Use cases

Payments features

Business account in the UK

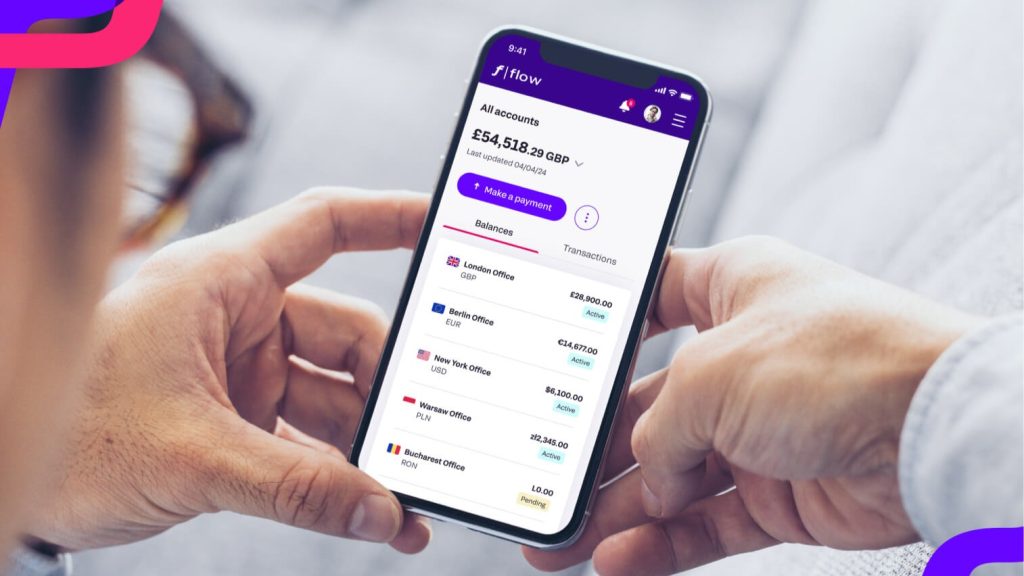

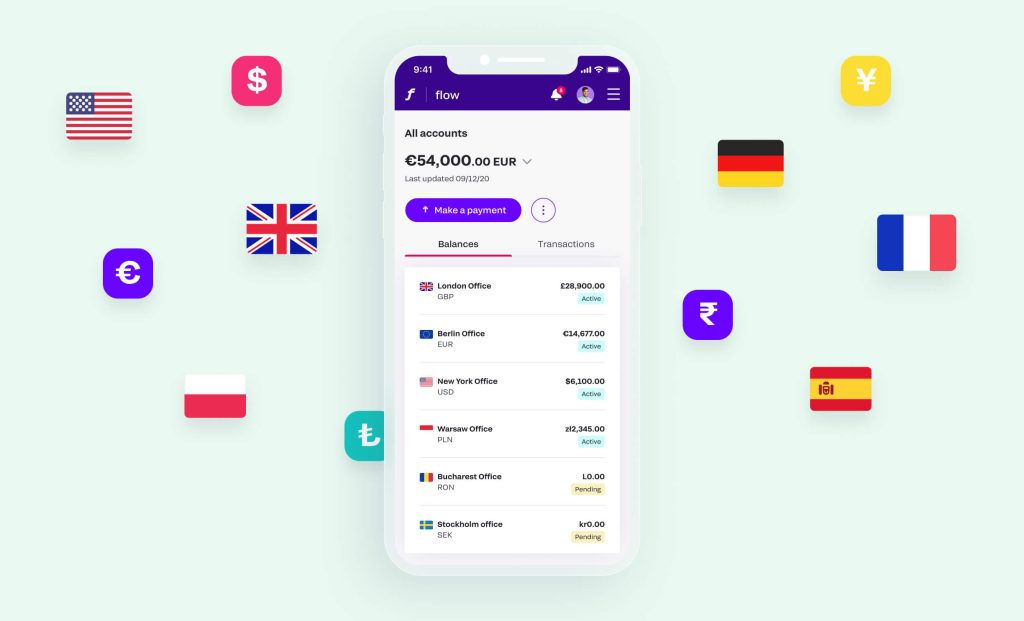

Online business accounts for global teams

Create unlimited business accounts, wallets and IBANs to manage your money in GBP, USD, and EUR. All in one place.

Enjoy instant access, smooth international payments, and full control over your funds. Built for global teams, trusted under UK financial regulations.

Take control with unlimited wallets

Create as many wallets as you need for your business, team, or partners. Organize your money by purpose, automate payouts, and stay in control with everything in one place.

Move money globally, without delay

Accept and send payments in GBP, EUR, and USD without borders. Whether you’re working with local clients or global partners, manage all your international transactions quickly and securely from one account.

Always safe. Always ready.

Fondy keeps your money and data safe with the highest global standards. Our infrastructure is PCI DSS Level 1 certified, protected by modern cybersecurity tools, full encryption, and 2FA. Whether you’re in the office or on the go your business account is always secure and within reach.

Get started within minutes

Smart businesses need business accounts that match their pace. Fondy lets you open an online business account in the UK without the usual hassle or paperwork of a high-street bank. Getting started is quick and straightforward – here’s how to do it in just a few steps:

Sign up for Fondy

Create your free Fondy profile online – no paperwork, no branch visits. Register your business from anywhere in the UK in just a few clicks.

Complete a quick KYC check

Verify your business details through a fast and secure online process. Our streamlined KYC check gets you up and running without delays.

Start receiving and sending payments

Use your new business account right away or create sub-accounts if needed. Share account details with clients, partners, or platforms to get paid, or move funds between your own accounts.

Additionally need to accept online payments on your website, e-store, or marketplace?

Once your business account is active, you can easily connect Fondy’s payment gateway. Get a complete solution for managing incoming paymens, splits and payouts — all in one platform.

Open an account now

and see how easy it is to get started. If you have questions at any step, our support team is on hand to help – but chances are you’ll find the process refreshingly simple.

Two account types to fit your business: Standard and Master

Fondy understands that different businesses have different needs. That’s why we offer two types of online business accounts to choose from:

Standard Account

Ideal for sole traders, freelancers, and small to medium businesses with straightforward needs.

A Standard Account gives you a dedicated business IBAN and up to three separate accounts under your profile. This is perfect if you want to keep certain finances distinct (for example, separating income streams or holding GBP and EUR in different accounts) without managing complex sub-accounts. Key features of Standard:

- Up to 3 accounts allowed: Create up to three individual business accounts (each with its own IBAN) to organise funds by project or currency.

- Simple and cost-effective: No sub-accounts are needed – everything remains easy to manage.

- Fast setup: Create a Standard account in seconds and start using it immediately. Just name your account and choose a currency.

- Instant payments: Send and receive funds instantly via the Faster Payments network.

- Perfect for online businesses: Easily manage revenue, expenses, and settlements with clients or suppliers.

Master Account

Designed for enterprises, marketplaces, and two-sided platforms with large teams and complex financial workflows.

Designed for larger enterprises, marketplaces, or any business with more complex financial operations.

A Master Account includes a dedicated business IBAN and lets you create unlimited sub-accounts (wallets) at no extra cost. Direct incoming funds to specific wallets using unique business references — perfect for separating revenue by department, region, client, or partner. Key features of Master:

- Unlimited sub-accounts: Create as many wallets as you need under your Master Account to manage different business areas.

- Aggregated balance & control: All wallets are linked to one IBAN account, giving you full visibility of total funds and each wallet individually.

- Flexible fund distribution: Move money between wallets instantly — no external transfers needed.

- Simplified reconciliation: Easily match payments and expenses to specific partners, suppliers, or teams.

- Built for scale: As your business grows, just add new wallets — no need to open more bank accounts.

Which account type is right for you?

If you’re a small business just starting out or only need a couple of accounts, the Standard Account will cover all your basics. If your business has multiple stakeholders, revenue streams or requires a more sophisticated setup, the Master Account provides the freedom and structure you need. Both options give you a fully functional business account with UK bank details, online access, and robust security. And remember, you’re not locked in – you can use a combination of account types if that suits your model: Standard accounts for simple needs and a Master account for complex operations, for instance.

Multiple business accounts, one platform

One of the biggest advantages of Fondy is that it lets you manage multiple business accounts effortlessly from a single online platform. Traditional banks often struggle here – you might end up with different accounts at different banks (and a lot of headaches keeping track). With Fondy, everything is under one roof, which means:

Easy separation of funds

Need to keep money for different ventures or departments apart? Open additional Fondy business accounts or sub-accounts in seconds. For example, you can maintain one account for your UK operations and another for European transactions, or separate client funds from operational funds.

Unified dashboard

View and control all your accounts in one interface. Even if you have several accounts (and sub-accounts within a Master), you don’t need to juggle multiple logins or banking apps. This unified approach saves time and reduces errors.

Consolidated reporting

At the master level, you can see an overview of your total financial position. At the sub-account level, you can drill down into specifics. This flexibility simplifies reconciliation and auditing, since every transaction is recorded in the same system with consistent formats.

No extra fees for extra accounts

Unlike some providers, Fondy allows you to create sub-accounts under a Master Account at no additional cost. You can expand your account structure as your business grows, without worrying about mounting bank fees for each new account.

In short, Fondy’s approach to multiple accounts and sub-accounts lets you organise your business finances in whatever way makes sense for you – all while keeping things convenient and centralised. It’s banking on your terms. If you still curious about the details, read our full step-by-step guide: How to open business accounts, create sub-accounts, and start making global payments with Fondy.

Real-world use cases for such business accounts

Fondy’s Business Account is flexible and powerful — built to support the financial operations of modern, multi-faceted digital businesses. Here’s how various industries use Fondy to simplify business payments and scale globally:

Freelancers & Gig economy platforms

- Freelancers from Upwork, Fiverr etc.

- Beauty services with independent professionals and revenue distribution

- Household and professional services platforms (cleaning, repairs, consultations)

E-commerce sellers & Marketplace platforms

- eCom sellers from Amazon, Ebay, Etsy etc.

- Digital services marketplaces (consultations, coaching, training)

- Digital goods marketplaces (software, games, content)

- E-commerce platforms (online shops)

Content monetisation & Creator economy

- Online galleries and art marketplaces with creator payments

- Online events, webinars and conferences with automatic revenue distribution between organisers and speakers

- Streaming services (video, audio, podcasts) with creator payments

Sharing economy platforms

- Item sharing platforms (cars, vehicles, tools, etc.)

- Equipment and technology rental (with multiple owners)

- Property rental platforms (accommodation, offices, co-working spaces)

Delivery & Online ordering services

- Taxi ordering platforms and ridesharing

- Food and grocery delivery (with payment distribution between restaurants, couriers and platform)

Subscription & Recurring payment services

- SaaS solutions (especially B2B)

- Subscription-based platforms (educational platforms, online courses, content subscription services)

- Telecom platforms with numerous subscribers and service providers

Business process & B2B payment automation

- Spend management solutions

- Project management systems with multiple contractors and suppliers

- Marketing and advertising automation platforms (with payments to agents and contractors)

- CRM, ERP and HRM systems (with integrated financial modules)

Crowdfunding, Donations & Charity

- Crowdfunding and crowdsourcing platforms

- Charitable foundations and donation platforms

Partnership & Affiliate management

- Affiliate platforms and CPA networks

- Partner, agent and affiliate payment automation services

- API platforms with revenue-sharing monetisation between ecosystem participants

Transparent pricing that scales with you

Fondy keeps pricing simple, clear, and built to grow with your business. Whether you’re just getting started or processing high volumes, we’ve got a plan that fits.

- Business accounts from £10/month

- Card payments from 0.9%, open banking at 0.7%

- Free inbound Faster Payments

- Flexible pricing for payouts, SEPA, CHAPS and more

Not just a bank account – a better business banking solution

Fondy isn’t a traditional bank, and that’s a good thing for your business. It’s a business bank account reinvented for the modern, online world. Here’s how Fondy Business Account stands out versus a typical business banking experience:

Built for global commerce

Traditional banks often impose limitations or tedious processes for international transactions. Fondy is designed for cross-border business from the ground up. Every account comes with an international IBAN, so you can send and receive global payments as easily as local ones. You no longer need separate bank accounts in different countries to operate internationally – Fondy removes those barriers.

Immediate access to funds

Waiting days for payments to clear is a thing of the past. With Fondy’s instant settlements, your money is available right away. This is a game-changer for cash flow management compared to conventional banks, which might hold your card payments or transfers until the next business day (or longer). Faster access means you can use your funds instantly – whether it’s paying for supplies, settling bills, or reinvesting.

Online setup and management

Say goodbye to in-person appointments. Opening a Fondy account is fully online and takes just minutes, whereas a high-street business bank account might require days or weeks to get approval. Managing your account is also online via a user-friendly portal – no need to visit branches for routine transactions. Everything from onboarding to everyday banking is optimised for digital convenience.

Integrated payments and payouts

Accept payments and manage your business finances from one place. With Fondy, customer payments flow directly into your business account — no delays, no need to switch systems. You can then pay suppliers, freelancers, or partners straight from the same dashboard. It’s a smooth, all-in-one process that replaces the complexity of using separate banking and payment tools.

Robust security and compliance

Fondy is authorised and regulated by the UK’s Financial Conduct Authority (FCA) as an Electronic Money Institution. Client funds are held in safeguarded, segregated accounts are separate from Fondy’s own finances. All accounts are protected by advanced fraud monitoring and security protocols. While not a traditional bank, Fondy meets and often exceeds banking-level security standards.

End-to-end business toolkit

Build and scale your business with powerful tools beyond basic banking. Fondy offers a full-featured payment gateway for card payments, subscriptions, and marketplaces — plus robust API to automate everything from onboarding and reporting to custom payout logic. Whether you’re a platform, SaaS, or growing online business, Fondy gives you the infrastructure to operate and expand efficiently.

In summary, Fondy offers the best of both worlds – the reliability and trust of a regulated financial institution combined with the agility and innovation of a fintech platform. It’s more than just a bank account. It’s a comprehensive financial ecosystem for your business.

Frequently asked questions

Is Fondy a traditional business bank account?

Fondy is not a traditional business bank account — it’s an online business account solution designed to offer greater flexibility, instant payments, and multiple accounts.

Can I open a Fondy Business Account if I’m not based in the UK?

Yes — you can open and manage your account online from anywhere in the world. Unlike a traditional business bank account, Fondy does not require UK residency or branch visits.

How fast can I start?

Most businesses are verified and up and running within minutes after completing KYC. This process is significantly faster than opening a typical business bank account.

Are there any hidden fees?

No hidden fees. All pricing is transparent and available upfront. You only pay for what you use. This clarity sets Fondy apart from many business bank accounts.

Can I use Fondy without accepting card payments?

Yes — you can use Fondy just for managing your business accounts and transfers. Connecting the payment gateway is optional.

Get started today!

Ready to take control of your business finances? Get started today and discover how Fondy can boost your efficiency, financial clarity, and growth potential. Empower your company with a smarter way to bank and handle payments. With Fondy’s online business accounts, UK businesses and global enterprises alike can move money without friction. Opening a Fondy Business Account is quick, and our team is here to support you at every step. Leave behind the limitations of your old business bank account and move forward with Fondy today.

Gateway

- Go borderless and accept payments from anywhere, anytime and anyhow

- Enable your customers to pay how they want wherever they are

- Enjoy full transparency with cost-effective pricing and zero hidden costs

Flow

- Access faster settlements with multicurrency IBAN accounts

- Enjoy multiple benefits and features including recurring payments and payouts

- Manage all the movement of funds from one convenient platform without a third party

We use cookies to ensure our web-based products are functioning properly while continuing to improve your browsing experience, offering social media functionality, personalising our marketing and advertising content to suit your needs. We sometimes share cookie data with our partners for these purposes. Our cookies remember your preferences and the data you fill out on forms on our web products. As well as analysing traffic, our cookies register how you found us and collect information about your browsing habits. By continuing to use our web products, you agree to our use of cookies.