If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- What is pay-in and pay-out: a comprehensive guide to payment processes for online business

- Mastering delayed payouts: ensuring timely transactions with Fondy

- Streamline your payout process with our comprehensive payout system: low fees for outgoing financial transactions

- How to use payout gateway for outgoing payments on your platform

- How does split payment work for business with Fondy Flow

- A guide to eCommerce split payments

- What is split payment & how Flow Payments can help your business

- What are payouts: a guide to instant & global payouts for business

- How to split credit card payments online: solutions for platforms & marketplaces

- The gig economy’s impact on traditional industries

- Integrating electronic health records with payment systems: advancing efficiency in MedTech billing

- The crucial role of payments in empowering gig platforms

- An introduction to recurring payments

- What is the Faster Payments Service (FPS)?

- What is the SEPA payment method?

- What are quick payments in one click?

- What are cross-border payments?

- What are open banking payments?

Integrating electronic health records with payment systems: advancing efficiency in MedTech billing

A patient’s paper chart is an essential part of healthcare. In today’s digital world, paper charts must be available instantly and securely in digital form via electronic health records (EHRs). Even better, with the advent of medical technology (MedTech), providers, patients, and healthcare assistants can integrate electronic health records with a payment network or service provider.

Are EHRs the same as electronic medical records (EMR)?

Electronic medical records and electronic health records aren’t the same concept, but they’re often used interchangeably as they do share some similarities.

Electronic medical records are patient charts specific to one medical practice or healthcare provider, whereas electronic health records include information from multiple practices or healthcare systems and have a more general view of the patient’s health history, such as test results, illnesses, hospital visits, and medications.

With electronic medical records, if a patient moves to another healthcare practice or provider, their EMR needs to be transferred to provide continuity of care.

One theme that EMRs and EHRs share is the need for reliable payment systems.

What are the benefits of integrating your EHRs with a payment system?

All healthcare providers need some method of collecting payments, but when payment processing systems aren’t integrated with patients’ electronic health records, the process can often become a burden and feel intimidating to the patients. When it comes to MedTech especially, this is unacceptable.

Integrating payments into electronic health records offers a variety of benefits to patients and healthcare, including:

Improve patient experience

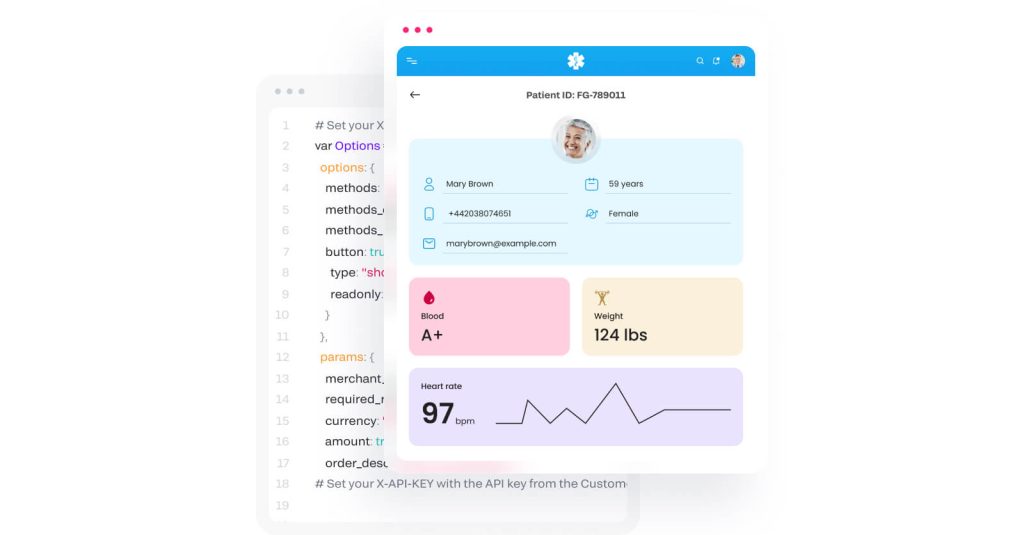

Most importantly, payment integration creates a patient-friendly interface that provides a secure environment to send payments. Additionally, the ability to view medical records at the same time as medical billing can remove any confusion that comes with understanding medical payments. As MedTech advances, user experience becomes just as important as medical treatments and services.

Improved collection rates

Traditional billing can be a burden on patients and providers, and integrating payments into EHRs can remove the inconvenience and time delays while increasing collection rates. With an integrated platform like Flow Payments, billing can also be streamlined with automation so that invoices are created, sent, and collected efficiently.

Time management

Invoicing and payment processing require significant resources from healthcare providers. When payments are tied to patient records, the process becomes seamless, meaning that patients and medical practices are better equipped to manage accounts. Payment integration also removes the human error risk of manually inputting payment data from paper invoices.

Record reconciliation

An integrated payment platform makes looking at reports and reconciling payment records easier. Although many healthcare providers today still use multiple methods of collecting payments, separate systems can be complex to reconcile, and they also pose additional risks for human error and mistakes.

Improved compliance

Integrating EHRs with payment systems allows medical providers to better maintain compliance and legal requirements and reduce risks associated with having separate, unconnected payment systems. But with one-stop payment solutions like Flow Payments that integrate payment capabilities into electronic health records, healthcare providers can easily track and maintain these records, making them safer and more compliant.

Enhanced data security

From PCI compliance to SSL protocol and features such as tokenization and 3D Secure, integrating electronic health records with payment systems helps patients and providers stay safe online. Even better, payment systems can help keep abreast with updated operating systems.

Understanding the need for payment integration

Accepting payments, managing recurring subscriptions, and billing are important for any business, including SaaS platforms. That said, there are many challenges associated with managing each of these elements correctly. These issues include:

- Documentation errors. Medical documentation is notoriously error-prone due to its complexity, thus increasing the likelihood of human error. As a result, wrong documentation can result in claim denials and payment delays.

- Compliance with regulatory requirements. MedTech providers need to adhere to compliance requirements to maintain high patient safety standards. Even more crucially, healthcare providers need to keep up with the ever-evolving regulations and policies within the industry.

- Slow reimbursement processes. When handled manually, billing and reimbursement need to be cross-checked with existing policies to ensure compliance with complex reimbursement requests.

All the aforementioned challenges, plus the limitations of traditional billing systems, slow down the entire reimbursement process.

Streamlined payments can positively change the way businesses interact with their customers. They can also open new revenue streams for businesses by enabling them to offer value-added services, such as fraud detection and compliance monitoring.

Additionally, payment streamlining through processes like automation can lower costs by eliminating the need for multiple payment processors and associated fees. That’s because traditional payments and manual accounting can require employing full-time bookkeeping services, but automation removes this need.

Although platforms and marketplaces will need accounting services occasionally, streamlined payments make them less of a burden, as accurate reporting limits the need for supplementary costs such as legal fees resulting from accounting errors.

The challenges of managing recurring billing in the MedTech industry

Recurring billing is a boon for businesses, especially Software-as-a-Service (SaaS) platforms.

Fortunately, there are plenty of SaaS billing software, tools, and technologies that aid organisations in automating the creation and sending of invoices, collecting payments, and tracking customer interaction. The software enables SaaS companies like MedTech providers to manage billing and subscriptions for patients and healthcare assistants subscribed to their SaaS platform while benefiting from a broad range of payment methods and automated follow-up messages.

However, the aforementioned features can’t cover up existing inefficiencies or fix future problems if your billing system isn’t robust enough. Some of these challenges include:

- Unscalable billing infrastructure. The choice is simple but also complex. Should companies build their billing system or use one of the available solutions in the market via payment service providers? Building billing in-house may seem like a cost-effective option, but in the long run, as you scale, new subscribers, price changes, new payment methods, upgrade and downgrade requests, and flexible billing plans will create more complexity. At this point, running an in-house system will take precious time and resources away from your main business operations. To gain a deeper understanding of SaaS platforms and how they function, explore our detailed guide what does SaaS platform mean. Discover the foundational principles, key features, and how tailored payment solutions can drive better performance for SaaS businesses.

- Complex invoicing processes. Along with diverse billing, companies have to deal with multiple customer bases, various product packages, and promotions. On top of that, automating the invoicing process is also tough for subscription businesses that deal with a massive pool of customers. The situation is even more complicated for those offering different product bundles, prices, and promotions, especially when customers sign up at different periods for different services.

- Increased security and compliance challenges. Recurring billing systems come with the responsibility of handling sensitive customer data. This poses significant challenges related to data security and compliance and the ramifications of data breaches. To prevent such breaches, businesses must invest in reliable data security measures and adhere to data protection regulations. Transparent communication with customers about data handling practices will also need to be had to build customer confidence.

Fondy simplifies recurring billing processes through automation, making invoicing, payment processing, and payment collection easier for MedTech platforms and their clients.

The importance of accurate reconciliation in MedTech billing

MedTech providers need to perform two tasks to successfully track their finances: payment tracking and billing reconciliation. For this, you need to invest in EMR or EHR software that allows you to automatically keep track of your payments and billing reconciliation all in one place.

Billing reconciliation means matching incoming statements to open or outstanding invoices to ensure that your MedTech platform is receiving the correct amount of money for the provided services.

In the past, billing reconciliation had to be done by hand, which meant keeping track of payments, costs, and bad debt expenses in a labour-intensive exercise. Then, review those results to determine how efficiently and effectively your platform has been performing.

Automating payment tracking and billing reconciliation will make your platform run more efficiently and reduce the human error that manually completing these tasks may cause.

Flow Payments reconciliation features help streamline payment tracking and billing reconciliation. By choosing to automate the reconciliation process with Fondy, MedTech platforms can reduce the time spent on reconciliations by over 75% and cut costs significantly, working with any type of data and processing any reconciliation.

This results in improved data control and confidence while reducing the risk of regulatory breaches and penalties and ensuring ongoing compliance. Unlike spreadsheets, Fondy’s automated solution’s flexibility accommodates both company growth and new regulatory requirements.

Fondy for MedTech companies

Fondy can help platforms and marketplaces in the healthcare space advance MedTech billing efficiency. That’s because MedTech providers need innovative payment solutions like Fondy that allow healthcare marketplaces and platforms the means to move money without friction by supporting the integration of EHRs and payment systems.

These innovations include key features such as recurring billing, reconciliation, multiple payment methods, payouts, and account management. That way, it’s easy for MedTech platform owners to manage the flow of payments and payment data through a single, convenient API.

At Fondy, payments flow uninterrupted by complicated iterations, multiple parties, and unnecessary documentation. As a leading payment service provider, Fondy is designed to assist businesses as they scale up, be it with additional payment solutions or money management functionality.

In fact, advanced payment APIs offer several additional benefits to MedTech providers, including:

- Scalable payment processes

- Easy implementation for developers

- Improved user experience and customer journeys

- Increased payment security and protection