If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- What is pay-in and pay-out: a comprehensive guide to payment processes for online business

- Mastering delayed payouts: ensuring timely transactions with Fondy

- Streamline your payout process with our comprehensive payout system: low fees for outgoing financial transactions

- How to use payout gateway for outgoing payments on your platform

- How does split payment work for business with Fondy Flow

- A guide to eCommerce split payments

- What is split payment & how Flow Payments can help your business

- What are payouts: a guide to instant & global payouts for business

- How to split credit card payments online: solutions for platforms & marketplaces

- The gig economy’s impact on traditional industries

- Integrating electronic health records with payment systems: advancing efficiency in MedTech billing

- The crucial role of payments in empowering gig platforms

- An introduction to recurring payments

- What is the Faster Payments Service (FPS)?

- What is the SEPA payment method?

- What are quick payments in one click?

- What are cross-border payments?

- What are open banking payments?

Mastering delayed payouts: ensuring timely transactions with Fondy

Introduction

Delayed payouts can disrupt cash flow and cause uncertainty in financial operations. Many businesses face challenges when funds are not received on time, leading to potential delays and missing transactions. This article explores effective strategies to manage delayed payouts, ensuring that no payout is missed and that every payment is processed seamlessly.

Understanding the challenges of delayed payouts

Delayed payouts have a direct impact on a company’s operational efficiency. When transactions are delayed, businesses risk not only financial strain but also damage to their reputation with partners. A single delayed payout can create a cascade of issues, such as increased administrative work and a loss of confidence in the payment system. The fear of missing important payments often forces companies to seek solutions that guarantee a smooth flow of funds. Realising the importance of addressing delayed payouts is the first step towards mitigating risks and preventing missing funds.

The impact of missing transactions

Every instance of a missing payout or delayed transaction can undermine a business’s stability. Companies must ensure that funds do not go missing due to inefficient processes. A robust system that tracks each payout is essential to avoid the pitfalls of a delayed payout scenario. By identifying potential delay triggers early, businesses can prevent situations where a delay results in critical funds going missing.

Flexible payout management for seamless operations

Modern payout management systems offer flexibility and control that can significantly reduce delays. These platforms are designed to adapt to varying regional regulations and support multiple local currencies, ensuring that every payout is processed on time. Flexible solutions allow businesses to customise their payout schedules and automate key processes, thereby minimising the risk of delayed or missing payments.

Customised configurations to avoid delays

Tailored payout structures empower companies to handle unique business requirements effectively. With automated triggers and precise scheduling tools, businesses can set up systems that reduce the possibility of a delayed payout. This proactive approach means that even if there is a potential for delay, it is managed efficiently, keeping every payout on track. The focus remains on ensuring that no transaction is left missing, which is crucial for maintaining steady cash flow.

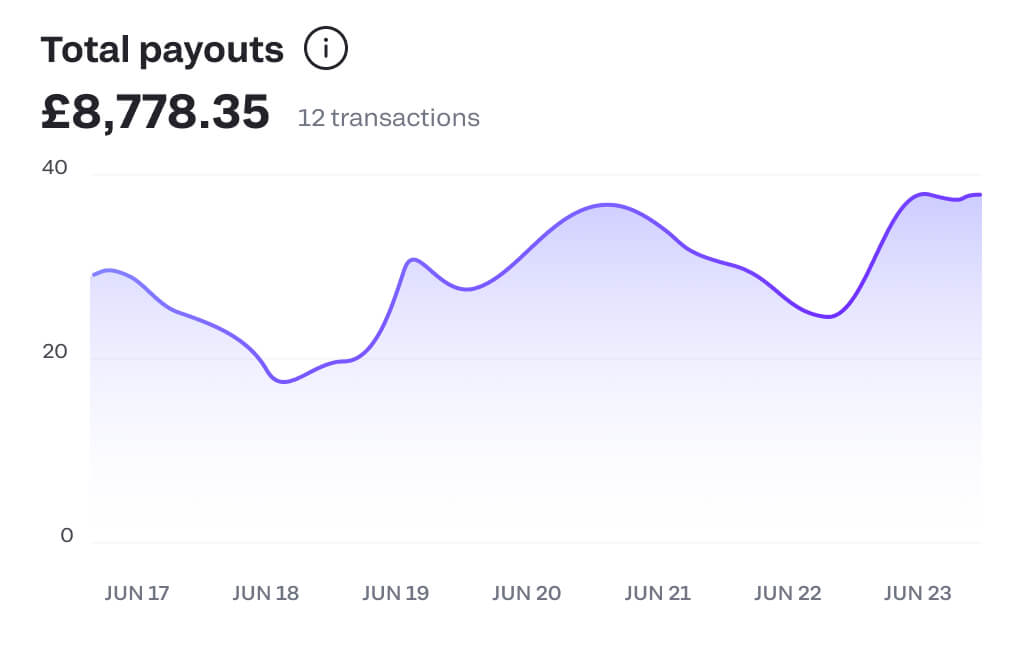

Data-driven insights and robust security

Accurate, real-time data is invaluable when it comes to managing payouts. Advanced analytics help businesses monitor every transaction, allowing them to detect early signs of a delayed payout. With clear insights into payout performance, companies can make informed decisions that reduce the chances of missing payments. Data-driven decision-making is a key factor in preventing delay issues and maintaining financial stability.

Ensuring compliance and secure transactions

A secure and compliant payout environment is critical for avoiding delayed or missing funds. Modern systems adhere to strict international standards, which safeguard every transaction. By employing advanced monitoring tools, businesses can quickly detect any unusual activities that might lead to delays. This level of security reassures companies that every payout is protected, minimising the risk of a delayed payout affecting overall operations.

Global reach and efficient integration

Managing payouts on a global scale requires a solution that can handle various currencies and regional regulations. Global payout systems enable companies to route transactions locally, which reduces unnecessary fees and prevents delays. A well-integrated platform not only ensures that no funds go missing but also supports the smooth functioning of international operations.

Seamless API integration for streamlined processes

Effortless API integration allows businesses to incorporate payout management solutions into their existing systems. By automating routine tasks, companies can eliminate manual processes that often trigger delays. The result is a reliable system where every payout is processed accurately and on time, with no risk of missing transactions.

Conclusion

In today’s competitive market, ensuring that every payout is processed without delay is essential. Delayed payouts can lead to missed opportunities and disrupt a company’s cash flow. By adopting flexible payout management systems that offer customised configurations, data-driven insights, and secure integrations, businesses can effectively overcome the challenges of delayed payouts. Embracing such solutions means fewer delays, no missing funds, and a more reliable financial operation that supports sustained growth.