If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- WooCommerce recurring payments: how to set up subscriptions & monthly orders with Fondy gateway

- WooCommerce credit card processing: add a plugin to accept Visa & Mastercard with Fondy’s low-fee payment gateway

- Apple Pay WooCommerce plugin: how to add fast payment gateway to your store

- Google Pay for Shopify: how to add GPay and why use Fondy

- Apple Pay Shopify integration: how to enable, setup & best practices from Fondy

- Shopify payment provider guide: third-party payment processors and split payments solutions

- Shopify payment processing fees: complete guide to transaction costs and international payments

- Wix payment processing fees: complete guide to Wix credit card processing costs in 2025

- Shopify payments: What it is, how it works and how UK ecommerce businesses accept credit card payments

- How to accept payments on Wix: why Fondy beats other Wix payment gateways

- How to create a payment link: step-by-step guide to make or generate it online

- How does a payment gateway work to process online payments: a complete guide with examples

- What is the cheapest payment gateway in the UK: compare online payments for Ecommerce

- Payment gateway fees comparison 2025: find the low cost payment gateway for your business

- Top 10 payment gateways in the UK, Europe, and the World: 2025 list of most popular providers

- Complete guide to payment gateway integration: connect, setup, and implementation process for your website

- 10 best payment gateways for e-commerce in the UK or Europe & Why Fondy leads the way

- What is a payment gateway: a guide for entrepreneurs interested in e-commerce

- How to accept mobile payments?

- How to integrate payment gateway APIs?

- How to accept mobile payments?

- How to accept international payments and transactions?

- How to choose the best payment gateway for small businesses?

Google Pay for Shopify: how to add GPay and why use Fondy

You’ve set up Apple Pay for your iPhone-carrying customers, but what about the other half of your mobile shoppers? Android users represent 50-55% of UK smartphone owners and over 70% globally. Add Chrome desktop users to that mix, and you’re looking at a massive audience that can’t use Apple Pay at all.

Google Pay fills this gap perfectly. Whilst Apple Pay captures the premium iOS demographic, Google Pay reaches everyone else: Android phone users, Chrome browser shoppers, and customers who prefer Google’s ecosystem. The checkout experience feels just as smooth: one tap, auto-filled details, instant purchase, but it works on devices where Apple Pay simply isn’t available.

This guide walks through everything you need to know about Google Pay and Shopify integration. You’ll learn why it complements Apple Pay rather than competing with it, how to set it up through Fondy’s payment gateway, and what results UK merchants actually see when they offer both payment methods. The technical setup takes about 10 minutes, and if you’re already using Fondy for Apple Pay, enabling GPay is literally one toggle switch.

Why Google Pay reaches customers Apple Pay misses

The smartphone market splits roughly down the middle in the UK. Half your mobile visitors use iPhones, the other half use Android devices. When you only offer Apple Pay, that entire Android crowd faces the old-fashioned checkout process: typing 16-digit card numbers, entering addresses character by character, filling security codes. Many of them abandon their carts rather than bothering with all that.

The reach extends beyond iPhones

Google Pay solves this problem for the Android majority. Someone shopping on a Samsung Galaxy or Google Pixel can tap the GPay button, authenticate with their fingerprint or face scan, and complete their purchase in seconds. The experience mirrors what iPhone users get with Apple Pay — fast, convenient, and secure, but it works on entirely different devices.

The reach extends beyond mobile phones. Chrome browser users on Windows laptops and desktops can also use Google Pay if they’ve saved payment methods to their Google account. This desktop opportunity often gets overlooked. People assume express checkout only matters for mobile shoppers, but plenty of desktop customers appreciate not having to dig out their wallet mid-purchase.

Different demographics, same spending power

Demographics differ between the two payment methods. Apple Pay users tend to skew towards higher income brackets and older millennials. Google Pay captures a broader range: younger shoppers, students, price-conscious buyers, and international customers from markets where Android dominates. Both audiences have money to spend; they just use different devices to spend it.

Here’s what matters for your bottom line: offering both payment methods covers nearly everyone. Apple Pay handles iOS users, Google Pay handles Android users and Chrome desktop shoppers. Between them, you’ve eliminated checkout friction for 80-90% of potential customers. The remaining 10-20% can still use traditional card entry, but your conversion rates improve dramatically when most people get the express option.

Different product categories see varying splits. Fashion and lifestyle stores often lean slightly towards iOS users. Electronics and gaming merchants see heavier Android traffic. Food and beverage businesses split fairly evenly. Rather than guessing, check your own analytics to see how your specific audience breaks down between iOS and Android.

Security that builds customer trust

The security angle works in your favour with both methods. Google Pay never shares actual card numbers with merchants. Every transaction uses a virtual account number that’s useless if intercepted. Customers increasingly understand this tokenisation provides better protection than typing their real card details into websites. That trust factor helps conversions, particularly for first-time buyers who don’t know your brand yet.

Google Pay requirements for Shopify

Setting up Google Pay on Shopify needs a compatible payment gateway that supports the integration. Shopify Payments handles this natively, but you face the same limitations covered in detail in our Apple Pay integration guide: restricted multi-currency capabilities, limited control over payment flows, and basic analytics.

Fondy provides the alternative approach. You get full Google Pay functionality plus the advanced features that growing businesses actually need:

- Proper multi-currency processing with settlement in GBP

- Payment holds for order verification before capture

- Split payments for marketplace and dropshipping models

- Subscription billing with saved payment tokens

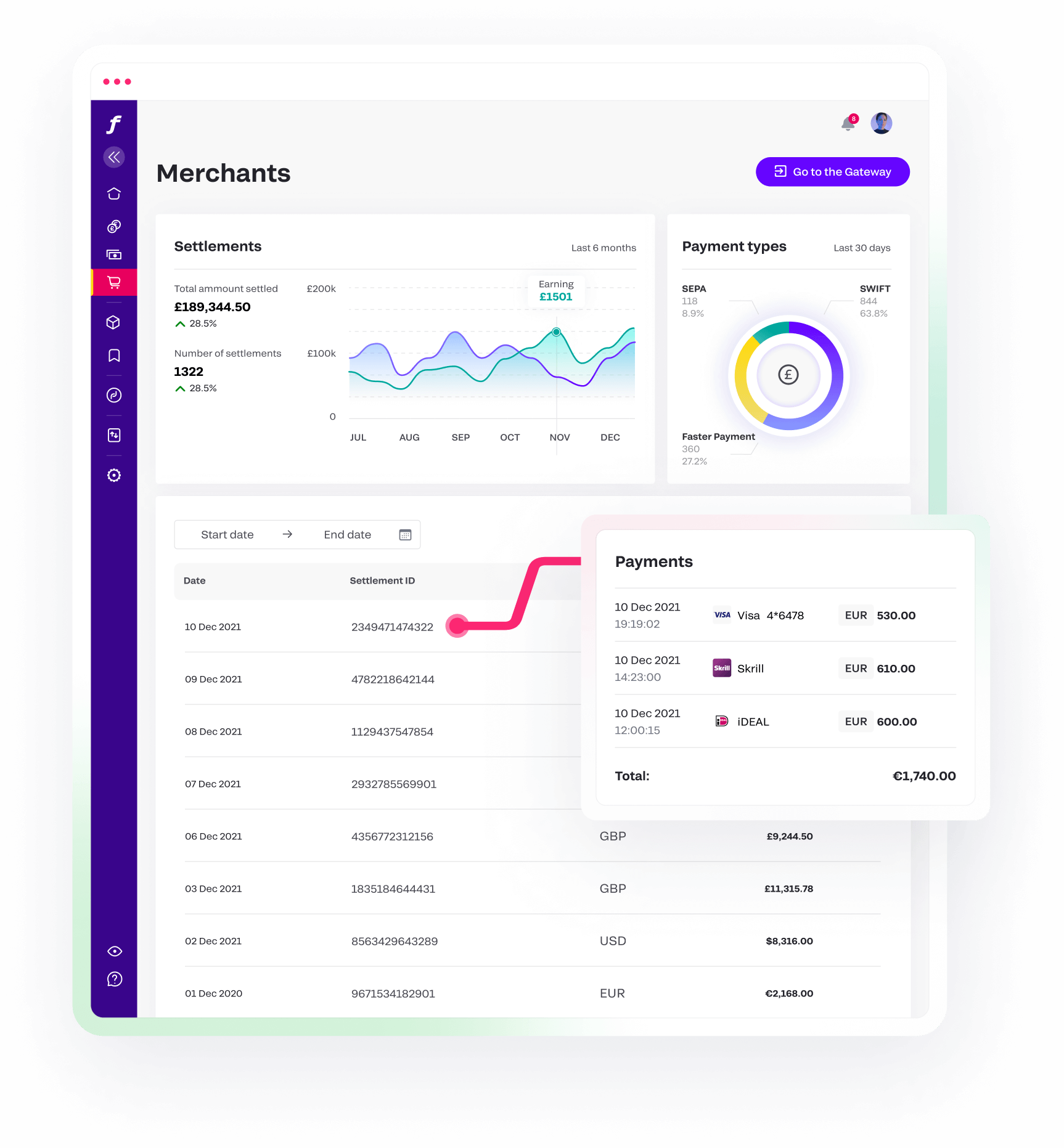

- Detailed transaction analytics and reporting

The technical requirements stay simple:

- Your Shopify store already has an SSL certificate as standard

- No Google Developer Account or special certifications needed

- Fondy handles merchant verification with Google automatically

- Certificate management and security compliance run behind the scenes

- API integration happens through simple app installation

Currency and country support deserves mention. Google Pay works in over 40 countries and processes transactions in more than 100 currencies. Fondy extends this to 150+ currencies with settlement in GBP, which matters enormously for UK merchants selling internationally. Your French customers pay in euros, your American customers pay in dollars, you receive pounds in your UK bank account.

Setting up Google Pay on Shopify with Fondy

If you’ve already installed Fondy for Apple Pay, adding Google Pay takes about two minutes. Both payment methods run through the same integration, use the same dashboard, and share the same settlement flow. You’re not adding a second gateway; you’re just switching on another payment option within your existing setup.

For merchants starting fresh, the complete process takes under 10 minutes from signup to accepting live transactions:

Where to show the Apple Pay button

- Install Fondy’s plugin from the Shopify App Store. Search for “Fondy,” click “Add app,” and authorise the connection to your Shopify admin. The installation happens automatically — no code to edit, no files to upload, no technical knowledge required.

- Grab your Merchant ID and Payment Key from your Fondy merchant portal. You’ll find these under Merchant Settings in the Technical section. Copy both values and paste them into the Fondy app settings within Shopify. This links your Fondy account to your specific store.

- Head to Settings > Payments in your Shopify admin and activate Fondy as your payment provider. You’ll see it appear in the list of available gateways. Select it, confirm the connection, and you’re halfway done.

- Open your Fondy dashboard and navigate to Payment Methods settings. You’ll see toggle switches for various payment options: cards, Apple Pay, Google Pay, and local payment methods. Switch Google Pay to “on.” That’s it. Seriously.

- Choose where the GPay button appears. Product pages work brilliantly for impulse purchases: someone likes what they see and buys immediately without viewing their cart. The cart page captures people who’ve decided to buy but dread filling out forms. The standard checkout page covers everyone else. Enable all three locations for maximum impact.

- Run test transactions before going live. Fondy provides a test mode specifically for this purpose. Use your own Android device or Chrome browser, add something to your cart, and complete a purchase with Google Pay test credentials. Verify the payment flows correctly, the order appears in Shopify, and the transaction shows up in your Fondy dashboard.

- Test on multiple devices if possible. Different Android manufacturers (Samsung, Google Pixel, OnePlus) sometimes behave slightly differently. Desktop Chrome on Windows should also get tested. Tablets fall somewhere in between. Five minutes of testing now prevents customer complaints later.

- Switch to production mode when everything works smoothly. Your Google Pay integration goes live immediately. Start with a few days of close monitoring: check that transactions process correctly, orders sync to Shopify properly, and settlement hits your bank account as expected.

Button styling follows Google’s brand guidelines automatically. The familiar blue and white button appears in the right format for each placement. Don’t try customising it beyond what Google allows. Customers look for that recognisable GPay design; changing it just confuses them.

Why Fondy makes Google Pay integration simple

The biggest advantage Fondy brings to Google Pay Shopify integration? You’re already set up if you’re using it for Apple Pay. Both payment methods share the same infrastructure, flow through the same dashboard, and appear in unified reporting. Adding GPay doesn’t mean dealing with another gateway relationship, another set of credentials, or another reconciliation process at month-end.

Key benefits of using Fondy for Google Pay:

- Unified payment infrastructure: Device detection happens automatically. Android users shopping on your store see the Google Pay button. iPhone users see the Apple Pay button. Chrome desktop users might see both depending on what they’ve saved to their Google account. Safari users see Apple Pay. No manual configuration required; the system adapts to each visitor.

- Seamless multi-currency processing: Works identically for both payment methods. The same competitive conversion rates apply. The same single-GBP settlement model. The same transparent fee structure. If you’ve already experienced how much easier international sales become with proper multi-currency support through Apple Pay, you know exactly what to expect with Google Pay.

- Advanced payment features across all methods: Holds, splits, subscriptions apply to Google Pay transactions just like they do for Apple Pay. Someone paying through GPay can be placed on payment hold whilst you verify a high-value order. Marketplace transactions split automatically between sellers. Subscription customers don’t need to re-authenticate each billing cycle.

- Enterprise-grade security for all transactions: Fraud detection and security monitoring cover all transactions regardless of payment method. Fondy’s PCI DSS Level 1 infrastructure protects Google Pay purchases the same way it protects Apple Pay and card transactions. Real-time analysis flags suspicious patterns. 3D Secure authentication adds extra verification layers when needed.

- Single support relationship: Support comes from the same UK-based team whether you’re asking about Google Pay, Apple Pay, or anything else. Phone support during UK business hours. Email responses from people who actually understand your business context. Live chat when you need immediate help.

This intelligent display matters more than it sounds. Showing someone an Apple Pay button when they’re on Android looks unprofessional and creates frustration. Fondy’s smart detection ensures everyone sees only payment options that actually work on their device. Cleaner checkout experience, fewer support questions, higher conversion rates.

Best practices for Google Pay conversions

Button placement strategy makes an enormous difference to adoption rates. The most effective approach puts GPay buttons in multiple locations throughout the customer journey, not just at final checkout.

Strategic button placement

Product pages with “Buy Now” functionality let Android users complete impulse purchases immediately. Someone sees something they like, taps the Google Pay button, authenticates, and owns it within 10 seconds. No cart review, no form filling, no time to reconsider. Fashion stores and electronics retailers see particularly strong results from product page GPay buttons.

The cart page represents another prime location. Customers have decided what they want and how much to spend. They’re ready to buy. A prominent Google Pay button right there: above the traditional checkout button, converts people who’d otherwise face that lengthy form and potentially abandon.

Standard checkout pages should display both Google Pay and Apple Pay options clearly at the top, before any manual entry fields. Make express checkout the obvious path and traditional card entry the fallback option rather than vice versa.

Mobile-first optimisation matters

Mobile optimisation becomes crucial for Google Pay since most usage happens on Android phones. Page load speed matters enormously; every extra second of loading time kills conversions. Keep your theme lightweight, compress images properly, and minimise third-party scripts that slow things down.

Show all costs before the GPay modal appears. Calculate and display shipping charges, VAT, and any other fees upfront. Customers hate authenticating with their fingerprint only to discover unexpected costs afterward. Transparency prevents abandoned purchases and reduces support complaints.

Address autocomplete should be enabled throughout your checkout flow. Android users typing on small phone keyboards appreciate anything that reduces manual entry. Google Pay brings saved addresses, but for fields it doesn’t populate, autocomplete helps tremendously.

Testing across devices and platforms

Testing needs to cover various Android devices, not just one. Samsung phones behave differently from Google Pixels. Older Android versions sometimes have quirks. Chrome desktop on Windows represents another testing scenario. Different screen sizes affect button visibility and placement. Spend an hour testing across devices and you’ll catch issues before customers complain about them.

Promote both payment methods together

Promote both payment methods together in your marketing. Email campaigns can mention “Pay with Google Pay or Apple Pay for instant checkout.” Product descriptions might highlight “Express checkout available.” Social media posts showing mobile shopping should feature the GPay and Apple Pay buttons visibly. Many customers don’t realise express checkout exists until you tell them about it.

Real results from adding Google Pay

UK Shopify merchants running both Apple Pay and Google Pay through Fondy typically see 40-60% of all mobile transactions flow through express checkout methods. That’s not a typo: when you remove friction properly, more than half of mobile customers choose the fast option.

Conversion rate improvements from Google Pay specifically run around 20-30% for Android users. Someone shopping on a Samsung Galaxy converts 20-30% more often when they can use GPay versus typing card details manually. The numbers mirror what happens with Apple Pay on iOS: same principle, different ecosystem.

Desktop Chrome users represent the surprise benefit many merchants overlook. These aren’t mobile shoppers, yet they still appreciate having payment details saved to their Google account. Conversion uplift isn’t as dramatic as mobile (maybe 10-15%), but it’s pure bonus since most stores don’t even consider desktop express checkout.

Combined strategy results matter most. Stores offering both payment methods capture nearly all express checkout opportunities. Someone on an iPhone uses Apple Pay. Someone on Android uses Google Pay. Someone on a Windows laptop with Chrome might use Google Pay. Between the two methods, you’ve covered roughly 80-90% of potential customers with convenient checkout options.

One UK fashion retailer selling internationally added Google Pay alongside their existing Apple Pay setup. Android conversion rates jumped 28% within the first month. iOS performance stayed steady since those customers already had Apple Pay. Overall mobile revenue increased by 18% without any changes to products, pricing, or marketing — purely from removing checkout friction for Android users.

Cart abandonment rates drop noticeably when you offer both payment methods. Mobile cart abandonment typically runs around 70-85% for stores with manual-only checkout. Adding Apple Pay brings it down to perhaps 60-70%. Adding Google Pay as well pushes it closer to 50-60%. You’re never eliminating abandonment completely, but every percentage point improvement means more completed purchases.

The combined express checkout volume lets you analyse payment method preferences across different customer segments. You might discover iOS users buy more clothing whilst Android users prefer electronics. Maybe international customers lean heavily towards Google Pay whilst domestic shoppers split evenly. These insights inform inventory decisions, marketing targeting, and product development priorities.

In conclusion

Google Pay and Shopify integration fills the gap Apple Pay leaves. iPhone users get their express checkout experience; Android users and Chrome desktop shoppers get theirs. The technical reality makes offering both methods as simple as offering one: particularly through Fondy, where they share infrastructure and require virtually identical setup.

The business case writes itself: broader device coverage, higher conversion rates, lower cart abandonment, better customer experience. Setup takes 10 minutes if starting fresh, 2 minutes if you’re already running Apple Pay through Fondy. The conversion improvements start immediately and compound over time as customers discover how easy purchasing becomes.

Don’t force shoppers to choose between convenience and their preferred device. Give iPhone users Apple Pay. Give Android users Google Pay. Give Chrome desktop users another express option. Cover all the bases and watch your mobile commerce metrics improve across the board.