If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- What is pay-in and pay-out: a comprehensive guide to payment processes for online business

- Mastering delayed payouts: ensuring timely transactions with Fondy

- Streamline your payout process with our comprehensive payout system: low fees for outgoing financial transactions

- How to use payout gateway for outgoing payments on your platform

- How does split payment work for business with Fondy Flow

- A guide to eCommerce split payments

- What is split payment & how Flow Payments can help your business

- What are payouts: a guide to instant & global payouts for business

- How to split credit card payments online: solutions for platforms & marketplaces

- The gig economy’s impact on traditional industries

- Integrating electronic health records with payment systems: advancing efficiency in MedTech billing

- The crucial role of payments in empowering gig platforms

- An introduction to recurring payments

- What is the Faster Payments Service (FPS)?

- What is the SEPA payment method?

- What are quick payments in one click?

- What are cross-border payments?

- What are open banking payments?

What are quick payments in one click?

If you need information about payment(s) in 1 click, look no further. Continue reading to discover more about payments in 1 click, including:

- The definition of a fast payment in 1 click system

- What do quick and instant payments mean?

- How to accept fast payment in 1 click on your gateway

- What are the benefits of gateways that accept one-click payments?

- The difference between one-click payments and one-click checkout?

What is payment in one click?

Payment in 1 click or one-click payments are a quick, fast, and instant payment processing method that gives customers the option of accepting to pay on the web with a single button. Although payment in one click is geared toward single payments, the quick payment method can also be used for recurring transactions such as cinema tickets or paying for online fast food orders.

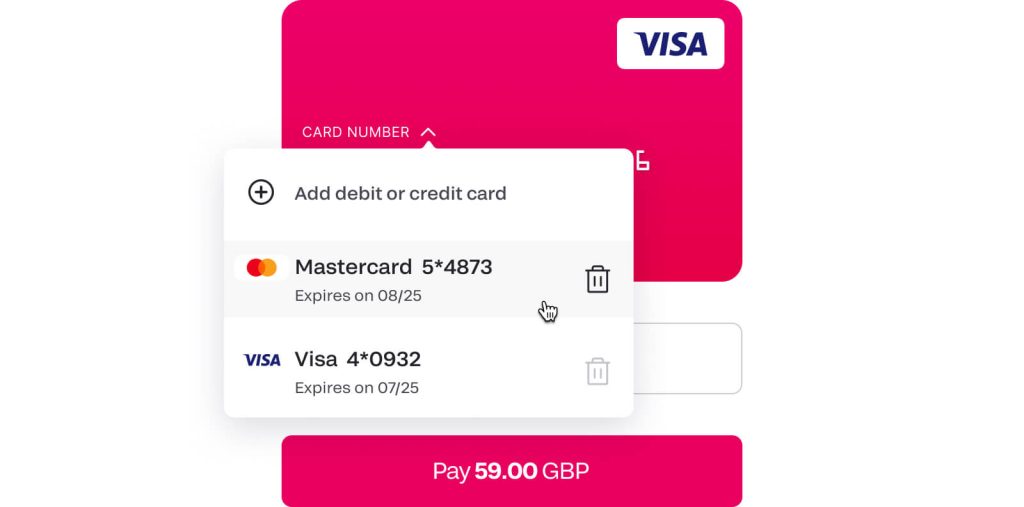

Customers must fill in their card details during the initial transaction to enable payment in one click on the web. After the first card sale and with the customer’s card payment details securely stored, the single payment option becomes available. This instant payment processing method is usually accepted for quick credit cards, debit cards, loyalty cards, and eWallets web payment systems.

During the next purchase, the customer will see their pre-filled card details or a button with the card details, which will need to be selected to confirm the payment in one click. This process speeds up the payment confirmation.

Similarly, a comparable feature is used in the recruitment industry. One-click apply or easy apply is a method that lets job applicants apply for roles quickly with one click. The method works just like fast card payments in 1 click in that the process starts with applicants uploading a generic cover letter and a CV (or resume) to their accounts on web providers like LinkedIn and Indeed. After that, the candidates can quicken their job search process by accepting to submit an application using the easy apply functionality.

What are instant payments?

The term instant payments can refer to many types of payments. In some industries, such as the banking and remittances field, instant payments can mean quick payments that are accepted in seconds, in minutes, or within an hour.

What instant and quick payments actually mean is that they’re electronic retail payments that are processed in real-time. After the payments are processed, the funds are quickly made available for use by the recipient. As such, each processing method can take seconds, minutes, or up to an hour.

In fact, the Euro Retail Payments Board defines instant payments as “electronic retail payment solutions available 24 hours a day, seven days a week, and 365 days per year”. They also state that instant or quick payments lead to the immediate or close-to-immediate interbank clearing of the transaction and crediting of the payee’s account with confirmation to the payer.

As a one-stop payment platform, Fondy understands the need for businesses and electronic commerce stores to be flexible and accept various payment methods in various currencies. Want to know more about us? Great! Check out our About Fondy page and discover what inspires us and how we can best benefit your business, no matter the size.

How does payment in 1 click work?

Payments in one click are quick and straightforward in practice. Initially, it works just like a normal debit card or credit card payment. That involves the customer entering their card number, CVV code, and card expiration date, as well as the first name (or initials) and last name of the cardholder. Then, quick instant payments in one click work by:

- After the first transaction is completed, all accepted payment information is tokenised and stored by the gateway.

- When the customer returns to the same online merchant, they are quickly identified by the merchant.

- The 1 click payment option is now available to use should the customer choose to accept to use it for a specific web transaction.

- The system quickly completes the transaction with the stored online payment information.

One-click checkout with Fondy

At Fondy, you have access to a unique feature called One-Click Checkout that allows you to pay quickly with bank cards or via a bank account. Whenever a customer makes their first payment with a particular merchant, they’ll need to:

- Choose a bank where they already hold a bank account and enter their IBAN.

- Log on to their online banking to confirm the payment.

After that, the Fondy gateway will recognise the customer’s login and display a ClickToPay button with his bank details. From there, they’ll need to click on the button to get redirected to their online banking account. Even better, with tokenisation, card and account-to-account payment times are reduced from around four minutes to less than a minute.

What are the benefits of one-click payments?

Payments in 1 click have many other advantages besides quick and fast payment transactions. Additionally, payments in 1 click are hugely beneficial to mobile app purchases such as Google Pay, online games, subscription-based businesses, and eCommerce stores. That’s because all these industries have returning customers who will appreciate the convenience that comes with fast one-click shopping.

Other advantages of quick payments in 1 click are that they:

Encourage online sales conversions

Long gateway checkout processes have been known to discourage customers from completing a purchase. On the other hand, the shorter, faster online checkout process offered by payments in 1 click means that your conversion rate is likely to go up.

Always simple and efficient

As payments in one click only involve a single, quick online action, businesses can provide a fully efficient and fast payment process to customers. Even better, there’s no fee for using payments in 1 click.

Offers the security of tokenisation

With quick one-click payments, all of the shared data is tokenised with a payment identification created. It is then used for subsequent online purchases. Additionally, many online and mobile merchant payment gateways boast 3D Secure payment security tools like Verified by Visa and Mastercard SecureCode.

The difference between one-click payments and one-click checkouts?

One-click payments and one-click checkouts sound similar but are separate transactions.

Let’s imagine you want to rent a car online from a company you’ve never used before. The initial transaction and subsequent inputting of your payment fee information, such as names, billing addresses, etc., is known as a one-click checkout.

That’s because you’ll only need to enter this information once. So instead of going through a multiple-step checkout that requires several steps, a single checkout process allows the shopper to complete a purchase directly from the gateway’s merchant web page.

It’s the information mentioned during a one-click checkout that forms the basis of a one-click payment. In other words, before you can complete a payment in 1 click, you must first complete a quick one-click checkout.