers in the gig economy

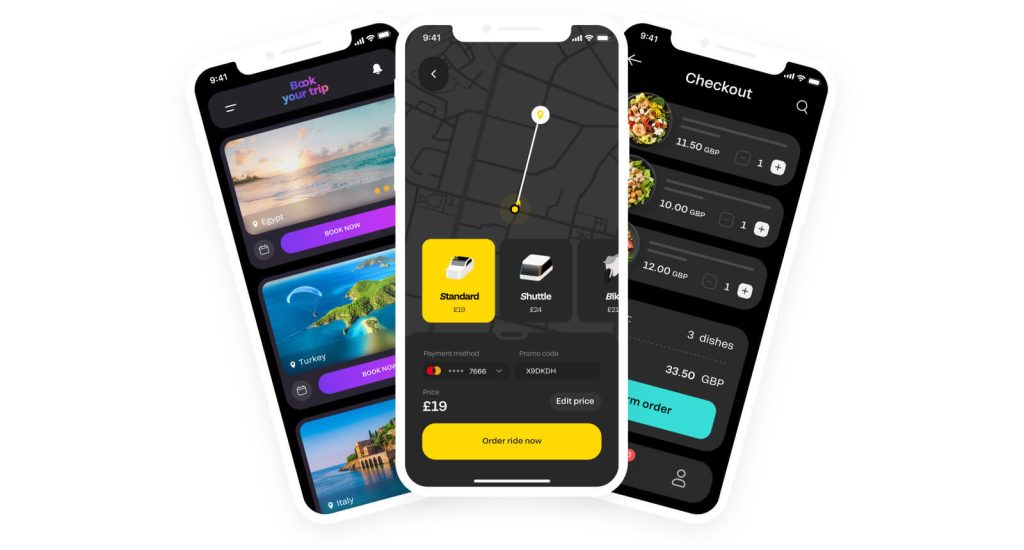

Efficient payment systems are central to the gig economy. When it comes to one-off, on-demand employment, gig workers and platforms alike need payment flows that match the very nature of the gig economy business model.

Payment service providers help gig economy companies such as Grub Hub process payments. From seamless onboarding to multicurrency payouts, Flow Payments help facilitate payments for merchants and their gig workforce, such as skilled workers, drivers, couriers, etc.

For instance, for platforms that involve payments to several partners, such as Just Eat or Lyft, features such as automated instant settlements and split payments can save you time and money by eliminating manual reconciliations and reducing acquisition costs. That way, you can pay gig workers like drivers and couriers instantly and cost-effectively without third-party services or payment aggregators.

With split payments, different payment amounts from a transaction, such as those between a restaurant (such as the cost of the items for McDonald’s), a food delivery platform (such as service fees Deliveroo), and courier wages plus any tips, are automatically divided and credited to the accounts of each recipient all at once.

So, if you need to make same day settlements with several different partners after each payment from a client, you can use payment service providers with split payment functionality.

That means saving time by eliminating manual reconciliations, reducing acquisition costs, and optimising your revenue management. For example, instant settlements are great where required, like Uber drivers and Deliveroo riders who choose the ‘instant cashout’ option to collect their wages instantly.

The gig economy in the United Kingdom

From Uber drivers and Deliveroo riders to digital freelancers and beyond, the gig economy is vast and growing in the UK every year. Gig workers contribute £20 billion to the British economy. Some other highlights of the gig economy in the UK include:

- The number of regular gig workers in the UK is estimated at nearly 8 million, which equates to almost a quarter of the total UK workforce

- Almost half of gig workers in the UK also have a full-time job

- More than 75% of gig-working taxi drivers and couriers increased their hours because of rising fuel costs

According to the Office for National Statistics, by 2026, the number of gig workers will almost double to 14.86, causing further change to the employment landscape. Despite the adoption of the gig economy, some concerns remain about its introduction into the global workforce.

Challenges for the gig economy

For some individuals, the so-called flexibility of gig work can actually be detrimental to a healthy work-life balance, sleep patterns, and other activities of daily life. It also means that workers have to make themselves available around the clock while hunting for the next gig as competition for gigs and contracts continues to rise.

And because of the random nature of the gig economy, traditional long-term relationships between workers, employers, clients, and vendors have seemingly changed for good. This often means a lack of benefits that normally arise from building long-term trust and familiarity with clients over time.

In a global Deloitte survey undertaken by more than 7,000 business leaders, the top three challenges of the gig economy were:

- Legal requirements (20%)

- A business attitude unreceptive to gig workers (18%)

- A lack of knowledge among corporate leadership (18%)

For the gig workers themselves, some of the concerns regarding the gig economy include:

- The lack of job security, proper contracts, medical coverage, and workplace benefits

- The lack of transparency and predictability in working conditions

- The increasing isolation and loneliness of gig work

- Income instability and retirement planning difficulties

- The low loyalty, motivation, and incentives for freelancers

- The outdated regulatory framework and legal classification of the relationship between service providers and digital platforms

- Payment delays, confusion, and hidden fees cause diminished profitability

Diving deeper into the potential drawbacks of payments in the gig economy, naturally, these concerns weigh heavily on the gig workers. Chief among their payment worries include:

High cross-border currency exchange and transaction fees

Some international payments have been known to be slower and more expensive when compared to local transactions. The delay and cost of currency conversion are harmful to a gig worker’s bottom line due to high forex and transaction fees and volatile exchange rates.

Complex international taxation and regulations

The legal status of gig workers varies by country. Companies operating on a global scale need to manage regulatory differences from one locale to another, such as contractor versus employee status, tax liabilities, and the unfamiliar nature of international payments.

Cultural and location differences

Workers everywhere want payments to be instantaneous, simple, and cost-effective. But from one location to another, gig workers have different expectations about payment methods that companies need to understand and address, such as adopting the use of eWallets and virtual accounts in emerging economies where many gig workers don’t have access to a bank account.

The answer is features capable of handling any issues with cross-border payments, such as split payments, payouts, and instant settlements, making international transfers as seamless as local payments.

Supporting the gig economy with better payment flows

Solutions like Fondy’s Flow Payments are essential to the gig economy because they help drive and grow the sector with enhanced user experiences.

One example of how Fondy is supporting businesses within the gig economy is the partnership with Glovo. Formed in Spain in 2015, Glovo specialises in last-mile logistics, primarily connecting users, businesses, and couriers, offering on-demand services everywhere, from restaurants to supermarkets, via its mobile app.

One of Glovos’s unique selling propositions includes the ‘Anything’ button, where users can request couriers bring anything to their front door, as long as it fits in their iconic yellow and green courier bag. Today, Glovo has become a technological link between users and businesses, with gig-working couriers at the core of their innovative operations.

In addition to smoother and more versatile money movement, payment service providers like Fondy help address challenges within the gig sector, such as payment compliance, tax requirements, and security.

The future of the gig economy

Despite the rise of the gig economy, the traditional employment world still mostly comprises long-term contract employees who work for one employer, usually from an office or headquarters, within a commutable distance. The gig economy has flipped the landscape as most gig workers, such as delivery drivers and couriers, work for multiple employers remotely and under short-term contracts. In terms of freelancers, such as coders and graphic designers, they can literally work from anywhere.

So, while the traditional job market was created as a result of need and convenience, the gig economy was born out of the reach and functionality of technology, particularly the Internet. Before the Internet, the best and only option was to find long-term employment locally. Nowadays, the “options” are limitless. But will there ever be a time when long-term, local employment is the exception to the rule?

Regarding the future of the gig economy, one area to keep an eye on is payment methods. As the gig economy progresses, there will be a need and space for innovative payment methods to replace the more traditional and conventional solutions.

How the gig economy is creating new opportunities within the job market

Flexible working arrangements can be priceless to those people who need the ability to vary their working hours from time to time. These individuals include adults with childcare responsibilities, older people, and students in part and full-time education. Gig work helps them attain a realistic balance between home and work or university life.

Many people think that gig workers are the ones who benefit most from the gig economy, but if you compare the advantages to both sides, it’s the companies like Uber, Airbnb, and Vrbo that profit the most. That’s because companies like these save enormous expenses as they often don’t need to provide office space, equipment, and some corporate benefits. Even better, companies can select from an infinite pool of “employees”.

In addition to creating their own revenue, gig workers can create their own work schedules to fit around their personal lives. In the future, this may be the decline of traditional 9 to 5 p.m., Monday through Friday contracts as the internet and demand for services make it easier than ever to work whenever it’s convenient. As time goes on, companies that embrace the economy and its workforce may adapt and innovate faster.

For gig workers, the future means that this business model will align with starting their own businesses, being their own boss, and commanding their own salaries. Peace of mind to many employees is the convenience of a regular wage, but budding entrepreneurs like gig workers think differently. Instead, gig workers are betting on themselves to take control of their income and make the most of the opportunity.

Fondy has been a great partner for us when it comes to expanding our acquiring capabilities in Eastern Europe. Their experience in the market has been invaluable, helping us scale across the region.

Florian Jensen

Global Fintech & Risk Director at Glovo