If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- The best international business accounts for cross-border payments

- Setting up business accounts: how Fondy makes it simple

- Startup business accounts: how to choose the best option for your UK business

- Compare business accounts in the UK: features, fees, and benefits explained

- Best small business accounts UK: pick the right one with basic or extra features

- Top 10 business accounts in the UK and why Fondy is the best choice

- Best business accounts in the UK for limited companies or sole traders: compare with banks and open online

- How to open business accounts, set up and create sub-accounts & start making global payments with Fondy

Best small business accounts UK: pick the right one with basic or extra features

Running a small business in the UK today means managing money smartly, flexibly, and efficiently. Choosing the right small business account is no longer just about finding a bank with a local branch; it’s about selecting a financial partner that aligns with your operational needs, whether you are a sole trader, a growing start-up, or a small company aiming to expand. With the rise of online-only providers, fintech solutions, and new-generation banking services, the challenge is no longer the lack of choice but understanding which account structure works best for your business.

This guide explores everything you need to know about small business accounts in the UK — covering both basic accounts for small business owners who want simplicity and extra-feature accounts designed for more complex needs. It will help you understand the evolving landscape, weigh your options, and discover why providers like Fondy have become standout choices for businesses seeking not just a place to store money, but a platform to manage and grow.

What is a small business account, and why does it matter?

A small business account is specifically designed to handle company finances, keeping them separate from personal funds. Even the simplest small business accounts online provide dedicated account numbers, allow you to send and receive payments, and help maintain clear financial records — critical not only for internal management but also for tax reporting and regulatory compliance.

Beyond the basics, a good small business account gives you professional credibility. Customers and suppliers are more likely to trust a business that operates with a professional banking setup. It also reduces the risk of financial errors or confusion that can arise when personal and business finances are mixed. For many businesses, having a formal account also opens access to services like credit facilities, business loans, or advanced payment solutions that are not available to private account holders.

Understanding the landscape: basic vs extra-feature accounts

Understanding which features deliver genuine value for your specific situation is crucial to making a cost-effective choice.

At the basic level, every business account should provide reliable money movement: sending and receiving payments promptly, managing direct debits, and handling standing orders. Online banking access with intuitive interfaces is another essential, though sophistication varies dramatically between providers.

More advanced features worth considering include:

- Multi-user access with customisable permissions becomes invaluable as your team grows, allowing delegation without sharing full account access

- Integration capabilities that connect your account with accounting software, payment processors, and other business tools

- Multi-currency features for businesses with international aspirations, including competitive exchange rates and efficient cross-border payments

- Data analytics tools that transform your account from a simple money repository into a strategic asset for financial decision-making

The most valuable features are those that directly address your pain points or unlock new opportunities. Anything else becomes an unnecessary expense that increases your banking costs without delivering proportional benefits.

The rise of online-first business accounts

One of the biggest transformations in recent years is the shift from traditional branch-based banking to online-first solutions. Small business accounts online allow you to open an account within minutes, often from anywhere in the world, without visiting a bank or filling out piles of paperwork.

This online shift matters for several reasons. First, it speeds up access: businesses can onboard, pass KYC checks, and activate their accounts quickly, reducing downtime. Second, online providers are often more innovative, offering seamless integrations with e-commerce platforms, CRMs, or accounting systems. Third, they are designed with modern business needs in mind — offering not just basic services, but scalable solutions that grow alongside your company.

Multi-currency capabilities: a modern necessity

For UK small businesses with any international dimension, multi-currency functionality has evolved from a luxury to an essential component of effective financial management. Brexit has only amplified this need, making currency considerations more complex for businesses trading with EU partners and beyond.

At minimum, look for the ability to hold balances in different currencies: typically GBP, EUR, and USD for UK businesses. This shields you from unnecessary conversions and associated fees when receiving or making payments in those currencies.

More sophisticated accounts offer dedicated international bank details, providing local account numbers in different regions. This arrangement allows your business to appear local to customers and suppliers in those markets, often resulting in faster payments and reduced transfer fees.

Pay careful attention to exchange rates and settlement speed. Traditional banks typically embed significant margins into their rates, creating a hidden cost easily overlooked when evaluating overall banking expenses. Digital-first providers like Fondy often offer more transparent and competitive rates, potentially saving thousands annually on international transactions.

For businesses with complex international requirements, some providers offer additional services like forward contracts to lock in exchange rates or mass payment capabilities to efficiently pay multiple international suppliers or staff members.

How to assess your small business banking needs

Before exploring specific account options, assess what your business genuinely needs to avoid paying for unnecessary features or discovering critical gaps too late.

Consider these key factors when evaluating business accounts:

- Transaction volume and type: How many transactions do you process monthly? Are they primarily domestic or international?

- Currency requirements: Do you need multi-currency capabilities for regular international trade?

- Business structure: Sole traders might find a simple account adequate, while limited companies with multiple departments could benefit from sub-accounts.

- Growth projections: If rapid expansion is likely, choose an account that can scale with you to prevent migration headaches later.

- Industry-specific needs: E-commerce businesses typically need payment processing integration, while service-based businesses might prioritise invoicing features.

- Technical comfort: Some accounts offer powerful API capabilities that improve efficiency, but only if you can implement them effectively.

Be realistic about which features will deliver genuine value for your specific situation rather than being swayed by impressive-sounding capabilities you’ll rarely use.

Fondy: an ecosystem, not just an account

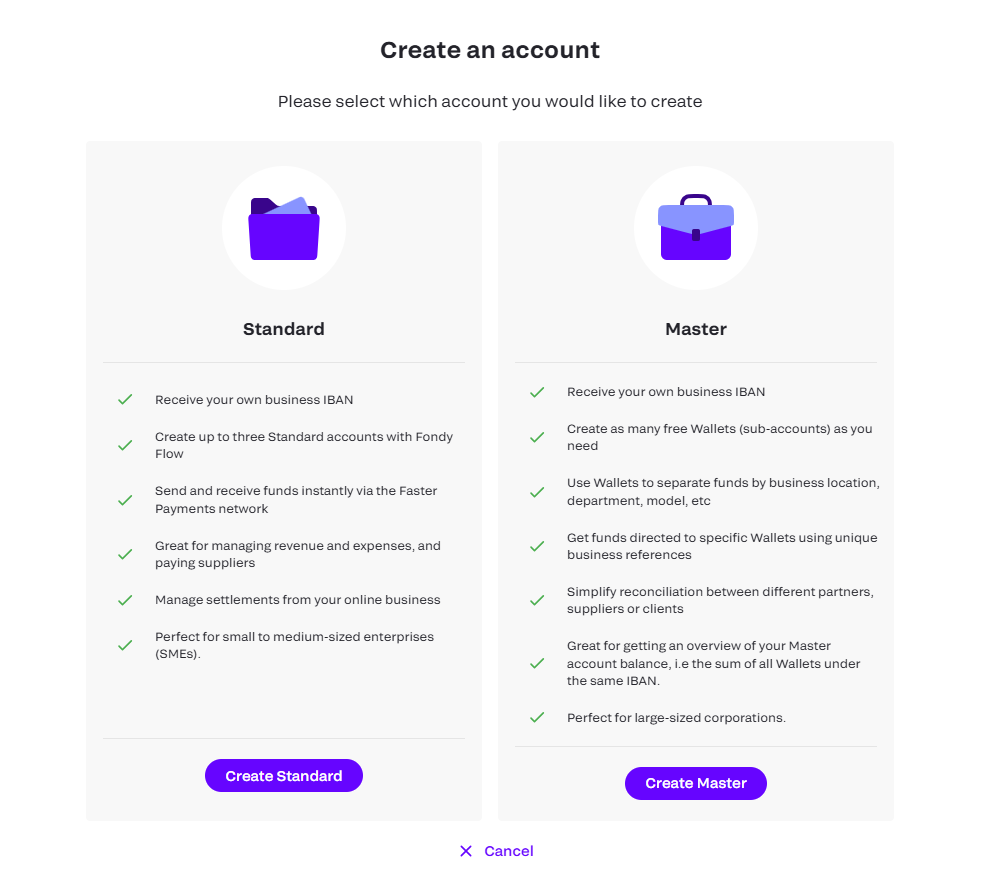

Fondy offers a particularly compelling solution because it blends basic and advanced features into one flexible system. For businesses just starting, the Standard Account provides up to three accounts under one profile, each with its own IBAN, letting you separate revenue streams without added complexity. For larger or more ambitious businesses, the Master Account unlocks unlimited sub-accounts (known as wallets) that allow you to manage funds by department, project, region, or client.

Where Fondy shines is in its combination of scalability and simplicity. You can start small and expand as needed, without having to migrate systems or renegotiate contracts. Importantly, you also get integrated access to Fondy’s payment gateway, enabling you to accept customer payments, manage incoming and outgoing funds, and automate many financial processes from one dashboard.

Security, compliance, and peace of mind

Security is non-negotiable when dealing with business finances. Fondy, regulated by the UK Financial Conduct Authority and certified to PCI DSS Level 1, provides top-tier security standards, including encryption, two-factor authentication, and robust fraud detection systems. This ensures that whether you’re a sole trader or an SME, your funds and data are protected at all times.

This level of compliance goes beyond mere technical safeguards. It reflects a commitment to trust, accountability, and transparency — all of which matter when you’re choosing a financial partner. For small businesses, working with a provider that holds itself to banking-grade security standards gives reassurance, especially when handling customer payments or sensitive data.

Costs and pricing transparency

One of the hidden pain points in small business banking is the buildup of unexpected costs. While many providers advertise attractive headline rates, fees can multiply if you need additional services, extra accounts, or international transactions. This is why pricing transparency is critical.

Fondy positions itself strongly here, offering clear and upfront pricing models. Whether you are using basic accounts for small business operations or scaling up to a Master Account with advanced features, you can expect predictable fees, flexible payout structures, and no hidden charges for adding wallets or managing multi-currency balances.

Why the right account choice fuels growth

Selecting the right small business account is not just an administrative task — it’s a strategic decision. The right account can support growth by enabling faster payments, simplifying cashflow management, and reducing operational headaches. Conversely, the wrong account can create bottlenecks, add costs, and slow you down.

For example, many businesses start with a basic account because it seems cheaper and simpler. But as they expand, they discover that adding new revenue streams or handling multi-currency operations becomes cumbersome or costly. Switching accounts later often involves friction, downtime, and additional expense. This is why providers like Fondy, which allow you to start small and grow seamlessly, are particularly attractive.

How Fondy helps businesses scale efficiently

To see how this works in practice, consider a small e-commerce business. Initially, they might only sell domestically and use a basic account to handle GBP payments. As they grow, they start selling to European or US customers, requiring EUR and USD wallets. With Fondy, they can simply add these wallets under the same system — no need to open separate bank accounts or move to a new provider.

Next, they hire a small team and need to split funds between operational expenses, salaries, and marketing budgets. Again, Fondy’s Master Account allows them to set up sub-accounts for each purpose, with full visibility over the aggregated balance. Finally, they integrate Fondy’s payment gateway to manage online payments, automate settlements, and simplify reconciliation — all from one place.

This ability to scale without disruption is one of the most valuable features modern fintech providers offer. It gives small businesses the confidence to expand without worrying about outgrowing their financial tools.

Comparing competitors: why Fondy leads the pack

When assessing the best small business accounts UK, several notable providers frequently appear on comparison lists, each with their own strengths.

Revolut Business impresses with multi-currency accounts and expense tools, but often limits integrated payment capabilities, forcing businesses to connect separate systems. Starling Bank offers no-fee basic accounts with a sleek mobile interface, yet lacks the advanced sub-account flexibility needed by scaling companies. Tide is popular among freelancers for its fast digital setup but provides only limited currency options and struggles with higher transaction volumes.

Wise Business shines for international transfers with excellent rates but focuses mainly on payments, not full-featured business banking. High-street giants like HSBC, Barclays, and NatWest offer broad service portfolios but are often slowed by paperwork, long onboarding times, and high fees for international operations. Meanwhile, Monzo Business delivers a user-friendly app but limits payment processing integration, while Zempler Bank provides easy access but charges higher fees for essential services.

Fondy sets itself apart by combining the best of all worlds:

- Instant online setup with no branch visits

- Unlimited sub-accounts (wallets) under a single Master Account

- Full multi-currency management (GBP, EUR, USD) with competitive rates

- Integrated payment gateway for seamless sales and payouts

- Transparent, scalable pricing starting from £10/month

- FCA-regulated security standards matching top-tier banks

Whether you’re a freelancer seeking simplicity or a complex international business needing sophisticated payment flows, Fondy delivers unmatched flexibility and control. Its all-in-one approach removes friction between banking, payments, and global operations — making it the clear leader among UK small business account providers.

For a comprehensive comparison of specific UK business account providers, including detailed feature analyses and direct comparisons, our article “Top 10 business accounts in the UK and why Fondy is the best choice” offers valuable insights to supplement this guide.

Final thoughts: shaping the future of small business banking

As small businesses face increasing competition, digital transformation, and global opportunities, the need for smart, flexible, and secure financial solutions has never been greater. The best business accounts for small business in the UK are no longer just about holding money; they are about enabling businesses to operate, grow, and innovate efficiently.

Basic accounts for small business use provide an essential foundation, offering simplicity, clarity, and cost-effectiveness. But for businesses ready to take the next step, extra-feature accounts like those offered by Fondy deliver the advanced tools, integrations, and scalability that modern operations demand.

Whether you are just starting out, looking to optimise existing operations, or preparing to expand internationally, the right small business account can make a significant difference. By carefully assessing your needs, exploring the available options, and partnering with a provider that offers both flexibility and strength, you can position your business for long-term success.