Use cases

Payments features

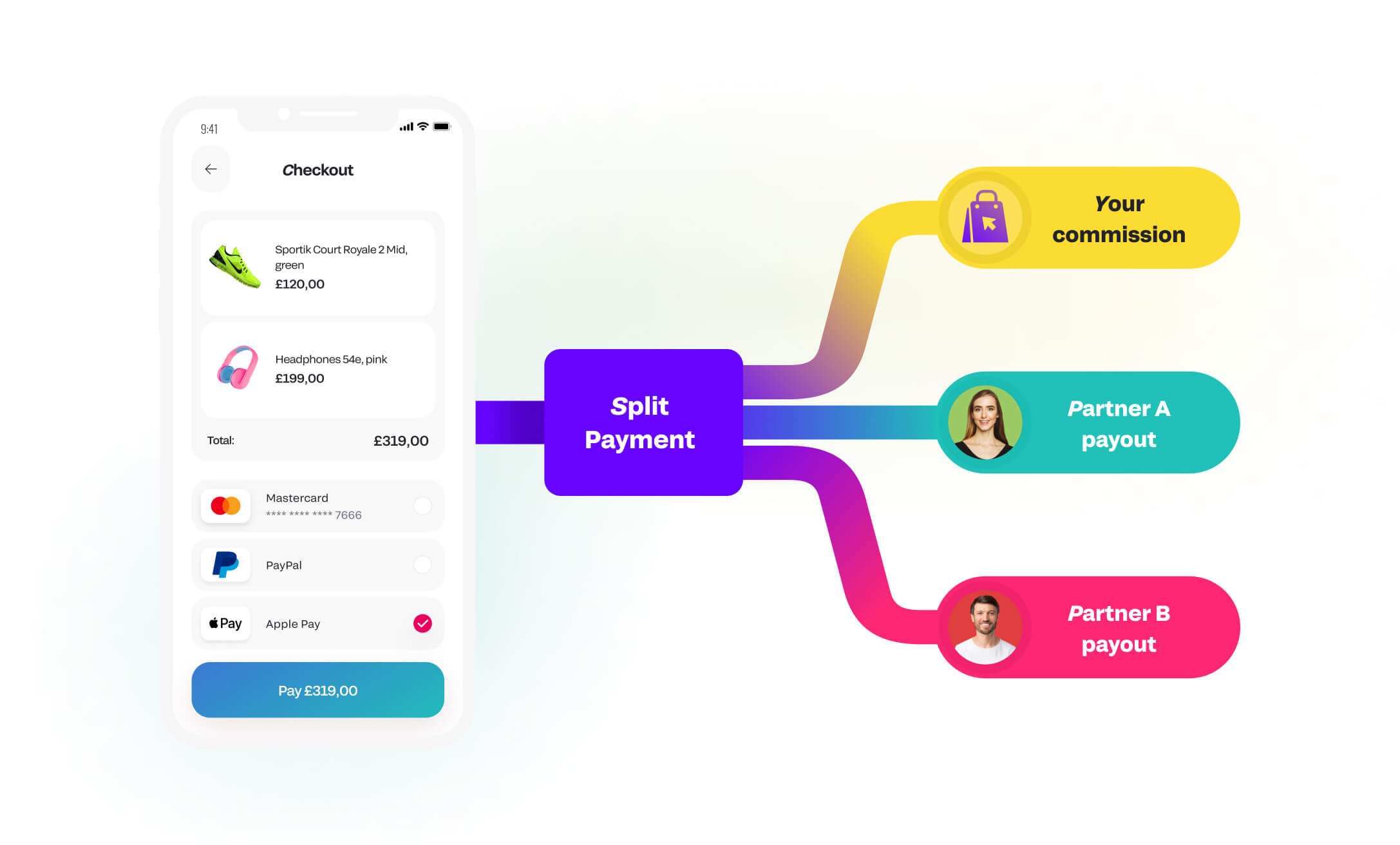

Split payments online

Split payments for harmonised cash flows

Empower your marketplace or platform with seamless split payments. Effortlessly distribute funds, commissions, fees, and more among your partners, both in the UK and globally.

Enhance your business with automated split payments

Automated split payments allow you to divide each online transaction instantly and distribute funds to multiple recipients at once. This solution is ideal for businesses operating with multiple partners or acting as intermediaries. Whether customers pay with credit cards on your marketplace, ridesharing app, event booking platform, or travel agency, split payments can streamline your financial operations, ensuring accurate and timely payments to all parties involved.

When your business requires settling with several partners after each customer transaction, Fondy’s automated split payment system is your perfect ally. This service not only saves you considerable time by removing manual reconciliation but also reduces processing costs and minimizes tax liabilities. By automating your payment processes, you can focus on scaling your business rather than being bogged down by intricate financial tasks.

Utilise Fondy’s split payment solutions to boost efficiency, reduce errors, and optimise your financial management across the board.

Transform your business and enjoy multiple benefits

Split versatility

Versatile splitting options: perfect for platforms that host products or services from numerous vendors and for businesses operating on commission or fee structures.

Split your way

Customise your splits: decide how each payment is divided — set fixed amounts, percentages, or a mix of both—and choose whether funds are split from your account or directly to your partner’s wallet.

Split and split, again and again

Automate recurring splits: simplify ongoing transactions such as subscriptions by automating your payment splits with our tailored integration solutions.

How split payments work

1. Customer makes a payment

When a customer pays with a credit card on your platform, Fondy payment gateway processes the online transaction smoothly and securely.

2. Payment allocation

The card payment is then automatically divided based on your predefined rules — whether that’s fixed amounts, percentages, or a combination to ensure accurate allocation.

3. Funds distribution

The allocated funds are distributed to the respective accounts, such as your partners’ wallets or your split account, guaranteeing timely and accurate payments.

— Real-time tracking

Monitor every online transaction in real time via your Fondy dashboard. Access insights into payment statuses, allocations, and overall financial health.

— Automate recurring payments

For subscription-based businesses or those with recurring payments, Fondy’s split payments can automate the process, reducing manual workload and saving you time.

— Secure and compliant

All credit card transactions are processed securely, adhering to industry standards and regulations, ensuring your business remains safe and compliant.

Discover the simplicity and effectiveness of split payments with the Fondy gateway, and streamline your financial operations like never before.

Maximise efficiency and growth with Fondy’s split payments

Save time and resources

Conserve time and resources: automate payment splitting among your partners—whether they’re vendors, content creators, service providers, or customers — allowing you to focus on expanding your UK business.

Boost conversion rates

Increase conversion rates: improve the checkout experience with seamless split credit card payments, reducing cart abandonment and failed transactions, leading to happier customers and more sales.

Enjoy full financial flexibility

Gain financial flexibility: with Fondy’s customisable commission and fee models, tailor the payment process to fit your specific business requirements.

Benefit from enhanced security features

Enhanced security: safeguard your online transactions with advanced security protocols and fraud prevention, ensuring a secure split payment experience for you and your partners.

Streamline to success

Streamline operations: cut down on operational expenses and enhance user experience by optimising your processes with split payments, benefiting both you and your customers.

Utilise your business account

Leverage your business account: partners receive funds instantly without fees or currency conversion charges, making your financial operations seamless with Fondy.

Fondy’s split payment processing

With Fondy, you can process split credit card payments efficiently and securely:

For companies

Fondy offers personalised payment solutions with transparent pricing and VIP support for established platforms.

With easy API integration, create custom solutions to suit your advanced needs. Benefit from cloud infrastructure that scales rapidly, dedicated management, and automated compliance to keep your business running smoothly.

For startups

Fondy provides transparent pricing and simple no-code integration, perfect for startups.

Use Payment Links, Invoices, or integrate with over 30+ available plugins for platforms like Shopify, Wix, WooCommerce, and more. Enjoy clear pricing without hidden charges, user-friendly design, real-time analytics, and easy registration to get your business off the ground quickly.

The ideal fit for splits

Split payments are particularly advantageous for modern business models in the UK. They are utilised by some of the most renowned brands today, including:

Optimising eCommerce marketplaces and multi-sided platforms with split payments

eCommerce marketplaces

Online marketplaces such as Amazon, Etsy, and eBay host products from numerous sellers. eCommerce split payments are crucial when customers purchase items from different sellers in a single cart, ensuring each seller receives the correct payment portion.

Multi-sided platforms

Platforms like Uber, TaskRabbit, and Airbnb, as well as content creators and crowdfunding platforms, are prime examples of multi-sided platforms. They connect service providers with customers seeking services like transportation, home repairs, holiday rentals, digital content, or fundraising opportunities.

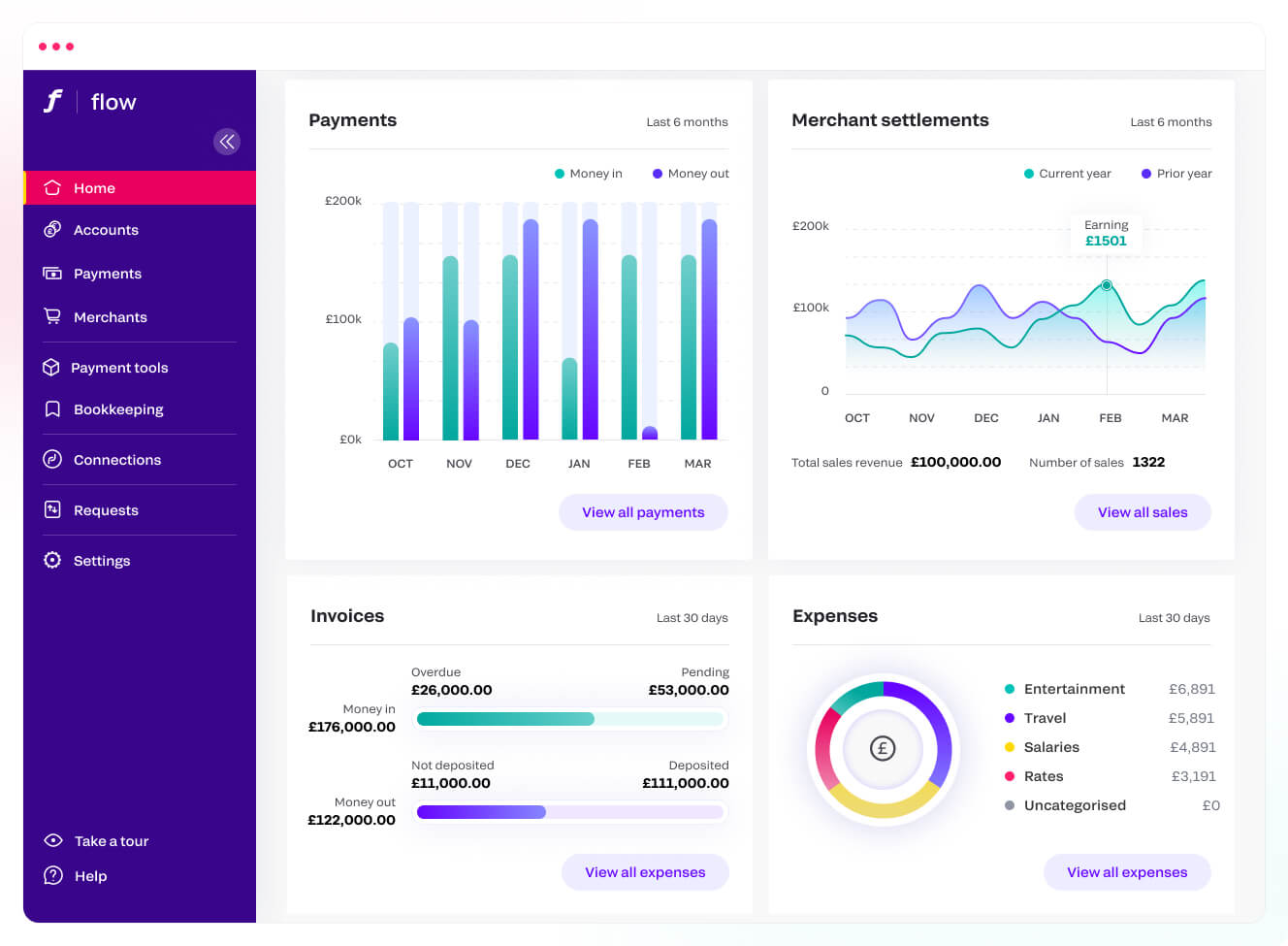

Payment analytics in the merchant portal

Monitor your split payments through your Fondy merchant account with customisable reports. Access detailed lists of all automatic and manual split payments, along with insights into any unsplit payments and the reasons behind them. You’ll have access to two key reports:

- A list of all split payments, including information about recipients and the status of funds received.

- Unsplit payments – a list of all payments that were not split for various reasons, with detailed information on where the funds were sent, in what amount, and when.

Furthermore, leverage custom reports from your platform or marketplace to track all split and unsplit payments, using Fondy’s API capabilities.

Get started!

Unlock the advantages of split payments by signing up with Fondy today. Access versatile split payments, efficient payout transactions, and seamless settlements for your marketplace or platform.

Gateway

- Go borderless and accept payments from anywhere, anytime and anyhow

- Enable your customers to pay how they want wherever they are

- Enjoy full transparency with cost-effective pricing and zero hidden costs

Flow

- Access faster settlements with multicurrency IBAN accounts

- Enjoy multiple benefits and features including recurring payments and payouts

- Manage all the movement of funds from one convenient platform without a third party

We use cookies to ensure our web-based products are functioning properly while continuing to improve your browsing experience, offering social media functionality, personalising our marketing and advertising content to suit your needs. We sometimes share cookie data with our partners for these purposes. Our cookies remember your preferences and the data you fill out on forms on our web products. As well as analysing traffic, our cookies register how you found us and collect information about your browsing habits. By continuing to use our web products, you agree to our use of cookies.