If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- How to create, build, set up, and start a crowdfunding platform with expert insights & Fondy’s payment solutions

- App vs platform: discover the difference between an application and a platform for business with Fondy’s solutions

- Simplify B2C payouts for marketplaces and the gig economy with Fondy

- Flexible payout schedules and seamless settlement payouts for two-sided platforms

- Boost your growth with automated payouts by implementing payout automation on your platform

- International payouts with our innovative system for two-sided platforms

- Product vs Platform: exploring the benefits and choosing the right payment solution

- How to accept payment on marketplaces: a guide to streamline your platform

- How to create a platform: step-by-step guide for building an online success

- What is an online platform or marketplace platform: key insights & payment solutions

- How does marketplace work: a focus on online payments and payouts

- How to create a marketplace website with payment solutions designed to build growth

- Ecommerce Platform vs Marketplace: key differences and how to choose the right payment solution

- What is a SaaS platform: meaning, examples, and payment solutions to boost their performance

- The role of advanced APIs in enabling seamless payment flows for MedTech innovators

- Maximising positive impact: the synergy of AI, sustainability, and comprehensive payment solutions

- Deconstructing payment processing

- How to accept payments on social networks?

- What are the best payment gateways for WooCommerce?

- What is the best payment gateway for marketplaces and platforms?

Flexible payout schedules & seamless settlement payouts for two-sided platforms

Introduction

In today’s fast-paced digital economy, two-sided platforms and marketplaces face unique challenges when it comes to managing financial operations. One of the most critical aspects of these operations is ensuring that sellers and service providers receive their earnings on time and in a manner that supports business growth. Fondy has emerged as a trusted partner, offering flexible payout schedules and seamless settlement payouts that streamline these complex processes. This article explores how Fondy’s capabilities can transform the way platforms manage their payout and settlement processes, ensuring efficiency, reliability, and satisfaction for all parties involved.

Understanding the challenges of managing payouts on two-sided platforms

Two-sided platforms operate by connecting buyers and sellers, creating a dynamic environment where financial transactions occur continuously. As a result, these platforms must handle frequent and sometimes high-volume transactions. A critical challenge lies in managing the payout schedule. Without a well-organised schedule, businesses may struggle to deliver timely payouts, leading to disputes, dissatisfaction, and a loss of trust among service providers and sellers.

Furthermore, the concept of settlement payout is equally vital. Settlement refers to the process of finalising transactions after verifying that all conditions have been met. On two-sided platforms, settlement payouts must be managed carefully to account for various factors such as transaction fees, refunds, and disputes. Mismanagement in this area can result in financial discrepancies, regulatory issues, and a breakdown in the trust that is essential for the smooth operation of a marketplace.

How Fondy streamlines the payout and settlement process

Fondy provides a comprehensive solution that addresses these challenges by offering an integrated platform for managing both payouts and settlements. At its core, the system is designed to handle complex financial flows and to support the unique requirements of two-sided platforms. By providing a flexible payout schedule, Fondy allows platforms to customise the timing and frequency of payouts based on their operational needs and the expectations of their users. This flexibility ensures that each participant in the ecosystem receives payments promptly and securely.

Equally important is the efficient handling of settlement payouts. Fondy’s robust technology supports the automated reconciliation of transactions, ensuring that funds are settled correctly and transparently. This means that once a transaction has been authorised and verified, the funds are promptly released according to the predetermined schedule. The system’s ability to manage settlement seamlessly reduces the administrative burden on platform operators and minimises the risk of errors, creating a smoother experience for everyone involved.

Customised payout schedule solutions

One of the standout features of Fondy’s offering is its ability to provide customised payout schedules. Every platform is unique, and the financial needs of marketplaces vary greatly depending on the industry, volume of transactions, and regulatory requirements. Fondy enables businesses to set up a payout schedule that aligns with their operational model. Whether the platform needs daily, weekly, or even real-time payouts, the system is designed to adapt without compromising on security or efficiency.

This flexibility is particularly beneficial for platforms that operate across different regions and currencies. Fondy’s system accommodates multi-currency transactions and ensures that payouts are processed in accordance with local regulations and business practices. As a result, platform operators can focus on growing their business without the distraction of managing complex financial logistics manually.

Efficient settlement payouts for improved financial management

Settlement payouts represent the final step in the financial transaction process, and efficiency at this stage is critical. Fondy’s solution ensures that settlements are not only accurate but also executed swiftly. By automating key aspects of the settlement process, the platform reduces the likelihood of delays or discrepancies. The integrated system cross-checks each transaction against the agreed payout schedule, thereby ensuring that funds are disbursed according to the specific rules and conditions set by the platform.

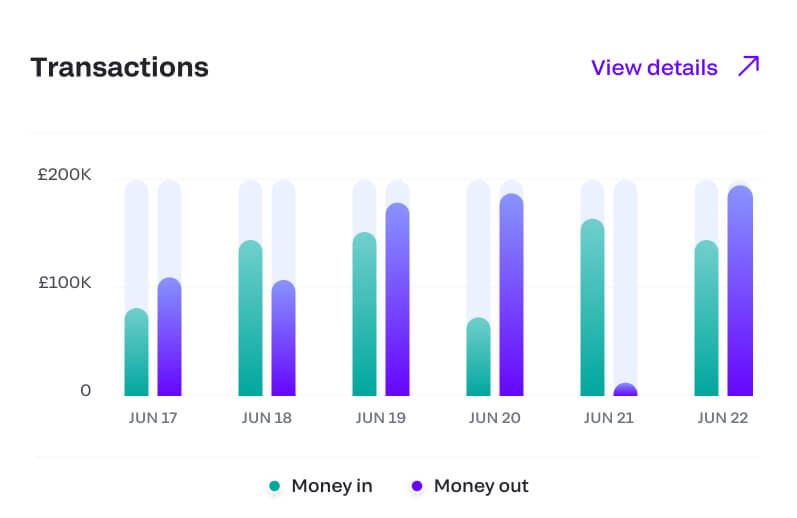

Moreover, the settlement functionality is designed with transparency in mind. Platform operators have access to detailed reports and real-time analytics that provide insights into every payout and settlement. This level of visibility is essential for maintaining the trust of sellers and service providers, as it demonstrates a commitment to clear and accountable financial practices.

The benefits of using Fondy’s payout and settlement system

Integrating Fondy’s payout and settlement system offers numerous benefits for two-sided platforms and marketplaces. One of the most significant advantages is the boost in operational efficiency. By automating both payout and settlement processes, platforms can reduce the manual effort required to manage transactions. This automation not only speeds up financial operations but also minimises the risk of human error, which can be costly in high-volume environments.

Another important benefit is enhanced transparency. With detailed reporting and analytics, platform operators can monitor every aspect of their payout schedule and settlement payout process. This transparency is crucial for compliance and for maintaining the confidence of users. When sellers and service providers see that their earnings are managed in a secure and reliable manner, they are more likely to remain loyal to the platform.

Furthermore, the ability to customise the payout schedule means that businesses can optimise their cash flow management. By aligning payouts with revenue cycles, platforms can ensure that funds are available when needed and that operational costs are managed effectively. This level of control over financial operations can be a decisive factor in the long-term success and scalability of a marketplace.

Key features and capabilities of Fondy

Fondy’s platform is built on advanced technology that supports a range of features designed to meet the demands of modern marketplaces. Among these, the automated payout schedule is a cornerstone feature that allows businesses to define specific intervals for releasing funds. This feature is complemented by the system’s capacity for handling settlement payouts with precision, ensuring that all transactions are finalised in a timely manner.

Real-time reporting and analytics

A major component of Fondy’s solution is its robust reporting system. Real-time reporting provides platform operators with up-to-date information on every transaction, including details of each payout and settlement. This comprehensive view allows businesses to track performance, identify bottlenecks, and make data-driven decisions. The transparency offered by real-time analytics also helps in building trust with users, as they can verify that their transactions are being processed accurately and promptly.

Seamless integration with existing systems

Another critical advantage of Fondy’s technology is its ability to integrate seamlessly with existing systems. Many platforms already use a variety of tools to manage different aspects of their operations. Fondy’s API-based approach ensures that the payout schedule and settlement processes can be embedded into the platform’s infrastructure with minimal disruption. This integration means that businesses do not need to overhaul their current systems; instead, they can enhance their financial operations with a solution that works in tandem with their established processes.

How Fondy supports business growth through efficient payouts

As two-sided platforms continue to evolve, the need for a reliable and flexible payout system becomes even more pressing. Fondy’s approach to managing payouts and settlements is designed to support business growth by ensuring that financial operations are robust and adaptable. When platform operators can rely on a consistent and transparent payout process, they are better positioned to invest in other areas of the business. The financial stability provided by a well-managed payout schedule helps in attracting new sellers and service providers, thereby expanding the platform’s ecosystem.

Moreover, the automated nature of settlement payouts means that businesses can scale their operations without a proportional increase in administrative overhead. As transaction volumes grow, the system’s efficiency remains consistent, ensuring that all parties receive their funds without delay. This scalability is critical for platforms aiming to expand their market presence and enhance their competitive edge.

Ensuring compliance and security in every transaction

In the realm of financial transactions, compliance and security are paramount. Fondy’s solution is built with stringent security measures and is fully compliant with international regulations. This commitment to security extends to every aspect of the payout and settlement process. The system employs advanced encryption and fraud detection techniques to protect sensitive data and prevent unauthorised transactions.

Compliance is further enhanced by the system’s ability to handle multi-currency transactions and to adapt to various regulatory environments. By ensuring that every payout is processed in line with local and international standards, Fondy provides a secure environment that fosters trust among users. This dedication to security and compliance is a key reason why many platforms choose Fondy as their financial partner.

Real-world success and future potential

Many successful two-sided platforms have already benefited from Fondy’s innovative payout and settlement solutions. By implementing a flexible payout schedule, these platforms have seen improvements in cash flow management and user satisfaction. The seamless integration of settlement payouts has reduced the administrative burden, allowing businesses to focus on growth and customer engagement.

Looking ahead, the future potential for Fondy’s solution is substantial. As digital transactions continue to evolve, the demand for flexible and secure payout systems will only increase. Fondy is committed to continuous improvement, regularly updating its technology to meet emerging challenges and to incorporate new features that enhance user experience. For platforms seeking a partner that understands the intricacies of financial management in a digital ecosystem, Fondy offers a reliable and forward-thinking solution.

Conclusion

In conclusion, efficient management of payouts and settlement payouts is critical for the success of two-sided platforms and marketplaces. Fondy provides a comprehensive solution that not only addresses these challenges but also offers significant benefits in terms of efficiency, transparency, and security.