Use cases

Payments features

Payout profile

Payout account: build a custom profile for seamless transactions

Set up a tailored payout account that perfectly aligns with your business needs. By building a custom profile, you ensure seamless transactions, maintain precise control over payout schedules, and eliminate unnecessary complexities. With this structured approach, you gain the flexibility to adapt to changing demands while focusing on steady growth and financial stability. By reducing your reliance on bank processes, you reclaim time and resources for strategic pursuits.

Adaptable configurations for any market

Shape each payout bank account to meet the demands of different regions and customers. Adjust timing, currencies, and rules according to your ever-evolving business framework. Scale effortlessly while ensuring every payout lands without delay or confusion. Or skip the traditional bank framework altogether and enjoy full autonomy over your financial operations.

Custom payout profile for predictable outcomes

Design a payout profile that suits your unique operational flow. Set automated triggers, choose preferred payout currencies, and determine payment frequencies that perfectly match your commercial goals. In contrast to rigid bank regulations, you can fine-tune every detail to align with your specific requirements and reduce bottlenecks.In contrast to rigid bank regulations, you can fine-tune every detail to align with your specific requirements and reduce bottlenecks.

Smooth payout account operations

Refine your settlement approach with streamlined processes that cut back on manual tasks. Let recurring payouts run behind the scenes, integrating seamlessly into your infrastructure. Eliminate manual steps often required by bank transfers, so you can concentrate on innovation while every transaction completes reliably in the background.

Lower expenses and worldwide reach

Combine local routes with an optimised payout bank account to reduce unnecessary fees. Whether you operate in a single region or around the globe, smart routing keeps costs low while accelerating international expansion. Cut unnecessary bank fees and overhead, ensuring that funds move swiftly without costly delays.

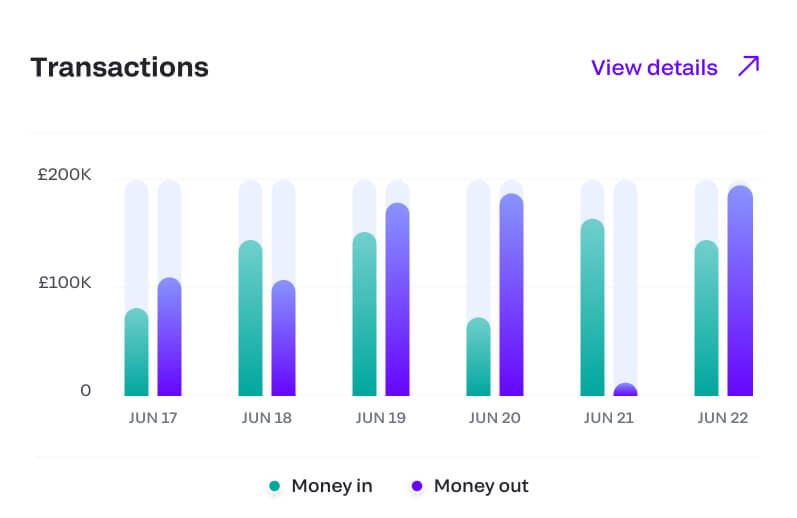

Real-time data for informed decisions

Monitor every step of the payout cycle using timely analytics. Track performance, pinpoint any issues early, and revise your payout profile to remove bottlenecks. Stop second-guessing with partial bank statements – our analytics deliver a comprehensive real-time view, boosting confidence in your financial flow.

Easy API integration for streamlined automation

Connect our solution to your existing systems through a straightforward API. Automate day-to-day settlements, customise payout rules, and minimise the need for hands-on oversight. Free your team from typical bank approvals and paperwork, so they can focus on strategic planning.

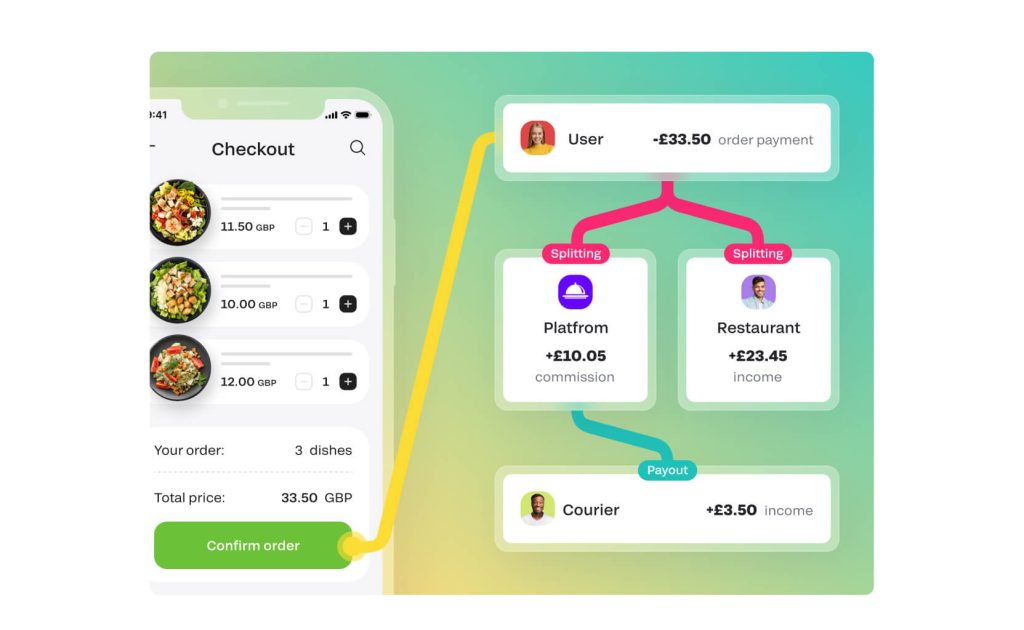

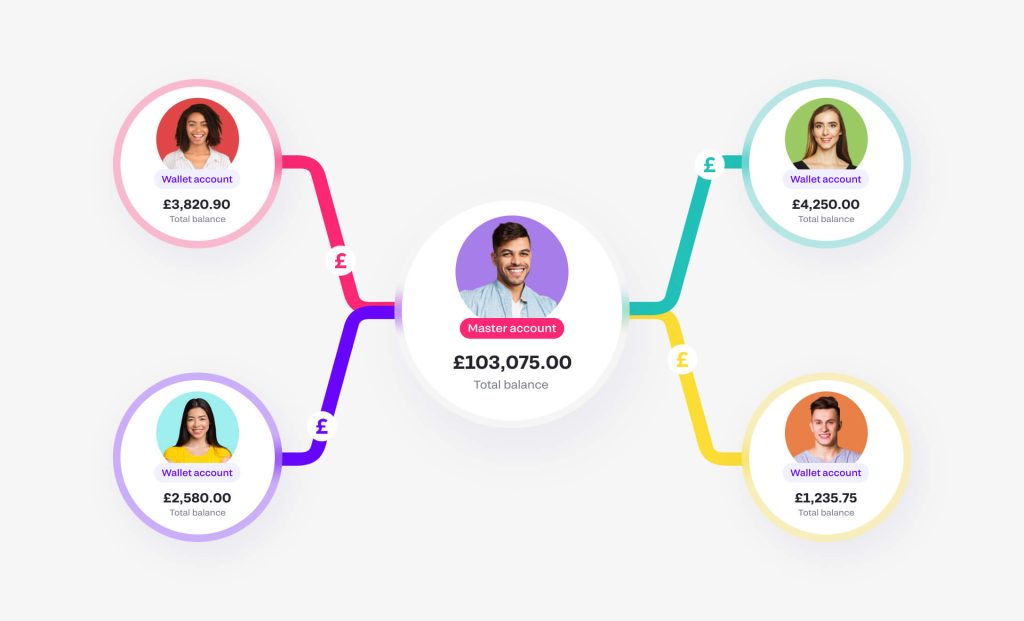

Unified account environment

Gather all partner and operational accounts under one manageable structure. Oversee each payout profile in a central location and reduce administrative burdens. This single-hub approach enhances transparency, simplifies oversight, and encourages smoother collaboration across your organisation.

Secure and compliant infrastructure

Safeguard your payout account with robust data protection and industry-approved security standards. Rely on consistent regulatory compliance for your payout bank account, ensuring every transaction remains protected against potential threats. You no longer depend on bank security procedures alone – our system enforces additional protective measures for complete peace of mind.

Future expansion with flexible payout bank accounts

Remain ready for upcoming business opportunities by configuring multiple payout bank accounts. Assign different currencies, schedule unique payout frequencies, and adapt your approach as you enter new markets. This forward-thinking setup lays the foundation for rapid and worry-free scaling.

Ongoing support and expert advice

Draw on our dedicated team for help with refining your payout profile. Get immediate answers, strategic tips, and direction whenever you encounter a challenge. We’re here to keep every process running smoothly, so you can concentrate on achieving your long-term objectives.

Optimize your payout account strategy

Adopt a proven system designed to create certainty in your payouts. Avoid unexpected delays, sharpen resource planning, and establish a trustworthy financial routine that supports your ambitions.

Create a free account

Open a new account at no cost and discover how a well-constructed payout account revolutionises your funding flow.

Request a demo

Curious to see how it all works? Book a demonstration and see first-hand how flexible scheduling and automation can boost your overall efficiency.

Gateway

- Go borderless and accept payments from anywhere, anytime and anyhow

- Enable your customers to pay how they want wherever they are

- Enjoy full transparency with cost-effective pricing and zero hidden costs

Flow

- Access faster settlements with multicurrency IBAN accounts

- Enjoy multiple benefits and features including recurring payments and payouts

- Manage all the movement of funds from one convenient platform without a third party

We use cookies to ensure our web-based products are functioning properly while continuing to improve your browsing experience, offering social media functionality, personalising our marketing and advertising content to suit your needs. We sometimes share cookie data with our partners for these purposes. Our cookies remember your preferences and the data you fill out on forms on our web products. As well as analysing traffic, our cookies register how you found us and collect information about your browsing habits. By continuing to use our web products, you agree to our use of cookies.