If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- The best international business accounts for cross-border payments

- Setting up business accounts: how Fondy makes it simple

- Startup business accounts: how to choose the best option for your UK business

- Compare business accounts in the UK: features, fees, and benefits explained

- Best small business accounts UK: pick the right one with basic or extra features

- Top 10 business accounts in the UK and why Fondy is the best choice

- Best business accounts in the UK for limited companies or sole traders: compare with banks and open online

- How to open business accounts, set up and create sub-accounts & start making global payments with Fondy

Best business accounts in the UK for limited companies or sole traders: compare with banks and open online

A business bank account is a great way of storing and managing all your company’s income and outgoings. If you’re a small business owner, a business bank account helps separate your personal cash flow from that of your company. “But why not just set up your personal bank account for your business?”. Continue reading to discover:

- If you can set up a personal bank account for your company

- The features of business bank accounts

- Which documents do you need to set up a business bank account?

- How to choose a business bank account to open

- Why Fondy beats traditional business bank accounts

- The best online free small business bank accounts

- How to open online business accounts with Fondy

💡 While there are many options on the market, businesses increasingly choose Fondy for its fast, flexible, and fully online setup – making it easier to manage payments and grow internationally without traditional banking roadblocks.

Can you use your personal bank account for your business?

The short answer is yes. That’s because sole traders are under no obligation to set up independent business accounts. That said, it’s a good idea to have one current account for personal banking and a bank account for the business. This will help you keep your business cash flow separate from your own.

Limited companies legally need a separate account, which should be a designated business account if possible. That’s because the company or business is deemed to be legally distinct and separate from you.

Features of business bank accounts

Most UK business accounts differ from individual current accounts. That’s why it’s worth understanding what you’re signing up for before you open your business account. For example, there might be costs involved when you open business accounts that you may not have incurred for your personal account.

Although accounts vary from one provider to another, below are some of the features you should consider when you want to open a business account:

Introductory/open offers

Providers may offer short-term rewards when you open up with them, such as international transfers, access abroad, competitive interest rates, zero-standing charges, open or online-only offers, or cashback.

Standing charges

Certain online business accounts charge a monthly or quarterly fee when you open a bank account with them.

Transaction charges

These charges are made for the handling of money moving in and out of your current account. Some accounts might offer lower transaction fees for making and receiving overseas payments.

Internet banking

While most business accounts provide internet banking, there are some exceptions, so it’s best to make sure beforehand if it’s essential to your company.

Apps

Many business accounts have dedicated apps that integrate with other services, such as accounting and online invoicing software, once you open your account.

Debit and credit cards

You’ll usually be able to get several bank cards with the account, giving you and any staff access to company or merchant funds.

Interest rates

The higher interest rates that come with business bank accounts can see you get greater returns on your savings.

In-store branches

Some business bank accounts are online only, so it may be worth finding an alternative if this is a priority.

Protection

Some business bank accounts even offer insurance, international assistance, and support in the event of online fraudulent activity at home or abroad.

Fondy understands that businesses need flexibility in terms of managing payments from a business account. Fondy Flow offers the convenience and simplicity of managing global payments all from one platform. Discover more about a Fondy Flow account today.

What documents do you need to open a business bank account?

Opening a bank account in the UK is a pretty simple process. All you need is all your documents in one place before you apply. You’ll likely need the following:

- Proof of your identification, like your driving licence or passport, and proof of any change of circumstances, such as a change of name or marital status.

- Proof of your address, such as an online utility payment or council tax bill, or a statement from your personal bank account.

You’ll also need the following information about your business:

- The full name of the company.

- The business’ international postal address.

- The business’ main phone number and email address.

- The business’ UK Companies House registration number.

- The approximate annual UK revenue.

How to open a business account in the UK

Opening a business bank account in the UK provides companies with access to one of the world’s premier financial hubs, whether you’re a UK resident or operating from abroad. If your company also operates internationally or deals with cross-border payments, it’s worth exploring specialised international business accounts tailored to global operations. Fondy offers versatile banking solutions designed to meet the needs of diverse businesses seeking to establish financial operations in the United Kingdom.

For UK-based entrepreneurs and companies, Fondy streamlines the process of creating and managing business accounts with dedicated IBANs, multiple currency support, and efficient payment processing. You can learn the complete step-by-step process in our comprehensive guide: “How to open business accounts, set up and create sub-accounts & start making global payments with Fondy”, which covers everything from account creation to making your first transactions.

For international entrepreneurs and businesses without UK residency, Fondy offers specialized solutions that remove traditional barriers to banking access. Our UK business bank account for non-residents service provides a standout solution tailored for global entrepreneurs, freelancers, and businesses—no UK residency required. With fast online setup, instant settlements, and smart tools like virtual accounts, you can manage GBP funds effortlessly from anywhere. Whether you’re a sole trader or run a limited company, this service gives you the flexibility to handle international payments, payouts, and cash flow with ease.

Both resident and non-resident business accounts come with Fondy’s powerful features, including sub-account creation capabilities, customizable payment workflows, and robust security measures. Start leveraging the advantages of a UK-based business account today and position your company for international growth with banking solutions designed for modern business needs.

How to choose a business bank account

It’s difficult to say which bank offers the best small and start-up bank business accounts. There are so many great bank accounts out there, at home in the UK and abroad, each with its own banking and online features.

One of the things most business owners should look for is lower costs – and many UK banks offer fee-free banking for the first 12 to 18 months. However, there’s usually a significant hike in fees once the opening period is over. It’s worth checking how much these fees will cost your business in the long term.

You should also check how flexible the account is. Just like a mortgage, you should look for the flexibility to switch to a new bank account once the payment fees start to stack up or change when the initial rate is over.

It’s also worth considering which business features your company could benefit from, such as online tools, earning cashback on your purchases, or interest on your opening balance.

🟨 While traditional banks often offer short-term deals, Fondy focuses on long-term value — no paperwork, no queues, just fast and secure global banking designed for real-world business needs.

Why Fondy beats traditional business bank accounts

Choosing the right business bank account can be overwhelming, especially when each bank sets different limits, fees, and requirements. Traditional business bank accounts often involve paperwork, long verification times, and geographical limits that slow you down.

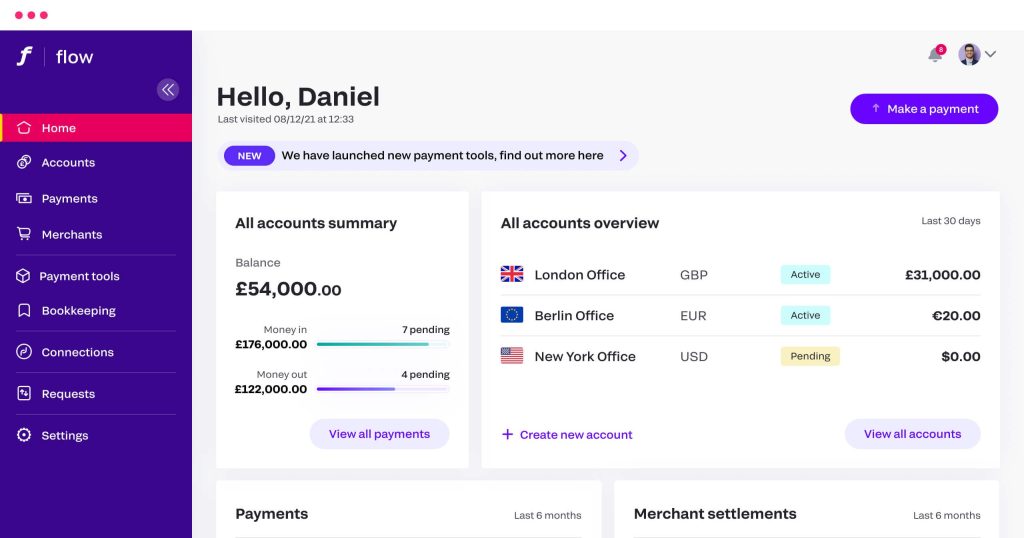

Fondy is designed to eliminate those limits. Whether you run a startup or an established business, Fondy provides a flexible alternative to the bank experience — with a multicurrency business account that works like a local bank account across borders. You can set up and manage multiple business wallets, monitor cash flow, and process payments — all without visiting a bank branch.

Unlike many bank providers that limit features based on size or residency, Fondy supports your business whether you’re based in the UK or abroad. There’s no need to open several bank accounts for different currencies — Fondy lets your business grow without borders.

By choosing Fondy over a traditional bank, your business gains the speed, freedom, and clarity to manage payments globally. Don’t let outdated bank structures limit your business potential — go beyond limits with Fondy.

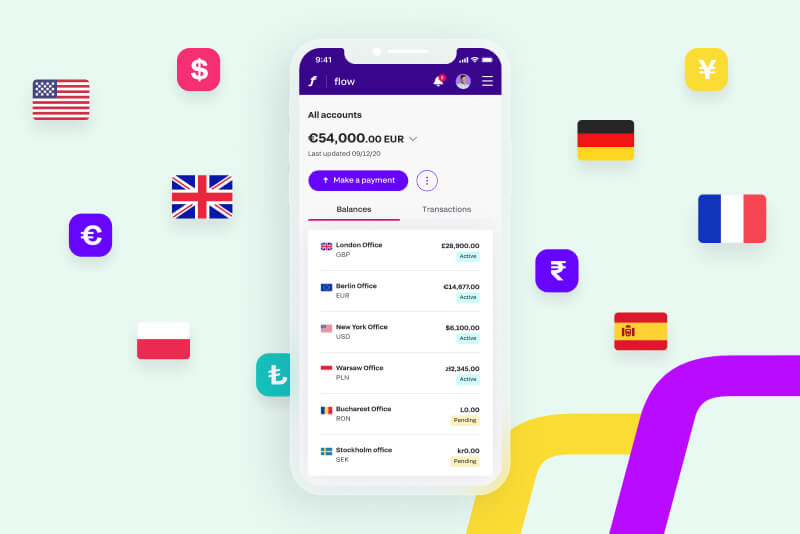

Use Fondy Flow as a business account

If you need a way for your business to simplify the process of setting up multiple accounts, managing payments, and making it easier to sell your products overseas, then a Fondy Flow multicurrency business account may be just the ticket. Fondy Flow accounts come equipped with their own IBANs, meaning they work similarly to bank accounts, enabling you to conduct business like a local in different countries.

Whether it’s receiving and transferring funds or making payouts in multiple currencies, a Fondy Flow account removes the hassle, expense, and time restraints usually associated with processing business payments. Even better, Fondy Flow offers convenient features such as split payments, reconciliation, and instant settlements to help automate the payment collection and cash flow monitoring process.

How to compare the best small business bank accounts

If you’re a new business or even just switched to Virgin Money, you’ll get 25 months of fee-free banking. To be eligible, you need to be a new UK business ready to open an account within 12 months of starting up or a small business or start-up with a turnover of less than £6.5 million.

After the fee-free period, you’ll be switched to the business tariff payment – it’s £6.50 a month, excluding charges for other transactions like Direct Debits and cash paid in. That said, you’ll save £162.50 in just over two years. Virgin Money also provides specialist bank relationship management and an optional overdraft in the UK, making it a compelling choice for startups. To explore more options and compare features, fees, and benefits of various UK business accounts, check out this detailed guide: “Compare business accounts in the UK: features, fees, and benefits explained”.

🔄 Unlike banks that offer limited flexibility or require multiple accounts to manage international operations, Fondy gives you everything in one place — multicurrency wallets, sub-accounts, and instant settlements included.

Open online business accounts with Fondy

If you’re looking at a challenger bank, Tide and Starling Bank have some of the best online business bank accounts in the UK. Tide has a dedicated mobile-first business current account with three different price plans, from free to £49.99 a month, while Starling Bank has a free account with options for both limited companies and sole traders in the UK.

However, both options have limitations when it comes to global growth. Unlike Tide or Starling, Fondy offers built-in multicurrency support, virtual IBANs, instant payouts, and sub-accounts — all in one place, with no hidden fees. For businesses aiming to expand beyond the UK, Fondy is the smarter, scalable choice.